Thanks for being part of Equity Guru this year! We’ve experienced fantastic growth in 2017 and it was great to have you along for the ride. We hope our market insights helped you bank some bucks.

With the year almost gone, we wanted to share our thoughts on the big stories and look ahead to what might be in store for 2018.

Let’s rewind.

Trump was inaugurated

Amazon (AMZN.NASDAQ) went shopping for Whole Foods while Sears continued to fight off bankruptcy.

Cuba became the go-to travel destination.

Maria, Irma, Harvey and Jose yet again showcased the devastation Mother Nature can inflict upon us.

We lost Tragically Hip frontman Gord Downie as well as Batman, Benson, Bennington and (a) Bond. Oh, and Hef finally left the mansion.

️ Same-sex marriage became a reality for Australians. Bravo!

Floyd and McGreggor battled it out in the ring and Hamilton notched up a 4th World Championship behind the wheel.

Chuck Norris announced he is suing several medical companies that produced the MRI scanning machine used on his wife, Gena

The Horizons Medical Marijuana ETF (HMMJ.T): Is it worth your investment?

Hey, we like Chuck and all… but Cannabis Wheaton (CBW.V) is a shit show right now

Your first PP financing? Green Organic Dutchman (TGOD) unveils $10m pre-listing deal

Green Organic Dutchman (TGOD) opens another pre-listing financing to small investors

The hammer lingers: Aurora (ACB.T), Hempco (HEMP.V), Cannimed (CMED) and a boatload of shorting

Abcann (ABCN.V) trading opens with a thud: Here’s why

The inside scoop on DOJA, BC’s soon-public late-stage weed applicant

Supreme Pharmaceuticals (SL.C) CEO answers questions regarding license

My 5 big undervalued weed picks right now: And one that will shock you

HIVE Blockchain (HIVE.V) levels off after crazy opening week, but crypto cash still swirls

From all of us here, we wish you a great holiday season and a prosperous Year of the Dog (2018)!

Craig Amos

2017 was a year where investors who stuck with major themes were well compensated. Think bitcoin, blockchain, Cobalt and Lithium.

2017 was a year where investors who stuck with major themes were well compensated. Think bitcoin, blockchain, Cobalt and Lithium.

Weed found its 2nd wind and the mania spread to Australia as Medicinal Cannabis became investible in a big way. We covered the space in detail with some of our stories gaining incredible traction. Case in point our coverage of Creso Pharma which now ranks higher than material on the company’s own website in some instances. Nice.

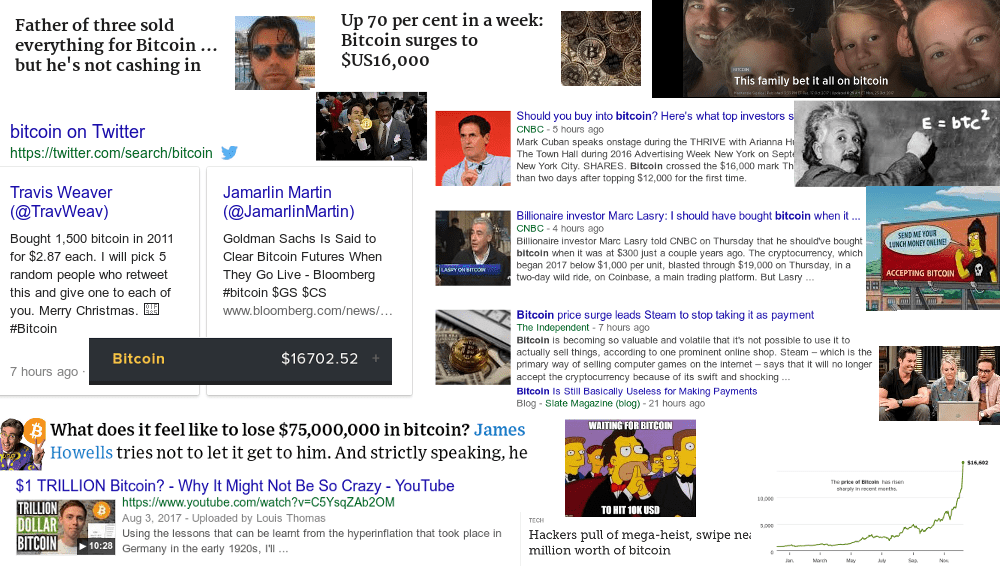

Bitcoin was THE story of 2017.

