Lithium you ask? For the uninitiated, here’s why…

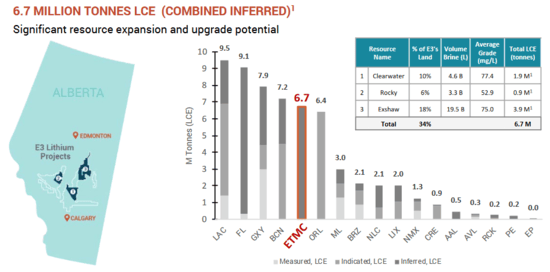

There are multiple ‘whys’ underpinning E3 Metals (ETMC.V) as a shortlist candidate in the battery metals space. It all begins with their resource – one of the largest on the planet – in some 6.7 million tonnes of LCE (lithium carbonate equivalent) at an average grade of 75 milligrams per litre.

The company has defined three separate resources in the prolific Leduc Reservoir of central Alberta:

1. Clearwater – 1.9 million million tonnes of LCE.

2. Rocky – .93 million tonnes of LCE.

3. Exshaw West – 3.9 million tonnes of LCE.

E3 management – serious forward thinkers – is onto a unique lithium resource and is pulling out all the stops to figure out the best way to extract and concentrate it economically.

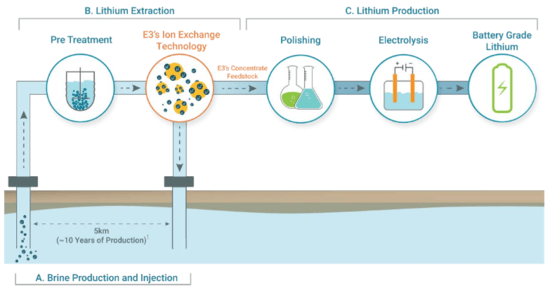

The following slide gives you a simplistic view of what the company envisions using its proprietary extraction technology – 3 steps…

Step A in the above slide involves the production of Petro-lithium brine.

A network of wells would deliver the Petro-brine to the surface for lithium extraction. The image also depicts the re-injection of (lithium-void) brine back into the reservoir.

In this pre-treatment step, residual oil and H2S (hydrogen sulfide) are removed from the brine to improve the efficiency of the downstream extraction processes.

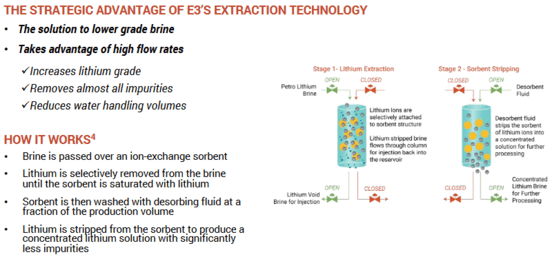

Step B depicts the ion-exchange lithium extraction process which selectively extracts lithium from these Petro-brines. This step will reduce the brine volume as well as concentrate the lithium.

Step C depicts the actual production of lithium.

The polishing phase removes impurities and further reduces brine volume.

The electrolysis and crystallization phase utilizes electrolysis to further purify the brine stream in order to produce lithium hydroxide monohydrate (more on E3’s proprietary extraction technology further on down the page).

Aside from a world-class lithium resource and groundbreaking extraction/concentration technology, E3 enjoys the following advantages (and opportunities)…

- Each 5-kilometer development network outlined in the company’s 43-101 sports the potential to produce 10,000 tonnes of LCE (Lithium Carbonate Equivalent) per year for up to 10 years.

- There are 188 – 5-kilometer development areas in the Central Clearwater Resource area alone.

- E3’s resource, located in the heart of Central Alberta’s legacy oilfield, is surrounded by an extensive network of underutilized surface and subsurface production infrastructure (wells, pipelines, powerlines, roads).

- Existing oil and gas operations within E3’s leases have facilitated resource evaluation, sampling and extraction testing.

- At $0.18 per tonne LCE, with no requirement to drill wells, E3’s discovery costs are some of the lowest in the industry.

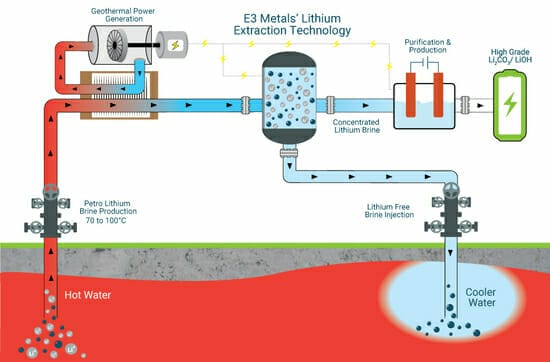

- Water temperatures in the Leduc formation range from 70-100°C – geothermal energy that can be used to reduce energy costs – a huge potential advantage.

- Envisioning a “hub and spoke” approach with a centralized processing facility and a network of smaller modular concentration plants, the company will be able to scale the project rapidly.

- By re-purposing existing oil and gas facilities, E3’s “brownfield” development approach minimizes land and biodiversity impacts. The company’s closed loop water processing system could result in zero waste, no additional water use, and no effluent discharges at surface. This low energy production scenario is expected to significantly lower greenhouse gas production compared with the competition – hard rock mining and evaporative salar producers.

