During a recent episode of Diggler’s fixation on all things gold, we asked:

Are we on the verge of a new bull market in gold? Will the companies that explore for the stuff – the junior exploration companies aka ExplorerCo’s – rise from the smoldering ruins and come back into the light?

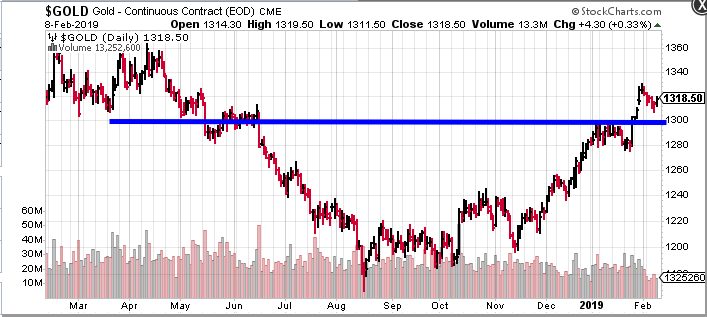

In an even more recent offering, we looked at the price action in gold, and what it may be telling us:

Read: A potential breakout in gold and 11 dirt cheap ExplorerCo’s in the Yukon

That was a timely article. Gold has carved out some higher ground since.

Golds current price action continues to look constructive. It’s sporting a nice stair-step trajectory.

You don’t need to be a TA expert to spot the positive momentum here. A series of higher highs and higher lows demonstrates nice, methodical accumulation.

We’re looking for the next advance to successfully challenge the $1370 level – that would truly signal game on.

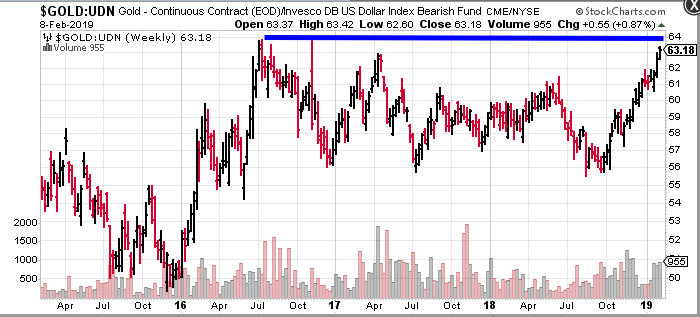

The above chart depicts gold in USD terms. But there are other currencies to match muscle with.

The chart below features gold performance versus a basket of foreign currencies. As you can see, the metal is demonstrating tremendous strength.

Multiple year resistance is dead ahead:

The Abitibi Greenstone Belt of Ontario and Quebec:

The gold camps formed along Abitibi’s two major shear zones – the Destor-Porcupine and the Larder Lake-Cadillac Fault zones – include:

- The Timmins-Porcupine Gold Camp of Northern Ontario, home of the Dome, McIntyre and Hollinger gold mines.

- The Kirkland Lake Gold Camp, a Mile of Gold sporting no less than seven high-grade mines all chipping away at one single orebody.

- The Red Lake Mining District aka the “high-grade gold capital of the world” where Goldcorp launched itself from a lowly cash-starved junior to a mighty senior producer.

- The Hemlo Gold Camp, sparking a staking rush that rivaled the Klondike, setting up the rich Page Williams, Golden Giant, and David Bell Mine gold mines.

- The Malartic Gold Camp, home of Quebec’s largest gold mine at 500,000-plus ounces per year.

(We’ve included the Red Lake camp here even though it technically doesn’t belong to the Abitibi)

Our 13 dirt-cheap ExplorerCo’s:

Actually, there’s 14 now, plus another four development co’s worthy of your attention. That makes 18. But who’s counting?

Since we profiled these ExplorerCo’s back in mid-January, some have declined in value, some have flatlined, some have screamed higher.

Welcome to the junior exploration arena.

Once again, I’m casting a fairly wide net here – this is by no means a comprehensive list.

