EDITOR’S NOTE: We believe, this year, resources will make a pretty hard move, just as cannabis and blockchain did in 2017, and because many of our investor readers are new to the mining space, we decided to bring aboard a writer who can dig deep into the details and explain what matters and why.

Greg Nolan, AKA Dirk Diggler, is a fount of mining knowledge. His brief: Take a look at mining and oil and gas explorers and producers, and tell us what he feels, positive or negative, with no fear nor favour.

We encourage readers, if they come across a phrase or concept that they don’t understand, to let us know in the comments, as we’re putting together a series of pieces that will explain terminology in greater detail. See more of Greg’s work here.

—

“There is nothing in the desert. And no man needs nothing”.

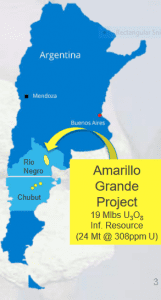

Blue Sky Uranium’s (BSK.V) CEO Nikolaos Cacos might beg to differ with the (simplistic) interpretation of the above quote. His company just tabled an impressive inferred maiden resource estimate of some 19.1 million pounds of U3O8 in the (semi) desert… 19.1 million lbs of yellow cake.

That’s right… clean, green uranium baby.

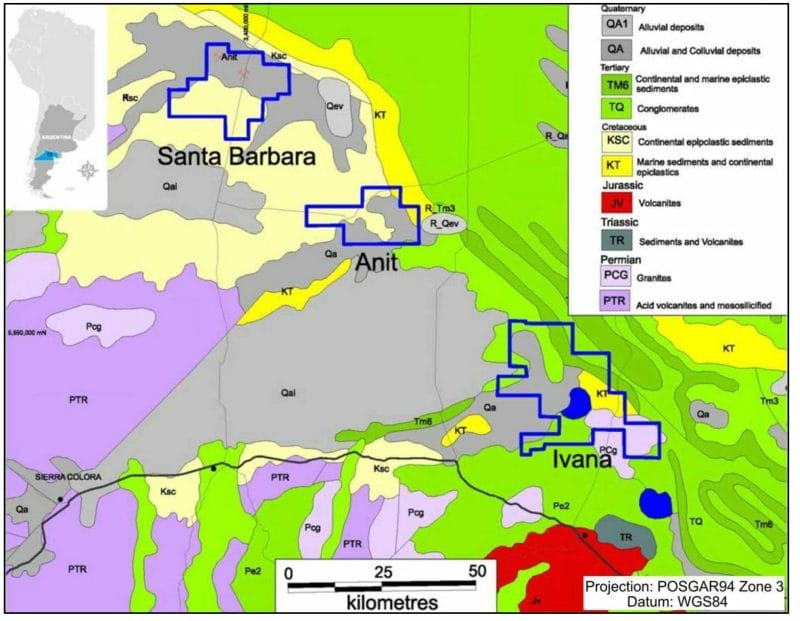

This independent mineral resource estimate at the company’s Ivana project represents only the very southern tip of the company’s 140 km long x 50 km wide 100% owned Amarillo Grande project.

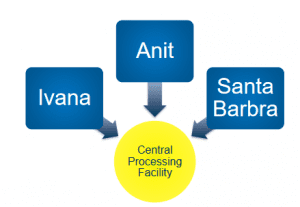

All three of Amarillo Grande’s projects – Ivana, Anit and Santa Barbara – are located in central Rio Negro province, in the Patagonia region of southern Argentina. All three properties have good road access from major centres via hard-packed gravel (Provincial Road 66), approximately 65 kilometres south of the town of Villa Regina.

Nikolaos Cacos, Blue Sky President & CEO, had the following to say about their recently announced maiden resource estimate:

This first resource estimate represents the biggest uranium discovery in Argentina in the last 40 years and it represents for Blue Sky a major step towards our goal of defining a low-cost regional-size uranium producing district.

CEO Cacos also had this to say in a recent interview with Equity Guru’s Chris Parry:

We made a uranium discovery in Argentina which could turn out to be one of the largest uranium discoveries on the planet […] We have about 430,000 hectares over two provinces. We have discovered uranium occurrences along a 140-kilometer trend.

These glowing comments are what one might expect to hear from a company CEO after a watershed news event drops.

But I detect no exaggeration in the Cacos’ words. None whatsoever.

