The world is going mobile (and electric). For this reason, there is a ravenous appetite for battery ingredients like lithium, nickel, graphite, manganese – and cobalt.

There’s an extra kicker to the cobalt demand driver – because most of the supply currently comes from the Congo – which has a child labour problem. It’s causing big cap companies to search for new cobalt supply lines.

On May 3, 2018 CPO reported results from the Phase 2, 16-hole, 2,345 meter drill program at its Smith Cobalt project in Cobalt, Ontario.

Highlights:

- Vein systems extended to over 400 meters in strike length

- Significant concentrations of cobalt and silver encountered.

- Thick, highly anomalous zones of battery-related metals in multiple holes

- Including copper, nickel, zinc

- Confirmed vein systems mapped from historical mine workings.

- Property lies in the same structural setting as the nearby Deer Horn Mine.

Assay Highlights Include:

- 371.0 g/t silver and 0.10% cobalt over 1 meter

- 0.20% cobalt over 4 meters

- 1.15 g/t silver over 64 meters

- 5.73 g/t silver, 0.17% copper over 6 meters

- 3.08 g/t silver over 49.2 meters

- 211.0 g/t silver over 0.20 meters

- 22.7 g/t silver, 0.27% cobalt, over 1 meter

According to the press release, “These holes were successful in extending the mineralized strike length to over 400 m from the western property boundary.”

“This drill program has added significantly to our knowledge of the mineralization in the Smith cobalt area and will allow us to plan more focused drilling for the next phase”, stated Chris M. Healey, P. Geo and VP Exploration.”

When geos talk about “adding to their knowledge” (rather than adding to the size of a resource), it suggests the results were less than eye-popping.

We chatted with the new CEO, Greig Hutton who confirmed that the results were “not company-makers” but advanced the “proof of structure”.

Because drilling is so expensive, Hutton intends to run a massive air-survey over the entire CPO Ontario property using drones – before finalizing more drill targets.

That’s smart.

“The advantage of a drones is that they can fly lower,” stated Hutton, “And it’s easy to tighten up the spacing.”

CPO plans to run its drone survey in a grid on 25-meter spacing – looking much closer – in the search for cobalt-rich veins.

CPO has also recently agreed to acquire Western Cobalt, a privately held mineral exploration company controlling 20,130 acres in the eastern Athabasca basin of Saskatchewan, Canada.

The Western Cobalt claims are contiguous with UEX Corporation’s (UEX) West Bear Cobalt-Nickel Project that recently announced drill results including 2.0% Co and 1.26% Ni over 10.5 meters and 0.73% cobalt and 0.36% nickel over 20.5 meters.

With the tailwind of surging cobalt demand – and tight supply – you could probably spin Western Cobalt off into a separate investment vehicle. For CPO investors, the near-term stock price catalyst is going to come from the Smith Cobalt project.

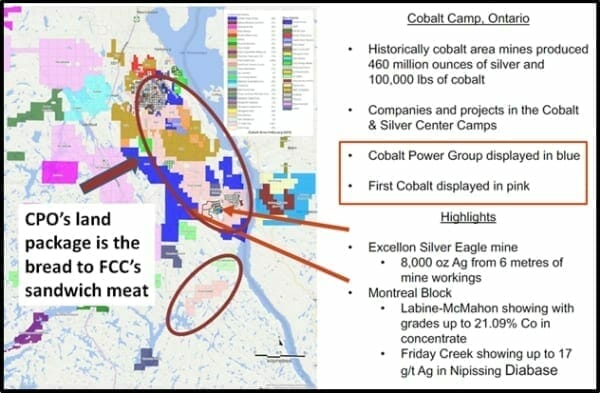

Part of this is because of the success of it’s neighbour, First Cobalt (FCC.V).

As Chris Parry wrote on March 14, 2018, “If you’re looking to watch your stake grow over years, as cobalt shortages bite and a renewed focus on responsible supply drives companies away from the DRC, First Cobalt is legit, and its $200m market cap is far below value.”

The FCC stock price has dropped off about 40% in 2018, but it’s still up about 700% in the last 2 years.

Why does FCC’s success matter to CPO shareholders?

It’s called Closeology (staking land close to an existing high-grade project). In CPO’s case, they are so close and cuddly – there is a danger of accidental impregnation.

There is another pertinent CPO subplot: the strategic alliance with a $1.1 billion company, Hochschild Mining (HOC.LSE).

Hochschild currently operates 4 underground mines, focused on the production of precious metals, of which 3 are located in Peru and 1 in Argentina.

HOC has the right to option and JV one of CPO’s properties, to appoint one director to the Board of CPO and to top up its percentage interest in CPO

HOC has extensive experience in commercially exploiting steeply dipping, narrow epithermal veins, like those found in the Cobalt Camp. They have a $150 million cash lying around and an army of geologists which CPO can tap into.

Volkswagen (VLKAY:OTCPK) recently tried to secure a $59 billion non-DRC cobalt contract for 150 gigawatt-hours of lithium-ion battery storage – about 30,000 tonnes per year (30% of total 2017 global supply).

The cobalt producers called it a “low ball” and no deal was done.

FULL DISCLOSURE: Cobalt Power Group was an Equity Guru marketing client. FCC still is. We own stock in both companies.

What’s your take on Nano One?

Richard, we first wrote about Nano One in March, 2016 saying, “NNO has tech that can help nano needs be met not by lithium, which is expensive and is supply-strangled, but by lithium carbonate, which is cheaper and not so tough to find.” Since then, we’ve written 30 NNO articles, while the stock price has increased 600%. The last article stated, “Capacity gets all the attention, but manufacturers are bound to be interested in service life. If a company sells an electric car that won’t hold a charge after two years, it’ll be the last one that company sells.” Nano One is kicking ass. The company is also a client, so take that into account. But believe me, they have earned the love we give them. More here: https://equitystaged.wpengine.com/tag/nano-one-materials/