Stocks Fall, Stocks Rise

US and China are moving closer to agreeing on the amount of tariffs that will be rolled back the phase-one deal, despite tensions over Hong Kong and Xinjiang. You can almost know for certain that you will never know for certain when it comes to Trump.

Insider sources suggested that the President downplaying the urgency of the deal didn’t mean that talks were stalling.

You can pretty much expect what happens when news like this breaks: stocks rally riding waves of optimism. Markets rebounded from declines on Tuesday, and futures traded up.

Dow climbed 146.97 points, to 27649.78, the S&P 500 rose 19.56 points, to 3112.79, and the Nasdaq Composite added 46.03 points, closing at 8566.67.

Fed Gets the Devil’s Advocate

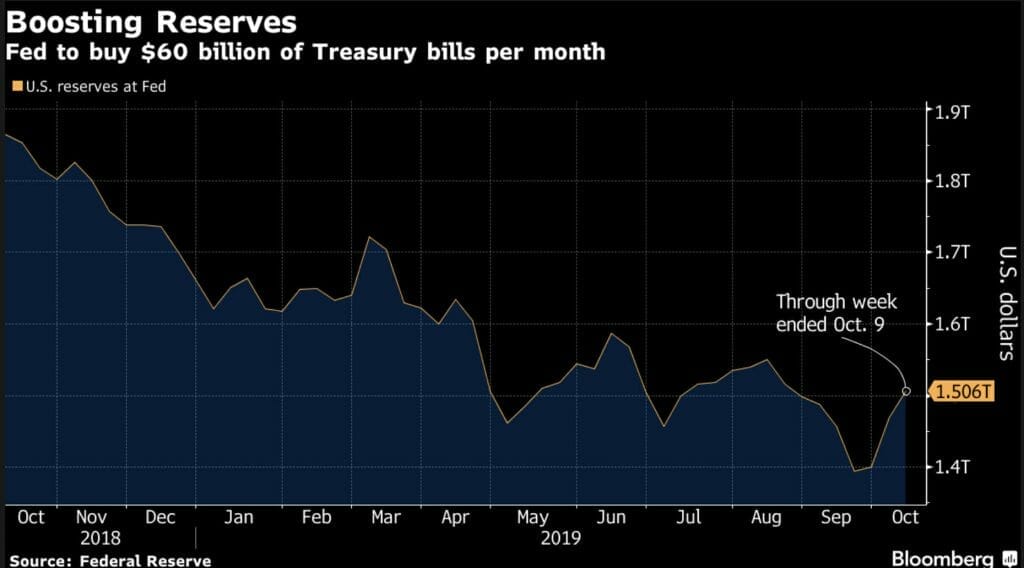

The repo market crisis that led Fed Chairman, J. Powell, to clarify that treasury repurchases were “NOT QE” now has a devil’s advocate.

The Financial Stability Oversight Council is calling for federal agencies to collect data and scrutinize cleared repurchase transactions to determine the precise causes of the repo market crisis.

When overnight borrowing costs rose sharply from 2% to ~10% in September, the Fed had to intervene to maintain rates, and it did the only thing it knows how to do – inject money to solve a problem whose cause it cannot identify.

I don’t think we’ve ever heard a precise articulation of why the liquidity crunch happened in the first place from the Fed. Maybe “not-QE” aka pumping money into the system was the only solution, but its nevertheless important to articulate the precise nature of the problem one is attempting to solve.

If one is unable to do that, especially if it’s a large institution that is bestowed with “public trust”, there are one of two possibilities:

- Either the Fed doesn’t know the cause, and is afraid to admit to the public that it doesn’t really know what’s happening, or

- The Fed knows why the problem occurred in the first place and is keeping it from the public because of whatever reason (political, if politics is influencing policy, and economic, if things are worse than the Fed wants the world to know)

Either way, it doesn’t look too good for the Fed and it’s perhaps the reason why the institution’s credibility has taken a hit in recent years.

While the chairman was silent, the Vice-Chairman spoke. Randal Quarles, the Fed’s vice chairman of supervision, granted Wednesday that Wall Street may have been right in arguing that the central bank shares blame for what happened to money markets in September.

The Fed, Securities and Exchange Commission, Office of the Comptroller of the Currency and Commodity Futures Trading Commission are among FSOC’s members. The council was set up after the crisis to monitor risks that could threaten financial stability.

Expedia CEO, CFO Resign

Expedia Group Inc said that CEO Mark Okerstorm and CFO Alan Pickerill have resigned effective immediately after clashing with the board regarding the firm’s strategic direction.

“Ultimately, senior management and the board disagreed on strategy,” Diller, Chairman of the Board, said in a statement Wednesday. Recently, Expedia has been burning cash on its home-sharing Divison Vrbo to compete with rivals such as Airbnb Inc. and Booking Holdings (Booking.com).

The third-quarter results for the firm weren’t particularly great, and the firm’s “ambitious reorganization plan” may not have gone as well Okerstorm thought it would go. The board disagreed, so now he is gone.

Diller further added that he is willing to buy additional shares in the company as a “tangible sign of my faith in and commitment to Expedia’s long-term future.”

Okerstrom had been at Expedia for 13 years, previously as CFO before becoming CEO in August 2017. The stock has declined by about 38% since then. At least this is better than Bierman’s stewardship that lost investors over 83% of their value just in the past year.

I don’t think that your stock price over a period of time is the perfect description of your decision-making capabilities, there are often other factors outside of your control at play – macroeconomics, competitors, price wars etc. What I think is more important is whether you can convince the board that you’re doing a good job. In this case, the answer seems to be – “no”.

The stock jumped by 6%, closing at $105.56.

What we’re talking about

-

Experion Holdings ($EXP.V) banks on premium cannabis offerings to steer through stormy weather

-

Amazon.com ($AMZN.NASDAQ): Corporate welfare over welfare capitalism

-

Equity.Guru podcast: A Closer Look – Ampd Ventures ($AMPD.C) paves the way for Web 3.0

-

Barrian ($BARI.V) eyes high-grade Nevada acquisition, consolidates its shares, contemplates PP

-

Uber’s ($UBER.NYSE) problem is trust and blockchain is the solution