Manitoba.

Neil Young. BTO, Anna Paquin… Fred Penner!! The Guess Who (American Woman).

These prolific talents all hail from Manitoba, a province wedged into the cold creamy filled center of Canada. Who’d a thunk that such creativity could spring forth and blossom from such a cold dark place. Actually, Winnipeg – the capital – boasts the sunniest winter season in the country with some three-hundred and fifty-eight hours of sunshine, but that’s nit-picking.

And who’d a thunk Manitoba might also be the source of some of the cleanest, highest purity lithium around?

The Company:

Equitorial Exploration Corp (EXX.V) is a new client here at Equity Guru. The company was covered recently by our very own – Equity Guru’s Commander-In-Chief – Chris Parry who laid out the company’s positioning and prospects rather eloquently.

Parry’s article also touched on EXX’s neighbor, Quantum Minerals Corp (QMC.V), and the significance of a mineralized structure the two companies appear to share.

Okay… Parry more than ‘touched’ on Quantum Minerals. He spoke his mind and didn’t hold back. It was a brutally honest critique. It was also a fair one imo.

Parry drew comparisons between two companies, one that over promises and under delivers, the other which puts its nose to the grindstone, goes to work and gets things done… reporting its progress to shareholder’s every step of the way.

Here’s a taste from Parry’s latest:

QMC had a head start on everyone in the area, because initially it was just them in the area. But instead of progressing the story, they farted around making 3D models and channel sampling.

Equitorial isn’t just drilling, they’ve completed their drilling. Meanwhile, QMC didn’t even apply for drill permits until last December, and only just received those permits in March of this year and intend to use them to validate their historic data.

It’s a compelling read. I’d stop with this piece right now and read Parry’s latest first if you haven’t already done so.

The above excerpt is one of the reasons I like hanging out here at Equity Guru. Puff pieces are not exactly welcome…

The nitty-gritty – why you should take a look under Equitorial’s hood:

Though the company has four properties that boast lithium potential, EXX’s Manitoba asset is what we’re ogling with piqued interest here at Equity Guru. This could be a good one. We may get our first taste of just how ‘good’ real soon. More on that later.

The potential value here is all in the details…

There are a few things you need to know about what Equitorial is looking for, what they may have lying not too far beneath the surface.

As mentioned above, the company is searching for lithium. They are searching for it in the form of Spodumene.

Spodumene is a pyroxene mineral found in granite pegmatites. I know what you’re thinking: ‘WTF is a pigglytite’?

Pegmatites are intrusive rocks (igneous in nature) that develop during the period when liquid hot magma cools and crystallizes.

Back to Spodumene…

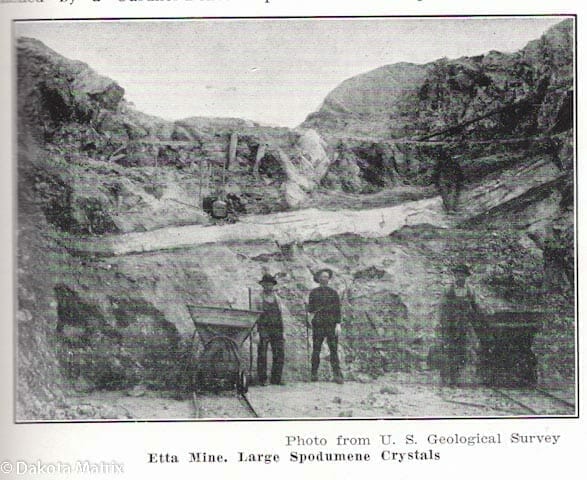

Spodumene is known for its unique crystal structure. Spodumene crystals can be gynormous… HUGE.

(the long white layer above the three old timer’s is one helluva spodumene crystal)

And why is the company searching for these humongous Spodumene crystals?

Spodumene once served as the most important ore of lithium metal. Although it remains an important source of lithium, today most of the world’s lithium is produced from subsurface brines in Chile, Argentina, and China. These sources of lithium have lower production costs and are suitable for most uses. However, when lithium of highest purity is needed, spodumene is the source that is used.

Equitorial Exploration appears to hold ground in an area rich in spodumene, and within, a potential source of lithium that is of the highest purity – their neighbor may already be sitting on a rather substantial deposit.

This is the kind of lithium – the kind that doesn’t explode and go all 4th-of-July on your ass – that we need for our most sensitive electronic devices, our cell phones, our kids tablets… portable devices we often place in close proximity to intimate body parts, like our lips and other delicate regions.

Explosions you ask…?

Chris Parry gave us his illuminating take on the matter earlier this year:

You remember back when Samsung cellphones were being taken off airplanes? That happened because the current method of drawing varying grades of lithium from 70 different locations in China and tossing it all in one big bucket with graphite from who knows where and cobalt from child labour in the Congo… that’s apparently – who’d have guessed – not the best way to get your energy metals.

