Yesterday, Hempco (HEMP.V), the recent Aurora Cannabis (ACB.T) acquisition target, was trade-halted twice by the Toronto exchange.

It didn’t have news that warranted a halt. It didn’t do anything wrong that deserved a halt.

But it was getting beaten down like a short kid at basketball camp, and sold so hard and fast that it tripped a single-stock circuit breaker with the exchange – twice – which killed trading for five minutes at a time.

This means, there was so much selling on HEMP in such a short amount of time that the Exchange’s system thought it unnatural.

Regulators put these circuit breakers in relatively recently, specifically to catch a stock implosion for a few minutes so that, if the abundant negative trading activity going on is in fact a glitch, be it from high speed trading issues or perhaps deeds most wicked, it can be caught before serious damage is done.

Hempco is a good company. It doesn’t do business with us, mostly because it doesn’t do business of any sort in terms of market-focused marketing, but it does do a lot of business in shelling hemp seed and processing hemp. A lot of hemp. It’s a real business with big customers and they’ve been doing it for a good long while now, far longer than the Green Rush has been a thing.

So their share price, usually, isn’t exciting. It drifts along. They post financials. It drifts along some more. They make product and sell product. It drifts some more.

In sports terms, Hempco is a utility infielder.

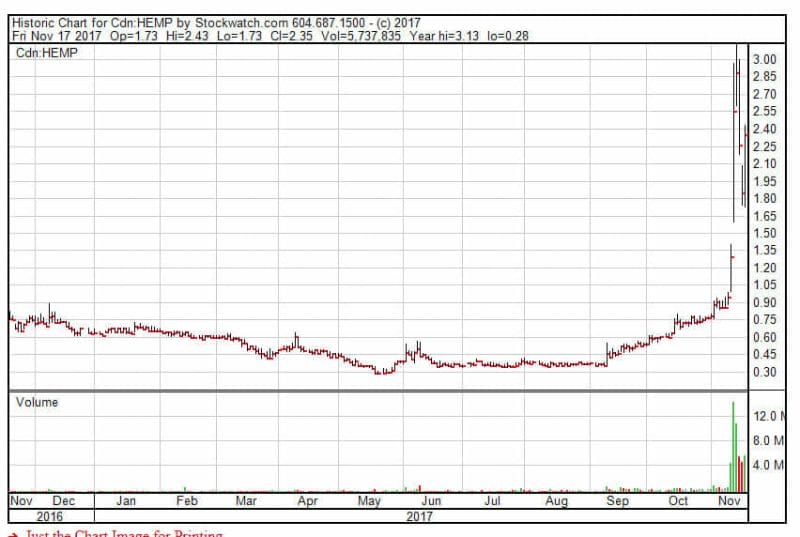

So when it went from $0.35 to $0.70 from September to mid-November, the rise was notable and noticeable. When Aurora announced they liked it enough to buy some, the stock price went parabolic.

That’s a nutty chart. Unsurprisingly, it comes with another:

I like Hempco. I know people at Hempco. It’s a good company run by smart people.

But if you weren’t shorting the hell out of that chart this week, I can’t do nuttin’ for ya.

And I’m not a guy who likes to short. I think it’s a gross way to make money, and fuels the urge to intentionally shitcan a company to propel it downwards undeservedly.

But a stupid upward run of an outlandish nature does need a corresponding ripchord that can be pulled to bring sanity back, and the weed market has needed short seller activity to make it sane again for some time.

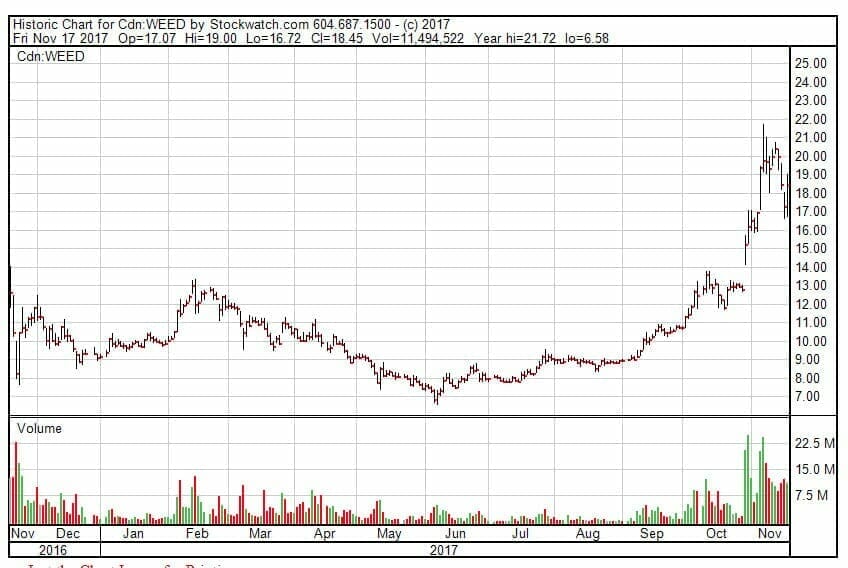

Weed valuations over the past few weeks have been nuts, and the two biggest fish have led the way into NuttyTown by turning over the 13th digit to the left on their market cap with regularity.

