No matter what measure you apply to Canada Cobalt Works (CCW.V), it clearly stands out as THE most advanced junior exploration company working in the prolific historic Cobalt Mining Camp in northern Ontario.

This lofty designation is deserving. The company is operating on multiple levels, and thus far, its execution has been impressive.

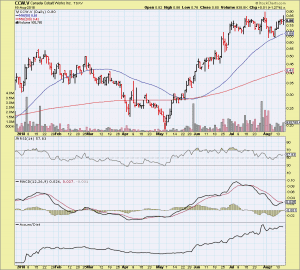

The company’s ability to deliver has not gone unnoticed. Market expectations have been elevated accordingly…

This stock has been a dominant force in the junior exploration arena – a sector that might best be described as a medieval battlefield at dawn.

The above chart speaks a thousand…

A brief summary for those out-of-the-loop…

- The company operates in a region which produced in excess of five-hundred million ounces of silver and over thirty million pounds of cobalt historically.

- The Castle Mine itself produced 9,410,095 ounces of silver and 376,053 lbs of cobalt in its day.

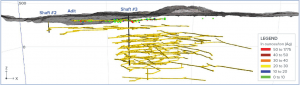

- The company boasts fully permitted underground access to eleven levels covering some eighteen kilometers.

- High-grade cobalt veins, with significant nickel and silver credits, fan out across the property.

- Underground drilling began two months ago.

- Bulk sampling is ongoing.

- Permitting the construction of a six-hundred ton per day mill on site is well underway.

- A pilot plant is being scaled up to process ore from the first level of the mine.

- The company’s proprietary Re-2OX metals extraction and separation technology have the potential to completely eliminate the high costs of shipping concentrate to a smelter (more on this below).

- Re-2OX stands to produce battery-grade cobalt sulphate to end buyers in Asia.

- CEO Basa and his team appear well on their way to becoming a vertically integrated cobalt company.

More good stuff…

Canada Cobalt Works has been featured prominently here at Equity Guru. A thorough review of the company, and the prospects for the cobalt market in general, can be found here, here, and here.

Before we get to the news…

Just pondering developments here (authors speculation only)… It’s possible that Frank Basa (P. ENG.), Director, President and CEO, may forgo the process of tabling a resource estimate for the Castle Mine, or at least make it less of a priority than one might expect. That appears to be his gameplan right now.

It’s possible that he may be tearing a page out of Chester Millar’s mine building playbook: target the obvious mineralization, skip the resource model, start mining, turn a profit. It’s an unconventional strategy, but it’s worked for Millar over the decades.

This isn’t the strategy of a rogue operator. It’s the strategy of a man who has an exhaustive in-depth understanding of the subsurface characteristics at the Castle mine site.

Don’t forget that CEO Basa worked at Castle, in a leading capacity, while Agnico Eagle was in silver production mode back in the day.

Mr. Basa has over 28 years’ global experience in gold mining and development as a professional hydro-metallurgical engineer with expertise in milling, gravity concentration, flotation, leaching and refining of precious and base metals.

He knows Castle’s vein structures intimately.

He knows where they run, how they run, and which veins offer the greatest cobalt grade potential.

The method to the madness – efficiencies called upon…

There are tremendous efficiencies being deployed here in this corner of the northern Ontario Cobalt Camp.

By going straight after the mineralization, without first producing a resource estimate, this team is staging a significant cost-cutting coup. I know from having operated as a contractor in the resource sector how employing one novel efficiency – one unconventional shortcut – can cut costs dramatically, adding significant bulk to the bottom line.

I don’t see the risk in forgoing the resource estimate step. Not here. The visual nature of Castle’s cobalt-rich veins makes targetting potentially economic ore a walk in the park.

As you can see from this video, one I’m fond of featuring in my articles, the cobalt-rich vein systems are immediately identifiable… the resource sprawls out in front of the cameras eye.

When you think about a typical drill program, one which operates from surface and requires the perforation of (often) hundreds of meters of waste rock and overburden to get to the source of mineralization, the significance of the company’s underground access at Castle cannot be stressed enough.

When you watch the video, it becomes clear that the drill bit will make immediate contact with ore-grade material the minute it begins to turn. This is a capital saving efficiency that few explorers enjoy. It’s one that is difficult to overstate as companies can spend, depending on the location, hundreds of dollars for each meter drilled.

