Right now, the weather in Red Lake, Ontario, is beautiful, springlike. Most days are a mix of sun and cloud, cool breezes and maybe a spot of rain. For a field worker in the resource sector, there’s no time of year quite like it.

The setting is perfect for exploring: mobilizing field crews, kicking rocks, sampling outcrops, mapping ground, homing in on potential drill targets using good science (geochemical and geophysical).

The only thing that’ll ruin the show is the inevitable descent of billions and billions of black flies, and believe me, they’re no joke…

Multi-jurisdictional ExplorerCo, Nexus Gold (NXS.V), is putting boots on the ground at Red Lake, under ideal spring conditions.

A bit of background on this Red Lake asset – the McKenzie Gold Project

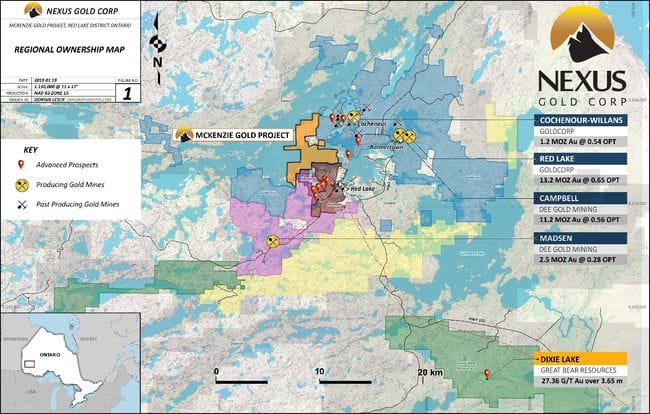

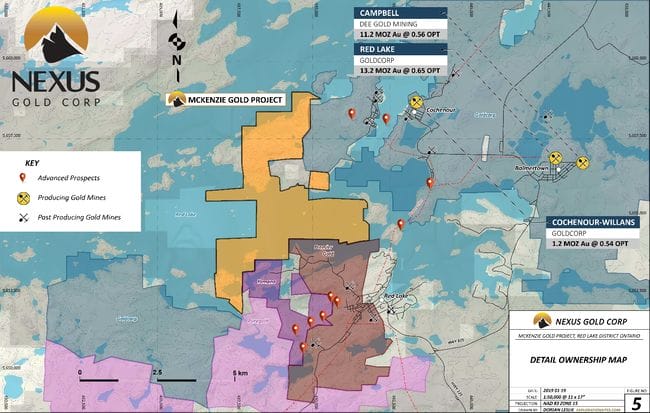

A cursory look at the map below places McKenzie’s 1,348.5 hectares right in the heart of the Red Lake gold camp, the high-grade gold capital of the world, if you will.

The project is strategically positioned. Newmont Goldcorp (NGT.T), Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T) are neighbors – well endowed neighbors.

Drilling in 2005 by Cypress Development (CYP.V) along the southern edge of the property encountered quartz veining accompanied by sphalerite, arsenopyrite, chalcopyrite, and free gold. The best hit from this limited drilling campaign cut 6.0 meters of 2.2 g/t Au.

This 2005 hit occurred within an east-west-trending 600-meter long mineralized zone (the zone is open along strike and at depth).

During a 2017 ground reconnaissance campaign on McKenzie Island, grab samples returned values of up to 313 g/t Au.

On the southwest corner of the island, a new showing – a 12 cm wide, low-angle quartz vein exposed over a length of 2.0 meters – was discovered along the shoreline. High-grade samples from this vein ranged from 9.37 g/t Au to 331 g/t Au.

This new discovery lies approximately 100 meters west of a historical showing that assayed up to 212.8 g/t Au.

Although this vein is narrow and the strike length is unknown, it demonstrates the untapped potential of the McKenzie project (Red Lake is known for its narrow high-grade veins).

The May 13th news

Nexus Gold to Begin Exploration Work at McKenzie Gold Project, Red Lake, Ontario

The company is about to begin a detailed prospecting program supplemented with geochemical and geophysical surveys.

The project is located in the heart of the world-famous Red Lake gold camp. The highly prospective geological setting is analogous to several past producers. McKenzie hosts nine documented historical gold occurrences with limited exploration and is preferentially situated adjacent to Newmont Goldcorp on its east and northern boundaries, and Pure Gold Mining’s Madsen project on the southern boundary.

Identifying geological trends and structures, those warranting a probe with the drill bit, is the goal of this first phase of groundwork.

Detailed mapping and sampling will fall under the supervision of senior geologist and vice president of exploration, Warren Robb.

Alex Klenman, Nexus president & CEO:

“We’re happy to begin developing our Canadian assets. Both McKenzie, and our New Pilot property in BC, represent prospective high-grade projects, and we intend to allocate appropriate resources to expedite their development over the next several months.”

Klenmam sounds like a man with a plan.

Aside from the high-grade gold values noted above, quartz veining and sulfide mineralization were reported in multiple locations within the northern portion of McKenzie Island where Nexus is bounded by the Cochenour-Gulrock deformation zone, host to the Campbell and Red Lake mines.

Sampling conducted in 2017 returned up to 18.02 g/t Au in grab samples from this vein exposure.

The McKenzie acquisition is an interesting story, one that highlights the skill and resourcefulness of this crew. Scalping a few details from a previous Guru offering on the subject:

The project suddenly became available when Enforcer Gold (VEIN.V) gave up its pursuit of the project after a proposed financing fell through.

This was a real heads up move on management’s part. And I’m guessing that 1082545 B.C. Ltd, the vendor of the McKenzie property, was being extra careful about who they partnered with next, not wanting a repeat of the Enforcer fail.