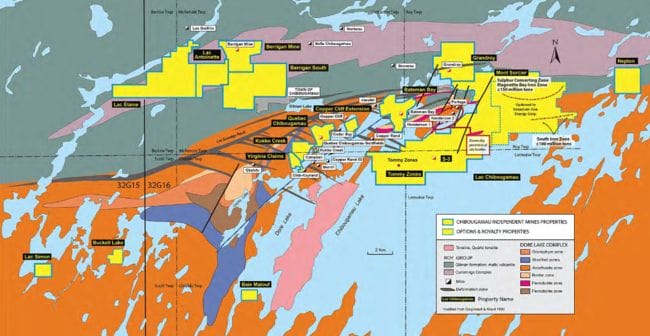

Chibougamau Independent Mines (CBG.V)

- 41.96 million shares outstanding

- $2.52M market cap based on its recent $0.06 closing price.

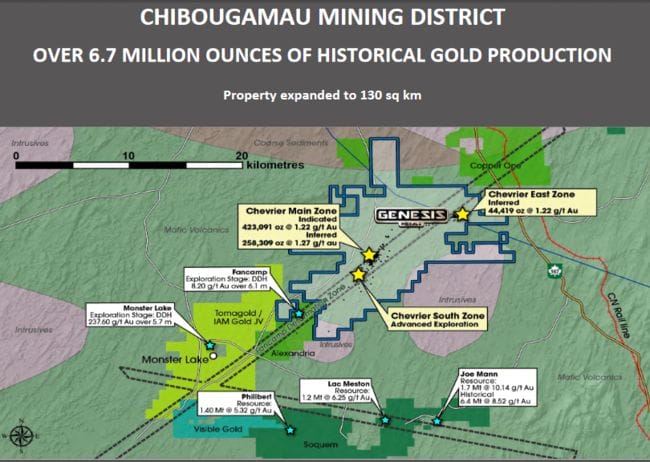

CBG operates along the northeastern part of the Abitibi Greenstone Belt, in the Chibougamau region of Quebec. The area boasts over 6.7 million ounces of historical gold production.

This one appears to be biding its time, unwilling to finance at current prices, reluctant to kick things in gear until the gold bull asserts itself with conviction.

It’s a cheap stock based on its multiple projects and the potential to convert historic resources (non-NI 43-101 compliant) of roughly 3.3 Mt at an average grade of 1.78% Cu and 2.92 g/t Au into NI 43-1012 compliant numbers.

The company’s share price has done the square root of dick – NOTHING – since early 2017. This is one to keep an eye on though. It could come to life at any time, especially if gold goes on a tear.

Large volume surges and crosses will be your first clue.

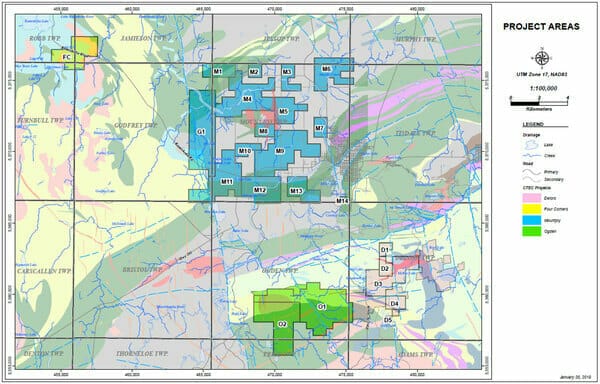

Central Timmins Exploration (CTEC.V)

- 44.1 million shares outstanding.

- $3.09M market cap based on its recent $0.07 close.

This one is just getting started having only just begun trading a few months ago.

The company’s primary focus is on the Timmins Gold Camp of north-eastern Ontario. One of its projects – Deloro – has a historic drill hole from the 1940s that intersected three mineralized intervals: 2.2 g/t Au over 11 meters, 1.8 g/t Au over 12.2 meters and 3.3 g/t Au over 22.0 meters.

Recent news from January 21 reported results from a drilling campaign designed to confirm the geology of that historic hit.

Results were mixed.

Read: Central Timmins Exploration Corp. Provides Update on Recent Work and Details of 2019 Work Program

The best interval cut 3.94 g/t Au over 0.5 meters.

Welcome to the world of junior exploration.

