International Frontier (IFR.V), a first-mover in Mexico’s energy reform, is kicking development into a whole new gear on its Tecolutla block.

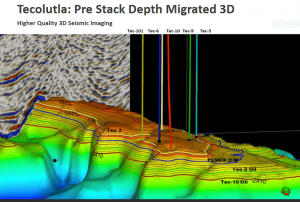

Tecolutla is located on the Tampico-Misantla Basin, a prospective onshore ‘Super Basin’ with huge unconventional oil and gas potential.

A little back ground…

Investing in Mexico’s energy reform represented an unparalleled opportunity for IFR. ‘No market in the world holds greater potential for companies to acquire, develop and produce existing oil and gas assets.’

IFR’s joint venture partner in developing Tecolutla is Grupo IDESA, one of the largest petrochemical companies in Mexico. The name of this JV is Tonalli Energia, and it’s a 50/50 arrangement.

Aside from gaining entry into an underdeveloped mature field with huge upside potential, IFR’s first-mover status gives the company an inside track on future auction rounds.

Building a base for future growth at Tecolutla:

- A workover on the company’s TEC-2 well led to a 7 day test average of 125 barrels of oil per day.

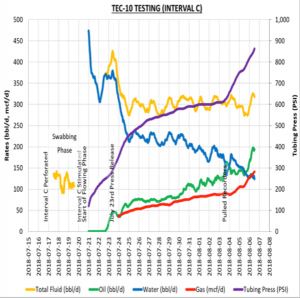

- The recently drilled TEC-10 well produced 175 barrels of oil per day at the end of a production test on August 6th.

- Up to 4 additional horizontal wells are in the planning stage, the first of which is due to be spud in a few weeks (more on this first horizontal well below).

One crazy ride…

The past six months have been a real roller-coaster for the company, and a classic comeback story highlighted by the following news releases and Equity Guru articles…

- IFR News July 23rd – IFR Provides Operation Update at Tecolutla

-

Equity Guru article July 24th (Chris Parry) – International Frontier Resources (IFR.V) slammed after drill hits sinkhole, but the climb back has begun

- IFR News Aug 7th – Extended Testing of TEC-10 Well Results in Significant Increase in Oil Production at Tecolutla

-

Equity Guru article Aug 8th (Dirk Diggler) – International Frontier (IFR.V): Wait a tick… TEC-10 has significant flow

- IFR News Sep 13th – IFR Joint Venture Commences Tecolutla Oil Shipments and First Cash Flow

-

Equity Guru article Sep 14th (Chris Parry) – Redemption tale: International Frontier Resources (IFR.V) told you they’d kick back

It was the July 23rd news release, highlighted above, which triggered the wild ride initially. The highly anticipated flow rates on the company’s TEC-10 well came in below projections. It was a crap piece of news to drop on the market. But all of a sudden, the pressure picked up and the oil began to flow. Note the rising red, green and purple lines (gas, oil and tubing pressure respectively) on the chart below….

Recent developments and company milestones…

Late last month, Mexican President-elect Andres Manuel Lopez Obrador (AMLO) assured oil companies operating in Mexico that their investments were safe, as long as they were in compliance and everything was in good standing. In the months leading up to the election, no such assurances were given. There were rumblings coming out of the AMLO camp – it appeared that no one was safe.

A collective sigh of relief was felt by all after ALMO’s announcement.

Equity Guru’s Lukas Kane covered the development a few weeks back….

Renaissance Oil (ROE.V) and International Frontier (IFR.V) both breathe a sigh of relief

On September 26th the company entered into a share option agreement with Grupo IDESA, its joint venture partner. This agreement allows IFR to purchase all of IDESA’s outstanding shares in the joint venture company, Tonalli Energia.

Under the terms of the Option Agreement, IFR’s wholly owned subsidiary has the right to acquire the outstanding shares of Tonalli held by IDESA prior to the expiry date of September 25, 2020 upon payment of the exercise price in the amount of 70,000,000 common shares in the capital of IFR (“IFR Shares”), less the number of IFR Shares issued to IDESA (up to $1,000,000) pursuant to the Future Private Placement.

