If you own stocks in big cap U.S. companies like Salesforce (CRM.Q), Slack (WORK.NYSE), Chipotle (CMG.NYSE), Visa (V.NYSE) and Home Depot (HD.NYSE) you may be interested to know that senior management in those companies have been pounding out shares.

This is the new normal.

A TrimTabs Investment Report reveals that insider selling on the U.S. stock markets is at its highest level since this seemingly-endless bull market began in March 2009.

TrimTab is a three-decade old company that employs a room full of number crunchers who focus on “equity market liquidity”.

“The leaders of Corporate America are cashing in their chips as doubts grow about the sustainability of the longest bull market in American history,” confirms CNN Business,” “Corporate insiders have sold an average of $600 million of stock per day in August.

August is the 5th month of 2019 in which insider selling tops $10 billion. That has only happened twice before, in 2006 and 2007 – prior to the great 2008 recession.

“It signals a lack of confidence,” stated Winston Chua, one of TrimTabs’ number crunchers. “When insiders sell, it’s a sign they believe valuations are high and it’s a good time to be outside the market.”

Recession fears have ignited a burst of market volatility over the past year, punctuated by the worst December since the Great Depression. Although the S&P 500 remains up 14% in 2019, markets have tumbled in August as the trade war escalated.

If you’re a Home Depot shareholder thinking: “Maybe this isn’t such a bad thing” – don’t worry – you’ve got back-up.

“Most managers get paid on earnings growth. If they anticipate bonuses will be slower, they will sell stock to make up the gap,” stated Nicholas Colas of DataTrek Research, “It’s one more sign that managements know this will be a tough year for growing earnings.”

Got that?

Management isn’t selling stock because they think the share price is about to go down, they’re selling it to pad their bank accounts in anticipation of reduced bonuses.

Good to know.

“To avoid spooking shareholders,” explained another pundit, “some executives schedule periodic stock sales.”

Got that?

Management isn’t selling stock because they think the share price is about to go down, they’re selling it because they always sell it. A regularly scheduled bad thing is less bad than a strategically timed bad thing.

Again, good to know.

Apparently, there is no cause for alarm.

Of course, if some tiny part of yourself thinks the Crazy Car might be about to crash, you might want to own some gold.

One year ago, we gloomily reported that, “gold is stuck in a 3-month downtrend, as investors remain stubbornly transfixed on the surging U.S. dollar.”

Is gold truly dead?

If so, which of Elisabeth Kübler-Ross’ 5 stages are grief are we now experiencing?

- Denial – “Deep state manipulation!” “It’s not real!”.

2. Anger –”Why me?” “Who is to blame?”

3. Bargaining –“If gold goes to $2,000/ounce, I promise to stop vaping.”

4. Depression –”My stack of American Gold Eagles makes me cry, why go on?”

5. Acceptance – “It’s going to be okay – at least I own weed stocks”.After sober reflection, we have self-identified micro-traces of the last 4 stages of grief.

But it’s 98% denial.

That was then, this is now.

Deny this!

The spot price of bullion has moved up to a 6-year high of USD $1,520. In the last 5 years, the spot price has moved from CAD $1,350 to an all-time high of CAD $2,050.

The Junior Gold Miners ETF (GDXJ.NYSE) is up 30% in the last 6 months.

Too late to the party?

Look at this historical GDXJ chart:

Gold companies are still cheap. Big gains are being made now.

