The Bank of Canada’s Senior deputy governor Carolyn Wilkins gave a speech in Vancouver, BC last week, hosted by the University of British Columbia’s economics department.

“The global development that concerns me the most is rising debt,” stated Wilkins, “Whether you’re a homeowner or a business person, you know first hand that high leverage can leave you in a vulnerable financial position.”

Wilkins pointed out that global debt owed by “governments, businesses and households” now amounts to CAD $320 trillion, which is $140 trillion higher than just before the 2008 financial crisis.

The global debt load is now 300% higher than the global GDP.

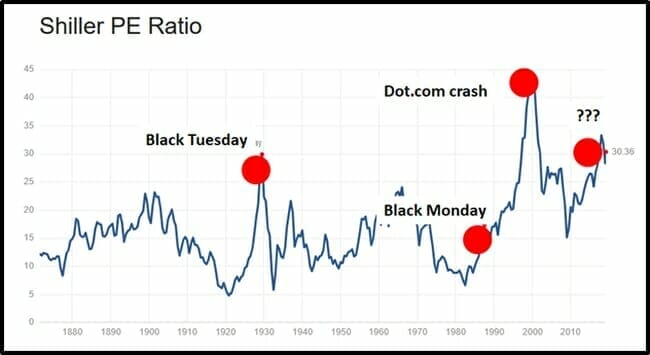

If you want to grapple with the scope of the threat, history is a good teacher.

On the first day of the 1929 stock market crash – the Dow Jones Industrial Average plunged 13% – and then fell another 12% the next day, Black Tuesday. The cause? Too many leveraged bets.

It’s happening again, but this time on a much bigger scale.

When we think of “debt pigs” – we first think of Americans.

It is true that they like shopping.

A lot.

Although Americans collectively carry $870 billion in credit card debt, they still spend $70 billion a year on domestic pets, including must-own products like “Poop Freeze”.

“Cleaning up after your dog is an unpleasant task; that is why we are so excited about Poop-freeze – a new way to keep the environment clean of unsightly dog poop”.

“I bought 7125 cans of Poop Freeze and it really works,” stated internet reviewer John Bong Joey, “I never go to the toilet anymore, I just shit in my pants and freeze it!”

The Fitch Ratings Report on Trump’s Tax Cuts and Jobs Act, projects an additional $1.5 trillion added to the federal deficit over a decade.

Every US tax payer now owes about $140,000.

The Price-to-Earnings ratio of the S&P 500 is double historical levels – and headed exactly where it always goes before a stock market crash.

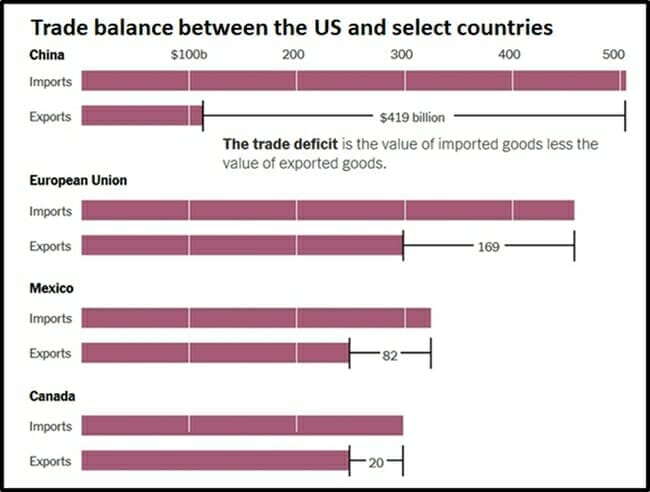

President Trump’s tariffs were intended to reduce imports.

His economic advisors told him it wouldn’t work.

They were right.

The overall trade deficit grew 12% in 2018, as the U.S. imported a record number of products, widening the deficit to $891 billion.

One of the catalysts for this widening trade deficit was Mr. Trump’s $1.5 trillion tax cut. Americans, flush with cash, bought more Poop Freeze – which is made in China.

“All countries run trade deficits whenever they consume more than they produce,” stated economist Kimberly Clausing. “And when we borrow to finance tax cuts, like we did with the Tax Cuts and Jobs Act, we make these imbalances worse.”

The trade gap in goods between the United States and China hit $419 billion in 2018, deepening a bilateral deficit that has been a source of frustration for Mr. Trump.

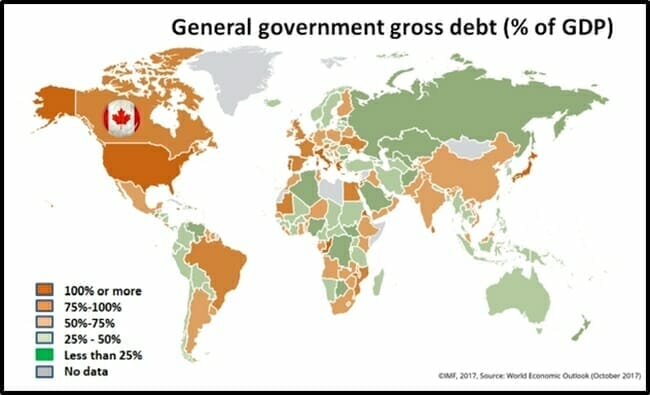

Canadians have zero reasons to feel smug.

A recent survey by MNP determined that 46% of Canadians are just $200 away from financial insolvency while the number of debt relief applications is increasing 5% year-over-year.

A 2018 survey by Sun Life determined that 22% of Canadian retirees owe at least $10,000 in non-mortgage debt. 20% of the elderly are still making mortgage payments, 7% have unpaid health expenses or owe money for vacations.

Canada’s debt-to-GDP% is about 90% – only 15% better than the U.S.

We predict the next financial crisis will be triggered by unsustainable global debt levels.

The best way to mitigate losses is to purchase hard assets – or financial instruments directly linked to hard assets.

- Gold bullion

- Shares in the precious-metals explorers

- Antique guns

- Apartments

- Art

- Farmland

- Collectible cars

“The debt ratio and the number of bankruptcies is up over last year,” stated Doug Jones, president of BDO Canada – a tax advisory company. “While it’s cold outside and a winter get-a-way may be tempting, people need to not automatically put it on their credit card.”

According to Jones, 75% of Canadians owe money, 59% have credit card debt, 31% have a car loan and 39% are carrying a mortgage.

Like “disappearing honey bees” or “forced marriages” – “global debt” sounds like a remote problem that won’t reverberate into our own lives.

But if you own stocks, that’s not true.

We’re debt pigs.

And we’re going to pay for it.