Less overburden, fewer meters drilled = lower costs, less equity dilution, and ultimately: greater (potential) future earnings per share. It’s the domino effect ya’ll…

Pondering complete, nearly…

It’s important to note that the 1st level of the Castle Mine is open for mining operations. Wide open. It’s equally important to understand that this is but one of eleven levels at Castle. The potential for a multi-year mining operation is clear.

The August 15th News…

Canada Cobalt’s Re-2OX Produces 22.6% Cobalt Sulphate

Back in July the company stated that it would update shareholders on progress relating to its proprietary Re-2OX process, and lo in behold, they delivered said progress update on August 15th. How often do companies in this sector deliver, as a matter of routine, updates when they say they will? The answer to that question is, sadly, ‘rarely’.

The company is producing, via its Re-2OX process at SGS Lakefield, premium grade cobalt sulphate. Its pilot plant is now producing cobalt-nickel-rich gravity concentrates from stockpiled ore at its Castle mine, and will begin scaling up Re-2OX this quarter.

The development of Re-2OX is being supervised by one Dr. Ron Molnar.

This is exciting stuff…

Highlights:

- Canada Cobalt’s vertically integrated, environmentally green Re-2OX process at SGS has produced a technical grade cobalt sulphate hexahydrate at 22.6%, directly from cobalt-rich gravity concentrates produced from the first level of the Castle mine in the prolific Northern Ontario Cobalt Camp (bypassing the smelting process).

- The 22.6% grade exceeds the technical specifications of cathode producers in Asia who are in discussions with the company’s marketing representative in that region to evaluate Canada Cobalt sample product for potential battery sector use (Re-2OX will meet client specific purities).

- The very adaptable Re-2OX process will now create a Canada Cobalt suite of nickel-manganese-cobalt (NMC) battery grade formulations using an additive approach where necessary.

This is yet another ‘efficiency’ the company has in its arsenal. This proprietary technology – a green, three-stage separation and extraction process – could allow the company to completely bypass the entire smelting process.

The Three Stages…

Re-2OX process first removes arsenic. Second comes the base metals followed by a selective precipitation of pay metals. Third comes the recovery of precious metals. The process is green. It’s all done hydrometallurgically.

According to the company’s May 31st news release, cobalt, nickel and manganese recoveries from the concentrate using Re-2OX were 99%, 81% and 84%, respectively, while 99% of the arsenic was removed. Arsenic removal is a critical factor in this process, one worthy of celebration…

The potential to bypass the smelter = a BIG eff’ng deal…

The ability to bypass the smelting process would represent a tremendous cost savings.

At some point in the not-too-distant future, the numbers will flesh-out what this potential advancement could mean to the company and its shareholders. The impact on future revenues (yes, CCW is rapidly evolving along that curve) could be significant. Margins (money-in minus money-out) could see a very positive impact.

Regarding the news, CEO Basa commented:

Through the expertise of Dr. Ron Molnar and the team at SGS in Peterborough, Canada Cobalt has broken new ground as a technology leader in Canada’s most prolific Cobalt district. We’ve now demonstrated that from concentrate produced from the Castle mine, we can create a premium grade end product (cobalt sulphate) without a smelting process. This is a testament to the efficiency and effectiveness of Re-2OX, a process that’s very amenable to scaling up.

He went on to add…

We look forward to marketing the Canada Cobalt Re-2OX brand to the battery sector while we ramp up activity at the Castle mine both underground and at surface. Underground work including diamond drilling is proceeding extremely well, with another update shortly, while the pilot plant and a surface drill program to test for potential new discoveries east of the mine add important new dimensions to this exciting project.

Final Thoughts…

It seems that with each fresh piece of news, the company manages to further de-risk one’s investment here.

Newsflow – Re-2OX related, mill permitting, drilling, etc – promises to be steady going forward.

On deck are underground drill results from level one at Castle. I suspect CEO Basa will be releasing assays in batches as the volume of core flowing into the lab is substantial.

The company is cashed-up, having recently closed a $1.5M PP on July 25th. With 68.9 million shares outstanding, it has a market-cap of approximately $55M.

I have an aversion to repeating myself, but CEO Basa and his team appear to be setting a new standard for how a junior exploration company should be run. Management over-promising and under-delivering seem to be the norm in this sector. CEO Basa and team are fast establishing a track record of over-delivering. Rare and admirable qualities, these.

END

~ ~ Dirk Diggler

Full disclosure: Canada Cobalt Works is an Equity Guru client. We own shares.

Feature image courtesy of Jalopnik

Domino Effect Gif courtesy of Giphy