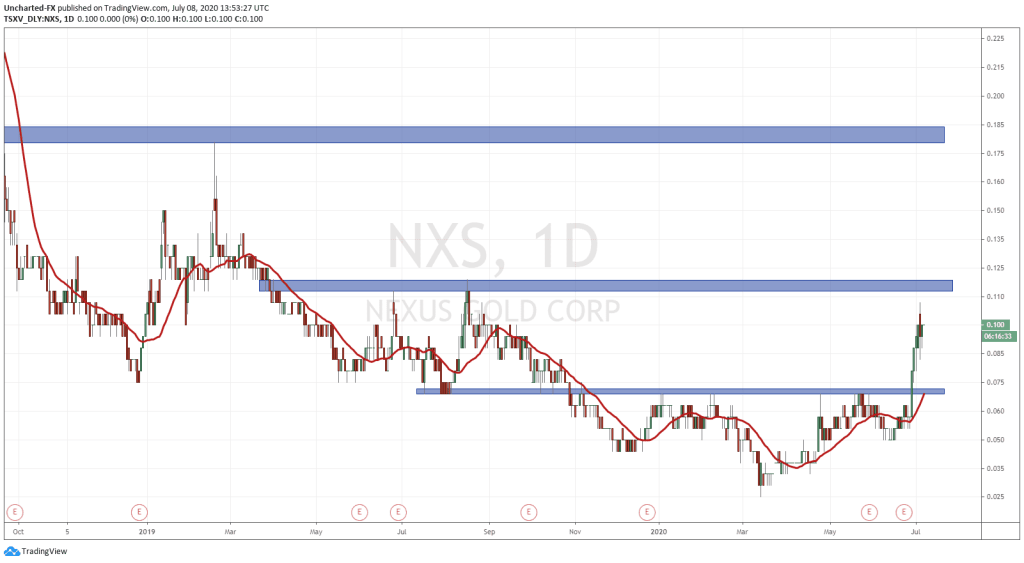

“Nexus Gold (NXS.V) stands out in my mind, both from a fundamental and valuation stand point,” states Equity Guru’s mining expert, Greg Nolan.

“On August 20, 2019 Nexus released a corporate update regarding its Dakouli 2 project in Burkina Faso, its McKenzie project in the Red Lake Mining Camp, and its New Pilot project in the Bridge River Gold Camp of southern BC.

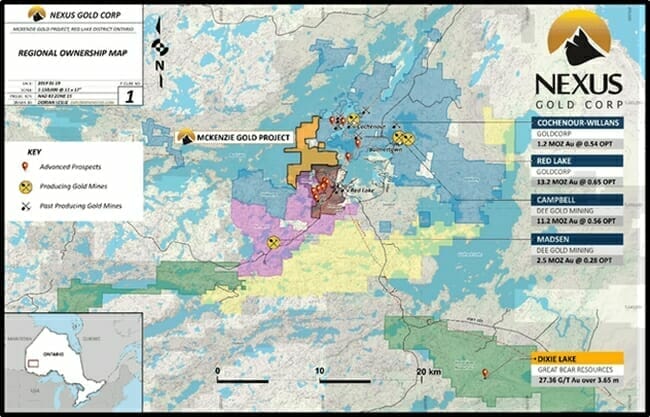

The McKenzie Gold Project, Red Lake, Ontario

This 1,348.5-hectare chunk of prospective terra firma is located in the heart of the prolific Red Lake Gold Camp aka the High-grade Gold Capital of the World.

McKenzie hosts no less than nine documented historical gold occurrences. Only limited exploration been performed on the property to date—the project has significant exploration upside.

The project is strategically located adjacent to Newmont Goldcorp (NGT.T) on its east and northern boundaries, and Pure Gold’s (PGM.V) Madsen project on its southern boundary.”

Nolan just published a book, “Highballer: Tales from a Treeplanting Life (Harbour Publishing, 2019 – which has got the media (national and local) in a tizzy.

A recent Equity Guru article about Nolan’s triumph, recounted his early call on Black Rock Gold (BRC.V)’s Silver Cloud Property which has “a Measured and Indicated resource of 430K tonnes grading 16.6 g/t gold (208,000 oz’s of Au) and an Inferred resource of 180K tonnes grading 14.4 g/t gold (74,000 oz’s of Au).”

Dear U.S. shareholders:

Don’t worry your CEOs are bailing out of their own companies.

Don’t worry about the Inverted Yield Curve

Don’t worry about the epic levels of U.S. debt

Don’t worry about money printing

Don’t worry that your country is run by a narcissistic Fuck-Tard who repeatedly went bankrupt and lost $150 million in the stock market when everyone else was making bank.

Everything – we are sure – is “good-as-gold.”

Full Disclosure: Nexus Gold (NXS.V) is an Equity Guru marketing client