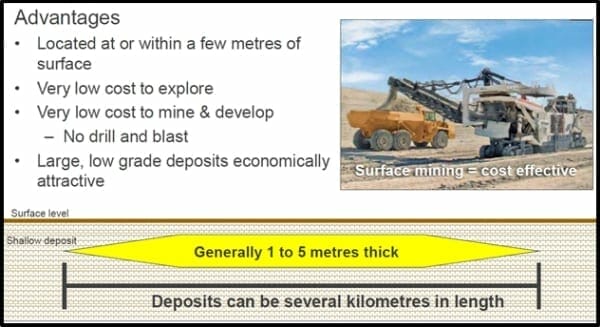

There are factors at play here that may not be apparent at first glance. Yes, the U3O8 grade is low, but the mineralization is shallow. It’s so shallow that it lies just beneath the surface.

<EDITOR’S NOTE>

THIS MATTERS: The more ore you have to dig up and process in order to get a ton of minerals, the more it costs to ultimately pour a pure bar of the stuff. So a high grade in a resource estimate is nice because it brings you more of the valuable stuff for less work.

Because of that, folks new to the resource investing game tend to gravitate towards the higher grades as a simple metric of likely success, but having a fantastic grade of mineral, say, under a lake (as happens in parts of Canada), which will have to be frozen or drained to access, is a much tougher situation to make money from than one where you could pull a backhoe across a paddock and reveal lesser grades of ore.

</EDITOR’S NOTE>

Rapid, low-cost development potential:

Like the sign says, this type of mineralization is a snap to explore. It’s also dirt cheap to develop and mine. Large deposits of this type often demonstrate very favorable economics, even at current U3O8 prices.

CEO Cacos also had this to say when he sat down recently with Chris Parry:

This amount of uranium is enough to trigger production, given that it’s right at surface, on unconsolidated gravel-like ground.

The exceptional characteristics of these types of deposits (Surficial Uranium Deposits):

What Blue Sky has in its maiden resource estimate is a deposit type – a ‘surficial’ deposit – that is comparable to those found in Kazakhstan, certain parts of Africa, and Australia. While they’re all relatively low-grade, they’re extremely low-cost operations. They also tend to be HUGE, often running into the 100’s of millions of pounds.

An example of a surficial uranium deposit is ‘Yeelirrie’ in Australia. The Yeelirrie deposit, a development project owned by Cameco (CCO.TSX), contains 128.1 million pounds (measured and indicated) of shallow U3O8 mineralization grading .16%. The plan is to mine Yeerlirrie via a series of shallow pits – 10 meters is about as deep as the pits will go.

Back to Blue Sky – a quote from the company’s most recent NR regarding their Ivana (surficial) deposit:

Mineralization at Ivana is hosted by loosely consolidated sediments from surface to 24 metres depth; it is expected that resources would be extracted via open-pit method.

I like this quote too, from the company’s website:

Defined mineralization at Amarillo Grande is found in three properties (Ivana, Anit, and Santa Barbara) along a 140 kilometre trend. Mineralization at all three properties occurs at or very near surface, in weakly-cemented host rocks, making simple and inexpensive open pit mining a likely development scenario. Uranium mineralization found to date is in the form of the leach-amenable mineral carnotite as coatings on pebbles.

and this one…

Mineralization at Ivana includes primary coffinite and uraninite, in pore spaces of poorly consolidated sandstones and conglomerates, in addition to peripheral secondary carnotite, which occurs interstitially to and coats pebbles and clasts in loosely consolidated sandstones and conglomerates.

The takeaway here – what the company is saying in the above quotations – is that the U3O8 mineralization at Amarillo Grande is NOT all locked up in solid, difficult-to-process rock. It crumbles.

The fact that it’s found near surface, often as a coating around pebbles and gravel, implies that it can be easily liberated and concentrated. This is HUGE from an economic standpoint.

In fact, after performing preliminary metallurgical studies on mineralized samples, the company believes they can pre-concentrate the U3O8 grade by a simple ‘wet-screening’ process. By concentrating the U3O8 grade onsite, they’ll be positioned to effectively slash transportation and treatment costs.

Again… HUGE!

Resource expansion and regional exploration potential:

A simple view of the above map suggests there’s more… plenty more U3O8 to be discovered over this massive 140 km long x 50 km wide corridor. After running my due diligence on this company, I’m convinced that 19.1 million lbs of U3O8 represents only the kickoff for Amarillo Grande. The tip of the iceberg if you will…

Now that Blue Sky understands the model, they’ll work toward unlocking further U3O8 potential across their entire 140 km x 50 km corridor of prospective terrain. They’ll use the exact same discovery model that led to this impressive maiden resource estimate at Ivana. CEO Cacos and crew have Amarillo Grande dialed.

