In our maiden article featuring Rockridge Resources (ROCK.V), we explored every aspect of the company, from management pedigree to geological merit:

Rockridge Resources (ROCK.V): one of Canada’s newest copper exploration companies

Today, we were served up a taste of what the company has percolating just below the surface at its flagship Knife Lake project in the Canadian province of Saskatchewan.

First impressions

This headline interval begins near surface:

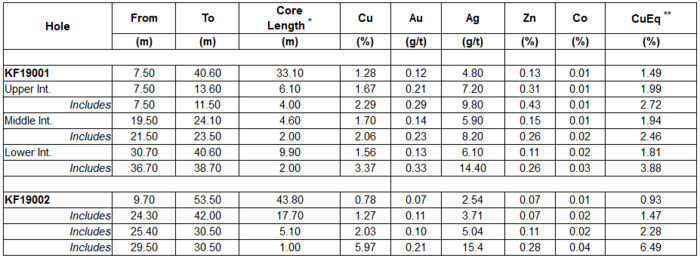

Drill hole KF19001 intersected net-textured to fracture-controlled sulphide mineralization between 7.5 meters to 40.6 meters.

The headline numbers – 1.49% copper equivalent (CuEq) over 33.1 meters – represent a fat hit.

The second interval highlighted in this press release – hole KF19002 – tagged 43.8 meters of net-textured to semi-massive sulphide mineralization grading 0.98% CuEq. This interval was also tagged near surface, at 9.7 meters.

The first drilling campaign in over 18 years is off to a flying start.

Results from 10 additional drill holes are pending.

Taking a closer look at KF19001 and KF19002

The ‘included’ sections in this headline interval are nicely laid out in the following table:

Jordan Trimble, Rockridge’s president and CEO:

“We are excited to report the results from the initial two holes of the winter drill program as they illustrate the shallow, strong tenor of copper mineralization at the Knife Lake Project. Results from ten additional drill holes are pending which will provide steady news flow and catalysts over the near term. This inaugural drill program represents the first meaningful exploration carried out on the project in over eighteen years as we execute on our strategy of going back into overlooked projects in favourable jurisdictions and applying modern exploration techniques and methodologies to make new discoveries.”