For me, $BTC has been particularly hard to watch, let alone write about – I have an unlived parallel life whereby I was smart enough to buy and hold just a few thousand worth of the cryptocurrency, which allowed me to buy a house and watch my daughter play netball every other weekend.

“We believe that they were open to us; but for some reason — and we might spend a great deal of our lived lives trying to find and give the reason — they were not possible,” Phillips writes. “And what was not possible all too easily becomes the story of our lives.” –British psychoanalyst Adam Phillips talks about “unlived lives”.

(I really should have caught this at least around 100 bucks when the Winkelvii were getting on board)

Shoulda, Woulda, Coulda – Didn’t.

The problem with bubbles is they can overshoot to a huge extent. Still think it’s not one? A few weeks back I scoured the daily news and threw together a composite graphic.

“This family bet it all on bitcoin”

$1 TRILLION Bitcoin – Why it might not be so crazy?”

As can be seen, $BTC has crossed over and is now commanding front page news stories everywhere, as well as having infiltrated pop culture with a recent storyline on The Big Bang Theory S11 playing out.

Did Homer sell his coins when it crossed 10K?

The very day I took those screenshots, an email hit my inbox from Nick Radge, of The Chartist, which contained his observations and thoughts

For example, I know a commercial airline pilot who starting hosting his own Crypto podcast.

Or a neighbour, who just 5 months ago was asking what Bitcoin was, that now offers crypto seminars on Facebook.

As Radge says “the downside for Bitcoin could be seriously ugly, even devastating.”. Agree.

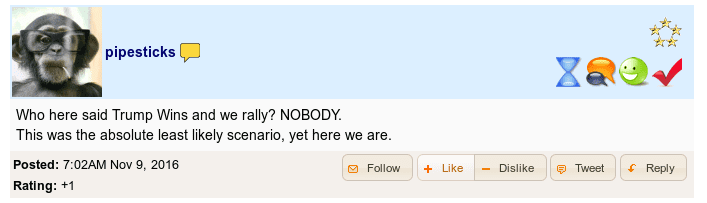

The Trump Trade rolls on and global markets (I’m looking at you America) are the highest they have ever been with the S&P500 within spitting distance of 2700.

Interesting on a few fronts.

Politics aside, many pundits predicted a market reversal which failed to eventuate. The common thinking was a Clinton win would spur markets higher while Trump would be disastrous for the economy.

How wrong they were! (the crowd usually is)

Recall that on the night of the election the S&P500 futures were down a staggering 100 points at one stage. It proved to be a massive bear trap.

Since Trumps victory, the major indexes have gone only one way – UP! Like Walter White said “Nothing stops this train!”

Roll on 2018 – Year of the Dog

Can this continue in 2018? I doubt it will be as smooth a ride as it was this year. Will Kim Jong-Un lose his remaining marbles and fire a nuke? Will China crack down on bitcoin due to excessive energy use (hat tip: SaxoBanks Outrageous Predictions for 2018) or will the EU finally implode and sink the Euro.

Here’s the thing – no-one knows and anything can happen. Indeed we live in interesting times.

Social Media on deck for 2018

FB.NASDAQ – Interest waning?

With my Peter Lynch hat on, I feel Facebook (FB.NYSE) could face some serious headwinds in 2018. Basing my hunch on the following:

• Personal experience of leaving the social media maven a few months back and enjoying my life much more. (hey I don’t have to deal with trolls every day now!)

• Governments pushing back (China, Germany)

•”All empires fall eventually. It is the way of things.” – Erin Morgenstern

Now for some data.

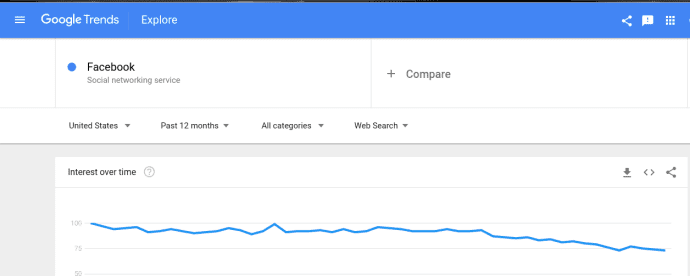

Exhibit A, The Google Trends chart for the past 12 months shows declining search interest. Canary in the coalmine? Maybe.

