Question: Where is uranium going in the short to medium term?

Answer: “I don’t know if uranium is going to run hot any time soon, but I wouldn’t bet against it.”

Opinions vary, but there are reasons for optimism.

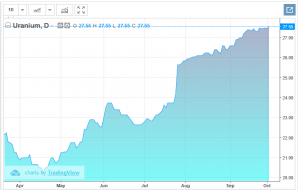

The price of U308 is firm. It continues to stair-step higher. We haven’t witnessed any violent spikes yet – not the type of price chart trajectory that’ll bring on gut wrenching g-forces…

But we’re in the early stages of price recovery. Things could get interesting in the weeks and months to come.

The positive undercurrents…

With electricity demand set to soar 76% by 2030 and 150% by 2035 (according to some estimates), the demand for uranium will remain firm. Reactor builds are at a 25-year high.

447 nuclear reactors are currently in operation worldwide. There are 59 under construction, 170 planned, and 372 proposed.

These new plants are going to need heaps of yellow cake.

Supply/demand…

The U308 market has been in a state of oversupply for years. Producers worldwide have been, for the most part, operating at a loss.

In order to restore balance, large producers, like Canada’s Cameco (TSX.CCO) and Kazakhstan’s state-owned miner Kazatomprom, began making significant cuts to production months ago. Others, like Paladin Energy, cancelled expansion plans or mothballed projects outright. This helped put a bid under the sector.

Something I find particularly interesting: Kazatomprom recently bypassed the spot U308 market and sold a chunky portion of its annual output to Yellow Cake plc, a London listed investment fund:

Investment fund Yellow Cake snaps up more uranium after float success

Obviously, this was an opportunistic move by Yellow Cake. They see higher U308 prices on the horizon.

The hedge fund community could punch a hole in supply. It could bring about shortages. It could bring on those g-forces we all want to experience from our price charts.

There’s more…

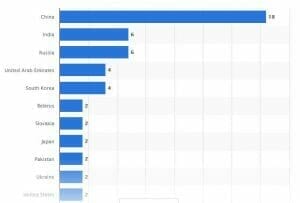

Adding validity to the argument for higher U308 prices, countries with aggressive nuclear power agendas are busy locking down subsurface supply.

Rio Tinto in talks to sell Rössing to China

The ‘Nuclear Intelligence Weekly’ last week suggested that if talks are successful, CNNC will acquire its largest overseas uranium asset, and would see complete Chinese control of Namibia’s active uranium production, with China General Nuclear’s (CGN) Husab mine already next to Rössing.

China wants more than its current 69% share in Rössing, a mine that ranks in the Top Ten globally…

There’s also this…

I hate highlighting any legislation signed by the Trump https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration, but this is worth taking note of if you need further convincing that U308 is for real:

Trump Signs Legislation to Promote Advanced Nuclear Reactor Technology. The bill reinforces the https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration’s efforts to revitalize the U.S. nuclear industry.

“There are some truly transformative advanced nuclear technologies being developed in America right now, and this bill just reinforces this https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration’s continued efforts to revitalize the nuclear industry,” said Ed McGinnis, principal deputy assistant secretary for the Office of Nuclear Energy, in a statement.

Additional fodder…

There are a number of good articles to peruse on the subject. This one from Mining.com is short, sweet, and it hits the nail on the head:

Uranium supply crunch may be just around the corner — experts

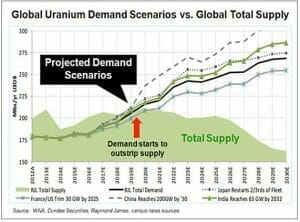

One more chart. This speaks volumes…

You can see why investment funds like Yellow Cake are eager to nail down and vault further supply.

A company worthy of your U308 short list…

We like junior U308 exploration companies here at Equity Guru, particularly those with the right address.

Azincourt Energy (AAZ.V) is an exploration and development company focused on the alternative fuels~alternative energy sector.

It has two advanced uranium exploration projects in the prolific Athabasca Basin of Saskatchewan, Canada.

What Wall Street is to the financial markets, the Athabasca Basin is to the U308 sector.

The Basin is best known for its high-grade deposits and currently supplies about 20% of the world’s uranium.

The Projects…

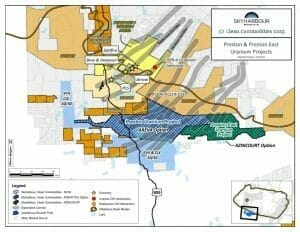

The East Preston Project is located in the western part of the Athabasca Basin. The prospectivity of the area is highlighted by recent discoveries made by NexGen Energy (Arrow) , Fission Uranium (Triple R), and a joint venture consisting of Cameco Corp., Areva Resources Canada Inc. and Purepoint Uranium Group Inc. (Spitfire).

Highlights of the entire Preston Project include (from the Azincourt website):

- Binding Term Sheet signed with new partner company whereby they have the option to earn a 70% interest in 52 hectares (of the total 121,249-hectare property) by spending $7.3 million on exploration and $700,000 in cash over 6 years.

- Western Athabasca Syndicate consisting of Skyharbour Resources and Clean Commodities as a partner with both companies owning a 50% interest; the goal of the strategic partnership is to explore and develop its large uranium property package in the western Athabasca Basin.

