Pasha Brands (CRFT.C) has developed quite the taste for lab-tested B.C. bud. On Tuesday, the company announced it had acquired Roll Model, a local favourite among craft cannabis connoisseurs who enjoy lighting up a joint the old-fashioned way.

With the deal, Pasha Brands is on track to become one of the fastest-growing craft cannabis companies in Canada. A series of mergers, distribution deals and nationwide expansion plans speak to those efforts.

When all is said and done, summer 2019 could go down as one of the most pivotal periods for Pasha’s management team.

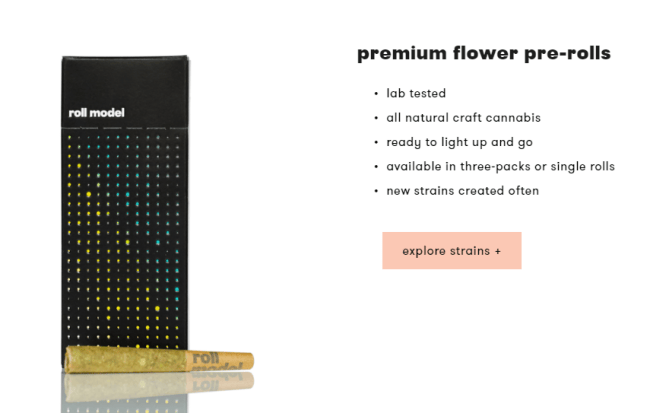

In an official press release, Pasha announced Tuesday that it has acquired all of Roll Model’s trademarks, names and intellectual property for an undisclosed amount. The brand will be re-launched in Canada under Medcann Health Products, a licensed subsidiary of Pasha, by the end of the fourth quarter.

Apparently, Roll Model products have already been included in several product packages presented to provincial wholesalers.

Patrick Brauckmann, Pasha Brands’ executive chairman, said the acquisition was a “must” given Roll Model’s glowing reputation for craftsmanship.

“We are thrilled to have Roll Model join our family of legacy brands. Its established reputation for quality and the craft market made this acquisition a must for Pasha, and I’m sure Canadian cannabis consumers will appreciate the craftsmanship behind the brand as much as we do.”

–Patrick Brauckmann

Pasha finds its Roll Model

For those unfamiliar with Roll Model, the company has been a leading purveyor of lab-tested, premium flower pre-rolls in B.C. Roll Model offers a variety of sativa and indica strains with various levels of THC and CBD content that are neatly presented on its website.

For Pasha, Roll Model is a means to a much larger end – namely, expanding into every corner of Canada’s legal cannabis market.

Now, that’s just my take on it, but a look at Pasha’s activity over the past three months paints a picture of a company looking to scale up quickly.

In July, Pasha announced it had submitted a formal application to the Ontario Cannabis Store to bring its products to Canada’s most populous province. During the same month, Pasha made a splash in the highly-touted topicals market by acquiring Earth Dragon Organics. Around the same time, it reached a supply agreement with Hearst Organic Cannabis, Canada’s first licensed micro-cultivator applicant.

A few short weeks later I had to report again that one of Pasha’s wholly-owned subsidiaries signed a new agreement with Canada’s first licensed microprocessor.

Yadda, yadda. You get my point.

While cannabis research firms have reduced their estimates for Canada’s marijuana market, spending and usage are steadily climbing, according to data from Arcview Market Research and BDS Analytics. The sale of dried cannabis has increased roughly 6% per month, while the sale of cannabis oil has been going up 16% each month. Combined, these sales are expected to feed into a multi-billion-dollar legal cannabis market by 2020.

CRFT.C stock update

Shares of Pasha Brands have been fairly steady over the past month, mirroring tepid trading conditions for the industry as a whole. Over that stretch, CRFT.C traded between CAD$0.32 and $0.36.

The stock peaked at $0.72 back in June, just before it received its new ticker symbol. CRFT.C is trading at the lower end of its yearly range, having recovered 19% from its trough price of $0.29.

At current values, CRFT.C has a market capitalization of $71.2 million, which is a lot higher than the last time I covered it in mid-August.

Like other budding marijuana companies, Pasha remains highly volatile from an investor’s point of view. An investment in CRFT.C should be based on whether you think its brands have a promising future once the stigma of cannabis consumption fades. The transition from black market to brick-and-mortar sales could take a while but keep CRFT.C on your radar in the meantime.

–Sam Bourgi

Full Disclosure: Pasha Brands is an equity.guru marketing client.