Zynga (ZNGA.Q), the mobile video game developer, is a terrible investment. The sort of large company that only stays large because it’s large to begin with, thereby attracting dumb investment from institutional folks who buy the things they see mentioned on CNBC, Zynga made US$280 million in revenues last quarter, dropping a net loss of US$70 million.

For that, the company has a market cap of $5 billion.

Zynga’s best result in the last five quarters was a $10m net income four quarters back. It turned a $1m profit the quarter after that, and a $129m loss the quarter after that one.

Part of the problem is, Zynga spends over $100m a quarter on research and development of new mobile games, at a time when, I don’t know about you, but I see less and less people playing new mobile games.

To see if the multitude of games Zynga are creating, most of which are the same game in a different skin, actually work… they spend another $100m plus per quarter marketing them.

Back in the day, Zynga got hot from a game called Farmville, which was infamous for also being the reason 98% of Facebook users turned off game invitation notifications and/or de-friended their mother.

“No mom, I don’t want to help you harvest your strawberries today either, for fuck’s sake.”

Zynga took that success to a fat IPO and created the sort of mobile games mega campus that should have been a hub of creativity and new ideas, but instead ended up with, well, this.

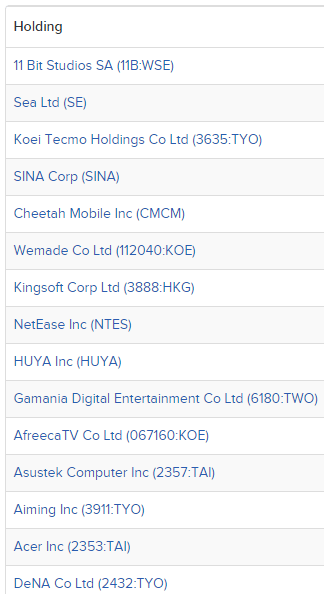

That’s Zynga’s revenue spread. 18% comes from Merge Dragons, a game I’ve never played because the roughly four total hours of its advertising I’ve so far endured only served to give me the impression it’s terrible.

Empires and Puzzles is the latest game to catch on, basically the usual match-three gem puzzle game with some card collection angle tacked on, the likes of which you’ve no doubt seen before in the 900 different guises it’s previously been sold under. That brings 14% of revenues, likely because it’s advertised all to hell. When it slows down they’ll release a re-skinned version, give it a name with ’empires’ or ‘adventure’ or ‘kings’ or dragons’ in the title, and it’ll puff back up for a month or two because this is what mobile games are now; no originality, just shuffle words and the same three concepts, re-launch, and re-market.

To show just how creatively barren it all is, slots and poker make up 30% of Zynga’s revenues, so they’ve clearly got a real nice handle on the ‘knee socks with sandals’ crowd.

It also explains why Zynga’s revenues and advertising and monthly user counts are flat, have been for some time, and even seem to be dropping lately.

Maybe that’s why they have five Farmville games currently, five Merge games (Merge Dragons, Merge Farm, Merge Town, Merge Gems, and Merged!), and followed the one time success of Words With Friends (a scrabble rip-off) with four more ‘With Friends’ games (crosswords, chess, Boggle, and Words With Friends 2).

And because imitation is the most profitable form of flattery, you can see things like the obvious rip off of Candy Crush seen to the right, or the odious Clash Royale rip, Tiny Royale, or half a dozen slot machine games or the mind blowing originality of ‘Solitaire.’

And because imitation is the most profitable form of flattery, you can see things like the obvious rip off of Candy Crush seen to the right, or the odious Clash Royale rip, Tiny Royale, or half a dozen slot machine games or the mind blowing originality of ‘Solitaire.’

I mean, Christ, I can play Solitaire on the seat back of half of the planes I’ve traveled on over the last year, but there’s Zynga promoting it across the internet because… theirs is better?

Give me strength.

So Zynga is crap, but that’s not news to most folks with even the slightest exposure to the game world. Why I’m talking about them isn’t because there’s a wave of folks running to invest in the company but, rather, because it’s in every god damned e-sports ETF and YOU’RE KILLING ME, WALL STREET.

My take on ETFs is not a secret. My standard refrain, for those who haven’t heard it 12 times already, is ETFs are gift baskets; they consist of some nice things, some filler, some things past their sell-by date, and a shit ton of shredded paper.

ETFs suck because ETFs follow dumb rules, like ‘hold a selection of stocks regardless of whether they’re good, based on market cap rather than value, automatically topped up or sold off once a month regardless of any actual event that might have made that stock a great deal or an insanely shitty one.