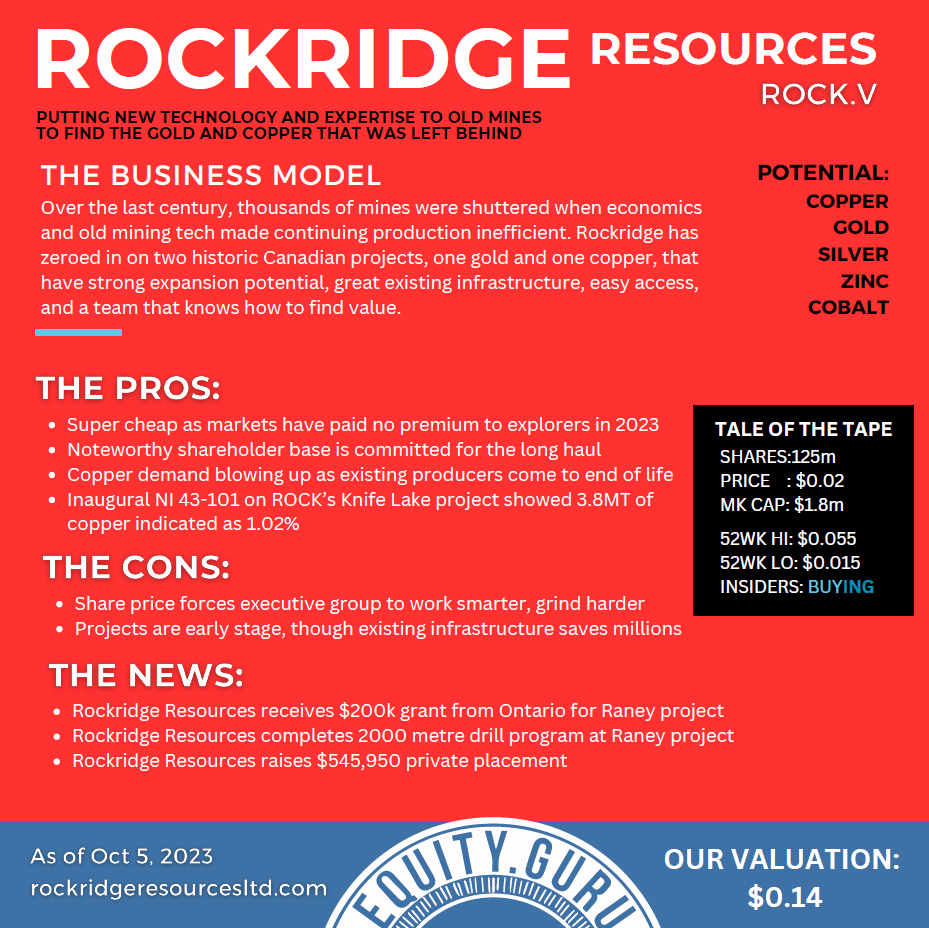

A review of ROCK’s compelling fundamentals

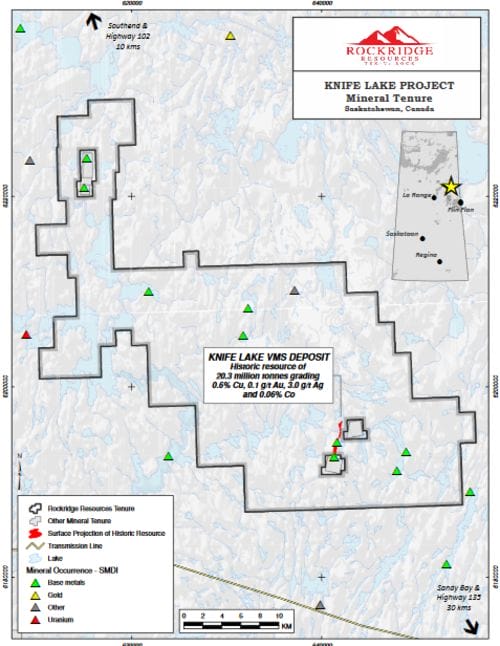

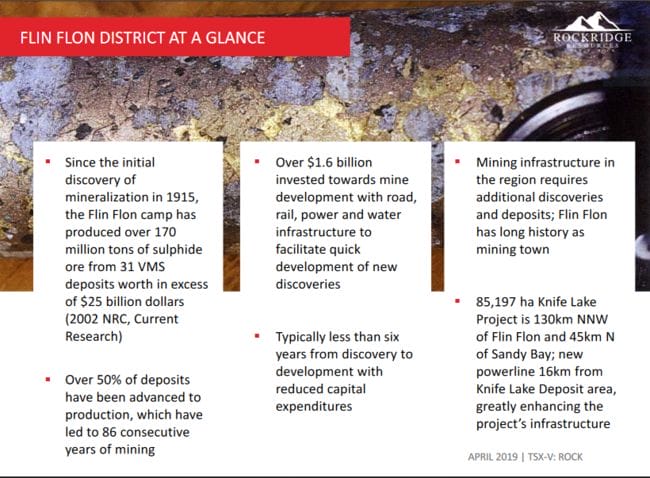

Knife Lake is located northwest of Flin Flon, along one of the most prolific greenstone belts on the planet, in a province ranked third in the Fraser Institute’s annual mining survey of mining jurisdictions.

This part of the country is steeped in mining culture, but the ore is running out.

New discoveries are needed to feed the regions $1.6B in mining infrastructure.

Rockridge acquired Knife Lake on the cheap. The price of admission was less than $0.005 per pound of copper in the ground.

The project is only the first of several advanced-stage acquisitions the company will likely take down in the copper space as management’s extensive contacts in the industry should help ROCK tap into the non-core asset portfolios of larger mining companies, allowing it to acquire projects on similar terms to Knife Lake.

Great negotiators, these guys.

The project has a historical resource (non NI 43-101 compliant) of some 20.3 million tonnes grading 0.6% copper, 0.1 g/t gold, 3.0 g/t silver, 0.06% cobalt and 0.11% zinc (a higher grade zone containing 11 million tonnes grading 0.75% copper lies within).