Weird.

Spodumene is in demand, because nobody wants their cellphones blowing up and turning your crotch into a fireball not seen since the boys went on shore leave in ‘Nam.

It’s all about lithium purity; how and where the mineral is sourced.

More on ‘Why Spodumene’…?

The demand for spodumene is dependent upon the use of lithium in manufacturing. In the past, most lithium compounds and minerals were used to produce ceramics, glass, aluminum alloys, and high-temperature grease. However, an exploding demand for rechargeable batteries to power cell phones, tablet computers, cameras, music players, GPS units, and other portable electronic devices is driving the demand for high-purity lithium – and that drives the demand for spodumene.

It’s also important to note that Spodumene hosted lithium deposits can be processed via simple acid extraction, in a very short time frame, whereas their brine hosted counterparts can take many months to evaporate into a useful concentrate.

The Project – The Cat Lake Lithium Property:

Equitorial acquired the project in October of 2017. Cat Lake consists of three claims, some ninety-nine hectares next door – right smack next door – to the Cat Lake Mineral Project owned by QMC. There’s a subtle difference between the two projects name wise – don’t get them confused.

The relationship between these two companies needs to be explored. It would appear that they both may be onto something significant.

This, from Quantum Minerals Corp News Release September 7, 2017:

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes into the Irgon Dike and reported a historical resource estimate of 1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This historical resource is documented in a 1956 Assessment Report by Bruce Ballantyne for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No. 94932). This historical estimate is believed to be based on reasonable assumptions and the company/QP has no reason to contest the document’s relevance and reliability.

A slightly less assertive tack might suit the classification of the above (historical) resource better.

Try this…

NOTE: The mineral reserve cited above is presented as a historical estimate and uses historical terminology which does not conform to current NI43-101 standards. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Although the historical estimates are believed to be based on reasonable assumptions, they were calculated prior to the implementation of National Instrument 43-101. These historical estimates do not meet current standards as defined under sections 1.2 and 1.3 of NI 43-101; consequently, the issuer is not treating the historical estimate as current mineral resources or mineral reserves.

Yep… feeling less twitchy already.

Moving along…

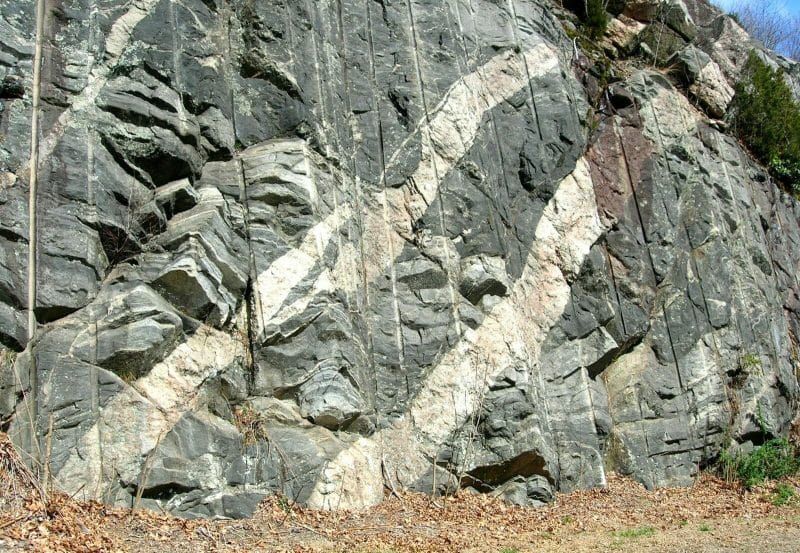

The source of QMC’s historic resource is a spodumene-bearing dike – the Irgon Dike to be specific.

(A dike is an intrusive body of rock (think intruder). It forms a sheet when magma intrudes through or across layers of its surroundings – when it rises up and cuts across faults or cracks, or up into an unlayered mass of rock, crystallizing as it cools)

Between 1953-1954 the ‘Lithium Corporation of Canada Ltd’ drilled twenty-five holes into the Irgon Dike in order to arrive at the above historic resource.

This dike, which is well exposed on a glaciated surface, has a total exposed strike length of 442 meters with an average width of approximately 7 meters.

Closeology:

Equitorial’s claim boundary is but a stones throw from QMC’s dike, and the historical lithium resources noted in the above quotes. Note the scale on the map below.

The Irgon Lithium Mine and access shaft – a old mid 1950’s lithium development project that was abandoned before it was put into production (Li was a soft market back then) – is located a mere 150 meters from south end of the Cat Lake claim block.

All of the above = Closeolgy.

Closeology can be a very good thing… ya’ll.