ETFs are no replacement for smart stock picking, and they’re not really supposed to be. Rather, they’re a replacement for mutual funds, which are also stupidly run, but with a sizable management fee attached, generally for the privilege of finding out you now own Bombardier, BMO, Air Canada, and Apple. Gee thanks for your wizardry, mutual fund gods. Couldn’t have come up with that bucket of yawn material by myself.

The ETF appeal to most isn’t that they’re better managed, it’s that they’re not managed, and thereby cheaper to buy and sell.

Which is where I turn on my heel and walk away, because – sue me – I don’t think a fund that boasts ‘no management at all’ is a smart place to put my money, unless you’re going to the Amazon rainforest for a year and won’t have access to your trading platform, and believe an entire sector is going to be thriving while you’re gone.

‘Entire sector’ can be loosely defined. When cannabis ETFs came to exist, Scotts Miracle Gro (SMG.NYSE) was generally tacked on because… plants? The company had negligible exposure to the cannabis industry, about as much as green house construction companies or plastic pot manufacturers did, but in it went to the ETF regardless.

Recently, when Canadian licensed cannabis producer CannTrust (TRST.T), was found to be running an illegal drug operation out of its legal drug operation, the share price of the company was shredded, which led one ETF to automatically buy a ton more of it to maintain its pre-set holdings weighting, sending that stock soaring momentarily, even though it’s likely to lose its license and be sold for parts.

So e-sports ETFs don’t exactly provide a compelling reason to buy in, regardless of the market’s sentiment that e-sports are a thing we should be exposed to.

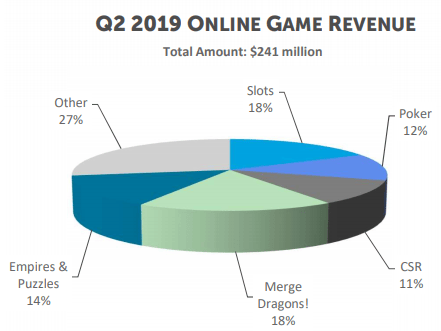

The ETF Managers Trust Video Game Tech ETF (GAMR.NYSE) features a hefty dose of Zynga at the high end, but the low end of its holdings are what interested me to look deeper.

Gravity (GRVY.Q) has most of its eggs in the basket of one game, Ragnarok M: Eternal Love, and reported revenues of $67m worldwide in the last quarter, largely due to that property. A net profit of $9m on that figure isn’t a bad haul, though it’s down 45% on last quarter, and the revenues are down 41% on last time around.

Ragnarok is dying. Though it remains profitable, there better be a big follow-up coming because the $220m market cap that company runs currently isn’t sustainable on a fast shrinking $9m quarterly profit. To that, GRVY shares are worth 2/3 less now than they were in June because “The decrease QoQ resulted primarily from decreased revenues from Ragnarok M: Eternal Love in Southeast Asia, North America, South America, and Oceania, Taiwan, and Korea.”

Read: Everywhere but Europe, where it launches next. After that, it’s Mars or die.

Maybe it’s just me, but I expect more than this from a Nasdaq-listed company:

Where do I line up to buy stock in the ‘cute cat mercenary guild’?

Right alongside that sits Modern Times Group (MTG.SWE), which runs the globally renowned Dreamhack conferences and tournaments, and has investments in mobile games, VR/AR, app platforms, and much much more. MTG is a legit e-sports company and the only way you can get to invest in it in North America is through an ETF because as a pubco it’s listed in Sweden.

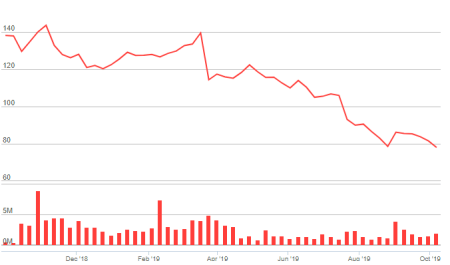

Score one for the ETFs, though, it’s worth noting the company share price has been plummeting over the last four months.

That’s come from running at a loss (US$44m in net sales, US$7m in EBITDA losses), with better numbers coming in from mobile gaming than e-sports.

And this points to the e-sports problem; there’s not a lot of money to be made in the sector just yet.

Mobile games: Sure, there’s money there, though it’s a cutthroat business.

Desktop and console games: Sure, there’s money there, though that too is a tough gig. One does not simply walk in to the Steam store and pick up 1 million users.

And if Dreamhack isn’t pulling a profit, with all of its high profile conferences and events around the world… that means tournaments aren’t the saviour for anyone.

