Pasha Brands (CRFT.C), one of Canada’s largest purveyors of craft cannabis products, has moved one step closer to becoming a leader of the promising cannabis topicals market.

On Wednesday, Pasha Brands announced it has finalized an agreement to buy Earth Dragon Organics, a prohibition-era topicals producer located in British Columbia.

The latest acquisition rounds out a hot July for Pasha following a bevy of distribution deals, historic craft cannabis agreements and plans for Ontario expansion.

Pasha Brands announced the acquisition in a press release that hit the newswire early Wednesday. Although no figures were disclosed, Pasha says it will seek provincial and territorial distribution agreements for Earth Dragon Organics products once legislation regarding edibles and topicals are finalized later this year.

The deal gives Pasha ownership of all Earth Dragon trademarks, names and intellectual property. Earth Dragon Organics has ceased all sales of its handmade products until Oct. 17, 2019 when edibles are legalized.

According to the press release, manufacturing of Earth Dragon Organics products will move to Pasha’s licensed processing facility on Vancouver Island.

“Huge milestone” for Earth Dragon Organics

Tessa Serra, founder of Earth Dragon Organics, called the acquisition a “huge milestone” for her company because “it will allow us to scale up and make these handmade craft products more available to the entire country.”

Serra will become a product developer and manufacturer on the Pasha team, according to Patrick Brauckmann, Pasha Brands’ executive chairman.

“This is exactly the kind of business legalization has been leaving behind, and Pasha is honoured to help bring Tessa’s passion for creating sustainably made, handcrafted cannabis-infused topicals into the legal market.” – Patrick Brauckmann

Cannabis topicals: A new form of consumption

Cannabis-infused topicals have grown in popularity ever since federal regulators decided to demystify the marijuana plant. Consumers have quickly realized that cannabis lotions, ointments and balms actually work in treating localized pain, soreness and inflation.

If Colorado, Washington and Oregon are an indication of where the market is headed, then we can expect demand for cannabis topicals to increase steadily in the coming years.

What’s so special about these three states? Aside from being lovely places, they were among the first to legalize non-medicinal cannabis consumption. As it turns out, residents of these states are doing a lot more than rolling joints.

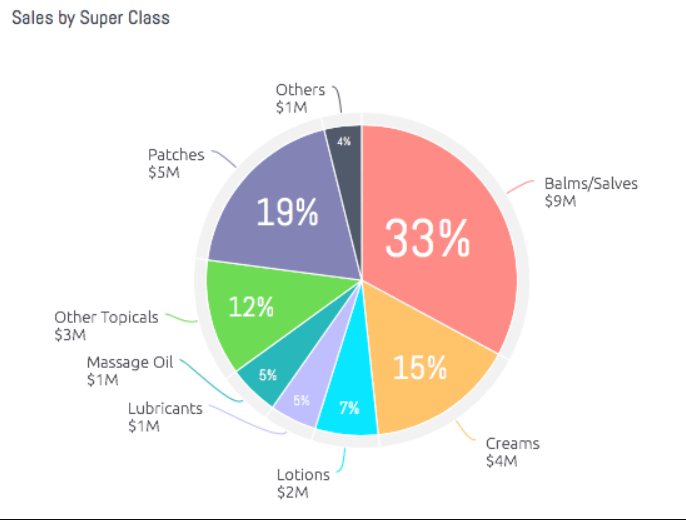

Research from BDS Analytics reveals that sales of cannabis topicals in these states nearly doubled in 2016, reaching USD$26.39 million. Balms, patches and creams appear to be the most popular products in this diverse sector.

There doesn’t seem to be comparable data for Canada, but these three states are pretty decent proxies for what we can expect here. We’ve written ad nausem about the size and growth rate of Canadian cannabis consumption. As equity.guru recently reported, cannabis derivatives will account for a growing share of the market. Derivatives will help grow the Canadian direct cannabis market by 50% over the next six years.

CRFT.C stock on the rise

Shares of Pasha Brands rose sharply Wednesday, reaching a session high of USD$0.3201. That represents a gain of around 5%.

Pasha has seen its fair share of ups and downs during its short trading history. The company began trading under its current exchange symbol in early June, which followed the reverse takeover with Broome Capital Inc.

The company has a total market capitalization of $63.1 million. A growing distribution network and strategic acquisitions in the fast-growing derivatives segment suggest Pasha Brands has a bright future. Investors should keep tabs and allocate intelligently if they think it’s worth a shot.

–Sam Bourgi

Full Disclosure: Pasha Brands is an equity.guru marketing client.