In the mining business, “political risk discount” factors in the possibility that a change of government could bugger up a mining project.

On July 1, 2018 Mexico elected a new leftist president, Andrés Manuel López Obrador (AMLO).

He will take office on December 1, 2018. AMLO has promised to end the ultra-violent drug war, eradicate corruption and strengthen Mexico’s state oil company PEMEX.

In the days following the election, AMLO said his government will stop foreign companies exploring Mexican oil fields “until his team had checked existing contracts for irregularities.”

On August 30, 2018 Equity Guru’s Greg Nolan wrote: “The election of AMLO throws into question future policies related to oil and gas exploration and development.”

How “left” is this “leftist president”?

The Mexican press have frequently compared him to Venezuela’s notorious ex-President, Hugo Chavez.

You can be sure, that is a comparison AMLO does not want.

Venezuela – a country pregnant with gold, oil and arable land has turned into an economically-isolated hellhole of hyper-inflation, lawlessness and starvation.

On October 2, 2018 Renaissance Oil (ROE.V) announced that AMLO “assured private energy executives on September 27, 2018 that their contracts will not be canceled if they meet existing terms.”

Last week, at a meeting of Mexico’s Association of Oil & Gas Producers (AMEXHI), AMLO “underlined the importance of the private sector’s participation in developing the oil and gas sector in Mexico.”

Renaissance Oil is a member of AMEXHI.

AMLO’s designated Energy Minister, Rocio Nahle, also confirmed the new government’s “support for existing contracts.”

ROE is developing a diversified shale and mature fields portfolio in Mexico.

Russian oil producer LUKOIL chose Renaissance as their partner to explore and develop the Amatitlán block in Mexico. LUKOIL has a market cap of $48 billion, a million of barrels of production and 100,000 employees in 40 countries around the world.

On August 27, 2018 Renaissance released its Q2, 2018 results.

SECOND QUARTER 2018 HIGHLIGHTS

- Revenue reached a record of $7 million.

- Revenue increased of 40% compared with the previous quarter.

- Revenue higher by 31% compared to Q2, 2017

- Production in Q2 2018 increased to 1,656 boe/d compared to 1,249 boe (barrel of oil equivalent)/day in the previous quarter and 1,552 boe/d in the second quarter of 2017;

- Renaissance & LUKOIL drilled 6 new wells targeting the shallow Chicontepec formations at Amatitlán.

“In order to expedite the process of penetrating the Upper Jurassic shales, Renaissance chose to re-enter an existing well rather than drilling off a new one,” wrote Nolan, “Drilling this unconventional well is expected to cost somewhere between $12 and $14M. Renaissance, with approximately $7M in cash on hand, is fully funded for its 25% share of the total cost.”

International Frontier Resources (IFR.V), is another Mexican energy company breathing a sigh of relieve at AMLO’S pro-business remarks.

On August 6, 2018, IFR’s partner, Tonalli completed an 18-day flow test of the primary zone interval producing 178 barrels of crude oil during the last 24 hours of the extended well test.

Daily oil production of the TEC-10 well increased throughout the extended production test from the initial low flow rates observed on July 23, 2018 to more than 175 barrels of oil per day,” wrote Equity Guru’s Greg Nolan.

IFR perforated a mere 2.4 metre section on the first vertical to get that 175 barrels a day; the most likely plan now is to go with a further 40m section,” added Equity Guru’s Chris Parry, “though the CEO Hanson says they can potentially go up to 100 metres”.

Key IFR take-aways:

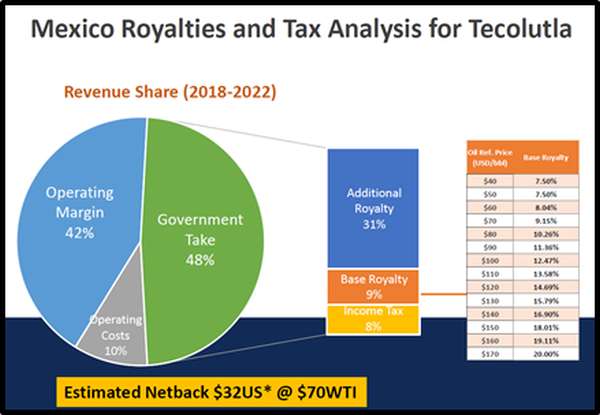

- Significantly lower royalty rate than many of their competitors

- Superior price for their oil from Pemex

- Budgeted costs on oil prices that are at about half the current market average.

On September 26, 2018, IFR announced that it has entered into a share option agreement with its JV partner, IDESA. IFR will purchase all of the outstanding shares in Tonalli Energia held by IDESA.

IFR now holds 50% of the outstanding Tonalli shares, with IDESA holding the remaining 50%.

Tonalli holds the license contract for onshore oil and gas development Block 24, the Tecolutla Block, located in the state of Veracruz, Mexico.

“The signing of this Option Agreement is a major milestone and solidifies IFR’s relationship with IDESA,” stated Hanson.

“The option agreement confirms IDESA’s historical commitment to our country’s energy sector and will certainly leverage our expertise in the upstream business,” stated Patricio Gutierrez, Grupo IDESA Chairman of the Board

IFR has agreed “not participate in, or own securities of, any Mexican oil and gas opportunities or businesses other than through Tonalli.”

According to the 2017 Fraser Institute Mining Survey, “The top jurisdiction in the world for investment based on the Investment Attractiveness Index is Finland.”

The least attractive jurisdiction for investment is Venezuela.

Mexico has a 63 rating, better then the Democratic Republic of Congo (DRC), worse than Indonesia.

Based on his comment last week, we believe the new Mexican President intends to make the country more attractive to foreign resource extraction investors.

“Renaissance is reassured by these developments,” confirmed Renaissance CEO Craig Steinke, “and encouraged that the Mexican government is supportive of the important role international oil companies, like Renaissance, play in the development of the Mexican petroleum industry.”

IFR has recently extracted 3000 barrels of oil from the TEC-10 – now trucked off to Mexico’s state oil company, Pemex.

Full Disclosure: ROE and IFR are Equity Guru marketing clients, and we own stock.