A curious detail:

At the edge of EXX’s Catail claims, there’s a historic drill hole which stands out. This 1948 hole apparently hit 14.6 meters of spodumene bearing quartz (Manitoba Assessment File 98073 – non 43-101 compliant).

The ancient hole cut spodumene over a wide interval and there’s no way of knowing what the lithium content was. A person can only ponder the possibilities…

The Plan:

Equitorial began drilling back in February.

Among the company’s outlined areas of interest for this first pass with the truth machine:

– test the eastward extension of QMC’s Irgon pegmatite dike.

– drill in the direct vicinity of the 1948 drill hole noted above – 14.6 meters of spodumene (non 43-101 compliant), for which there was no follow-up drill program.

How things have playing out so far:

Drill hole CT-18-02 was positioned to intersect a possible extension of the Irgon Pegmatite system, presently being explored by QMC Quantum Minerals to the west of the company’s claims.

The drill hole encountered approximately 36 meters of a spodumene bearing pegmatite (true width not determined at this time) at a depth of 126 meters downhole or 90 meters below the surface.

The company is pleased to report that drill hole CT-18-04 encountered approximately 20 meters of the same pegmatite found 50 meters to the east at the original pegmatite discovery (CT-18-02) at its 100%-owned Cat Lake Lithium Property in SE Manitoba directly, adjacent to the Cat Lake Mineral Project owned by Quantum Minerals Corp.

This pegmatite was encountered approximately 105 meters downhole or 72 meters below the surface. CT-18-04 confirms the lateral extension of the pegmatite discovery.

Equitorial Completes Drill Program at Cat Lake Lithium Property, Manitoba

Spodumene Bearing Pegmatite Approximately 33 Meters in Width

Pegmatite System Proven To Continue Horizontally and Vertically

6 of 7 Holes Test Positive for Pegmatite PotentialDrill hole CT-18-06 was the last hole of the pegmatite exploration portion of the drill program and was drilled to test the down dip of the initial pegmatite discovery (see NR 3/19/2018). Several pegmatites were encountered in the hole. The main pegmatite of interest was intersected at approximately 138 m downhole or 120 meters below the surface. The main spodumene bearing pegmatite is approximately 33 meter in width (true width not determined at this time). The pegmatite system has been proven to continue in a horizontally and vertically.

Assays are pending…

Getting to the core:

As Chris Parry noted in his recent piece on Equitorial, the company has been hitting the ground hard.

This is a pic of some of the core EXX has pulled from their recently concluded drill program.

It’s difficult to assign a value to drill core based on visuals, let alone to a pic of said core. I won’t go there. Assays are pending.

Other projects:

The company has lithium projects elsewhere. Perhaps most notable is the Little Nahanni Pegmatite Group Property (LNPG).

The LNPG property is in the NWT. It’s a fairly large property comprising some 5,393 hectares (53.93 km2).

It’s a big system that sports grades, in some of the individual dikes, of 2% Li2O and 500g/t Ta2O5 (Tantalum). The property has been worked only sporadically since the late 1970’s.

For those familiar with the bigger names/players up in this part of the Great White North, the project was optioned from none other than Archer Cathro and Associates.

Highlights from a 2016 channel sampling program on the project include:

- 1.57% Li2O, 250.3 g/t Ta2O5, 0.95% SnO2 across 1.70 m

- 2.04% Li2O, 57.8 g/t Ta2O5, 0.05% SnO2 across 4.00 m

- 3.10% Li2O, 53.6 g/t Ta2O5, 0.03% SnO2 across 0.95 m

- 2.33% Li2O, 59.0 g/t Ta2O5, 0.05% SnO2 across 1.20 m

- 1.67% Li2O, 41.4 g/t Ta2O5, 0.03% SnO2 across 3.75 m

- 1.83% Li2O, 67.3 g/t Ta2O5, 0.05% SnO2 across 1.25 m

- 1.63% Li2O, 52.9 g/t Ta2O5, 0.01% SnO2 across 5.15 m

They also have projects in Utah and Nevada. We’ll cover those another day.

Final Thoughts:

I’d be remiss in not pointing out the ride QMC went on after Equity Guru picked up coverage of the company.

I’m not saying that Equitorial will perform similar acrobatics on their price chart – climbing to heights that would give even the most intrepid tightrope walker vertigo – but the company is working the ground and they may be onto something.

With a $5M market-cap, compared to a $35M valuation for its neighbor QMC, Equitorial certainly has room to move.

Assays from Cat Lake are on deck. Positive results should push the company’s shares higher…

We stand to watch.

END

~ ~ Dirk Diggler

Full Disclosure: The author currently owns shares in Equitorial Exploration.

How about a follow up on Clean Commodities and more specifically how they have completely TANKED, maybe another pump up article can bring the price up again..

From 5c to 8c in the last two days on crazy volume.