Several interesting facts you may or may not know about Argentina:

- Argentina ranks high on the HDI and GINI scale.

- 97% of the country’s population live in urban areas.

- 98% of the country is literate.

- Argentines are in love with their cell phones – they average 2 per household.

- 75% of the population have access to the internet.

- 98% own television sets where a full cable catalog is deemed must-have.

- Public transport will take you anywhere in the country you wanna go, practically.

- Argentine scientists, held in the highest regard by the international community, work in collaboration with agencies such as ESA, NASA, and CERN.

And contrary to popular belief, revered revolutionary and symbol of the Cuban Revolution, Ernesto Che Guevara, was bred and buttered in Argentina – not in Cuba as many would have you believe.

Like all developed nations around the globe, Argentina has an appetite for all things resource and energy. To that end, the country currently has three nuclear-powered generators in operation. To satiate their increasing energy demands, they plan on building more.

Feeding these reactors forces the country to import 500,000 to 1 million pounds of uranium annually from either Canada or Kazakhstan.

What Argentina lacks is a domestic source of uranium. With plans to upsize its nuclear energy sector, it needs one in the worst way.

Enter Blue Sky Uranium (BSK.V), a company with the resource potential to ax Argentina’s dependence on foreign sources of U308.

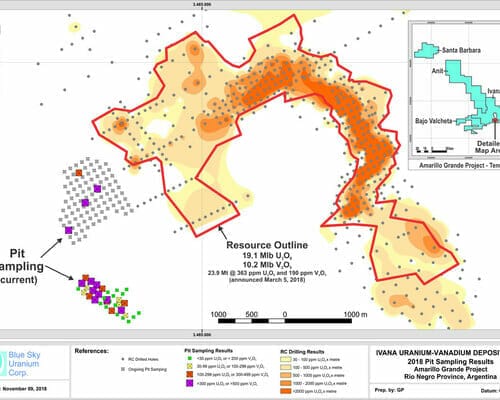

Blue Sky is exploring and advancing a portfolio of uranium and vanadium projects – near surface deposits with the potential for near-term, low-cost production.

