We’ve been hearing about the “global debt crisis” for so long it’s become background noise – like a sherry-soaked auntie babbling about UFOs at Thanksgiving.

But if a building has been burning slowly for a long time, it’s legitimate to point out that smoke is still billowing – and there is no fire-truck in sight.

According to this week’s New York Federal Reserve Report U.S. household debt increased 0.7% during Q3, 2019, to $14 trillion.

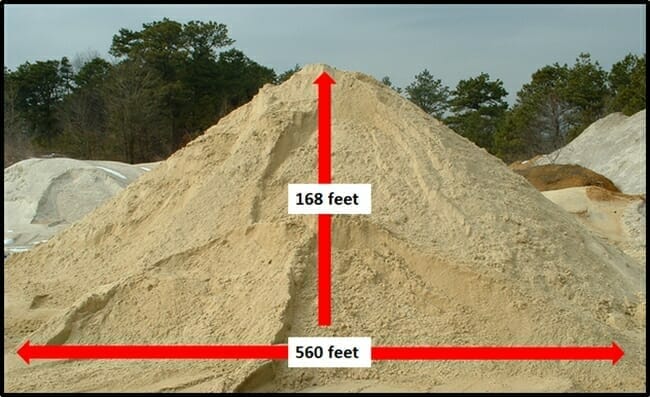

For most of us, a trillion is an abstract number.

Trying to wrap your head around it is like trying to imagine you are an athletic hero.

Or married to a Super-model.

Or stinking rich.

Or all three.

$14 trillion stacked in $1 bills would go to the moon and back.

14 trillion grains of spherical sand (accounting for air pockets) look like this:

“Consumer debt is now $1.3 trillion higher than the previous peak set in 2008,” stated CNN business, “Household debt has climbed 25% from the post-recession low of $12.7 trillion.”

Mortgages remains the largest chunk of Americans’ debt, accounting for $9.44 trillion. That’s up by $31 billion, from the end of Q2. Student loans climbed by 1.4% to $1.5 trillion, while credit card balances rose $13 billion during Q3 to $900 billion.

According to Fed Chairman Jerome H. Powell, there is no reason to panic, although $660 billion of household debt is delinquent, including $424 billion that is “seriously delinquent” (more than 90 days late).

Consumer debt default rates in black-majority zip codes are 200% higher than those in white-majority zip codes.

Each worker owes about $106,000 in personal debt. One quarter of the nation’s 131 million workers are over the age of 55, the average life expectancy is 78, the average salary is $63,000, and average savings rate of 8%.

Even if no new debt is accrued, 16 million of those indebted Americans are projected to die before they pay off the principal.

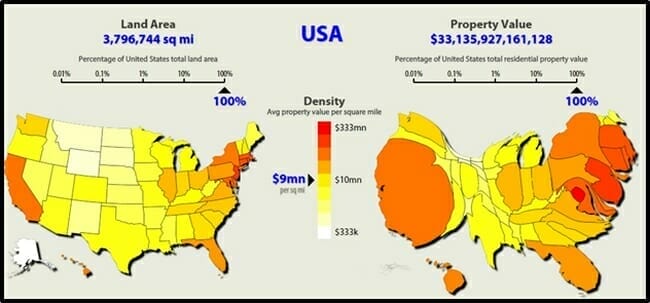

The U.S. government owes about $23 trillion itself (a lot of it to China), and is plunging another $1 trillion in debt every year.

The U.S. government could choose to pay off its citizen’s household debt by appropriating all the land east of Indiana and west of Nevada and selling the land and houses to the Chinese.

Combined U.S. national & consumer debt are more than the entire property value of the U.S.

“If the growth of the federal debt outruns the economy during these fabulously good times, what will the debt do when the recession hits?” asks Wolf Street, “It will jump by $2.5 trillion or more in a 12-month period. That’s what it will do.”

According to Bloomberg, “Global debt hit a record $184 trillion last year, equivalent to $86,000 per person — more than double the average per-capita income.”

This majority of this debt is based on fiat currency (paper money), and it is very easy to manipulate supply.

We believe this manipulation is likely to lead to a devaluation of fiat currency, particularly the U.S. dollar.

If this happens, one investment strategy is to own hard assets like land, jewelry, art, stamps and gold.

It’s a good time to think about gold, because the juniors are still quite cheap.