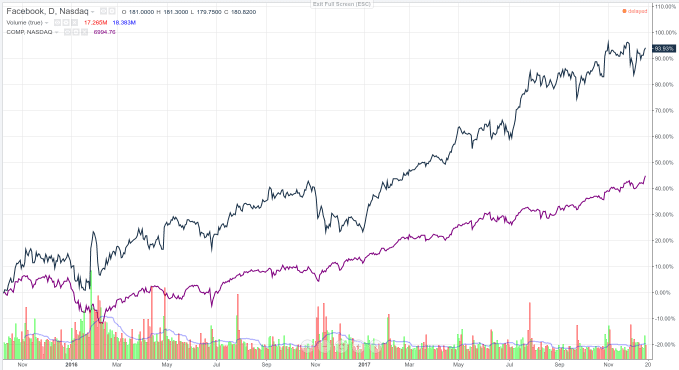

Exhibit B, FB chart with $COMP overlay. FB has easily outperformed the index and everything eventually reverts to the mean. FB looks top-heavy too. Price hasn’t moved above $180 with any conviction over the past month, in fact while the index has put in a new high, FB has failed to do so. Folks call that divergence. Longs be warned.

TWTR.NYSE – One to watch

Twitter has been quietly mounting a comeback in recent months and could easily surprise in 2018.

Since March this year, the stock has nearly doubled but could easily do so again.

Tweet that!

Lukas Kane

On January 1st, 2017 I woke up in freezing Beijing hutong, to an email informing me that a 19-year old boy I had watched grow up, had died of a fentanyl overdose.

He’s the boy on the left, my son is on the right.

I told his parents, “I have cried more for your son than for the death of my own mother – who I adored. My mother would understand this. She was ready to go. Your son was not.”

In the early part of 2017, this sadness become a filter, colouring everything around me. Did I know of a marriage that wasn’t crumbling? Probably. But I couldn’t think of one off hand. I witnessed an elderly Chinese woman weeping in a mall. Was it just my filter? Or was I now seeing things unfiltered for the first time?

And then slowly, the world brightened.

For one thing, I began working at Equity Guru. I’ve written about stocks before, but this was a different business model, with fewer constraints – as I mentioned in my first Equity Guru column.

Over the last decade, I’ve written about 400 articles for 11 different publications. Each publication required “newsy” “authoritative” prose that mimicked the style of The New York Times. Writers were instructed to “foreground the rewards” and “background the risks”

Equity Gury principal Chris Parry told me that I was welcome to make critical remarks about client companies, and that the staff writers at Equity Guru do not need to form a consensus: I am permitted to publicly disagree with his opinions.

If you pretend to admire things you don’t admire, your soul will rot. If you serve nothing but praise, that praise becomes devalued. If you can’t disagree with your peers, then a consensus of weak arguments will crowd out a solitary strong one.

In my new job I learned about manganese, weed, cryptocurrencies and nickel-rich cathodes.

The stock prices of some of our client companies went down. A few went sideways. But the vast majority of them went up. It’s been a privilege to help tell those stories.

Most of all, 2017 taught me that turbulence is a given.

In the stock markets, in love, in life.

Three months before he died, I saw this lad on the street. He bounded up to me, beaming, and hugged me like a treasured relative. After he left, I remember standing there in a daze from the bright bolt of light that had just hit me.

Goodbye my friend.

Goodbye 2017.

Stephan Herman

I only joined the team in October so I have less to reflect on than the rest of the team. My role this year has generally been to be your eyes as a newbie in all this. I also get to let the rest of the guys do the hard number crunching (although I like to dabble) while my job is to provide hot-takes, news, analysis and all the other weirdness that comes with being the resident futurist,.

I think Craig’s got it right when he says BTC was the story of the year. Even though as of the closing days of 2017, we’re starting to see the backlash gaining strength, this year marked the birth of something truly new in the global marketplace. Up until now, BTC was in labour. With futures trading, and value high enough to make international crime profitable, Bitcoin is now naked and alone in the wide world like a big-boy currency.

Whither Cannabis and Battery Metals

In the dying months of the year, I watched as the bloom faded from both Cannabis and Energy Metals. Oh sure, they still looked good, and lots of dudes were grinding up on them, but the hottest new thing was the new emo girl, Crypto.

What was interesting to me was how the easily distracted flocked to crypto stocks, but the smart money stayed in. Good call. What we saw in 2017 were real signs of market maturation in both the energy metals and cannabis sectors.

Cannabis is starting to look attractive to major beverage and food conglomerates. Battery technology demand is exploding (no pun intended) with power-wall, electric vehicle and mobile computing all expanding this year.

