This is the last segment of Crypto 101 and I hope you’ve found some value in it.

Today we’re going to be covering a cross section of cryptocurrencies themselves, and handing out some tips to help you find the investment that’s right for you. The problem with writing an article like this is that there are literally thousands of coins, and detailing all of them, or even finding discrete categories to fit them into, would probably mean filling a book.

Because nobody has time for that, here are four easily digestible categories of the most common coins presently on the market.

Overview

All cryptocurrencies meet the benchmarks of cash.

They act as both a store of wealth and a medium of exchange. Lots of retailers now accept Bitcoin, and while it’s not as much as say, those that accept Visa or Mastercard (which is almost everyone), it’s a lot more than in 2016.

There’s evidence to suggest that the eldest coins have shown some indication of becoming less volatile over time, but it’s not enough compared to securities and other commodities.

That makes it hard to justify using them as a means of exchange.

So why invest in cryptos at all?

Different cryptocurrencies provide different options and functions, and sometimes these correspond to certain worldviews, and can lead to opportunities unknown anywhere else.

Perhaps you’ll want a solid investment that—while it has a fair amount of price volatility in the short term—has a generally upward trajectory, then you’ll want to look at Bitcoin and Litecoin.

Maybe you’re a privacy hound and don’t want any regulatory bodies hovering over your shoulder, then you’ll want to have a look at Dash, Zcash or Monero, the three privacy coins.

Maybe you’re uncomfortable with decentralization, or would like a hedge against volatility so you can actually buy products with your coins—then stablecoins may be your jam.

Coins for long term investment

All active cryptocurrencies are technically exchange media as long as there’s an outlet to buy goods and services with them. It is entirely possible to buy a package of $0.10 gummies using a percentage of a percentage of Bitcoin, but why would you?

Even larger ticket items like televisions, cars and houses are entirely up for grabs using Bitcoin. But again, why would you? Even though it’s shown evidence of slowing down, the price of Bitcoin is still subject to such wild swings in value that you’re almost guaranteed to leave money on the table at some point.

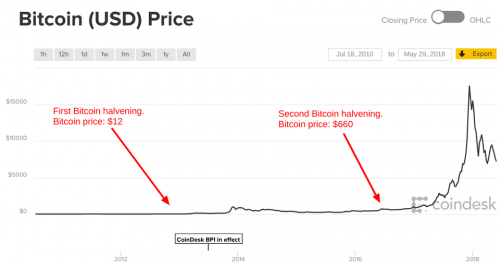

Consider the trends following a halving for a second.

Simple economics says that a reduction in supply for an in-demand product precipitates a rise in price. If Bitcoin is trading at 13,112.41 today (market cap: $232 billion) with the reward for successfully mining new Bitcoin is what it is today, then how much will it be worth when the available supply is half that?

More. A lot more.

That’s why it’s easy to think of coins like Bitcoin, (and to a lesser extent, Litecoin and some of Bitcoin’s bastards) as store-of-value coins. Treat them like investments. Throw money into them over time. Watch their comparable prices—if Dash is crapping out, consider shifting it to a better performing coin—and adjust.

It’s called arbitrage in market terms, and it’s a great way to make money using crypto.

Bitcoin will halve in 2020 and then again in 2024, and the price will go up as the scarcity increases. If we’re cynical, there’s always the possibility that some future government could build a political tunnel into your RRSP, or sabotage your pension to reduce government spending. It’s improbable, and an uncomfortable thought, but it’s not entirely outside the realm of possibility.

They can’t do that with decentralized cryptocurrencies, which means that they’re an effective hedge not only against the dollar, but also against greedy governments who can’t keep their fingers out of the cookie jar.

Bitcoin (BTC)

Bitcoin is the digital currency that started it all. Its story is well-documented from its ideological underpinnings to its early adopters up to the present day. Its purpose is the first store-of-value coin, which is why folks in high finance keep trying to bundle it up in ETFs.

This is probably the coin you’re most familiar with, but depending on your political leanings, temperament, goals and present cash position, it might not be the best coin for you.

It started out as the darling of anarcho-capitalists and Ayn Rand devotees, who would leave 4Chan long enough to put their computers to the test of solving the complicated equation required to win their few hundred Bitcoin. They would then brag to their friends about this new nerd-tech for cool points because that’s about all they were worth back then.

Then the technology developed—and if they didn’t do something stupid—those nerdy kids went from sweaty basement dwellers to penthouse denizens. Some sold out and others stayed in and a few went onto bigger and better things. Some are probably still living in their mother’s basement, and wondering where it all went wrong.

Then there’s James Howells, who spends everyday digging through a landfill in Wales for a hard drive he threw away in 2013 that had 7,500 bitcoin stored on it.