Regarding the company’s next move, CEO Charles Gryba…

“The best gold anomaly that CTEC obtained in the 2018, 1,700 sample MMI geochemical sampling program south of the DPFZ sits directly on a deep IP anomaly. This will be the next target drilled, with CTEC’s DDH #5 expected to be collared before the end of January. The CTEC drill program will then start testing drill targets in Mountjoy Township, with the objective of locating the more northern gold horizon of the Timmins Camp parallel gold system. The Timmins gold camp hosts two almost continuous east-west parallel gold systems through four townships covering a 30km strike length and hosting numerous historic and present mining operations. CTEC is looking to identify economic mineralization in the gap areas of these zones both north and south of the DPFZ. CTEC drilling in 2019 will be very interesting.”

The stock received a 30% haircut since we last looked at it one month ago.

These are early innings. Management has more up its sleeve. Speaking of management, this is a seasoned team.

Canadian Orebodies (CORE.V)

- 53.9 million shares outstanding.

- $16.17M market cap based on its recent $0.30 closing price.

CORE is a Hemlo focused ExplorerCo run by Gordon McKinnon, son of Don McKinnon, co-discoverer of the Hemlo Gold Camp back in the 1980s.

The company’s current focus is on its Wire Lake and North Limb projects located in the heart of Hemlo.

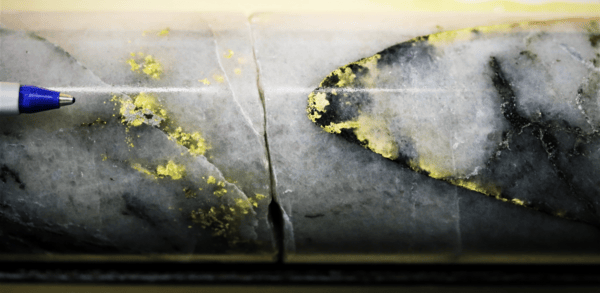

As we reported back in mid-January, recent drilling at their Wire Lake project tagged 133.2 g/t Au over 2.0 meters, including 443.0 g/t Au over 0.6 meters.

There has been no news over thepast four weeks. The shares are down slightly since we last took a look.

Great Bear Resources (GBR.V)

- 36.33 million shares outstanding

- $133.69M market cap based on its recent close at $3.68.

Great Bear is exploring its Dixie Project in the prolific Red Lake District of Ontario.

Following up on uber high-grade results which included 16.35 meters of 26.91 g/t Au, 7.00 meters of 68.76 g/t Au, 10.43 meters of 16.84 g/t Au and 1.75 meters of 101.05 g/t Au, the company tabled additional high-grade assays from its Hinge zone on Jan. 16:

We talked about the company’s address – the high-grade gold capital of the world – and how the company’s share price/valuation might appear expensive after only a few rounds of assays. We also talked about how significant discoveries in the Red Lake camp often command a price premium.

Since then, Great Bear’s share price is up an impressive 85% giving it a valuation of $133.69M.

This is a good lesson for newbies. Significant new high-grade gold discoveries are becoming increasingly difficult to find. The ‘smart money’ is well aware of this. It’s the reason Rob McEwan took down a solid chunk of this company.

Keep an eye on this one. Others are…

GFG Resources (GFG.V)

- 92.81 million shares outstanding.

- $18.56M market cap based on its recent close at $0.20

GFG owns 100% of the Pen and Dore gold projects, two large and highly prospective gold properties west of the prolific Timmins Gold Camp.

The company began a phase-1 drill program of some 5,000 to 6,000 metres back in late October.

On Jan. 17, the company dropped the following assays:

GFG Drills 33.77 g/t Gold over 1.05 Metres at Pen Gold Project West of Timmins, ON

Highlights from the release

- Three distinct high-grade gold structures were intersected 50 metres west of historic drilling at the Sewell prospect: 3.57 g/t Au over 5.55 meters (including 7.44 g/t Au over 1.85 meters), 4.20 g/t Au over 1.00 meter, and 14.70 g/t Au over 0.75 meters.

- High-grade gold mineralization was confirmed at the Sewell prospect with hole PEN-18-015 which returned 33.77 g/t Au over 1.05 meters, including 63.88 g/t Au over 0.55 meters.

- The Company completed 19 holes (4,744 m) – 13 holes have pending assays.