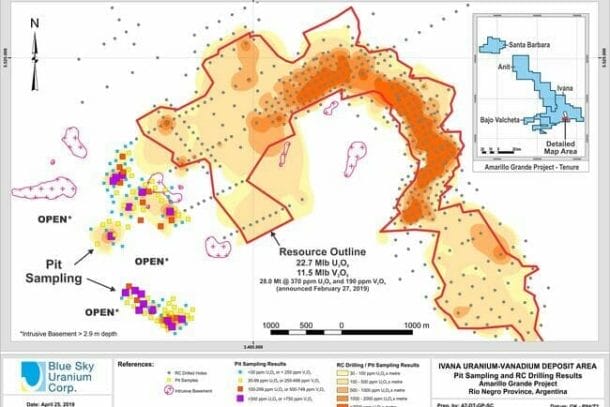

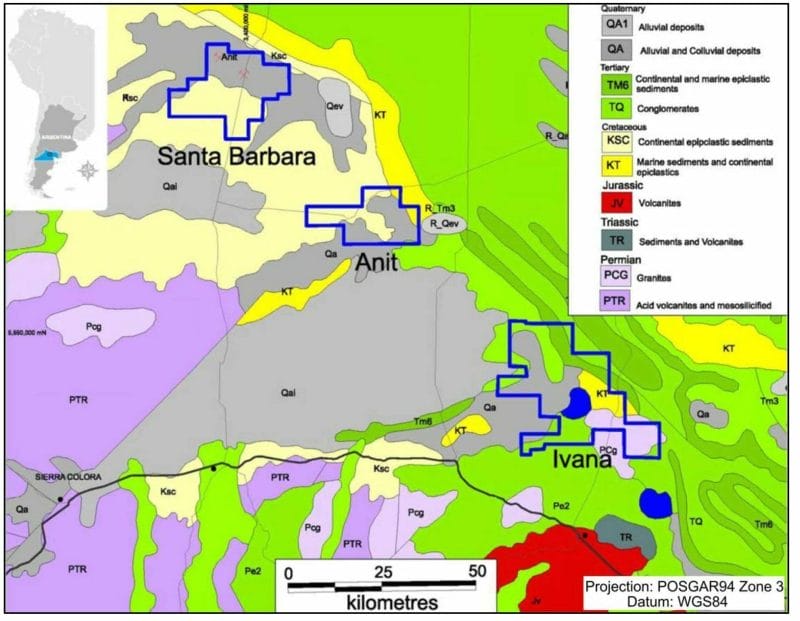

The company holds the exclusive rights to over 434,000 hectares of terra firma spanning two provinces in Argentina. Its flagship project, Amarillo Grande, is located in central Rio Negro province, in the Patagonia region of southern Argentina.

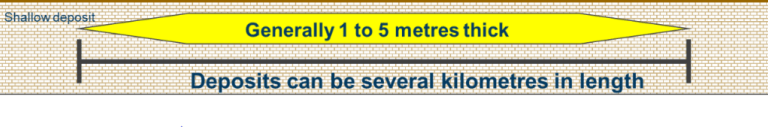

The mineralized footprint at Amarillo Grande boasts enormous scale – a 145 kilometer trend with three distinct mineralized zones.

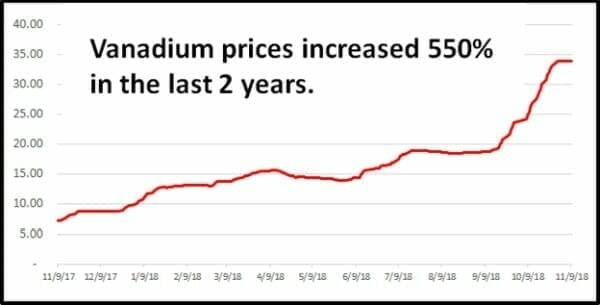

The Ivana Property on the lower right of this map currently sports a resource of 19.1 million pounds of uranium oxide and 10.2 million pounds of vanadium oxide. This represents the largest uranium discovery in Argentina in the past half century.

Ivana is a unique deposit. It’s largely a Surficial type deposit contained within the sediments of ancient river beds or paleo-channels.

The importance of this detail cannot be overstated. The mineralization is hosted in loosely (poorly) consolidated sediments making exploration, extraction, and processing a walk in the park… child’s play. The image of a sandbox rat moving dirt around with his Tonka truck is not that far removed.

A second deposit type at Ivana, found along its lower coordinates, is what’s called a sandstone-hosted deposit. This type of mineralization – related to a braided fluvial system – runs deeper. This gives Blue Sky excellent discovery potential at depth.

The following Equity Guru write-up offers greater detail regarding Amarillo Grande’s many attributes…

Blue Sky Uranium (BSK.V): Exploration blue sky at Ivana deposit – assays pending

As you can easily divine via the map featured further up the page, Blue Sky has a lot of ground to explore, a lot of ‘blue sky’ potential if you will.

Though the word ‘uranium’ is front and center in the company name, there’s a lot more to this story than yellow cake.

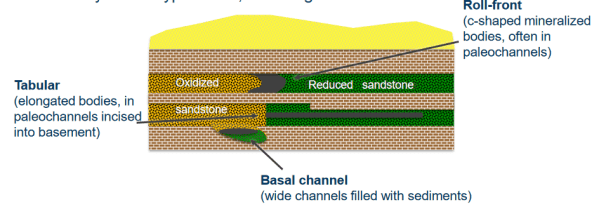

As noted above, the company is currently sitting on 10.2 million tonnes of vanadium oxide. Vanadium is added to rebar to give it shock and corrosion resistant qualities.

