When two people live on the same street, speak the same language, are in the same business and share the same lineage, it’s no surprise when they decide to hitch their wagons.

So it is, with TransCanna (TCAN.C) and Lifestyle Delivery Systems (LDS.C) who, on June 29, 2019 entered into an exclusive agreement “to negotiate a proposed business combination”.

These two companies are not strangers to each other.

Certain directors and officers of LDS own shares of TransCanna, and certain directors and officers of TransCanna may own shares of LDS.

From 2015 – 2018 the CEO of TransCanna, James Pakulis was the President of LDS.

On November 16, 2018 LDS announced that Mr. Pakulis had resigned though not through any “disagreements relating to LDS’s operations, policies or practices.”

TransCanna’s 4-pronged business model:

- Procurement – leveraging relationships with California cannabis farmers to access biomass.

- Branding & Design – music and beverage industry vets creating 15 premium brands.

- Transportation and Distribution – unified network includes 5 strategic facilities throughout California.

- Sales & marketing: acquiring and creating premium products with in-house sales team selling directly to dispensaries

TransCanna’s 196,000 sq. foot facility in Modesto, California has the same footprint as 70 regulation tennis courts.

LDS’ flagship product CannaStrips (similar to breath strips) offer superior bio-availability of cannabis constituents. Some strips include co-active ingredients such as nutraceuticals, vitamins and peptides.

Two months ago, CannaStrips, won 1st place honors at Kushstock 7 “Best Edible” competition, held at Adelanto Stadium, California.

The business proposition is this: TransCanna will buy all of LDS at a price equal to the greater of $51.6 million payable in TCAN shares, or the amount resulting from a fixed exchange ratio of one TCAN shares for every 10 LDS common shares.

Given the purchase price of $51.6 million, TCAN is paying a 17% premium to market (LDS’s market cap is currently $44 million).

Since it is an all-share deal, if TCAN share price falls, it will have to issue more shares in order to close the acquisition.

There is a real possibility that some early TCAN investors will push the share price down before the deal closes.

TCAN started trading on January 8, 2019. Financings done prior or at the IPO become free-trading after 6 months, which is July 8, 2019 (Monday of next week). The early financings include:

- 3 million shares at .005

- 9 million shares at .05

- 9 million shares at .10

- 4 million shares at .50

TCAN is currently trading at $4.10.

If you purchased stock at .50, your investment has appreciated 820%. If you purchased stock at .05, your investment has appreciated 8,200%. If you purchased stock at .005, your investment has appreciated 82,000%.

So yes – some folks will want to cash in.

Other folks will want to stay on this racing horse.

Business Combination Highlights:

- During 2018 plus Q1, 2019 – LDS generated $6.7 million in gross revenue.

- LDS shareholders will own about 13.9 million shares out of 47.8 million shares (29% of TransCanna).

- Owning CannaStrips revenue streams will help TransCanna become a California market leader.

- Combined entity will include 196,000 sq ft cannabis focused facility in Modesto (owned) -20,000 sq ft state-of-the-art laboratory, nursery and cultivation & 20,000 sq ft warehouse facility (leased) – 25.5 acres in Adelanto, CA; majority of land in the “green zone” (owned)

- Anticipated cost savings and synergies, leading to higher profit margins and lower taxation.

- Strong platform for further accretive growth and consolidation throughout California

- Enhance capital markets presence and analyst coverage, while expanding shareholder base.

“Merging the revenue generating assets created by the LDS team, with the scale oriented TransCanna team equals, in our opinion, a California-based powerhouse,” stated Brad Eckenweiler, CEO of LDS.

We have an extended, mostly good, history with LDS.

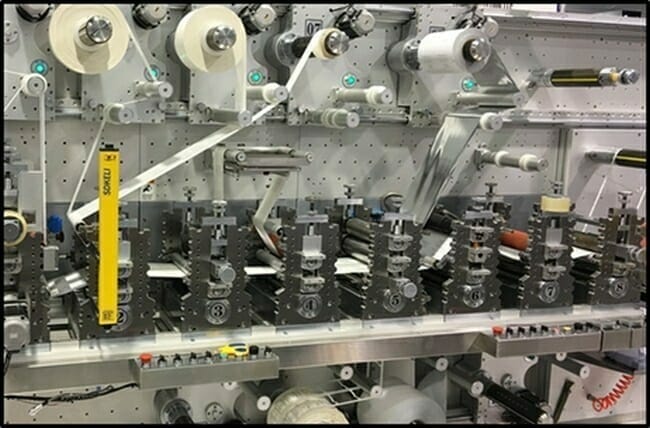

Nineteen months ago, we traveled out into the California desert and toured the factory, and more recently Equity Guru principal Chris Parry grilled LDS boss, Brad Eckenweiler.

“This has the potential to be a transformative acquisition by TransCanna,” stated Jim Pakulis, CEO of TransCanna, “The combined company will expedite our processes and corporate goals by at least 24 months. TransCanna will be revenue generating, with the ability to immediately scale throughout California.

California has 40 million people and an astonishing GDP of $2.7 trillion (almost double the GDP of Russia).

Most of California’s money is generated in large coastal cities including San Francisco, San Jose, Los Angeles and San Diego.

Thirteen percent of Californians (5.2 million people) smoke herb. The state has 1 million medical marijuana patients.

The proposed TCAN/LDS combined business creates a solid commercial platform in this state of wealthy cannabis consumers.

Transaction completion is subject to these conditions:

- Due diligence by TransCanna

- Due diligence by LDS

- Execution of a definitive agreement

- LDS receiving an independent fairness opinion

- Approval of LDS shareholders

- Approval of the BC Supreme Court

There is no assurances that the Proposed Transaction will be completed as described in this news release or at all.

Subject to the execution of a definitive agreement and satisfaction of all closing conditions, TransCanna expects the Transaction to be completed in September 2019.

On May 9, 2019, TCAN announced a pending deal with Persuasion Brewing – a private brewing company located in Modesto, California. Inside TransCanna’s 196,000-square-foot facility, Persuasion Brewing will produce a variety of different CBD infusion non-alcoholic beers.

“TransCanna is supplying the facility, capital, software, distribution and marketing platform, and we’ll supply the intellectual property and knowhow to create a superb CBD-infused non-alcoholic beer,” stated Chad Swan, president of Persuasion Brewing

“We believe that our first beverage product should be a private labeled non-alcoholic CBD-infused beer,” stated Pakulis, “Because it’s the least expensive method to generate the greatest margins as quickly as possible.”

TransCanna is holding an investor conference call on Wednesday, July 3rd at 1:15pm PST. Conference call in numbers: (US) 888-585-9008, (Canada) (888) 299-2873 and (Germany) 0 800 723 5123. The Conference room pin is 477 995 281.

– Lukas Kane

Full Disclosure: TransCanna and LDS are Equity Guru marketing clients.

What’s your opinion on the deal for LDS shareholders. With everything LDS has got going for it, continuing distribution of cannastrips in dispensaries, cultivation agreements, reveur, own nursery, revenues. Tcan has none of that , they have an 196,000 square foot facility with a vision of various plans for it. Seems like if anything LDS should be the company offering to buy out transcanna ? And for a 10:1 ratio for LDS share holders, seems like quite the slap in the face?

John, thank you for your insights. By mid-morning Tuesday, LDS is down 15%, and TCAN is trading flat. So it appears “the market” agrees with your assessment. I will point out that the next growth phase of both companies involves marketing and branding – this is something TCAN’s DNA is better suited for.