Because of this, e-sports ETFs need to go further afield than most of their ilk to find companies to invest in. The GAMR holdings (seen right) are a who’s who of game companies you’ve never heard of, from places your broker won’t let you buy from.

Because of this, e-sports ETFs need to go further afield than most of their ilk to find companies to invest in. The GAMR holdings (seen right) are a who’s who of game companies you’ve never heard of, from places your broker won’t let you buy from.

Hong Kong, Korea, Japan, China, Poland, Taiwan, Taipei, and that’s just from page 5 of 6. Beyond that you’ve got the London Exchange, Nordic, Euronext… AND NO CANADA.

When you get to the top of their holdings, that old ‘loosely affiliated’ situation creeps back in, with companies like Gamestop (GME.NYSE), which used to be a second hand game reseller but is lately a chain of retail stores selling as many bobbleheads as they can before liquidation comes, being one of the top holds.

So too is BiliBili (BILI.Q), a Chinese media and online advertising aggregator, and laptop and motherboard seller MSI, which doesn’t deal directly in e-sports at all, other than to sponsor teams and sell hardware to people who might watch them, and GREE, a Japanese social media platform with investments in media and mobile games, none of which involve e-sports in any meaningful way.

And this is really the big problem with the shift to e-sports as an investment in general; e-sports is a relatively small part of a much bigger thing that we should all be looking to invest in FOR SURE, and that’s content.

The reason so many of my grey-haired colleagues even know what e-sports is in the first place is we know traditional TV, and soon after that cable TV, and soon after that traditional major league sports, are disappearing. We can see our kids aren’t watching it like we used to, or at all, and it means somewhere out there is a fat alternative just waiting to share wealth with us.

Viewer numbers are down hard across the board, even for things that traditionally rated huge on TV, like the World Series. Content creation on the small screen moved hard into reality series a decade ago because it was so cheap to produce when compared against a Sopranos or Breaking Bad, and things like local news production, that also cost a lot when compared to the sixth daily repeat of an entertainment junket clips show (what’s up Extra), were also cast overboard during the great scripted reality surge.

But the downside of those cost savings for the TV industry has been that viewers now don’t consider legacy television important. If I’m not tuning in for the news, I’m not tuning in for what’s after the news. If I’m not making a weekly appointment to watch Six Feet Under, I’m fucking about on Twitter, or Youtube, or Twitch, or Netflix, or Crave, or Amazon Video, and you’ve lost me for the night, CBS.

Kids aren’t watching sports, because sports are increasingly hard to find, without buying into streaming services or pay-per-views, and because highlights are everywhere.

Early on in the life of the Ultimate Fighting Championship (which just cancelled its planned go-public and is struggling with its own numbers), head honcho Dana White made great pains to point out that boxing largely died as a sport when it shifted from free TV to pay-per-view, only to, a few years later, launch a paid subscription streaming channel for fans and watch them leave for other things.

I coach kids soccer teams, specifically kids who are OBSESSED with soccer enough to train as much as four nights a week, but only one in 20 actually watches full games at home, which leads those kids to a really deep knowledge of how to do highlight reel moves they see playing FIFA 20 and on DAZN highlight packages, but absolutely no knowledge whatsoever of in-game tactics. Minor league baseball scouts are reporting a massive increase in the number of teens who can bang homeruns, but a big reduction in those that can pull a double play, or draw a walk, because the dingers make the highlights and even enthusiasts consume highlights before they’ll consume a game.

A few years back, the NBA convinced a ton of fans to buy a season pass so they could see all the games, which took the game away from millions of kids who couldn’t afford the package.

But even those who could were pissed off hard when they couldn’t get the playoff games because those had been sold to another network.

Content consumed on TV is now far smaller and less important than content consumed on streaming video, or podcast, or through a mobile app.

Below you’ll see the Missouri Star Quilt Company’s Youtube tutorial on how to make a ‘blipper’ quilt. It runs ten minutes, cost about $40 in quilting materials to produce, and has attracted 226,000 viewers so far.

Below this is the trailer for the new season of Supergirl on the CW network.

It runs a minute, costs $3 million an episode to produce, and has 286,000 viewers on Youtube at the time of writing.

If you think that comparison makes no sense, because the actual Supergirl show will run on TV and so it must blow the blipper out of the water eventually, guess again.

The first episode of this Supergirl season drew 1.3 million viewers, or the equivalent of just 5 x ten-minute quilting videos on Youtube.

“But wait,” I hear you scream, “Just because Supergirl has no audience isn’t proof of TV’s demise! What about Sunday Night Football?”

K cool.