Commenting on the option arrangement, IFR President and CEO Steve Hanson stated…

“The signing of this Option Agreement is a major milestone and solidifies IFR’s relationship with IDESA. This next step in our established partnership firmly aligns IFR’s and IDESA’s interests in the Mexican upstream business and significantly broadens IFR’s access to investors and capital markets in Mexico.”

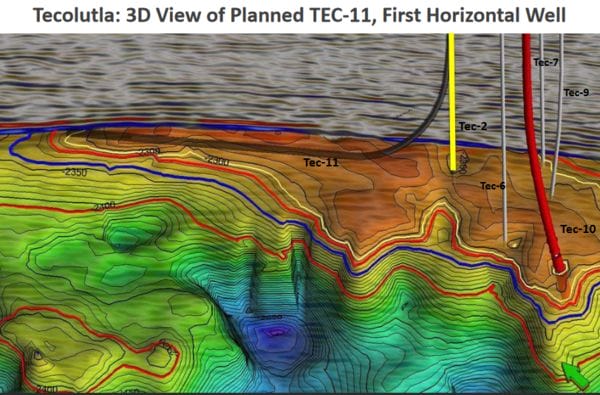

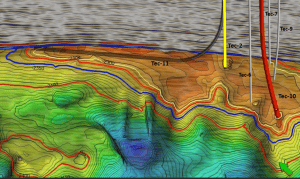

Then, on October 18th, IFR reported that it was preparing to drill TEC-11, its first horizontal well with a lateral extent of up to one kilometer:

IFR Joint Venture Receives Key Approvals for TEC-11 Horizontal Well

The TEC-11 Drill Plan:

- Tonalli Energia submitted an “Aviso” to Mexico’s Comision Nacional de Hidrocarburos (CNH) to cue their intent to spud TEC-11 on November 12th.

- Tonalli has secured all major services including a rig to drill TEC-11.

- The TEC-11 well is planned to penetrate the Tecolutla reef at a vertical depth of approximately 2,310 meters with a horizontal leg up to 1,000 meters.

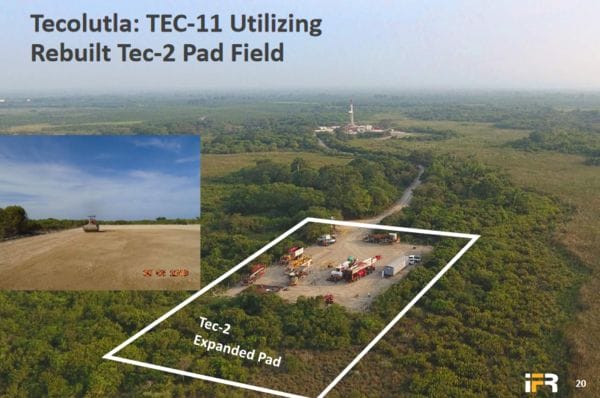

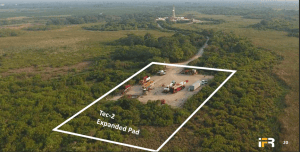

In order to cut costs and maximize efficiencies, the company will utilize their rebuilt TEC-2 pad field for TEC-11…

TEC-11 is only the beginning. The company envisions a multi-well drilling program for the Tecolutla block. Information gathered from Tonalli’s recently drilled TEC- 10 vertical well, including permeability porosity and pressure data, indicate that the reef at Tecolutla is capable of high deliverability.

Final thoughts…

International Frontier currently has 151 million shares outstanding. Based on its recent close (Friday, Oct 19th), IFR sports a modest market-cap of roughly $19.6M. Significantly, management has plunked their money down, some 32% worth, right alongside yours. This ownership alignment should inspire confidence among current shareholders.

The company is making strides and may find a whole new gear with TEC-11.

We stand to watch.

END

~ ~ Dirk Diggler

Full disclosure: IFR is an Equity Guru client. We own stock.