I’d keep a nice balanced position in 2018. One of these areas or both will provide lovely ROI, especially as the new regs open the legal floodgates on cannabis in July. On Battery tech, I’m long. The potential is exciting, but I can’t help but think that with ‘Manhattan Project’ level funding pouring into battery tech we may see a ‘black swan’ event that changes everything. (there I go with the tin-foil hat stuff).

Barring that, we’ll still see steady, incremental growth which means demand for Lithium, Graphite, Cobalt etc. isn’t going anywhere for the foreseeable future.

Even if some crazy breakthrough does occur – as long as it isn’t a fusion drive or dilithium crystals. Any other new battery tech will still require the same types of raw materials, most probably some form of graphite, if I were a betting man.

Set Course for 2018

Looking forward, I see a roller coaster for BTC this year, but I still think it’s a good idea to grab some and literally lock it away in your safe, go long and wait for the craziness to die down when the intrinsic value of the stuff will make the current investment value look like peanuts. (#tinfoilhat)

I’m bullish on energy metals, but only cautiously optimistic about Cannabis, The rubber is about to meet the road in Canada, and there will soon be a very clear pack of losers and winners. I expect a lot of hype and PR Chaff to be deployed in the next few weeks. I’ll be around to point it out and give you the straight dope.

Once the bloodbath is over, there will be a much clearer picture of the players for you to pick from in Q3 and Q4. You have six months to lay some cheap and risky bets, and then you’ll likely have a pick of safer but more expensive options come fall.

I hope to continue to cut through the fog a little bit and keep throwing out my analysis so you can use it to help you choose where to put your hard-earned cash. I will also continue to explicitly tell you where I stand, and why I’m writing about something. I will likely also continue to push back against draconian editing policy.

[I am a very nice person. -Editor]

See you in the new year!

Braden Maccke

Just took my dog to the vet. You’re not gonna believe this, but a cat sitting next to me asked if now is a good time to get into bitcoin.

— Irrelevant Investor (@michaelbatnick) November 22, 2017

The only story there is from 2017 that belongs here is the one about the bull market that just won’t quit. I’d like to say “I don’t understand it,” but that would be a lie. I do. Just not usefully.

It isn’t just crypto, either. 2017 is the latest saga in the most resilient equities market that anyone has ever seen, and it appears to be impervious to asset classes. Money is chasing money and it’s spilling over from one sector into the next as the price of equities takes off, earnings ratios barely matter and the buying just keeps on coming faster and with more reckless abandon.

I don’t even know how to ruin the party, because pointing out that it has to end – that what goes up must come down – is bound to be met with a collective shrug. Of course it does. One day nobody’s going to be into tulips and baseball cards anymore. Since nobody knows when, what business is it of ours to ignore unprecedented growth? Get the hell into that barrel and start shooting at these fish. Once the party’s over, you might not see a widespread bull market like this for another… four, five years.

I don’t have Herman’s nuts, so I can’t make calls or fight with made up editors. But I feel like it’s prudent to discuss the events that may finally end this all-asset-class bull run, black swan or otherwise.

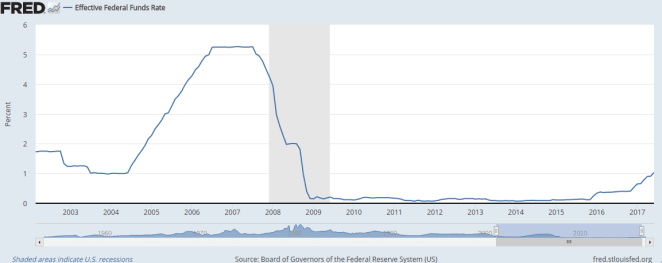

First up: Interest Rates.

This is the Fed Funds Rate, the rate at which the Federal Reserve lends money to commercial banks. It’s micro. Accordingly:

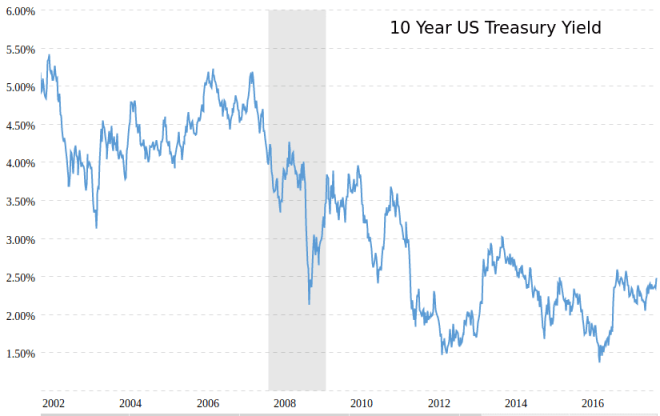

This is the yield on the year Treasury Notes.

