VIVO Cannabis (VIVO.V) is closing 2018 strong with industry accolades and an impressive financial performance in Q3.

Firstly, the company’s subsidiary, Canna Farms, was voted the ‘Top Reviewed Licensed Producer of the Year’ at the Canadian Cannabis Awards late last month.

“It is great to be recognized for being good at what you

love to do. This award is a recognition of the Canna Farms team – talented people that deliver the highest quality product with exceptional customer service.”-Dan Laflamme, president of Canna Farms.

The award was announced on November 29 by Lift & Co., an online cannabis education and review hub. Canna Farms won the award based on the overall volume and quality of reviews of LPs on the Lift.co website. Canna Farms was the first LP in the province of BC to receive an ACMPR/MMPR license.

Canna Farms (@CannaFarmsLtd) wins for Top Reviewed Licensed Producer of the Year. Congratulations! #CanadianCannabisAwards pic.twitter.com/OkXguOnD6C

— Lift & Co. (@liftandco) November 30, 2018

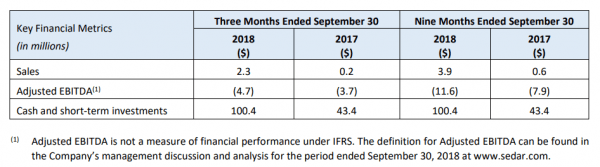

Next, VIVO Cannabis is finishing 2018 with a strong performance in Q3. The company is reporting record revenues and significantly increased production–in no small part thanks to the now award-winning Canna Farms.

“The acquisition of Canna Farms represents a transformational transaction in the evolution of VIVO that has led to a record quarter of $2.3 million revenue, with $4.4 million of pro forma revenue for the full quarter. Not only has this acquisition provided a significant revenue impact, it has tripled our production capacity, expanded our product range and substantially increased our medical patient base.”

-Barry Fishman, CEO of VIVO.

VIVO’s Q3 highlights

- Q3 revenue of $2.3 million

- Completion of the acquisition of Canna Farms on August 31, 2018, resulting in pro forma Q3 revenue of $4.4 million (the revenue that VIVO would have reported had Canna Farms been owned for the entire quarter)

- At the end of Q3 2018, total medical cannabis patients of 18,000 compared to 2,000 at the end of Q2 2018 (representing a 9-fold increase)

- Entry into adult-use supply agreements with British Columbia, Alberta, Saskatchewan, Manitoba, Ontario and the Yukon, and Canna Farms achieving one of the best order fulfillment rates in the industry

- Beacon Medical™ product was introduced into the Australian market

- Completion of corporate re-branding, including name change to VIVO Cannabis and the launch of the Beacon Medical™ cannabis brand

- Introduction of the Lumina™ and Fireside™ adult-use cannabis brands

- Expansion of senior level management team and appointment of Daniel Laflamme to the Company’s board of directors.

As of September 30, the company has $100 million in cash, total assets of $285 million and total liabilities of $61 million.

A net loss of $9.1 million is less than ideal, but the company is growing its revenue and has a positive cash flow. Furthermore, VIVO has hedged its bets by entering both the medical and recreational cannabis markets as fears over recreational cannabis eating up the medical market begin to swirl.

The company’s focus on patient education is an undeniable strength. Prior to Q3, VIVO’s subsidiary, Harvest Medicine, launched its cutting-edge telemedicine app which both garners patients, industry credibility and provides unparalleled education for potential medical cannabis users.

VIVO also closed its acquisition of Trauma Healing Centres in mid-October, providing VIVO with an additional 22,000 active patients and six clinic locations.

Now, the company also has the award winning Canna Farms to its credit. VIVO isn’t fooling around with gummies and chocolates, the company produces award-winning flower and provides top-of-the-line care and education to its patients.

VIVO Cannabis has a market cap of $230 million and is currently trading at $0.72. We think that makes it a steal.

Full disclosure: VIVO Cannabis is an Equity Guru marketing client.

With all the cannabis stocks getting hammered recently, good news like this is nice to hear. That being said, what are your predictions as to when good news and good projections like ViVo’s will create positive price movement? Or is there still bleeding to be done in this industry?

Hi Duane,

Sorry for the late reply. I think the market has a lot to figure out. Companies like VIVO are solid and deserve attention, but there’s so much noise out there. Everyone is talking about their fully funded capacity and their international expansions. Meanwhile, they’re riddled with debt and making no money. VIVO doesn’t care about that. They do a few things really well and it shows. No sizzle, just steak. I think it’s going to take some time for the pretenders to die off and for VIVO’s quality to shine through. Most experts I speak to anticipate an industry-wide die-off in 2-3 years. I think VIVO will be standing because they aren’t spread too thinly or over leveraged. Just my two cents.