- The 2019 exploration program at the Pen Gold Project will ramp-up in early-February with a 4,000 meter drill program focused on high priority targets including Reeves, Slate Rock, Jehann and Deerfoot.

Despite these positive results, the stock is trading flat.

Keep an eye on this one too.

Granada Gold Mine (GGM.V)

- 69.22 million shares outstanding.

- $13.5M market cap based on its recent close at $0.195

GGM is developing a significant gold resource along the prolific Cadillac Trend in northern Quebec.This is monster country.

“Transforming into a 100,000 oz/yr gold producer with numerous high-grade exploration targets” flashes front and center of the cover page of the company’s website.

With its sights set on a high-grade “rolling start” plan, the company continues to explore a number of highly prospective targets along 5.5 kilometers of strike.

There has been no news out of the Granada Gold Project over the past four weeks. We should hear something soon.

The stock has firmed up trading 10% to the better since we last looked at it.

Genesis Metals (GIS.V)

- 101.84 million shares outstanding.

- $9.17M market cap based on its recent $0.09 closing price.

GIS is exploring its 100% owned Chevrier Gold Property located in the Chibougamau region of Quebec.

Like the sign says, the area boasts over 6.7 million ounces of historical gold production.

On Feb. 6th, the company released an updated resource estimate for Chevrier:

This new resource is divided between two distinct zones – Main and East.

The news was well received by the market initially but has since dropped back under a dime.

726k ounces is a decent resource number considering the areas complex geology. Management needs to add ounces – they’ll be probing for new mineralized zones later in the year.

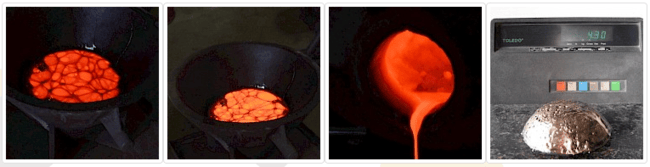

Gowest Gold (GWA.V)

- 388.23 million shares outstanding.

- $15.53M market cap based on its recent $0.04 closing price.

GWA’s North Timmins Gold Project is located on the Pipestone Fault / North Pipestone Break, two highly prospective gold-bearing structures within the Timmins camp.

According to the company’s homepage, its 100% owned Bradshaw Gold deposit is on the verge of “becoming the newest gold producer in Timmins.”

Bradshaw’s positive PFS and 1.18 million ounce (6-plus g/t) resource should offer good leverage to a rising bullion price.

The company is in the process of closing a private placement (PP) announced back in late November – insiders are in for approximately $625,000.00 of the offering.

There have been no new developments over the past four weeks.

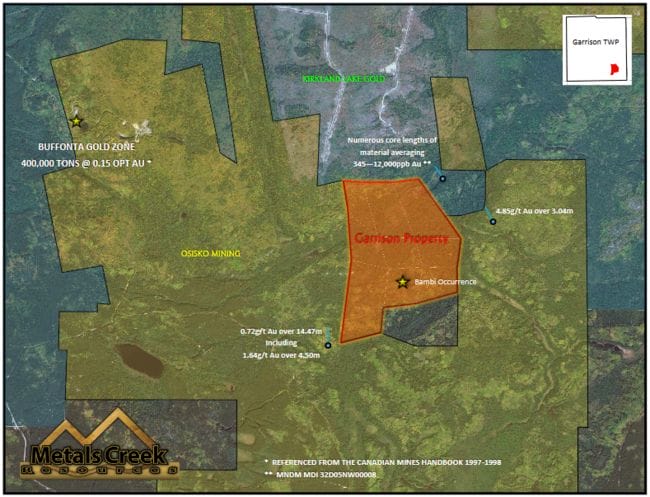

Metals Creek Resources (MEK.V)

- 69.52 million shares outstanding.

- $2.78M market cap based on its recent $0.04 close.

Metals Creek is exploring its Ogden Gold Property, a project boasting eight kilometers of strike along the prolific Porcupine-Destor Fault in the Timmins Gold Camp. The project, a 50/50 joint venture with Goldcorp, hosts a historic (non 43 101 compliant) resource of 1 Mt @ 4.12 g/t Au.

