The amount of lithium carbonate equivalent (LCE) used in electric vehicle batteries increased 76% in February 2019 when compared to the same period last year, according to battery metals tracker Adamas Intelligence.

“Among all metals and materials used in EV battery cathodes globally, LCE deployment in February 2019 saw the greatest gains versus the year prior speaking to the Chinese industry’s growing adoption of NCM cathodes in place of LFP cathodes, fueling an increase in LCE consumption per kWh of capacity deployed.”

Lithium Usage in EV Batteries Up 76% Year-over-Year in February 2019

It would appear the global shift from fossil fuel powered vehicles to EVs is in full swing. China is leading the charge, boasting more EVs and charging stations than anywhere else on the planet. China is fast becoming the Detroit of Electric Cars.

China is leading the charge, because it has to.

With the potential to help satiate this growing demand for LCE, Cypress Development’s (CYP.V) Clayton Valley project has nearly 2 billion tonnes of lithium-rich claystone material.

- 3.835 million tonnes of LCE contained in 831 million tonnes of material at an average grade of 867 ppm lithium (Li) in the Indicated category

- 5.126 million tonnes of LCE contained in 1.12 billion tonnes at an average grade of 860 ppm Li in the Inferred category

This world-class lithium-bearing claystone resource is strategically located next to Albemarle’s Silver Peak mine, North America’s only lithium brine operation.

Clayton Valley has its advantages. In a previous Guru offering, we stated:

“It’s important to note that unlike salt lake extraction (salars) lithium projects, where production levels are difficult to predict due to a host of variables (rain, snow, etc), Clayton Valley is a sedimentary hosted lithium deposit, which is easier to scale and production rates can be tabled with much greater predictability and confidence. This is a key differentiator.”

Another advantage: Clayton Valley is located in THE top mining jurisdiction on the planet – NEVADA – based on the Fraser Institute’s Investment Attractiveness Index.

Clayton Valley is currently at the pre-feasibility study (PFS) stage. This will follow-up on a positive preliminary economic assessment (PEA) released only seven months ago.

The PEA numbers are compelling:

- A net present value of $1.45 billion at an 8% discount rate

- An after-tax IRR of 32.7%

- Average annual production of 24,042 tonnes of lithium carbonate over a 40-year mine life

- Capex of $482 million, pre-production, and an operating cost estimate averaging $3,983 per tonne of lithium carbonate

- An estimated 2.7 year payback period

For those unclear of the distinctions between a PEA and a PFS, this might help bring you up to speed:

A preliminary economic assessment (PEA) is a first pass economic study that probes all the basic parts of a mineral deposit – resource, scale, logistics, etc. At this stage, an inferred resource is sufficient to get the ball rolling.

A pre-feasibility study (PFS) takes a closer, more comprehensive look at the economics of a project. Infill drilling – tightening up the spacings between drill holes and elevating the resource to the measured and indicated categories – adds greater certainty and validity to the number crunching. The PFS also includes metallurgical test work and the commencement of baseline studies.

It’s at the PFS stage that the company can begin brainstorming various development scenarios.

Equity.Guru’s Chris Parry took it one step further, defining some of the more meaningful must-know mining terms in a recently co-authored piece:

This Clayton Valley PFS is being conducted by Ausenco Engineering Canada, Global Resource Engineering and others.

As stated earlier, infill drilling is a critical component of the PFS process.

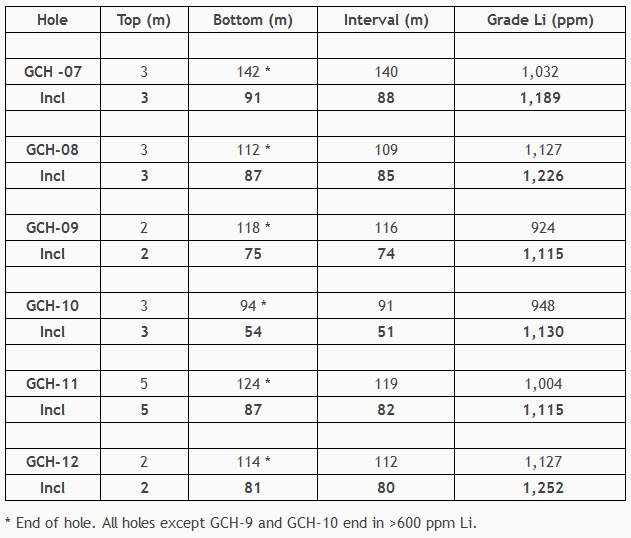

April 23rd news

Cypress Development Announces Results from Drilling at Clayton Valley Lithium Project in Nevada

Infill drill programs are generally not considered market-moving news events, but for the sophisticated resource investor, they are examined closely.

The numbers released from this infill program go a long way towards confirming and upgrading the current resource while bolstering the data the company needs to move the project forward.

Aside from upgrading the resource to higher confidence categories (measured and indicated), the company set out to define a high-grade zone and provide tonnage for the PFS mine plan and production schedule.

This program also provided fresh material for geotechnical and ongoing metallurgical testing.

If you take a close look at the numbers tabled in the property-wide resource at Clayton Valley (867 ppm Li in the indicated category – 860 ppm Li in the inferred category) and compare them with the values obtained from this infill drilling campaign, you’ll immediately spot the superior grades.

It’s also important to note the four out of six holes bottomed in mineralization, a most welcome development when drilling off any orebody.

Cypress CEO, Bill Willoughby:

“We are pleased with the results and regard the infill drilling program as a success. The program demonstrated consistent results from hole to hole and achieved our goal of obtaining better-than-average grade intervals within the target area. The results have been shared with Global Resource Engineering who are in the process of updating the resource model from the October 2018 PEA and producing an optimized mine schedule.”

This is an efficiently run company. It took only 18 months to advance Clayton Valley from the first drill hole to PEA.

The following links offer a closer look at the company and project:

Cypress Development (CYP.V): de-risking its Clayton Valley lithium project in Nevada

Cypress Development (CYP.V): de-risking its Clayton Valley lithium project UPDATE

Cypress Development (CYP.V): another milestone sets the stage for smart money accumulation

Final thoughts

Cypress is consolidating recent gains after coming off severely depressed levels in late March.

This consolidation may be a preamble to the next launch higher as the company prepares to table its Clayton Valley PFS this quarter.

We stand to watch.

END

~ ~ Dirk Diggler

Full disclosure: Cypress is an Equity.Guru marketing client. We own stock.