If you owned a 5% share in a 300-foot yacht, and the captain refused to let you sell your interest – then ran the ship aground – you’d have an idea how early MedMen (MMEN.C) investors, Brent Cox and Omar Mangalji feel.

Collectively, Cox and Mangalji own about 19 million shares of MedMen – a publicly traded company that operates a network of U.S. cannabis retailers.

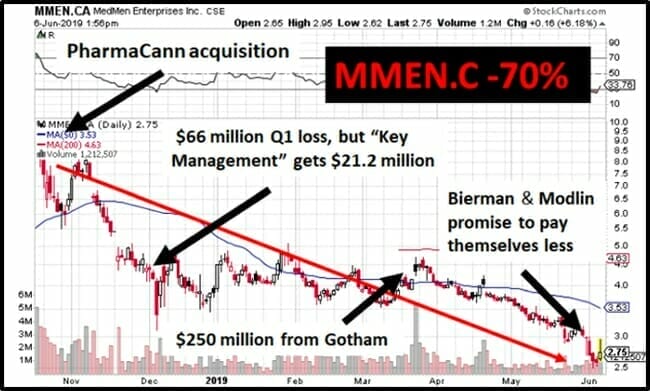

On October 18, 2018 – a 5% share in that shiny new yacht was worth $179 million.

The ship now has a banged-up hull, a flooded engine room and blood-stains in the stateroom; the 5% share is now worth about $52 million.

So yes – that’s probably annoying.

Cox and Mangalji were not allowed to sell their interest, because MedMen CEO Adam Bierman and President Andrew Modlin control most of MedMen’s voting shares.

On May 28, 2018, Equity Guru principal Chris Parry dug into the company’s financials and revealed the mass-castration of MMEN shareholders.

The greediness that Parry unearthed foreshadowed a pattern of MMEN execs using the company as an ATM.

In Q1, 2019, for instance, MedMen reported a net loss of $66.5 million. On p. 57 of the consolidated statements, it mentioned in passing that “Key Management Compensation” for the quarter was $21 million.

That is some sick, ballsy, shit.

If you have no job, hobbies or nagging chemical addictions – go ahead and read Cox and Mangalji’s 33-page law suit.

If you are squeezed for time, here’s the Cole’s Notes:

Cox and Mangalji, through an affiliated entity (MMMG-MC) own a shit-tonne of MMEN. They claim MedMen indulged in pernicious financial engineering to avoid releasing the plaintiff’s shares.

“Sadly, we are backed into a corner here and compelled to take action on behalf of all stakeholders of the company,” stated Cox, a former board member of MedMen.

“MedMen is a publicly traded company that is withholding its shares from its shareholders,” stated Mangalji adding that, “Simply put, Management is using conflicted corporate structuring in breach of its fiduciary duty to its shareholders.”

Efforts to describe the endemic self-dealing of Bierman and Modlin led to some elliptical prose.

BIERMAN and MODLIN agreed with BIERMAN and MODLIN, in their various self-interested roles directing, managing, and controlling MEDMEN CORP., MMCAN, and MMUSA, that BIERMAN and MODLIN should automatically be paid additional money and units by entities controlled by BIERMAN and MODLIN for reasons not correlated with shareholders’ best interests. This dynamic – BIERMAN agreeing with BIERMAN to pay BIERMAN for things BIERMAN agreed with BIERMAN to do because they were good for BIERMAN, while being terrible for shareholders and for the entities BIERMAN decided should pay him – permeates the entire MedMen enterprise.

If you’ve ever tried suing someone (not recommended – health costs are typically higher than the monetary reward), you know that a defendant go-to tactic is to delay, hoping that the plaintiffs will soften up over time.

The problem for Cox and Omar Mangalji is that their locked-up shares were rapidly losing value (about $40 million so far since they sued MMEN).

On June 5, 2019 Cox and Omar Mangalji announced that they had “filed a demand for arbitration in place of its pending lawsuit alleging breaches of fiduciary duty by MedMen founders Adam Bierman and Andrew Modlin.”

Arbitrations are harder to delay than lawsuits.

“Since our clients filed their lawsuit alleging mismanagement of MedMen, the company’s losses have continued, several executives have resigned, debt is accumulating and valuable real estate assets have been sold,’’ stated the lawyer. “Meanwhile, MedMen’s procedural filings delayed the case until November. That delay is untenable given our clients’ views that MedMen’s financial condition is rapidly deteriorating. In order to obtain prompt relief, they have decided to file an expedited arbitration.’’

Employing Cadet Bone Spurs’ play book, “When someone attacks me, I always attack back…except 100x more,” MMEN issued a press release the next day.

“Immediately after filing the faulty lawsuit, Mangalji, a reported “playboy” who uses the alias “Ronnie Bacardi,” appeared on various news media outlets touting his baseless claims and plugging his own competing company,” claimed MedMen, “Cox and Mangalji now seek to retreat to the anonymity of a confidential arbitration to avoid publicly airing their own wrongdoings.”

Later that same day, Mangalji released his own statement.

“We find the personal remarks today by MedMen to be beneath a public company, much less a company aspiring to be the ‘Apple of cannabis.’”, stated Mangalji, “The remarks demonstrate the temperament and values of MedMen’s management, which we believe places executive profit, personal vendettas, and name calling above the business of the Company and the interests of shareholders. We made this decision for one reason: we are concerned about the health of the company and want access to our shares as soon as possible.”

The unseemly public spat with Cox and Mangalji is not a new narrative for the slick weed retailer.

In a bitter law suit, MMEN’s ex-CFO James Parker claimed that Bierman and Modlin called him “fat and sloppy”, a “pussy-bitch” and also referenced L.A. City Councilman Herb Wesson as a “midget negro” and a rep. of the Drug Policy Alliance as a “fat, black lesbian” and various female foes as “cunts.”

In a Rolling Stone article, “Bierman called the claims ‘complete garbage,’ maintaining that Modlin is openly gay and that his wife is Latina, so accusations of bigotry don’t make sense.”

This isn’t a kitten-rescued-from-tree-story.

It isn’t a homeless-man-performs-at-Carnegie-Hall story.

It’s not even a Justin-Bieber-apologizes-for-pissing-in-a-mop-bucket-and-shouting “Fuck You Bill Clinton” story.

There may be no good people in this story.

But there are definitely some bad ones.

Full Disclosure: Equity Guru has no financial relationship with MedMen, or any entity mentioned in this article.