We’re currently waiting on assays from five holes from the company’s recent acquisition – the Garrison Gold Project – where historic drilling encountered 22.09 g/t Au over 6.10 meters, including 74.63 g/t Au over 1.52 meters.

A similar high-grade hit should have a very positive impact on this lowly $0.04 stock with a sub $3 million market cap.

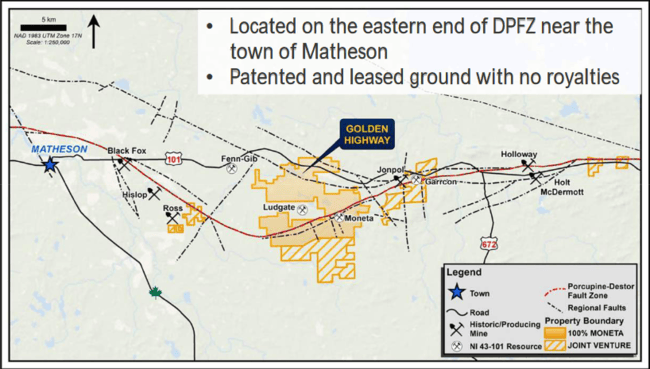

Moneta Porcupine Mines (ME.T)

- 266.83 million shares outstanding.

- $29.35M market cap based on its recent $0.11 closing price.

Moneta’s 100% owned Golden Highway project is located along the Destor Porcupine Fault of the Timmins Gold Camp of northeastern Ontario.

The company recently released an updated resource for Golden Highway:

Read: Moneta defines new resource at its Golden Highway Project: 383,400 oz of gold at 4.61 g/t of indicated and 873,200 oz of gold at 4.21 g/t inferred

Those who follow this company may have been taken aback with these new numbers (the original resource contained over 4 million oz’s of gold in all categories).

Fact is, the old resource was bullshit – it factored in gold ounces that will likely never be mined.

This new resource factors in ounces, and only those ounces, that stand a chance of being hoisted to the surface.

It’s refreshing to see a no-bullshit management team at the helm of an ExplorerCo.

Since the Jan. 17 news drop, the stock has lost 30% of its value. Apparently, there were a lot of twitchy shareholders clinging to those old resource numbers.

Gary O’Connor, Moneta’s CEO & chief geologist..:

We are encouraged by the significant increase in grade and the overall size of the updated mineral resource estimate based on the new geological interpretation for the Golden Highway Project. The program has been successful in defining higher value ounces in high-grade resources able to be extracted by underground methods. Previous resources were designed for large open pit extraction and not geologically constrained. The new initial resource will form an excellent basis to continue to expand and increase the quality of the resources. Most of the veins modelled remain open and are not fully drill defined. Internal high-grade plunging zones have been identified within veins that require drill testing. New near surface targets have been located with historical drilling which have intersected the same style of mineralization in numerous locations. We are confident of the ability to continue to increase the grade and size of the resource.

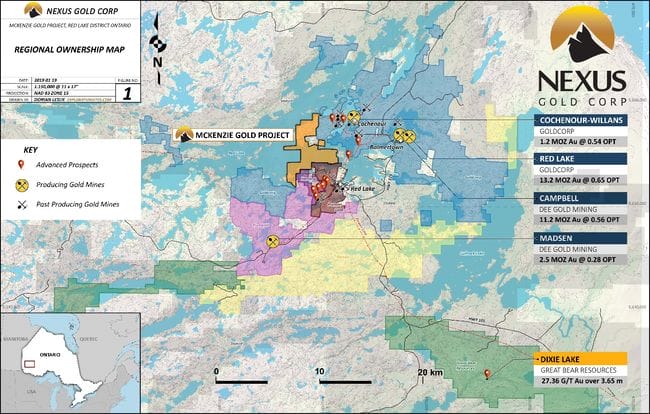

Nexus Gold Corp (NXS.V)

- 42.29 million shares outstanding.

- $5.07 market cap based on its recent close at $0.12

Nexus is perhaps best known for it highly prospective portfolio of projects in Burkina Faso, West Africa.

Seeking to expand its jurisdictional scope, the company just entered into an LOI to acquire the McKenzie Gold Project in the Red Lake Gold Camp.