- Over $4.7 million in exploration expenditures on the Preston Project over the past three years.

- VTEM plus survey completed in August 2013 mapped over 300 kilometres of graphitic-type conductor segments, some approaching 10 kilometres in length, in the eastern blocks of the Preston Uranium Property.

- Initial interpretation of the radiometric data has identified areas with elevated uranium counts that can be correlated along and between multiple lines which may indicate the presence of radioactive boulder trains or in-situ uranium mineralization.

- Radon surveys successfully identified a number of radon-in-water anomalies occurring both as clusters and as discrete point anomalies in places that appear to follow basement conductor trends identified by the 2013 VTEM survey.

- Fifteen high-priority drill target areas associated with eight prospective exploration corridors have been successfully delineated through this extensive geophysics and ground evaluation.

- The extensive fieldwork data was used for final targeting of the first two exploratory drill programs.

- Initial drill programs consisted of approximately 3,300 metres in 14 holes.

- Majority of the holes intersected broad, hydrothermally altered and reactivated, structural zones with several of the holes returning elevated radioactivity and intersecting multiple graphitic units within sheared and altered basement lithologies.

- The alteration seen in several of these drill holes commonly consists of pervasive chlorite, hematite and clay development; features which are common to uranium mineralization in the Athabasca Basin.

- Skyharbour’s Technical Team considers these findings in the early stages of drill testing to be a significant breakthrough towards locating shallow uranium mineralization.

Next month the company is planning a 2000-2500 meter drilling program at East Preston to test several high-priority targets.

The Patterson Lake North (PLN) project is located along a NE trending gravity low structural corridor that also incorporates the adjacent Patterson Lake South (PLS) property owned by Fission.

PLN highlights…

- The former Cluff Lake mine (>60M lbs U3O8 produced) and the UEX-Orano Shea Creek deposits (42 km and 27 km to the north respectively) lie along the western margin of this structural feature.

- Fission’s high-grade PLS deposit is located 5.7 km to the south and also lies within this structural corridor.

- NexGen Energy’s uber high-grade Arrow deposit is located immediately along strike from PLS, on a sub-parallel trend within the same basin-scale corridor.

- These deposits have combined uranium resources in excess of 440 M lbs U3O8 (all categories).

- PLN also lies within a complex magnetic corridor showing magnetic highs and lows along with breaks in regional major features.

- Several EM anomalies are evident within PLN, including what is interpreted to be the southern extension of the Saskatoon Lake EM conductor (associated with the Shea Creek deposit to the north).

The project is a joint venture between Fission and Azincourt (FCU – 90%, AAZ – 10%)

To date Azincourt has spent $3.1M earning into PLN, primarily on targeting geophysics and diamond drilling. Prior to Azincourt’s involvement, Fission spent ~$4.7M on exploration on PLN ranging from airborne to ground geophysics to a first-pass drilling of a few select targets. There are three separate target areas that are drill-ready. The first uranium mineralization was intersected on the central conductor system during summer 2014 drilling and follow up is necessary. The N and Broach Lake conductor systems in the north and south project area, respectively, are highly prospective targets that have yet to see drill testing.

In addition to U308…

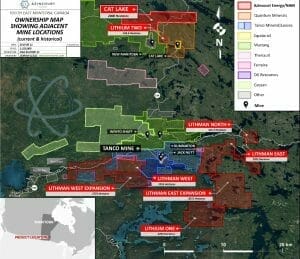

Azincourt has a number of prospective irons in the fire outside of the Athabasca Basin.

The company boasts an extensive portfolio of eight lithium exploration projects under joint venture with New Age Metals (TSX.V: NAM), located in the Winnipeg River Pegmatite Field.

The Winnipeg River Pegmatite Field is also considered a premier address. We’re big fans of lithium (spodumene) bearing pegmatites here at Equity Guru.

Azincourt’s Li projects share the same area code as Equitorial Exploration (EXX.V), a company covered here by our own Lukas Kane, and yours truly.

I look forward to probing Azincourt’s lithium potential further. There’s a lot to talk about here.

The company’s September 27th lithium project update…

Final Thoughts…

Azincourt is a busy exploration company with a number of prospective projects in the energy metals arena.

The company, led by Alex Klenman, President, CEO & Director, appears to be in very competent hands.

Current shares outstanding (68,130,319) give the company a market-cap of roughly $5.1M – a modest valuation.

Mobilization of a drill rig to their East Preston Project in the Athabasca Basin is one of several potential catalysts short-term.

END

~ ~ Dirk Diggler

Postscript ~

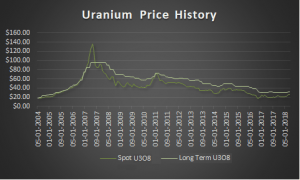

Earlier, I was talking about the current state of U308 and how we haven’t seen any real violence on the price chart. Note the price highs reached back in 2007…

I was around when the price of U308 exploded. The impact on the junior exploration sector was nothing short of epic.

FULL DISCLOSURE: Azincourt is an Equity Guru client, as is Equitorial Exploration. We own shares in both.