Heritage Cannabis (CANN.C), one of Canada’s fastest-growing vertically integrated marijuana providers, has just completed a bought deal offering of 32.66 million units of CANN shares.

The company netted a little over $17.3 million in proceeds to expand its presence in the extraction business – an often overlooked segment of the cannabis market that is expected to surge once the federal government legalizes concentrates and edibles later this year.

Deal Breakdown

The new funding deal was announced May 7, 2019 and includes a full exercise by the underwriters to acquire an additional $2.257 million worth of shares. The share units were bought at a price of $0.53, which is a $0.04 discount over Monday’s closing value.

Each unit consists of one common share of CANN.C stock and one-half of a stock warrant share. Stock warrants are similar to call options in that they give the holder the right, but not the obligation, to purchase shares of a company at a specified price. For the CANN.C deal, the warrant entitles the purchase of one common share at a price of $0.70 for a period of 30 months.

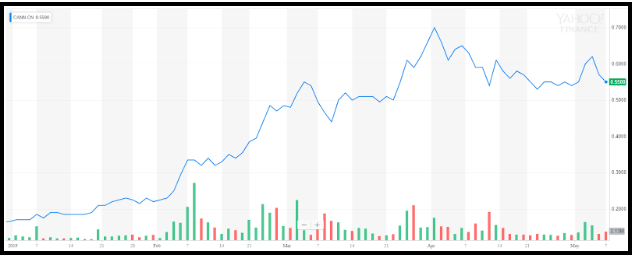

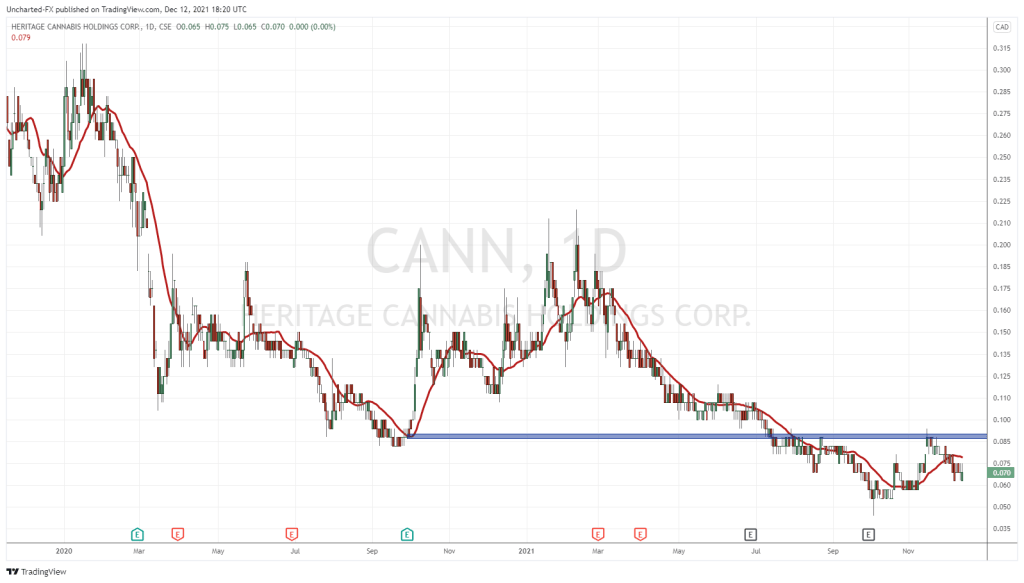

Heritage shares peaked at $0.70 on April 1 before correcting lower over the next four weeks. Even with the correction, CANN.C stock is up some 220% year-to-date. By comparison, the Canadian Marijuana Index has returned 35% since the beginning of the year. The broader North American Marijuana Index is up 37% over the same period.

Deal Purpose

According to the official news release:

“The Company intends to use the net proceeds from the Offering to increase extraction capacity and follow-on investments in existing portfolio companies, new domestic and international opportunities, working capital and general corporate purposes.”

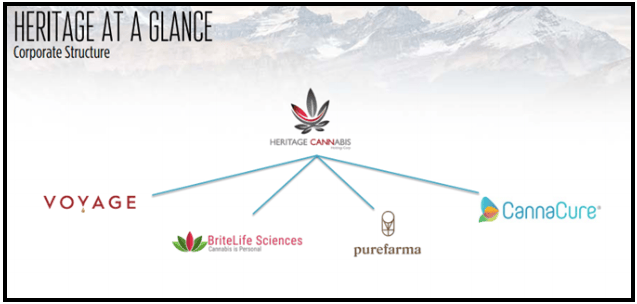

Heritage has a significant portfolio of pot-sector operations that includes several subsidiaries in cannabis extraction and medical solutions.

Purefarma Solutions is one of the company’s extraction subsidiaries. Based in Kelowna, B.C., Purefarma is a manufacturer and wholesale processor of premium CBD oils. It has an existing supply agreement with local farmers for 1,600 acres of hemp.

In its latest corporate presentation, Heritage targets Q3 2019 to expand its extraction supply agreements and complete phase 2 of its CannaCure extraction rooms. Heritage acquired CannaCure, a Niagra-based marijuana company, back in October.

The new funding deal will also allow Heritage to build on its other subsidiaries, which include two Health Canada-approved producers and a regulated medical cannabis company.

The company currently operates in two jurisdictions, British Columbia and Ontario. It maintains grow operations, products, oil, medical and intellectual property in both provinces.

Economics of Cannabis Extracts

Canada’s legal cannabis market is expected to generate more than $4.3 billion in sales this year, but extracts are still a relatively nascent business.

For instance, cannabis concentrates and vape pens have yet to get the green light from Ottawa. These products, which usually consist of THC or the less psychoactive CBD, are still under scrutiny by Health Canada.

Apparently, Ottawa bureaucrats are concerned about concentrates because they are created by an industrial process and therefore do not occur naturally (We’re not sure why cigarettes are legal, but these are the sorts of arbitrary lines that governments can create).

That’s all about to change later this year when new regulations pave the way for the sale and production of extracts.

According to research from GMP Securities, extracts will eventually account for half of Canada’s legal cannabis market. And vape pens alone will represent 20% of the extracts sector.

We already have evidence of this, state-side.

In California, vape cartridges accounted for nearly a quarter of legal marijuana sales in 2016.

Extracts are a gateway to many value-added segments of the legal marijuana sector, one that extends to oils, edibles, topicals and even infused beverages.

All of this will feed into an industry that may become competitive enough to take on the black market, where extracts enjoy a strong presence.

As Deloitte recently noted, legalization will see the black market slowly wither away as more Canadians embrace brick-and-mortar retailers and legal online channels

This will catalyze a global legal marijuana market that is expected to be worth $63.5 billion by 2024.

Full Disclosure: Heritage Cannabis is an Equity Guru marketing client.