McKenzie’s 1,348.5 hectares is located in the heart of Red Lake. The project is surrounded by the likes of Goldcorp (G.T), Yamana (YRI.T), Pure Gold (PGM.V) and Premier Gold (PG.T).

This was a smart, heads up acquisition by the company. We dove into it as soon as the news was announced…

Read: Nexus Gold (NXS.V) expands its jurisdictional scope – enters the prolific Red Lake Gold Mining Camp

Alex Klenman, Cypress president and CEO…

“The McKenzie Gold Project, with numerous high-grade showings, presents a compelling exploration opportunity for Nexus. This acquisition will give us two highly prospective Canadian-based projects with potential high-grade upside, that provides an excellent compliment to our active West African portfolio. Red Lake is a high-profile, well-established gold producing region that garners much market interest. By expanding our jurisdictional scope here, and elsewhere, Nexus can reach a much wider audience. Once this acquisition is completed, Nexus will have six projects on two continents, in some of the most prolific gold producing regions on the planet. We feel this puts the Company in an excellent position for growth, particularly in a stronger gold market.”

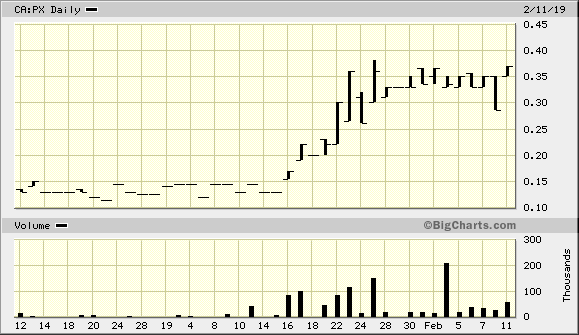

Pelangio Exploration (PX.V)

- 37.95 million shares outstanding.

- $10.82M market cap based on its recent $0.285 close.

PX’s current focus is on its recently acquired Dalton Property located in the Timmins Gold Camp, and the Birch Lake Property located in the Red Lake Mining District.

I find this one quite intriguing after the company recently consolidated its interests around Birch Lake and Dalton by acquiring 5SD Capital.

In recent news, the company announced an acquisition:

“The Dome West property is a major acquisition for Pelangio“, stated Ingrid Hibbard, president and CEO of Pelangio.

“It is located in a geologically significant area just 800 metres from the historic Dome Mine, one of the largest and well-known gold producers in Canada. Planning is underway for a first-phase diamond drill program to be carried out this winter. The Dome West project complements our recently acquired Dalton project, located 1.5 km west of Goldcorp’s Hollinger Mine.”

Since we last looked in mid-January, the stock ripped higher on above-average volume.

Interesting junior. One to keep an eye on.

Prosper Gold (PGX.V)

Project summary (no corp presentation)

- 60.11 milion shares outstanding.

- $6.61M market cap based on its recent $0.11 closing price.

PGX is exploring several properties along the Destor-Porcupine Fault of the Timmins Gold Camp. Recent results reported from its Currie Project include six meters of 4.79 g/t Au & 118.4 g/t Ag.

We’re currently waiting on assays from 2,500 meters of recent drilling at Currie.

“We are excited to be back on site to complete Phase 1 and are eagerly awaiting the assays. The remaining 1,500m will continue to target previously untested areas in this historically underexplored region of the Timmins Gold Camp”, stated Peter Bernier, Prosper’s CEO.

Even though things have been quiet over the past four weeks, the stock got pummeled, losing nearly 30% of its value.

This could be a prime opportunity to pick up shares if you believe in this project. I know a few smart people who are watching it closely.

If management is reading this, you should consider beefing-up your website. A corporate presentation would be a nice start fellas.

