On the same day mega-grower Cronos Group (CRON.T) said it no longer sees square footage and production capacity as “key performance indicators,” and will cease disclosing them, SpeakEasy Cannabis (EASY.C) put out a surprisingly tone-deaf news release touting its aim to become one of the largest producers in Canada.

$CRON basically signaling it isn’t in the growing business anymore. Will buy wholesale and turn into products it wants to sell. Turning into a biotech play.

Investors are looking at weaker than avg margins until they establish brands and yeast grown cannabis goes to market.

— Scott Willis (@ScottW_Grizzle) November 12, 2019

As of the time of this writing, SpeakEasy is up 10% and seeing serious volume, suggesting investors haven’t had enough of companies touting production capacity as their main selling point.

As of today, EASY is pre-revenue. The company is now growing in its 10,000 square foot cultivation in British Columbia. The company says build-outs will add an additional 80,000 and 26,600 square feet online, respectively.

Additionally, the company has an outdoor grow-space to its credit, pending Health Canada approval:

Speakeasy recently completed the transformation of a 60-acre orchard into a custom-built outdoor cannabis cultivation environment. The fertile agricultural land is expected to enable the farm to produce up to approximately 70,000 kilograms of cannabis flower and the company plans to double the output to up to approximately 150,000 kg, pending approval of its outdoor cultivation licence.

Supreme Cannabis (FIRE.T), regardless of what you think of its capital structure, has what is widely-recognized as some of the best cannabis on the market through its subsidiary, 7ACRES.

“Average quantity sold per year ranging from approximately 25,000 Kilograms to 50,000 Kilograms,” according to the company’s latest MD&A.

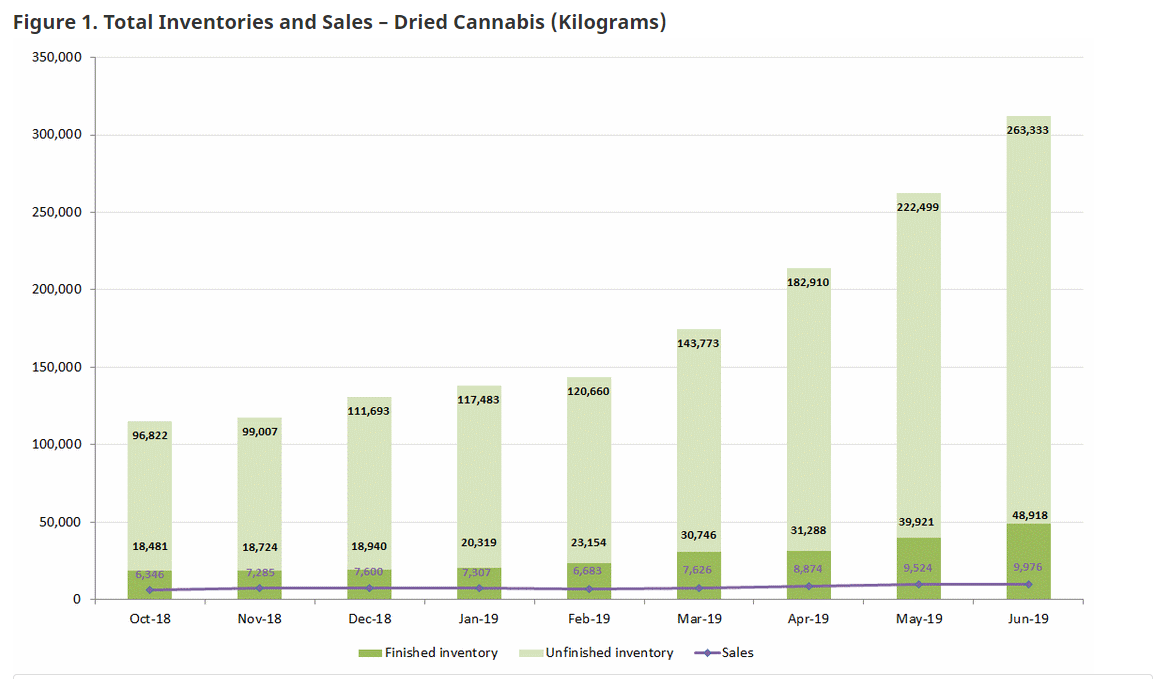

And that’s for the best cannabis on the market. Here’s how everyone else is doing as an aggregate.

Now, EASY wants to be the biggest producer on the market at a time when inventories are rapidly outpacing sales.

Canopy Growth (WEED.T) is the largest cannabis company in Canadian cannabis and they’re sick of it: recently tried to sell their Kelowna facility to GTEC Holdings (GTEC.V), even partnering with rap-superstar Drake as a way of pawning off excess production capacity.

If Supreme can’t dominate a crappy market with their cannabis, and Canopy can’t out-muscle smaller grows into irrelevance with raw capital, how is 60 acres of outdoor grow going to change the game?

Especially one which paid $2.6M in wages and $1.6M in consulting fees last quarter.

The company’s CEO was paid $960,333, $813,333 of which was a performance bonus in shares. A director was also paid $770,000, with $610,000 of it as a stock bonus.

‘Grow-job, grow-job.’

–Ethan Reyes