Sometimes it makes sense to be a contrarian, that is, to purposefully go against the flow, to buy and sell securities in complete opposition to the prevailing sentiment.

The resource arena, particularly where micro-caps are concerned, is in the mother of all funks right now. Everything from oil and gas to cobalt is being tossed on the scrap heap with little regard for value.

These depressed, beaten down stocks are in no way sexy. They don’t get a lot of coverage from the talking heads on business TV. Their charts look more like a dog’s breakfast than a going concern (people recoil when you say their names out loud). And worst of all, their tendency to stay beaten down and depressed test the limits of our ability to endure. But here’s the thing: this is where you find extraordinary value.

Buying dollars for dimes – it’s the goal of every devout contrarian minded soul.

For those who balk at the idea of investing in oil and gas, you need to know that your modern-day O&G company is, with very few exceptions, a good steward of the environment.

It doesn’t matter where you operate – if you do not establish an abiding relationship with your surrounding environment, via conservation and sustainable practices, you’re not going to survive in this modern O&G world.

A recap of recent events

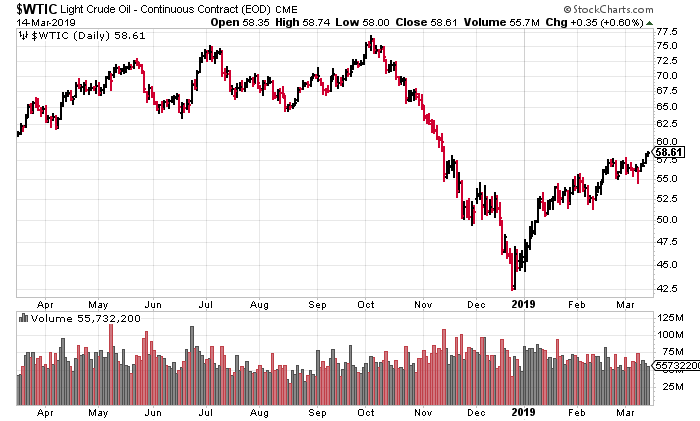

After a buoyant early to mid-2018 market in oil, everything came apart at the seams in October and November.

The correction in oil was brutal. It got hit with the longest losing streak in modern times.

This volatility can be blamed on a number of factors, liquidity being one, but the underlying fundamentals in oil are highly supportive – note the bounce back in recent weeks.

But shouldn’t our reliance on fossil fuels be tapering off by now?

Good question. A few points to consider:

Fossil fuels are finite. Hydrocarbons take hundreds of millions of years to form, and once drained from their subsurface reservoirs, they’re impossible to replace.

Global oil consumption is increasing. It’s not dropping off as expected. Even with a universal shift towards electric vehicles, and our fossil fuel powered cars of today – infinitely more efficient than they were decades ago – we’re consuming 100M barrels of oil per day globally. That’s a dizzying number. And as a consequence, we’re going to extreme lengths to find new sources of the stuff.

It would seem that with this current rate of global consumption, and the fact that oil is becoming increasingly difficult to find and extract, all of the green initiatives that are currently in development will need to kick into high gear – FAST – in order to prevent the oil price from going parabolic in the not too distant future.

Another weighty consideration: oil is probably the most geopolitically sensitive commodity there is. Brian Williamson, Jericho Oil CEO, in a recent thought-provoking interview with Equity.Guru’s Chris Parry, reminded us of the fact that we haven’t experienced a serious geopolitical shock in over a decade. Conflict is inevitable. If war breaks out and threatens any one of our major shipping channels, the price at the pumps might force you to keep it parked.

A standout opportunity

Jericho Oil (JCO.V) sports a stable of high-quality production and development assets, a top-shelf management team, and a shareholder base that includes the likes of:

- The Breen Family Trust, headed by patriarch Ed Breen (former president of Motorola, CEO and liberator of Tyco International, current CEO of DuPont).

- A prominent private oil family with Oklahoma roots, via a family trust.

- The Hegna Family via Steve and Mette Hegna.

Importantly, these ‘family office’ shareholders are extremely patient capital – strong hands if you will. They aren’t going anywhere and are content allowing Jericho management to operate as the oil price-cycles dictate.

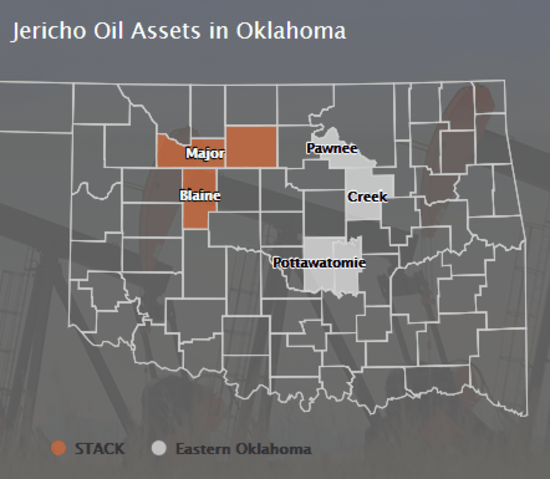

JCO has been operating in Oklahoma since 2014. The Fraser Institute recently picked Oklahoma as THE best oil and gas destination on the entire planet.

JCO spent the first three years, during the depths of the bear market, buying up high-quality assets for pennies on the dollar from distressed sellers.

The company currently boasts a land position of some 55,000 acres, including 16,000 acres in the STACK play of Oklahoma.