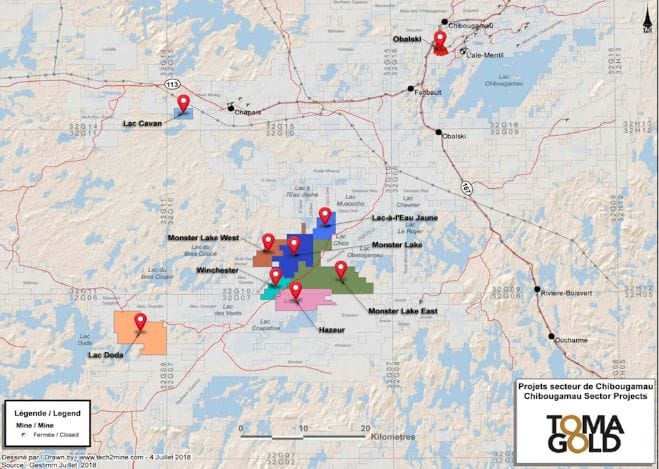

TomaGold (LOT.V)

- 140.26 million shares outstanding.

- $7.01M market cap based on its recent $0.05 closing price.

The company’s flagship asset is its Monster Lake Project, a joint venture with IAMGOLD (IMG.T). Back in March 2018, the two companies tabled an inferred gold resource of 433,300 oz’s at a grade of 12.14 g/t Au.

In a recent development, LOT consolidated its position in the Monster Lake project.

The company’s shares have been halted for the past two weeks…

TomaGold Announces Spin-Out Corporation for Monster Lake and Newly Acquired Gold Assets

The logic behind a spin-out is to unlock value in an asset, one the market isn’t currently giving the company credit for.

As per the press release:

TOMAGOLD CORPORATION today announced that its Board of Directors has approved, in principle, a strategic reorganization of the Corporation’s assets pursuant to which the Corporation would spin out its interests in the Monster Lake and Irene Lake exploration projects into a newly incorporated subsidiary (“Monster Exploration”), with the intent of listing Monster Exploration on the TSX Venture Exchange, and that the Corporation has entered into two letters of intent with arm’s length parties, with respect to the acquisition by Monster Exploration of interests in two additional gold projects in the vicinity of Monster Lake: Anik from Kintavar Exploration Inc. (TSXV: KTR) and Diego from a private individual. TomaGold will continue to hold its interests in its other projects in Quebec and Ontario. Subsequent to, or in connection with the completion of the Spin-Out, TomaGold intends to pursue capital market opportunities and to consolidate its share capital.

There are a LOT (scuse the pun) of moving parts in this proposed spin-out: the creation of a new company, a division of assets, a large financing, a share rollback, the acquisition of new assets… What am I missing? Oh ya… shareholder approval.

I’m a big fan of spin-outs. Due to the halt, we’ll have to wait and see what the market thinks of this deal.

4 companies further along the development or production curve:

Canada Cobalt Works (CCW.V)

- 75.84 million shares outstanding

- $36.4M market cap based on its recent $0.48 close.

CCW has been featured prominently in the pages here at Equity Guru.

The company is developing a high-grade cobalt resource at its Castle Mine project in the northern Ontario Cobalt Camp, making new discoveries along unexplored areas on the property, and scaling up its proprietary Re-2OX extraction and separation technology.

There are a lot of moving parts to this one, y’all.

To say that news is due on multiple fronts would be an understatement.

Harte Gold (HRT.T)

- 599.74 million shares outstanding.

- $218.9M market cap based on its recent close at $0.365.

The company recently declared commercial production at its Sugar Zone mine located approximately 80 kilometers east of the Hemlo Gold Camp.

Straight from page one of the company’s website…

Harte Gold Corp is Ontario’s newest gold producer through its wholly-owned Sugar Zone mine in White River, Ontario. Using a 3 g/t gold cut-off, the NI 43-101 compliant Mineral Resource Estimate dated February 15, 2018 contains an Indicated Mineral Resource of 2,607,000 tonnes grading 8.52 g/t for 714,200 ounces contained gold and an Inferred Mineral Resource of 3,590,000 tonnes, grading 6.59 g/t for 760,800 ounces contained gold. The Company is currently completing a 100,000 metre drill program on near mine and exploration targets, which will be incorporated in an updated mine plane and final technical report targeted for Q1 2019. Exploration on the Sugar Zone property includes 83,850 hectares encompassing a significant greenstone belt and 35 km strike length yet to be explored.

I like the grades here. The stock should offer good leverage to a rising gold price.

Osisko Mining (OSK.T)

- 257.2 million shares outstanding.

- $727.88M market cap based on its recent $2.83 closing price.