Case in point: Roxgold (ROXG.V) – a $338 million gold mining company operating the Yaramoko Gold Mine in the West African country of Burkina Faso.

The Yaramoko gold mine consists of two high-grade underground gold mines: the 55 Zone and Bagassi South.

One of the poorest nations in the world, Burkina Faso is victim to violent outbursts, most of which are attributed to the jihadist group Ansarul Islam – who have sworn allegiance to Al-Qaeda. This group usually operate in the North and the east.

Earlier this year, a Canadian mining-executive/geologist, Kirk Woodman, was kidnapped in Burkina Faso from an exploration camp and then fatally shot. Later Edith Blais, and her Italian traveling companion went missing in Burkina Faso. Earlier this month, an attack on a mining convoy killed thirty-nine.

There are also good things going on in Burkina Faso. The country recently built the biggest solar power generator in West Africa and gave a green light to a 2,000 kilometer fibre optic backbone.

Despite conflicts and food insecurity, Burkina Faso is the fastest growing gold producer in Africa. Eight new mines have been commissioned over the past seven years. The country has undergone less than 15 years of modern mineral exploration, remaining under-explored in comparison to neighbouring Ghana and Mali.

Endeavour Mining (EDV.T) – a $2.7 billion market cap gold miner – is operating the Houndé project in Burkina Faso, with an average annual gold production of 235,000 ounces (worth $343 million at current spot prices) at an All-In Sustaining Cost of $610/oz.

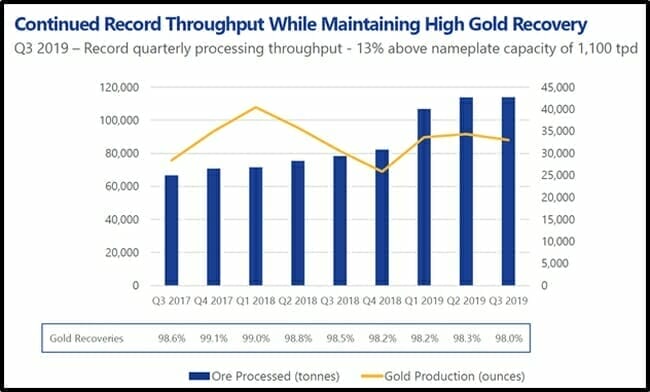

Three days ago, Roxgold reported its first nine months financial results for the period ended September 30, 2019.

Key 9-month (YTD) highlights:

Sold 100,100 ounces of gold for a total of $136.0 million in gold sales

Cash operating cost of $510 per ounce produced

All-in sustaining cost of $815 per ounce sold

Operating costs of $148 per tonne were 16% lower

EBITDA of $56.3 million at a margin of 42%

“I would also like to take a moment to remember the victims of the attack in eastern Burkina Faso last week,” stated Roxgold CEO John Dorward in the November 12, 2019 press release, “While this tragic event did not directly affect our people or operations [emphasis by Equity Guru] and was located a significant distance from our operations, we are deeply saddened by this senseless loss of life and stand with SEMAFO Inc. in its firm support of Burkina Faso’s security forces.”

Roxgold 2019 OUTLOOK

- Gold production between 145,000 and 155,000 ounces;

- Cash operating cost2 between $440 and $470/ounce;

- All-in sustaining cost2 between $765 and $795/ounce;

- Exploration budget of $10-$12 million;

- Bagassi South pre-commercial production development spend of $12-$15 million.

Reading the tragic headlines, it’s understandable why some investors are turning up their noses at Burkina Faso.

Burkina Faso has a mining corporate tax rate of 20%, and a sliding royalty on gold production from 3-5%.

According to the The Extractive Industries Transparency Initiative (EITI), Burkina Faso received USD $407 million from extractive industry taxation in 2016.

It’s vitally important for the future of this beautiful country that investors and mining companies – do not abandon it. France is sending troops, but the long-term security of the country will depend on a strong well-funded army.

Like “disappearing honey bees” or “forced marriages in the Sudan” – “U.S. household debt” sounds like a remote problem that won’t reverberate into our lives.

But we believe it will.

Companies like Roxgold function as an investment hedge against the inevitable consequences of rampant global money-printing.

Full Disclosure: Equity Guru has no financial relationship with any of the companies mentioned in this article.