When money is really cheap for a really long time it does two things. It makes borrowing cheap, and it makes bonds the effective equivalent of stuffing money in a mattress.

The net result is that big pools of money go further afield into riskier assets, like equities, chasing return. I keep my don’t-lose-it-or-else money in fixed income assets and the account is managed by one of the best fixed income guys in Vancouver. He called me in November asking about pot and crypto stocks.

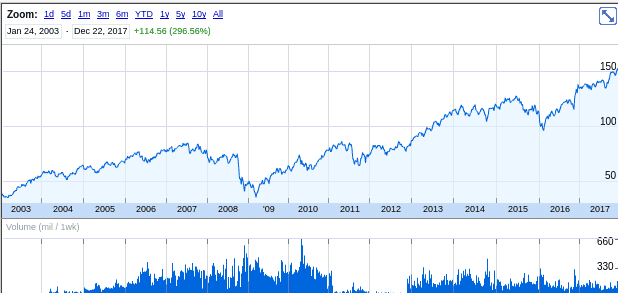

Here’s the Dow over the same period.

and the S&P, TSX Composite.

I have little doubt that this market runs on cheap money. One day, the cheap money isn’t going to be cheap anymore. This sounds like something that will happen gradually, and the steady hiking of interest rates indeed will happen slowly and steadily, but the nature of trades are that they’re either on or off. That’s why the yield chart is noisy and the chart of rates is smooth. When enough big chunks decide they’e had their fill of equities and are going to bonds, this thing is going to peak and reverse.

Second: Proletariat Uprising

2017 saw the inauguration of the weirdest and most twisted populist world leader we’ve ever seen, and the whole thing is a bit too fitting of 2017. This widespread prosperity isn’t exactly making its way down to the rank and file, who all agree that this is a terrible economy. In the wake of a $1.5 trillion tax cut bill, rushed through in days and unlikely to show up on the pay stub of anyone who gets a check every two weeks, nobody is calling Trump a populist anymore with a straight face.

But the sentiment that he leveraged is still around and it’s palpable. It’s the same sentiment that contributed to the rise of Bernie Sanders. Working people are strung out and they’re upset. We saw a wave election in Virginia last month. It put two Social Democrat candidates in the state legislature. The union crowd and the redistribution crowd are organized and they aren’t stupid. The massive money machines in the Democratic and Republican parties that used to keep them from getting anywhere don’t carry the same sort of electoral clout that they used to. Progressive candidates that were once labelled unelectable commies are suddenly very appealing. Witness Jeremy Corbyn’s giant-slaying over in the UK this past June. The populist message is selling here.

Stock Markets tend to hate that commie shit. That isn’t to say they’re right, and that more wealth making its way down the chain to workers in the form of cash or benefits isn’t any good for the economy, or even that it isn’t any good for capital in the long term. But the market gods are temperamental. I expect that rich folks will loudly throw their toys out of the sandbox as the tide shifts and that will cause a reaction.

The collapse of the great all-asset-class bull market is bound to happen eventually, and it will almost certainly happen suddenly. When it does, it will hurt. At that time, I’m going to try to remember that I was once part of the nuttiest capital explosion of all time. A time when P:E got so big they didn’t matter, fake internet money based on cryptography had everyone frothing at the mouth, and they finally legalized it… but only after it had been thoroughly securitized.

And the best part of it, for me, then and now, will always be you guys. The EG readers. You people are the only ones in the world who tolerate me pattering on and on about the stock market, and that’s one of few things I can do usefully.

Here’s to a great 2018. I can’t think of anywhere I’d rather be enjoying the ride or watching the world burn.

Braden Maccke

Great team, great stories, great work. Following since the launch of EG and will do so in the future

Merry christmas and a happy new year

After the incredible run of today (and the last couple weeks), do you think we will see a big sell off in the coming weeks or are we just getting started?

They must be on Vacation LOL.

No Comment or Articles after the 2 day crazy runs we Just had!?!?!?!

EG, You must be slacking 😛 🙂

Turkey coma watching a roller coaster. I’m personally waiting for the new normal to stabilize so I can make some sense of what happened.

My preliminary take – this oscillation is the first crash and the rebound will be impressive, if not necessarily rapid.