Mostly, Bitcoin’s political heydays are gone. Institutional investors have started giving it some serious attention, and that scares away the fringe anarcho-capitalist types with their dreams of a decentralized utopia.

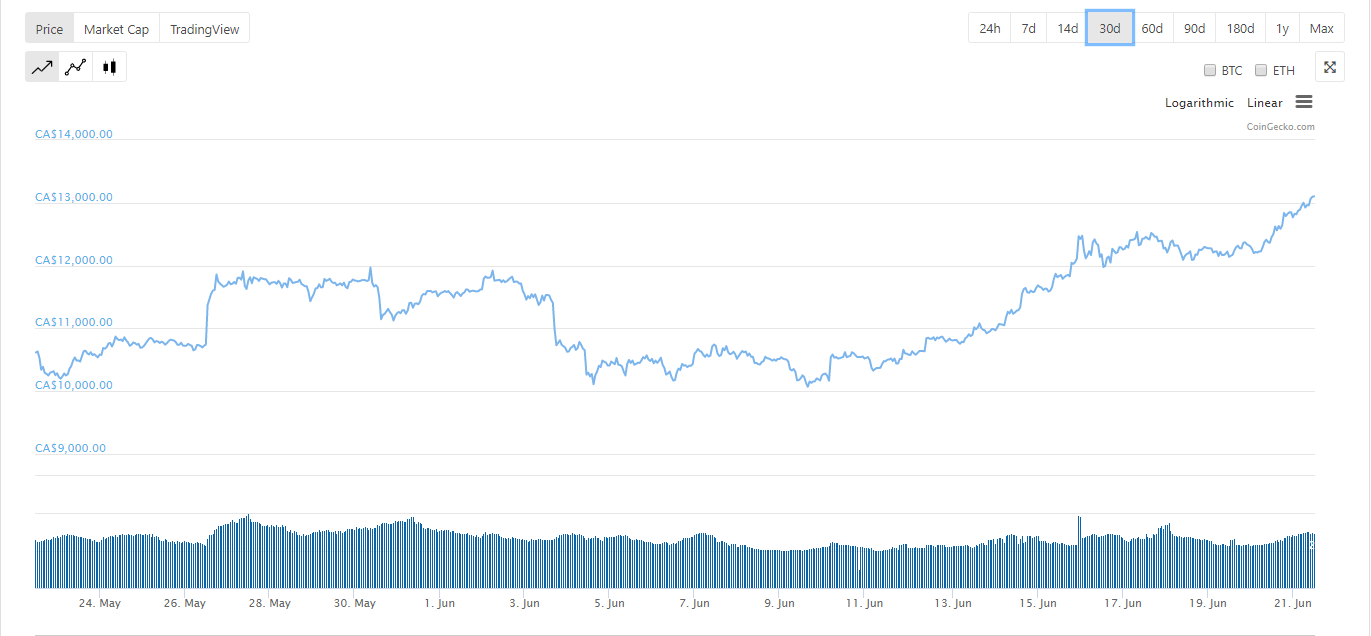

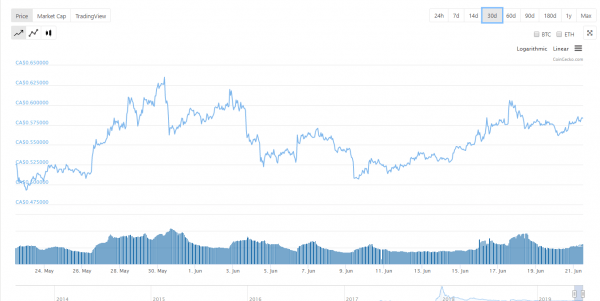

To sum up, Bitcoin is best used as a store of value because there’s too much volatility to make it worthwhile as a medium of exchange, as the percentage of bitcoin you spend today could be worth ten times tomorrow. Don’t believe me? Look at the chart. The needle has been known to move hundreds of dollars in a single day, and sometimes by thousands of dollars over the course of a week.

Besides, it’s been on a run lately and it’s probably not a good time to get in on this coin. It could theoretically still go up, but there are cheaper and easier ways to make your money stretch further.

Litecoin (LTC) is one of those ways.

Litecoin’s price stays artificially much lower than Bitcoin’s even though they’re effectively using the same protocol. There are some changes, though, such as a lower block reward (the amount miners get for solving the fancy math that closes the block) and the amount of coins out there in circulation.

