A while back our principal Chris Parry issued a heads up stating money was on the move back into energy metals. He thought the message important enough to alert subscribers even though he was suffering from the flu at the time.

You’re on the list, right? If not make sure to fill in the subscription form at the bottom of this article! We don’t send a lot of e.mails. You can unsubscribe at any time. We share with no-one, and the information can be helpful to your pocket book.

Cobalt and Lithium haven’t disappeared as investing themes – far from it. Even though blockchain and weed plays have been soaking up the attention, energy metals are quietly refuelling for the next leg up.

“The EV revolution is going to hit the car market even harder and faster than BNEF predicted a year ago. EVs are on track to accelerate to 54% of new car sales by 2040. Tumbling battery prices mean that EVs will have lower lifetime costs, and will be cheaper to buy, than internal combustion engine (ICE) cars in most countries by 2025-29.” source: Bloomberg New Energy Finance (BNEF)

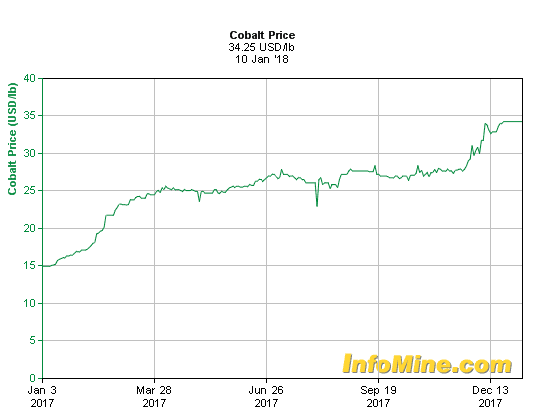

Take a look at the one-year chart of Cobalt. Up, up and away, as they say.

Let me hear you shout high (voltage)

Nano One Materials Corp (NNO.V) is at the forefront of battery tech, which is now a fundamental part of our way-of-life. Just quietly, their stock has been inching up and is now poised to break out to multi-month highs.

It sparked 5% yesterday on news of the successful completion of their High Voltage Spinel (HVS) project.

According to the news release, “HVS is suited to fast charging and high power applications and is a candidate cathode material in next generation solid state lithium ion batteries for automotive, consumer electronics and energy storage applications.”

HV what?

We’ll get to that shortly (pun intended!)

Firstly, more from the science geeks:

“We have met our objectives and made a number of significant breakthroughs,” said Dr. Elahe Talaie, Senior Scientist and HVS team lead with Nano One. “Battery performance is excellent when our HVS is tested with lithium, graphite and lithium titanium oxide anodes (LTO). As previously communicated, our innovative process can control particle size and output voltage; and it stabilizes HVS for high-temperature applications

Well done to the folks at NNO, sounds like the champers might be popping after having broken the back of this one. Not something you could throw together in a few weeks, they’ve been hard at it inside their high-tech plant for the past 18 months.

Finally, battery tech is coming of age.

Batteries 101

Cast your mind back to when you first learned something about how batteries work. For many of us, it was the time when Walter White and Jesse Pinkman were stuck out in the New Mexico desert after Pinkman had inadvertently left the keys in the RV ignition (who knew?)

After the portable generator goes up in flames, Walter is left to science the shit out of it, managing to build a mercury battery using whatever he found on hand at the time ; nuts, bolts, coins and powdered carbon from the brake pads.

In a real downer, the UK’s Telegraph took a look at the science behind the fiction to determine the liklihood of whether this would have worked IRL.

Answer: Very unlikely.

Their expert, Dr Matthew Vincent, says it just wouldn’t work. He states that a homemade battery would generate a mere “1-3 percent of the power needed to jump any self-respecting engine”, which is around 200-300 amps.

In real life, they’d be stuck in the wild.

Let’s head back into the classroom. Check out this video which does a much better job of explaining how batteries work than yours truly could:

HVS cathodes solve the cobalt supply chain conundrum

“High Voltage Spinel (HVS) cathodes could be the future of storage. Also known ass LMNO, they have the lowest raw material costs with 75% Mn, 25% Ni and no Co.” (Emphasis ours)

As the news release points out, “HVS differs from other cathodes because it is made from lithium, manganese and nickel, without the high cost and supply chain risk of cobalt.” (Emphasis ours)

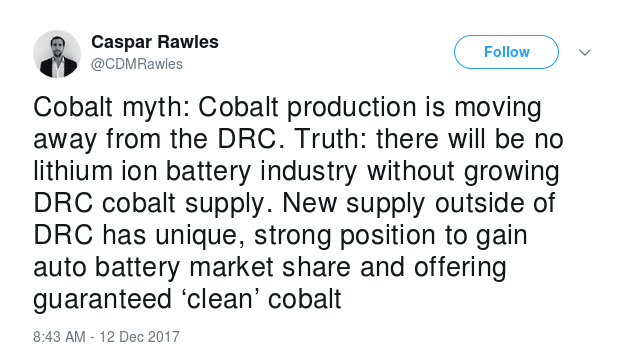

Supply chain risk is an important consideration which keeps CEOs sleepless as they try to figure out how to get their hands on enough of the stuff (to maintain production quotas) while pacifying investors who are worried company profits are being made on the back of kids mining cobalt in the DRC.

We’re pretty sure NNO are onto a winner here.

It’s all in the cathode

You may have heard the term cathode mentioned numerous times above and for good reason. This is the critical part of new generation lithium-ion batteries and the one producers are focusing on improving.

Here’s an excellent infographic from Visual Capitalist with the low-down on the high-tech.

Check these guys out if you haven’t done so already, they just might be a good fit for your portfolio going forward.

–// Craig Amos

FULL DISCLOSURE: Nano One is an Equity Guru marketing client. Some of us own stock. (the author excluded).