On May 14, 2019 Hemptown USA announced the completion of $23 million financing, led by Canaccord Genuity.

The company is growing 1,500 acres of high-grade “feminized hemp” in Oregon, on the northern tip of the famous weed-growers Emerald Triangle.

Feminised hemp comes from genetically altered seeds. Typically, they produce more medically active substances such CBD and CGB, than a male plant.

Hemptown USA plans to distil the hemp into full-spectrum CBD and “CBG crude”.

In a moment, will get into CBG.

But first – you’re probably wondering: where’s the ticker symbol?

There ain’t one – yet.

Hemptown USA is a private company.

We are telling you about it now, because this company is planning to go public in the fall of 2019.

Prior to that, there may be another round of financing – which would typically only be available to “accredited investors”.

What is an “accredited investor?”

“You need to be earning $200k or more,” explains Equity Guru principal Chris Parry, “or have access to $1m in liquid capital. Personally, I just lied on the forms until I qualified, but would never have qualified if I hadn’t lied on my forms”.

Editor’s note: Chris Parry makes up his own rules: shit that works for him, may not work for you.

But don’t despair: there may be an opportunity for non-accredited investors to take a position.

We’re not just “reading-the-tea-leaves” here.

Parry recently grilled Hemptown’s President, Mike Townsend. At the 17:15 mark of the podcast, Townsend talks about the plans to build a large shareholder base of retail investors.

What’s in it for them?

The opportunity to earn loyalty.

This relatively new-fangled strategy of building a direct relationship with an army of smaller investors has proved successful – even in cases where the CEO is a full-on nutbar.

Of course, not every IPO catches fire. But owning part of very young CBD/CBG company could be serious wealth generator.

Now – back to Chemistry class.

CBD is a non-psychoactive cannabis/hemp derivative, prescribed to treat pain, inflammation, stress and anxiety.

The regulatory floodgates opened after U.S. President Trump signed the Farm Bill into law in December, 2018, legalizing the production of hemp.

CBD has experienced an accelerated consumer adoption-cycle – moving from health fad, to accepted medicine, to mainstream usage in the time it took Rosanne Barr to torch a 40-year career.

But what the hell is this new cannabinoid product Hemptown USA is yakking about?

No, it’s not a 1970s’ Bowery punk club.

That’s CBGBs.

No, it’s not anti-Semitic slang for “apprehension.”

That’s the heebie-jeebies.

According to a well-researched article by Jacqueline Havelka on Leafly.com, “CBG is a powerful vasodilator that has neuroprotective effects” while also showing “great promise as a cancer fighter.”

Hemptown USA is monetizing the present (CBD) while looking to the future (CBG).

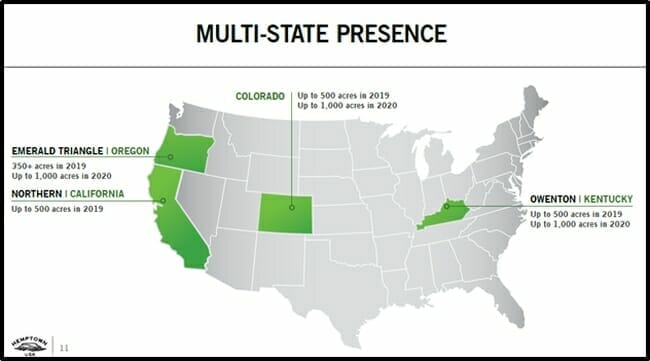

The company plans to embark on a multi-state expansion, purchasing USD $5.5 million worth of Oregon Cannabidiol seeds and begin the build-out of Hemptown USA’s processing and extraction facilities.

A Ministry of Hemp article, states that, “in 2017, hemp fields expanded by 163%. The five states that made the most significant hemp acreage leaps were New York (2,000 acres), North Dakota (3,020 acres), Kentucky (3,271 acres), Oregon (3,469 acres) and Colorado (9,700 acres).

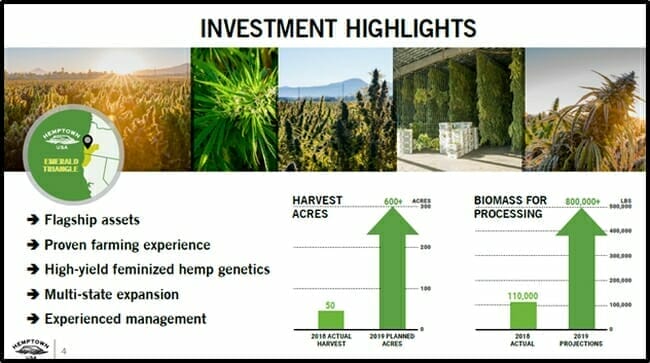

The Skinny on Hemptown USA:

- 1st year yield of 110,000 lbs of feminized hemp biomass.

- Projected gross margin greater than 77% on average from 2018’s harvest.

- Purchase of 1 million rare CBG seeds for the 2019 growing season.

- Coveted strain profiles containing 15% – 20% full spectrum CBD, CBG and other cannabinoids and terpenes.

- Presently growing 1,500 acres in Oregon, Kentucky and Colorado.

- Capability to double the acreage in 2020 and each year after.

- An R&D plan for mass production of novel cannabinoid strains (CBC, CBDV and CBGV) in 2020, 2021 and 2022.

- Plans to acquire a GMP- certified nutraceutical facility to develop unique cannabinoid products for the health and wellness industry.

- Plans to enter into the Consumer-Packaged Goods sector by building and acquiring high-potential brands.

According to Network News, “Hemptown USA uses best-in-class seed genetics from Oregon CBD Seeds, which contain less than 0.3 percent THC and exceptionally high cannabidiol content of up to 20 percent. Hemptown USA’s strains include Suver Haze, Sour Space Candy and Electra.

Hemptown USA is now positioned to vertically integrate into the consumer- packaged goods sectors. The business model intends to capitalize on a global market expected to exceed $22 billion by 2020.

When the “Offering Memorandum” for non-accredited investors crosses our desk – we’ll relay that info to you in real time (you’ll hear about it before regular schlubs.)

“The $23 million capital infusion will allow us to expand operations to Colorado, Kentucky and Northern California, ramp up processing capabilities, and develop disruptive product formulations,” stated Rod Wolterman, founder and Chairman of Hemptown USA.

Full Disclosure: Hemptown USA is an Equity Guru marketing client, and we will be taking a position in the next round of financing.

When is HempTownUSA going public ? What is Hemptown USA is Hemptown’s stock symbol ?

What is Hemp towns ticker symbol?

Hemptown had signed an LOI to go public through a RTO in September 2020, but that deal never went through. As far as we know, the company continues to operate as a private entity. Thanks for your feedback!