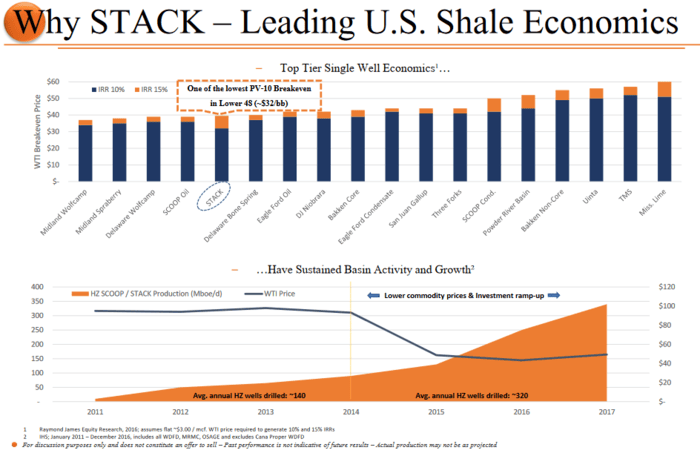

Those pennies-on-the-dollar acres are now fetching handsome premiums. A recent acquisition involving Canadian oil giant Encana, and Jericho’s neighbor, Newfield Exploration, is valued at an eye-popping $5.5 billion.

JCO is wedged between some of the biggest players in the oil arena.

The market is clueless. Truly. It doesn’t understand what these STACK acres represent for JCO and its shareholders. Herein lies the opportunity.

The market is bound to gain an appreciation of the significance of Encana’s entry into the STACK, and what it could mean for JCO. And as that bit of insight takes hold and awareness grows, greater value will be assigned to JCO’s acreage, pushing the stock significantly higher in the process. It’s only a matter of time (author’s opinion).

The company has spent the last year developing only a small fraction of their STACK asset base.

Mar. 14th, 2018: Jericho Oil Announces 957 BOE per Day STACK Well Targeting Meramec Formation

July 25th, 2018: Jericho Oil Announces STACK Well Results Targeting Osage Formation

Dec. 10th, 2018: Jericho Oil Announces 725 BOE per Day STACK Well Targeting Meramec Formation

The success of these horizontal wells is a testament to the quality of their STACK acreage.

Strategy

The company stopped drilling last November when oil prices collapsed. These horizontal wells are extremely sensitive to spot prices due to the huge volumes of oil produced in the first six months.

In a higher price environment – say, north of $65.00 – they can capitalize on the opportunity very quickly. Timing is everything. JCO is currently waiting for prices to recover and judging by the chart featured at the top of this page, they won’t have much longer to wait.

Importantly, JCO can take their sweet time riding these corrections out. Their Oklahoma acres are all held by production (HBP), meaning, they have no punitive clock ticking down forcing their hand – they can sit tight and wait for the opportune time to sink the bit back into the ground. HBP acres are held in perpetuity, as long as there is some form of production on the property.

$65.00 oil is likely the key for this management team:

“A continued improvement in commodity prices through the remainder of Q1 2019 will see Jericho move back into a development mode and also accelerate its return to production program for shut-in wells in its existing fields.”

Feb. 28th, 2019 News: Jericho Oil Announces 33% 2018 Total Production Growth

Company Production Hits an All-Time Yearly Record, Reduced Operating Expenses by 30%

“… preliminary 2018 full-year partnership production totaled approximately 297,000 barrels of oil equivalent (“BOE”) up 33% from 2017 full-year partnership production of 222,000 BOE. The Company’s 2018 partnership production is an all-time yearly high.”

For the past three-quarters, their operating expenses have been under $20.00 per barrel. Management feels they can drive them down even further, closer to $15.00 level.

Commenting on these outstanding results, Brian Williamson, CEO of Jericho:

“These outstanding and record results confirm our 2018 strategy to successfully prove and develop our premier STACK acreage position. The resulting production growth provides our shareholders confidence in the exceptional quality of our high-impact STACK resource. Looking forward to 2019, we are excited in our unique ability to drive further competitive performance through the quality of our investments and our capital and operating discipline. While we are pleased with our 2018 results, we were just starting to see our patience be rewarded as we began to drill our STACK asset, return existing shut-in wells to production and move to develop some of our other high potential assets when oil prices turned down 40% in the end of 2018. We are hopeful that oil prices will continue their upward trend and provide us the opportunity to expand upon 2018’s success.”

Also of great interest: Devon Energy (DVN.NYSE) recently announced a plan to sell off all non-core assets in order to focus on Texas and Oklahoma. One of the biggest players in the O&G arena is putting it all on the line for only a handful of plays, one of which is the STACK where Jericho holds a 16K acres. Heaps of validation here, Y’all.

Looking forward

The company believes the price contraction we witnessed last Oct and Nov triggered a ripple effect of debt facilities backfiring on over-leveraged companies. A number of high-quality assets may go up on the auction block as a consequence.

Jericho has kept its powder dry, waiting for the opportunity to pounce as the aftershocks from last years volatility play out.

Jericho has 128.67 million shares outstanding, 100 million of which are in strong hands. The float is a mere 28 million shares. When the market finally clues in that the company’s underlying fundamentals are more compelling now than they were one year ago when the stock was trading multiples higher, the shares will go on a tear (author’s speculation).

Jericho Oil (JCO.V): a Moneyball play in the STACK – Anadarko Super Basin

JCO is a classic contrarian play.

END

~ ~ Dirk Diggler

Feature image courtesy of Halff.com

Full disclosure: Jericho Oil is an Equity.Guru client. We own stock.