This past week, Sunday Night Football drew 16 million viewers, according to TV ratings.

You know what drew 17 million viewers?

This video on Youtube responding to another video on Youtube featuring a girl removing makeup.

And y’all are trying to invest in Overwatch tournaments? Have mercy.

Some ETFs are happily set to ‘entertainment’ as opposed to gaming. These include the iShares Evolved US Media and Entertainment ETF (IEME.NYSE), which you might think is EXACTLY what we’re looking for, for more growth area content exposure.

But no. Instead of finding ways to invest in content creation at the cutting edge, you’re getting Disney, Fox, CBS, Netflix, Comcast, DISH network, Roku, Sirus, TiVo, Cinemark, Seaworld….. it’s like an ETF for the very heart of all the industries that are dying.

One item held high on the IEME tree however is InterActiveCorp (IAC.Q), which started life in the 80’s as the Home shopping Channel, eventually became USA Networks, and then, in a stunning piece of cleverness, sold off its TV assets and began buying things with a future like Ticketmaster, mortgage site LendingTree.com, travel site Hotwire.com, Expedia, CollegeHumor.com, Vimeo, it owns ALL of the dating sits, including match.com, PlentyOfFish, Tinder, Hinge, and OKCupid, it owns AngiesList, The Daily Beast, Dictionary.com, online media aggregator DotDash, and the telemarketing blocker app Robokiller. It’s a beast and its business model is entirely directed at where eyes are looking.

And the result? $259m in adjusted quarterly EBITDA on over $1 billion in revenues. Admittedly, a $17 billion market cap doesn’t scream value on those numbers, but if IAC began liquidating those digital assets, I’d imagine you’d be looking at many multiples in cash back.

IAC is right where the big money will be in new media. Which isn’t to say video game development isn’t important: It absolutely is.

[contextly_sidebar id=”QM9WMZ3FVKjaA2JLCCtnrixIH75bkeC3″]

But game development is capital intensive and inherently risky unless you’re dealing in established IP, so investing in giants like Electronic Arts (EA.Q), TakeTwo (TTWO.Q), and Blizzard Activitsion (ATVI.Q), brings less chances for multiples on your money, even when they release successful games. Ideally you need a way in on the microcap side, not the gigantocap side.

There is a Canadian e-sports ETF, the Evolve E-Gaming (ugh) Index ETF (HERO.T), but if you’re looking for a hefty slice of Canadian content in it, keep walking, chum.

In Canada, if you’re looking to make more of a surgical strike in the e-sports realm, there’s a local company (really a media and content aggregator more than an e-sports play, but that doesn’t fit on the deal maker radar so they’re going with the flow a little) called Enthusiast Gaming (EGLX.V) that does have an actual e-sports segment, in Luminosity Gaming, which manages the Aquilini-owned Vancouver Titans franchise in the Overwatch League, which is an overperformer in that league, to say the least.

But the more important part of EGLX is the part nobody is giving them credit for; the content creation piece. The part where their e-sports athletes live stream, or post to Youtube, or huddle around Discord, or post to blogs, the part where A-list advertisers gather to sponsor sites and athletes and channels and blogs and new media outlets, the part where the actual tournaments aren’t monetarily important, but serve to reinforce the people operating their businesses under their umbrella as thought leaders, commentators, influencers, and winners, thereby getting more eyeballs in places they can sell ads onto.

EGLX isn’t a client of mine. In fact, no company mentioned here is, because they’re big and foreign and we’re pretty North American microcap focused.

But I get emails and texts and DMs all day asking me for input in the e-sports scene and I just wanted, once and for all, to lay out exactly why I hate the term as it pertains to investment opportunities, and where you should be looking going forward.

Not ETFs. Not mutual funds or VC groups or Kickstarters.

The game you need to be focused on isn’t Fortnite or Overwatch, it’s not Hearthstone or Rocket League, not Dreamhack or MSI or gambling or orcas in tanks… The game to be in is ‘attention.’

Media. Content. Interaction. Eyeballs.

— Chris Parry

FULL DISCLOSURE: No commercial relationship to any company mentioned.

A quick note, not even about the core topic of the article, but about Scotts Miracle Gro. SMG ended up in cannabis ETFs because SMG spent north of $1B investing in the hydroponics industry. Through acquisition, SMG is the single biggest equipment supplier to commercial/hobbyist cannabis growers in the world. As you recommend to your readers, ALWAYS DO YOUR RESEARCH.

Yes, and energy companies supply them power, and soil companies sell them soil, and janitorial companies sweep their floors. Throw their banks in there while we’re at it..