Blue Sky Uranium’s real blue-sky upside lies in the prospect of multiple deposits of a similar vein. That would brand Amarillo Grande with the distinction of a world-class U3O8 district.

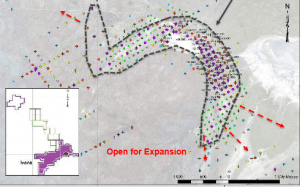

Ivana already sports 19.1 million lbs of U3O8 mineralization.

It encompasses a 5 km mineralized corridor which includes a >1km high-grade zone (see above).

The corridor ranges in width from 200 to 500 meters and is up to 23 metres thick.

Along with Ivana, exploration and resource development success at Amarillo Grande’s 2 other projects areas (Santa Barbara and Anit) could create good symmetry for a district-wide processing scenario.

Highlights

- Surficial uranium mineralization discovered by Blue Sky

- Mineralization related NE-SW structures affecting Late Cretaceous to Tertiary sedimentary sequences indicating probable remobilization

- A high-chargeability IP anomaly indicates potential for near-surface sandstone-hosted uranium mineralization related to Tertiary fluvial units

- Exploration work includes 1,672 stations of radon gas soil & ground radiometric surveys, hand-auger and sampling pits.

Highlights

- 15 kilometre trend of near-surface Sandstone-hosted uranium mineralization discovered by Blue Sky

- 1000m x 200m strongly mineralized corridor within a paleo-channel

- Mineralization open at depth in some areas and along paleo-channel strike

- Exploration potential along +5km

- Exploration work to date includes 123 sampling pits, 1,404 metres of trenching and 204 shallow drill-holes totaling 5,044 metres, including

- 4 m averaging 0.078% U3O8 and 0.107% V2O5,

- 3 m averaging 0.071% U3O8 and 0.153% V2O5.

- Metallurgical testwork indicates amenability to upgrading

Note the above vanadium values. The Anit property has vanadium. There are areas where vanadium exceeds uranium grades by a factor of 4 to 1. If Blue Sky continues to expand these mineralized areas – and it’s highly likely that they will – it could have a profound impact on the project’s economics.

The current market for vanadium is tight Tight TIGHT…

Vanadium, a medium-hard, steel-blue metal is extremely valuable in the manufacturing industry owing to its malleable, tensile and corrosion-resistant qualities. Used traditionally as a hardening agent in steel manufacturing, it’s now being used in vanadium redox flow storage batteries, a key component in the sustainability of renewable wind and solar power technologies. The metal also has numerous other uses.

CEO Cacos had this to say to Chris Parry about Amarillo Grande’s vanadium potential:

We are finding substantial amounts of Vanadium. It provides us with – not just a hedge – but a potential economic boost into the value of the work. In some areas, for every pound of uranium, there is 4 or 5 pounds of vanadium. So we’re reworking the data and we believe there could be a legitimate stand-alone vanadium deposit.

CEO Cacos also had this to say on BNN recently…

Certain targets seem to be primarily vanadium. We have drilling underway right now and a program to begin to model this, and shortly to be able to announce the amount of vanadium that is contained in our project.

Cool Beans! The price chart above is validation enough for CEO Cacos’ enthusiasm and emphasis regarding Amarillo Grande’s vanadium exploration potential going forward.

Moving along…

Argentina wants what Blue Sky’s got:

- Argentina has three nuclear reactors generating about one-tenth of its electricity.

- Its first commercial nuclear power reactor began operating in 1974.

- The construction of two additional reactors is planned.

- Construction has started on a small locally-designed power reactor prototype.

- Nuclear Energy requirements are expected to increase by 2.5 times by 2025…translating to a potential for 1.25 million pounds of U3O8

- All uranium for the nuclear industry is currently sourced from outside the country

The management team behind Blue Sky is the same team behind Golden Arrow Resources (GRG.V) – the Grosso Group. This highly competent team of explorers are the Argentine experts… the first movers in the country. Now, with 19.1 million pounds of U3O8 tabled at Amarillo Grande’s Ivana project, the Grosso Group boasts a total of 4 major discoveries in Argentina, including the Chinchillas deposit which is currently under development with SSR Mining. Remarkable!

Final thoughts:

Blue Sky appears to be onto a system of uranium/vanadium mineralization that has world-class district-scale potential. These are very exciting times for CEO Cacos and the company.

With a market-cap of > C$19 million and a maiden resource of 19.1 million pounds of U3O8, the company is absurdly cheap. This is a valuation anomaly that likely won’t last long.

END

~~ Dirk Diggler

FULL DISCLOSURE: Blue Sky Uranium is an Equity.Guru marketing client, and we own stock in the company.