According to CRU – a global metals and mining research house, the famed cobalt deficit is over as Glencore’s (GLEN.L) refurbished Katanga copper mine in the Democratic Republic of Congo (DRC) is coming back on line with a new “super-charged cobalt extraction circuit”.

Katanga is no ordinary little mine.

Within a couple of years, Katanga will be meeting 25% of global cobalt demand – producing cobalt as a by-product of copper.

Should non-DRC cobalt juniors be shooting themselves in the head?

No.

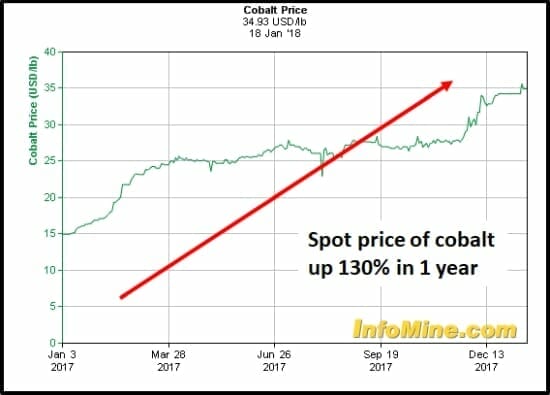

As it turns out, the spot price of cobalt doesn’t give two hoots about the Katanga re-boot.

Why?

According to CRU, the excess cobalt supply will be sucked up by “big future consumers of cobalt like automotive companies, tech companies and battery manufacturers” that will choose to stockpile cobalt.

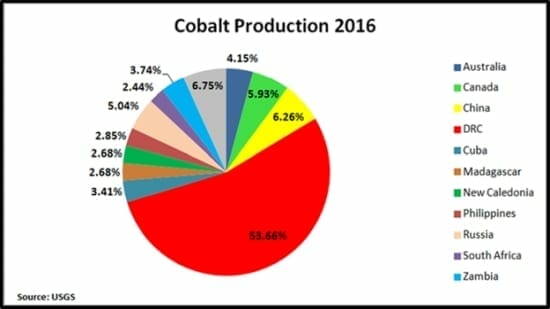

In fact, the reopening of the Katanga mine may be a stock price catalyst for cobalt juniors. Because it increases dependence on the DRC – which has well-publicized political and child labour problems.

At Equity Guru, we follow the cobalt space closely, and we’ve identified a few good projects in Ontario, and a new project in Scandinavia.

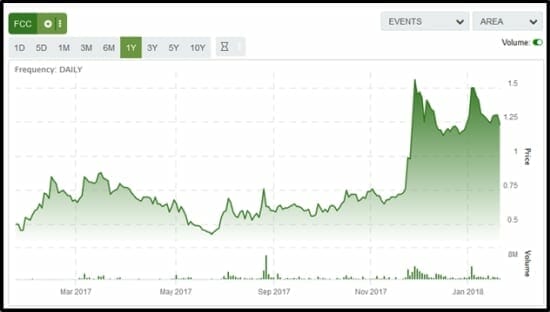

On Dec. 07, 2017 First Cobalt (FCC.V) announced that it has purchased four mining claims located in the Ontario Cobalt Camp, near the past producing Caswell mine.

The properties are contiguous to FCC’s existing properties, further consolidating FCC’s large land position.

First Cobalt now controls over 10,000 hectares of prospective land and fifty historic mines as well as a mill and the only permitted cobalt refinery in North America capable of producing battery materials.

On January 16, 2018 FCC announced a $7 Million Exploration Program that includes 26,000 meters of drilling on 13 different targets.

Drilling at the Bellellen mine in the Cobalt Camp, Ontario is now “testing the relationship between the disseminated style of cobalt mineralization identified in 2017 and the vein style mineralization that was traditionally mined in the Cobalt Camp.”

FCC stock price rose 140% in the last year.

Cobalt Power Group (CPO.V) has completed the purchase of four separate blocks of mineral claims owned or leased by Canadian Cobalt in the South Lorrain and Lorrain Townships.

“The price of Cobalt Power Group (CPO.V) ramped up 20% in early trading Monday after the company dropped news that Hochschild Mining (HOC:LON) has agreed to buy into the Canadian cobalt explorer for a minimum of US$500k.

The deal, which comes in no small part from the fact that CPO CEO Andreas Rompel worked for Hochschild for a lot of years, in Peru, Mexico and Chile, establishes Cobalt Power Group as a larger player than their (now) $8 million market cap would suggest.”

The 16-hole, 2306 m, Phase 2 drill program has been completed and the drill core has been logged, sampled, and shipped to AGAT Laboratories in Timmins, Ontario. The results will be released once the Company has received them and the QA/QC process has been completed.

CPO stock price rose 210% in the last year.