Osisko holds a 100% interest in the high-grade Windfall Lake gold deposit located between Val-d’Or and Chibougamau in Québec. It holds a 100% undivided interest in a large area of claims surrounding the Urban-Barry area and nearby Quevillon area (over 3,300 square kilometres). It holds a 100% interest in the Marban project located in the heart of the Abitibi. It has properties in the Larder Lake Mining Division in northeast Ontario. It also holds interests and options on a number of properties in northern Québec and Ontario.

The company’s Windfall Lake project boasts a high-grade resource of 2,874,000 tonnes at 8.17 g/t Au (754,000 ounces) in the indicated category, and 10,352,000 tonnes at 7.11 g/t Au (2,366,000 ounces) in the inferred category.

Not too shabby.

A company boasting this much bulk offers substantial newsflow for its shareholder base.

One month ago, news out of Windfall Lake reported the following assays from a multiple rig infill drilling program:

- 2223 g/t Au over 2.0 metres.

- 69.9 g/t Au over 2.7 metres.

- 64.2 g/t Au over 2.1 metres.

- 12.3 g/t Au over 10.7 metre.

- 34.6 g/t Au over 3.5 metres.

- 45.5 g/t Au over 2.6 metres.

- 30.5 g/t Au over 3.5 metres.

- Wow.

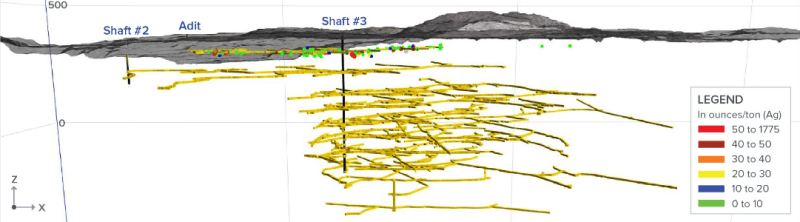

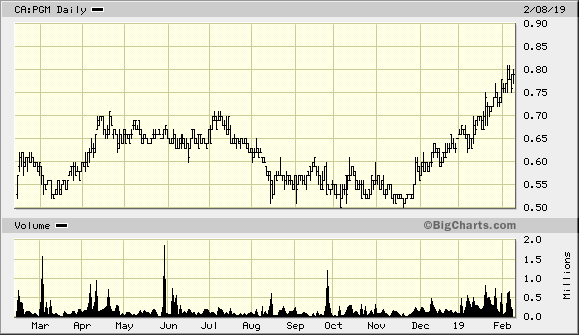

Pure Gold Mining (PGM.V)

- 256.34 million shares outstanding.

- $202.51M market cap based on its recent $0.79 close.

PGM is exploring and developing its high-grade Madsen Gold Project in the prolific Red Lake Gold Camp.

Madsen boasts an indicated resource of 2,063,000 ounces gold at a grade 8.9 g/t Au and an inferred resource of 467,000 ounces gold at 7.7 g/t Au.

The Project benefits from extensive infrastructure including a mill and tailings facility, paved highway access, power and water. There’s no shortage of experienced labour in the Red Lake area.

The last time we looked at the stock, it was trading at $0.66.

Today, the company is enjoying an appreciative market…

Mineral resources from the Madsen deposit will be incorporated into a feasibility study, followed by a preliminary economic assessment of the Russet South, Fork and Wedge deposits, both of which are expected to be completed and released this month.

Closing comments:

There’s been a common theme here in these pages of late; how senior and mid-tier gold producers are rapidly depleting their resource bases…

Read: Gold: uncharted waters – the technicals, the peak of discovery, the opportunity

Every day that a gold miner digs ore out of the ground – every day the company is in business – they reduce their inventory of the shiny stuff.

Years of slashed exploration budgets have choked off their pipeline to new sources of the metal.

This spells opportunity for shareholders.

If your junior ExplorerCo makes a significant new discovery in a mining friendly jurisdiction, like the Abitibi Greenstone Belt, its days are likely numbered.

Those higher up on the food chain have enormous appetites.

END

~ ~ Dirk Diggler

Full disclosure: Of the companies mentioned above, only Nexus Gold is an Equity.Guru marketing client.

Feature image courtesy of Giphy.