Knife Lake is a volcanic massive sulphide (VMS) setting – VMS belts often produce multiple deposits.

With 85,196 hectares to explore using newer, state of the art technologies, the above (historical) resource may represent only the first of many high-grade structures on the property.

As demonstrated in today’s press release, the exploration upside at Knife Lake could be substantial.

The underlying dynamics

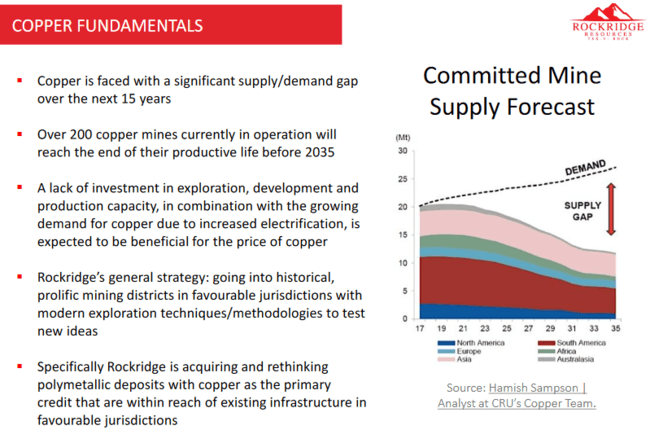

In our recent coverage of Rockridge, we cited some of the more potent fundamentals underpinning the metal:

Last week at the Cesco conference in Santiago Chile, one of the bigger expos in the copper arena (they’re already selling tix for next years event), analysts and executives point to the tightest market they’ve seen in more than five years.

CRU analyst Charlie Durant, in a recent Reuters article, stated, “Copper is going to be central to the green revolution.”

Electric vehicles (EVs) are seeing a global surge in interest. Manufacturers can’t keep up with demand. According to Driving Electric, it might take up 12 weeks for a new gas-powered car to be delivered, but lead times for EVs can be up to six months. “Order now” is their best advice.

Aside from EVs, which can use three times as much copper as internal combustion engines, the demand is increasing wherever energy transmission and distribution are required – solar panels and wind turbines are also good examples.

Bottom line: the world has a growing appetite for electricity. If the world wants to become more electrified, it’s going to need more copper – a whole helluva lot more copper.

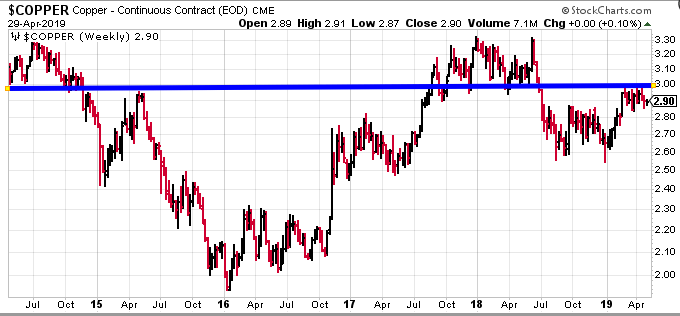

Looking at the price chart of the metal, it continues to flirt with that all important $3.00 zone. Note the metals attraction to this level over the past five years (who said charts are useless?):

With demand on the rise and the tightest market many analysts and executives have seen in more than five years, a breakout to the upside, well north of $3.00, appears inevitable.

Final thoughts

There haven’t been enough high-grade copper discoveries in recent years to satiate the growing demand.

Yes, there are large high-grade deposits out there, but many carry significant jurisdictional risk.

The humongous bulk tonnage porphyry deposits currently sitting on the sidelines require higher Cu prices and are oppressively expensive to build.

ROCK is in an enviable position. It has the grade and it has the right address.

The company’s goal is to build an inventory of copper resources by assembling a portfolio of high-grade projects in mining friendly climes in preparation for the next inevitable wave higher.

This could be a very good ride.

We stand to watch.

END

~ ~ Dirk Diggler

Feature image courtesy of TheReminder.

Full disclosure: Rockridge Resources is an Equity.Guru marketing client. We own stock.