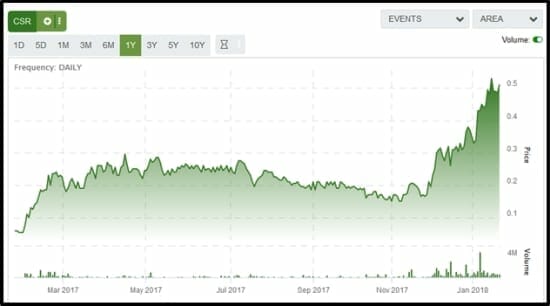

In 1983, a newly-graduated metallurgical engineer named Frank Basa got a job working at the Castle Silver Mine in Ontario – then operated by Agnico Eagle (AEM.TSX). The mine was situated about 80 kilometers northwest of the historic Ontario Cobalt camp.

The young metallurgical engineer (Basa) is now the CEO of Castle Silver (CSR.V) which controls the old Castle Silver Mine.

The three shafts of the Castle Silver Mine were held by different companies over the years. Some of the shafts are connected via tunnels.

High-grade mineralization was encountered in numerous chip samples:

- 1.8% cobalt, 8.6% nickel and 25.2 g/t silver (CSR-17-S03)

- 1.6% cobalt, 7.6% nickel and 32 g/t silver (CSR-17-S04)

- 0.81% cobalt, 5.9% nickel and 4.1 g/t silver (CSR-17-S01)

CSR is currently processing bulk samples using the company’s proprietary Re-2OX hydrometallurgical process to produce high purity cobalt for batteries. This process may also be useful in recovering cobalt from recycled batteries.

On January 19, 2018 CSR announced that it will be changing its name to “Canada Cobalt Works” to “more accurately reflect CSR’s primary focus in Canada’s premier cobalt district”.

CSR stock price rose 750% in the last year.

Boreal Metals (BMX.V) first got on our radar two weeks ago.

We were impressed with its 4 VMS deposits, containing rich veins of copper, zinc, gold and silver.

The beauty of VMS deposits is that multiple metals (zinc, gold, copper, silver) can all be found in the same deposits. So they function as single-deposit diversification investments.

As we said at the time, “Boreal Metals isn’t so much “unloved” as “unknown”.

Given the assets, the grades, the management and the geopolitics and the impending drill results, we suspect that is about to change.

A week later, BMX announced the execution of a definitive agreement with EMX Royalty for the acquisition of the Modum Project, surrounding southern Norway’s historic Skuterud Mine which was Europe’s largest and highest grade producer of cobalt though the nineteenth century.

“The Modum Project includes an impressive 12,000 Ha with 12 kilometers of cobalt prospective geology, with stand-alone mining potential,” stated President and CEO Karl Antonius. “Boreal is excited about the timely acquisition of a high grade cobalt project within an emerging battery production sector in the Nordic Region.”

According to an article in The Guardian “Norway is the undisputed world leader on electric cars, run almost exclusively off the nation’s copious hydropower resource.”

The 13,115-hectare Modum Project is located about 75 kilometres west of Oslo, Norway. Year-round access, road, rail, power, and skilled labour.

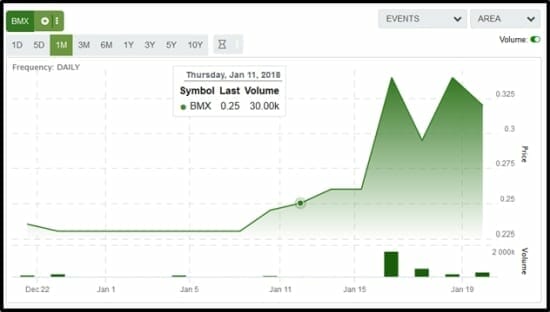

Since we first wrote about BMX two weeks ago, the stock price has risen 28%.

The spiffed-up Katanga mine is going to produce 11,000 tonnes of cobalt in 2018 and 34,000 tonnes in 2019.

The United States Geological Survey (USGS) estimates 2016 global cobalt production at 123,000.

As we recently pointed out, Energy Metals is a good place to be.

Much of the world’s cobalt comes as a by-product of nickel. Nickel is currently about $10,000 tonne, tied to stainless steel demand.

If nickel prices increase significantly, new nickel-cobalt mines with come on stream.

Until then, though they may not rival Katanga for size, the world will look to North American and Scandinavia projects for clean local cobalt supply.

Full Disclosure: FCC, CSR, CPO and BMX are Equity Guru marketing clients. We also own stocks in these companies.

As reported by newswire.ca ‘Castle Silver Resources Inc. (TSX.V: CSR, OTC: TAKRF, FRANKFURT: 4T9B) (the “Company” or “CSR”) is pleased to announce the name change to Canada Cobalt Works Inc. which will more accurately reflect the direction of the Company. The TSX Venture Exchange has confirmed that shares will commence trading effective, Friday, February 23, 2018 under the new ticker symbol “CCW”. The tickers for OTC: TAKRF and Frankfurt: 4T9B are the same and will not be changed at this time.’

Why has your coverage of QMC disappeared?

It’s still there, but our marketing program with them has ended. We’ll be continuing coverage as news merits, it’s just not linked up top anymore.

Pelagic, good question, hang tight, coming very soon.