The price of admission? Four million Nexus common shares and a one-time cash payment of $150,000.

I find the terms of the deal interesting, that the vendor is willing to take NXS common in exchange for their Red Lake claim blocks. They must believe in the potential of the property AND the Nexus’ ability to execute.

1082545 B.C. Ltd doesn’t win unless NXS and its fellow shareholders win.

From where I sit, it looks like a damn good deal, especially when you consider the address.

There’s a whole lot more to the Nexus story

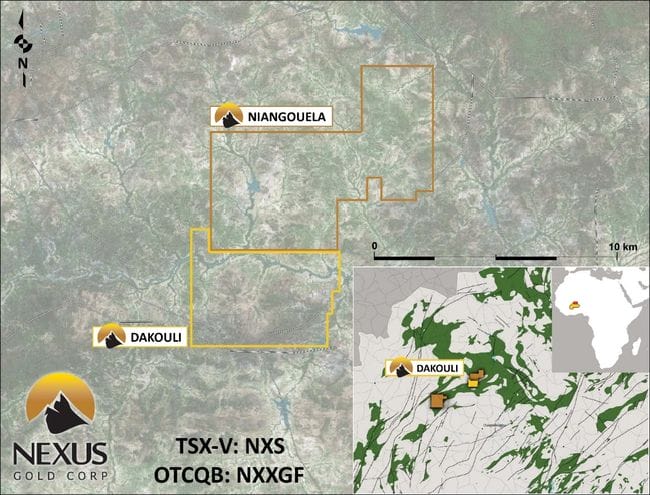

Having recently stoked the company coffers, management plans to drill high priority targets in Burkina Faso, including its recently acquired (high-grade) Dakouli 2 Project.

Nexus’ Burkina Faso project portfolio is extensive, strategic and highly prospective. Greater insights into this African story, and the company, can be gleaned via the following Guru offerings:

Nexus Gold Corp (NXS.V) extends strike length at Koaltenga gold zone

Market operators and a new high-grade acquisition for Nexus Gold (NXS.V)

Nexus Gold (NXS.V): Is Burkina Faso the next African gold superstar?

Nexus Gold’s (NXS.V) new baby just smiled

Nexus Gold (NXS.V) expands its jurisdictional scope – enters the prolific Red Lake Gold Mining Camp

Final thoughts

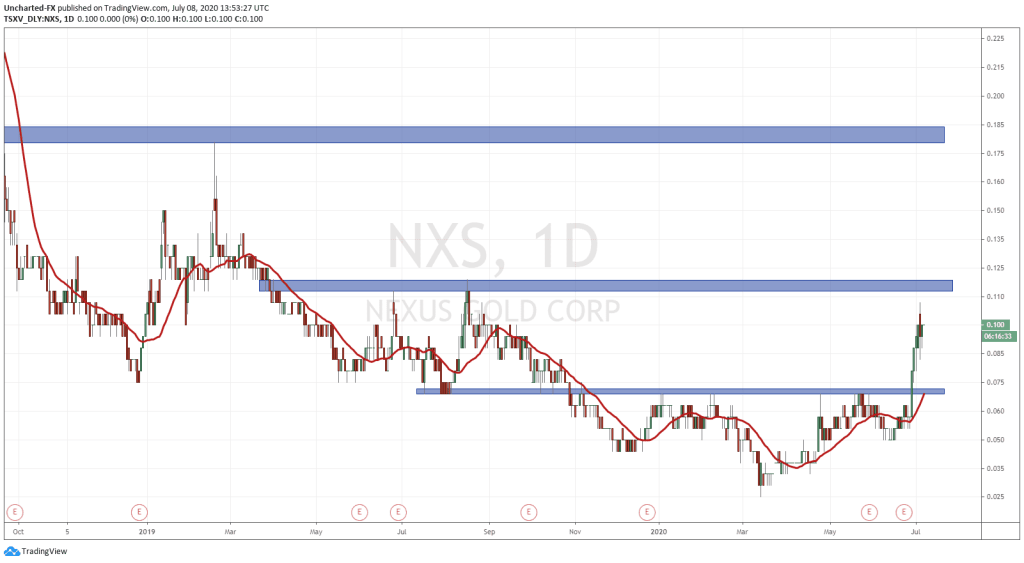

The company has 62.49 million shares outstanding and a market cap of $5.31M based on its sub-dime trading range. That strikes me as ridiculously cheap, especially for a company this well run, and this well positioned.

END

~ ~ Dirk Diggler

Feature image courtesy of irocks.com.

Full disclosure: Nexus is an Equity.Guru client. We own shares.

Are you kidding me.

You did not mention their other property here in BC in Goldbridge.

They did some grab samples last year and came back better then the Ontario property.

Thats the one Im waiting for and hope they get boots on the ground there.

“99 grab samples were taken in three zones (A, B, C in Figure 2), with three returning values in excess of 100 grams-per-tonne (“g/t”) gold (“Au”), including 102 g/t Au, 106 g/t Au with visible gold, and 111 g/t Au; three returning values in excess of 10 g/t Au (17 g/t Au, 21 g/t Au, 33 g/t Au); and 14 others returning values in excess of 1 g/t Au”

Hi Dave. Nope. Haven’t forgotten about the New Pilot project. I’m quite familiar with the area. Nearby Bralorne was uber high-grade Au. The entire region is highly prospective for gold/copper. New Pilot itself has sulphides, carbonate altered shears, and quartz veins containing arsenopyrite (often indicative of Au). Highly prospective. To address your complaint, yesterdays Nexus piece dealt almost specifically with newsflow outta Red Lake. When the company gets active at New Pilot, we’ll be there. Cheers.