- With the confluence of market demand and government policy promoting a clean energy transition in Canada, the company is riding the trend.

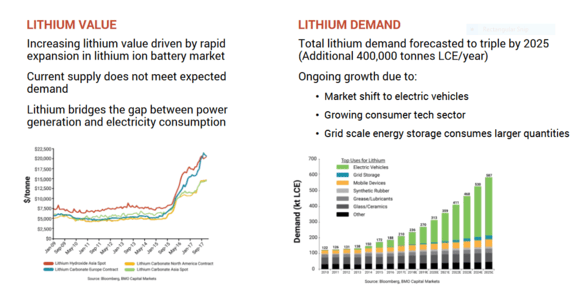

- The electric vehicle revolution sweeping the planet has created a projected supply-demand gap for lithium and increasing lithium commodity prices going forward.

- Legacy oil and gas operators see long-term partnership opportunities with E3 as their reserves near the end of their life cycles.

- Alberta’s simple permitting process and low sovereign risk offer a foundation for E3 to create a steady and reliable supply of LCE to a growing customer base.

To be brought fully up to speed on E3’s evolution as a potentially significant producer of battery grade lithium, the following Guru articles will assist…

E3 Metals (ETMC.V): one mother of a lithium resource in the Leduc Reef Trend

It’s giddy-up time for E3 Metals (ETMC.V) after blockbuster lithium test

E3 Metals Corp (ETMC.V): Pulling Out All The Stops / Mic Drop

E3 Metals (ETMC.V) developing pilot plant in Alberta to test rapid lithium-extraction tech

New developments – E3 news dated Dec 3rd…

Development of E3 Metals’ Extraction Technology Improves Lithium Concentration and Recovery

This piece of news provides an update on the optimization and scale-up of the company’s proprietary extraction technology as part of its pilot plant project announced back on September 26th.

Development highlights from this news release include…

- E3 Metals’ brine concentrated lithium nearly 20 times, to 1498 milligrams per litre (mg/L) lithium (Li).

- Extraction testing achieved lithium recoveries greater than 99% Li.

- Successful scale-up of lithium-selective sorbent outperformed previous testing.

- E3 Metals releases an updated Investor Presentation.

“The first set of objectives leading to the pilot plant project was to reproduce and enhance the performance of the initial results of the lithium extraction testing from E3 Metals’ brine. Four recent extraction tests completed on the scaled-up sorbent exceeded previous performance. The tests achieved demonstrated lithium recoveries greater than 99%, averaging 90%, and volume reductions up to 20 times while consistently removing 99% of critical metal impurities.”

Keep in mind that E3’s 6.7 million tonne resource has an average grade of 75 mg/L Li. This recent testing produced lithium-enriched brines 18 times more concentrated with an average concentration level of 1308 mg/L – the highest concentration being 1498 mg/L.

That’s solid progress. “Super-solid” some might say.

Conducted at GreenCentre Canada, these results demonstrate the successful enhancement of the ion-exchange sorbent developed in collaboration with the University of Alberta, a project funded through ‘Alberta Innovates’ (E3 Metals news announcement August 28, 2018).

An important differentiator of this proprietary technology is that it concentrates and purifies Alberta petro-brine feedstock in a single step, producing a highly concentrated lithium feedstock for further purification and refinement into battery-grade lithium products. The technology is also designed to be proficient at processing raw brines at the high brine flow rates that the Leduc Reservoir is capable of delivering.

The construction of a pilot plant is fast becoming a reality. The next steps planned for the ion-exchange optimization include testing its performance with increased concentration factors and repeat cycles. These next steps include…

- Optimizing the ion-exchange sorbent material to commercial readiness.

- Design, construction, and testing of lab-scale ion-exchange equipment using the optimized sorbent material.

- Refining mass balance and generating large volumes of concentrate.

- Producing lithium hydroxide at the lab-scale.

- Finalizing the lithium production process flow sheet.

E3’s CEO, Chris Doornbos, stated the following re these recent results:

“The increased performance of the ion-exchange material demonstrates that E3 Metals continues to be on the right track with its proprietary technology. The ion-exchange sorbent, and continual scale-up of this process, is the last key development prior to outlining a full cycle process flow sheet for lab-scale production of lithium hydroxide. While we continue to push for increased performance of the technology, the Company is confident that it is in a position to achieve its goals outlined above.”

This recent piece of news went on to state that the lithium extraction technology under development at E3’s partner’s laboratories represents only a small portion of the overall direct brine processing flow sheet the company intends to pursue. They’re confident in stating that they’ve developed a technology that they believe “integrates seamlessly into already commercially available processes, minimizing the overall technology development risk.” Being conservative, they went on to add, “there is no guarantee these results will have a positive impact on overall project economics.” Fair enough.

Final thoughts…

This is a dynamic company with a number of moving parts

E3’s share-structure is tight with only 20,647,409 outstanding (23,879,909 fully diluted). At its current $0.32 stock price, the company has a current market-cap of $6.6 million.

On the subject of these deeply undervalued resource opportunities, Equity Guru’s Chris Parry, in a recent offering on Saville Resources, stated: “Time for the millennials to give resources a good long look.” Damn straight y’all.

END

~ ~ Dirk Diggler

Full disclosure: E3 Metals is an Equity Guru client.

Feature image courtesy of oilprice.com