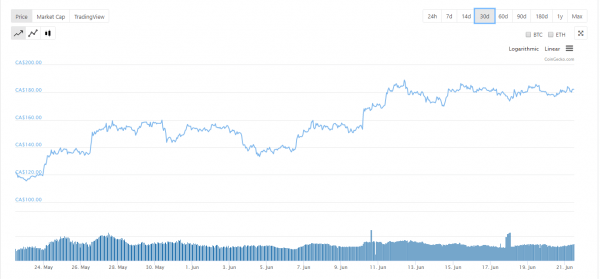

Charlie Lee, the coin’s creator, reconfigured the Bitcoin protocol to spill out even more coins into the marketplace, jacking up supply in relation to demand. Like Bitcoin, it halves every four years, and the total supply will be 84 million. Also, like Bitcoin, it’s pretty volatile.

Litecoin has a transaction time of 2.5 minutes, which means that it’s possible that if the apparatus were in place, you could potentially use it to buy something if you didn’t mind waiting for a few minutes. It’s still not going to compete with Visa or debit cards for transaction speed, though.

Arbitrage is another of its most common uses. If your pre-existing coin has been consistently underperforming, then shapeshift it to Litecoin. If Bitcoin is performing better than Litecoin, then shapeshift it up and add to a pre-existing Bitcoin. Or down from Bitcoin to Litecoin. The sky’s the limit.

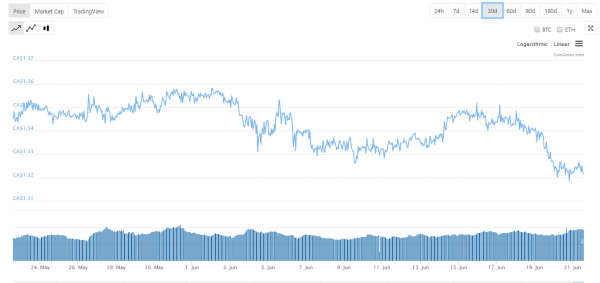

Right now, though, Litecoin’s been on a tear.

It’s presently trading at $182.29 with a market cap of roughly $11 billion for a bullish run of 340% in six months.

Coins for business

Bitcoin was created as a medium for exchange. It was decentralized money that was meant to replace the existing fiat currency, which could be otherwise manipulated by governments.

Coins like Ethereum (ETH) are completely different.

Invented by programmer Vitalik Buterin and released in 2015, Ethereum was intended to be the world’s first decentralized computer.

Ethereum is a completely open-source global, decentralized platform for money and new kinds of applications. You can use ethereum to control money and build applications accessible anywhere in the world.

Accessing it involves owning ‘ether’ the coin behind the Ethereum blockchain. It gives you access to the blockchain itself and the global computer behind it, which you can join or create smart contracts, and develop decentralized apps (d’apps).

You could always just trade ethereum like every other coin, and for that purpose it’s trading at $389.27 with a market cap of $41 billion.

Ripple (XRP)

Ripple is generally thought as the red-headed stepchild of cryptocurrencies, because of its many many deficiencies, which we’ll get to later.

It has its own crypto – XRP – yes, but it’s mostly known as a technology that offers a digital payment network and protocol. It’s a payment settlement, asset exchange and remittance system that works for international money and security transfers.

Ripple’s three products are xCurrent, xRapid, and xVia.

xCurrent uses Ripplenet, the ripple blockchain, to send money across borders.

xRapid helps banks improve liquidity for banks when trading in emerging markets. Banks tend to be agnostic on its uses, because while it does manage to help them free a lot of otherwise illiquid assets, it introduces cryptocurrency’s scaleability issues into banking, which bogs down the process.

xVia allows financial institutions and businesses to send payments to emerging markets through the RippleNet.

Here are a few of Ripple’s biggest deficiencies:

First – it’s centralized. The coins are already mined and Ripple Labs owns 61% of the coins, therefore the coin’s future is entirely under their control.

Secondly, it’s open source, which means that the code is out there and available for hackers to read, absorb, and learn how to hack.

I wouldn’t call that a stable investment.

At present, XRP is trading at $0.58 with a market cap of $24 billion.

Coins for politics and privacy

Decentralization brings with notions of privacy and hidden movements. If a structure has no available points of weakness in its foundation, then it cannot be knocked down. Likewise with cryptocurrency. Decentralization means that no power—be it a government, supra or subnational influencing force—can contradict or impede the proliferation of the network. That’s pretty cool.

But the conflict over information is an ongoing arms race. Bitcoin (and blockchain) conferred an advantage until the puzzling technology was demystified, and now anyone with time and patience can read the contents of the blockchain, and discover everything and everyone involved with it.

That’s why privacy coins were created. The three recognized coins are Dash, Zcash and Monero. We’ve written extensively about both Dash and Zcash in previous articles, so all there’s left is to talk about is:

Monero (XMR)

BitMonero was born in 2014 from a fork of the codebase of another privacy coin called Bytecoin. Initially, it wasn’t received well by its support community, owing to its lengthy block closing time and block reward for miners. It was taken over by a different group, who changed the name from BitMonero to Monero.