Vanadium is also revolutionizing energy storage. Billionaire Robert Friedland talks about its relevance today in the most glowing of terms…

“The beauty of the vanadium redox battery is that you can charge and discharge it at the same time, something that can’t be done with a lithium battery. With a vanadium redox flow battery, you can put solar power and wind power into the battery, and you can put excess grid power into the battery at night, and at the same time you can have a stable output into the grid.”

Cool beans…

As a consequence, this steel-blue metal has risen from $4 per pound to over to $33.00 in the space of only a few years.

Vanadium crows some serious elevation price gains. Increasing global demand could push it significantly higher.

More can be gleaned on the subject by way of Lukas Kane’s recent offering…

Is Blue Sky’s (BSK.V) uranium rainbow leading to a pot of vanadium?

The November 15th news…

The uranium and vanadium channel sample values reported here are excellent. It’s important to note that these pit samples were taken one kilometer west of the main Ivana resource. Translation: Ivana has the potential for some seriously big ass’d scale.

“The brownfields pit sampling program is ongoing, with a total of 133 pits planned. To date, analytical results have been received from 39 pits, 35 of which cover an area of approximately 1 kilometre by 500 meters, with the remaining 4 being from a second larger grid to the north. The pits were dug from surface down to a maximum of 2.1 meters. Pits revealed that uranium and vanadium mineralization is commonly present in the area below a 40 to 60 centimeter veneer of un-mineralized soil; the mineralization is hosted in unconsolidated sediments or regolith from underlying basement units.”

Assay highlights from this news:

- 5,032 ppm U3O8 and 323 ppm V2O5 over 1.7 meters at AGI-CAL26,

including 10,658 ppm (1.07%) U3O8 and 566ppm V2O5 over 0.5 meters. - 1,420 ppm U3O8 and 539 ppm V2O5 over 2.1 meters at AGI-CAL36,

including 3,931 ppm U3O8 and 1,055 ppm (0.1%) V2O5 over 1.1 meters. - 1,082 ppm U3O8 and 503 ppm V2O5 over 2.0 meters at AGI-CAL10,

including 2,453 ppm U3O8 and 950 ppm V2O5 over 0.6 meters. - 510 ppm U3O8 and 457 ppm V2O5 over 2.0 meters at AGI-CAL39,

including 1,290 ppm U3O8 and 782 ppm V2O5 over 0.8 meters. - 489 ppm U3O8 and 355 ppm V2O5 over 2.0 meters at AGI-CAL37,

including 867 ppm U3O8 and 500 ppm V2O5 over 1.0 meter.

The U308 and V values registered in these channel sample assays blow away the grades making up the main Ivana resource. The elevated vanadium grades are of particular interest.

Regarding these results, Nikolaos Cacos, Blue Sky President & CEO stated…

“These results further demonstrate the expansion potential of the Ivana deposit, this time to the west, and the ongoing pitting and auger drilling program has the possibility of significantly expanding the footprint of this new mineralized area.”

These elevated grades could have a dramatic impact on the overall size of the company’s resource at Ivana. Same goes with future economic studies.

Final thoughts…

The mineralization at Blue Sky’s Amarillo Grande project is at or near surface and can be concentrated onsite with a simple wet scrubbing and screening process. The price of uranium and vanadium are sporting solid upward trajectories. These two factors bode well for the overall economics of Ivana – a preliminary economic assessment (PEA) is on deck and will give us our first peek at the robustness of the project.

“After the completion of the PEA, we are going to start working on a feasibility study with the goal of bringing the Amarillo Grande into production” stated CEO Cacos.

With 109.8 million shares outstanding (158 million fully diluted), recent trading in the stock gives us a market-cap of roughly $15.4M.

Lastly, this short video beautifully demonstrates Amarillo Grande’s latent potential….

END

~ ~ Dirk Diggler

Full disclosure: Blue Sky Uranium is an Equity Guru client. We own stock.