Monero’s technology hides the origins, amounts and destinations of all of its transactions. Monero offers all of the benefits of a decentralized cryptocurrency but without any of the privacy concessions

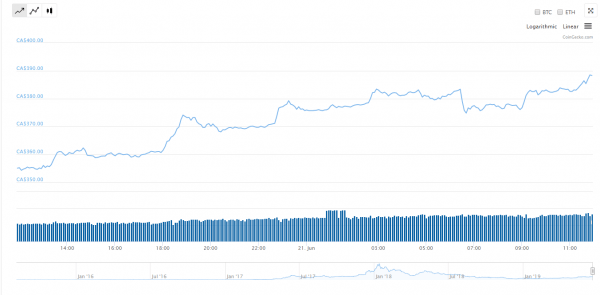

Its privacy features led it to be the fastest growing cryptocurrency of 2016 with its market cap jumping up by leaps and bounds.

Since then it’s earned a reputation as the coin of choice for criminals, being used in darknet markets to buy guns, drugs, and other items.

Data on who uses Monero and why is understandably quite lacking, but its potential uses are unlimited.

The question remains as to why would someone would need to hide their transactions if they were for legitimate purposes? Why use Monero when Bitcoin (or even fiat currency) would do just fine?

The odds are quite good that nobody reading this has a legitimate use for Monero, but sometimes there are circumstances in life where one may need to buy something that doesn’t leave a paper trail. Monero is for these folks.

What’s interesting is the speculation behind what effect, if any, privacy coins like Monero will have on geopolitics in the future. Movements of money between subnational political entities are hard enough to track as is, let alone giving them access to a technology which completely hides any resemblance of a paper trail.

Right now Monero is trading at CAD$142.52 and has a market cap of $2.4 billion.

Stablecoins

Stablecoins exist in direct contrast to privacy coins in that they’re tied to pre-existing commodities or baskets of currencies, and therefore can be traced and tracked everywhere they’re used. These confer price stability in exchange for centralization.

We’ve discussed stablecoins before when we took apart Mark Zuckerberg’s proposed cryptocurrency (now named Libra), so there’s little point in rehashing it, but there is definitely something to be learned from another case study.

Tether (USDT)

Remember Tether? The coin that Bitfinex used to attempt to cover up their considerable shortfall after Crypto Capital ran away with almost $1 Billion of their money? They’re technically a stablecoin, and they claim they’re backed USD$1 to one coin, although they’ve come under a bit of scrutiny lately regarding their unwillingness to submit to an audit to ensure that they have the reserves required to make that claim.

The accounting, tax and business consulting firm, Friedman LLP had been working on an audit of Tether and Bitfinex since May. Then Tether admitted to Coindesk that its relationship with Friedman was over.

This is disconcerting, because Tether has been rapidly expanding the supply of their crypto but not necessarily the fiat to back it. Last April, they had more than $50 million worth of tether in circulation, but today the figure is more like $2.2 billion, with January 2019 accounting for $850 million tethers alone.

So what are they backing it with?

How about nothing at all?

“I, and many others, suspect tether is being used to effectively counterfeit hundreds of millions of dollars of perceived value,” wrote security researcher Tony Arcieri in a January blog post.

Go to the company’s site and read the fine print:

“In April 2017, we announced that Tether’s primary banks in Taiwan were being blocked by U.S. Correspondent banks, including Wells Fargo. We are among a number of innovative companies in the digital token space experiencing such banking roadblocks.

Since that announcement, we have been diligently working on other payment avenues and channels, including third party payment processors and banking relationships in countries with friendlier correspondent banking connections.”

In short—nobody will give us the money we need to back our cryptocurrency—and we’ve had to get extremely creative to fulfill our client’s needs.

The USDT stablecoin is only about 74 percent backed by fiat equivalents as of April 30, says its issuer’s general counsel.

The most recent update says:

“Tether, the company behind USDT, holds about $2.1 billion in cash and short-term securities, wrote its general counsel Stuart Hoegner in an affidavit Tuesday. Hoegner is also general counsel to Bitfinex, a crypto exchange which shares executives and has overlapping owners with Tether.”

Cool story, bro.

Long story short – stay away from Tether.

If you’re not inclined towards taking advice, it’s trading at $1.32 and has a market cap of $4.7 billion.

These offerings are but a sample of the coins out there for the diligent collector.

Keep reading, keep watching, keep learning and don’t forget to hodl strong.

—Joseph Morton

Nice and valued content.