Canopy Growth Corp (WEED.T) gets the ‘grandpa’ investor dollar by virtue of being the biggest fish in the space. It’s had a lock on that investment dollar since inception.

By the ‘grandpa’ investment dollar, I mean grandpa has been told he should invest in weed but he doesn’t know anything about it and doesn’t want to take the time to find the best opportunity, and doesn’t get the product, and so he will inevitably invest with the general pack and just slap his dough into whatever’s the biggest player in the sector, which leads to that company value being inflated, which causes others to chase the gains, which makes for more gains. For a while.

It’s why Apple’s (AAPL.NASDAQ) valuation is so humongous – if you want to invest in electronics, they’re just an easy place to dump your dough, even if its best days are arguably behind it. It’s why Nvidia (NVDA.NASDAQ) is having such a run – it’s the biggest play with involvement in the cryptocurrency world, because crypto-miners use their GPUs – though it makes nowhere near the money on that business that its share price would indicate.

It’s why, when Pokemon Go was launched and became a global craze, Nintendo (NTDOY.OTC) stock jumped $10 billion overnight, even though that company owned precious little of the game proper and stood to make nothing from it. It’s why Tesla (TSLA.NASDAQ) is worth more than Ford (F.NYSE), despite making a lot less on the revenue and profit side; if you want to invest in rechargeables, there is Tesla being all ‘Hey Grandpa, I’m always on the news, how can you lose?’

Well, you can lose alright, and if this week’s share activity is showing us anything, it’s that chasing a run can be problematic, and pack investing can be bad strategy – eventually.

If you caught Aurora Cannabis’ (ACB.T) run from $2.70 to $6.90 in the approximately eight minutes it took to happen, and didn’t convince yourself that it was never going to end, well played, Captain, on your perfectly timed exit.

But if you bought in at $6.50 because it was going nuts, only to see the stock swing back the other way, here’s hoping you had your stop loss triggers set.

WEED and ACB were always going to collapse, as was HEMP, because the market can’t watch a three-day triple and not get cynical about it all.

ACB tried to support its higher price by announcing it would go after Cannimed (CMED.V) to create the biggest weed play in Canada, but did so with its newly inflated stock, laid out no dollars, committed to no actual deal, didn’t formalize the approach, and the market sniffed a fart.

Cannimed, in the meantime, defended against that attack by announcing it was going to take over Up Cannabis/Newstrike Resources (HIP.C), AKA ‘the company that licensed the Tragically Hip name and gave them a bunch of stock in return’.

That deal was seemingly being discussed for some time because, before it was announced, HIP stock went bonkers. Ditto, before the Cannimed approach was announced, that stock went bonkers. And before Aurora made that approach to HEMP, both of their stocks went bonkers.

Indeed, Aurora mentioned in their announcement that IIROC had forced their hand in announcing their approach. Word was out, across the board.

So we know HEMP is one of the most shorted companies on the Venture Exchange (alongside HIVE Blockchain (HIVE.V), which has also had a lunatic run of late, even if we like the business and the sector).

But what does the top shorted chart look like on the TSX?

Pipeline leaks and weed, baby.

Look at the size of that short position on Aurora. That’s a MASSIVE bet that the wheels are going to wobble. Canopy has always carried a decent level of short seller aggression in its wake, and though that position has grown in the last two weeks, what you see right beneath it is a huge bet against Aurora maintaining its current share price.

Aurora, if it is to beat that bet, has to squeeze those people short selling it.

EDUCATION BREAK!

WHAT IS SHORT SELLING?

Now we’re all on the same page.

So if Aurora has a massive short against it, that means a load of people who don’t own the stock have ‘sold’ it this past week, and are betting it will keep heading south so that they can buy it back later, and make money on the difference.

A squeeze comes when the company, or investors of the stock, put activity in place designed to run the stock up, and force those shorters to cover their losses by covering their short.

Like, as an example, putting news out that you’re going to buy a competitor, that you haven’t formally approached, and with none of your actual cash, for stocks with a maybe temporarily inflated value.

Market dives in and buys your stock, shorts get squeezed, sanity is restored.

But what if the market doesn’t dive in?

What if the market figures out your plan and doesn’t follow ACB’s lead? What if the shorters get out there with a whisper campaign and spread rumours that ACB is in trouble? What if they start yelling about how ACB only actually has 55k sq. ft. of grow space currently which can’t justify their market cap? What it the market shifts its interest on weed for a bit, which happens often enough, and bails long enough for those shorts to win?

What if the shorts jump all over HEMP? What if the short money grows stronger than the squeeze money?

What if ACB has to abandon that CMED deal, now that CMED is ankles deep in another deal and rejects ACB’s approach, to the satisfaction and agreement of its shareholders?

Aurora is leveraged. It’s long been making grand plans and promises. It was the first to promise a million square feet of grow space. It was the first to put out yield numbers that, from what we can tell, are as much as 8x higher than other LPs on a gram per sq. ft basis which we find concerning. It has raised a lot of money and made a lot of approaches to other companies.

At $3.00 per share, or a $1.2 billion valuation, that level of risk/reward is acceptable to the market.

But at $7 per share, or $2.8 billion of market cap, that’s a shorter’s dream.

At the current $5.50, or a $2.2 billion value, there’s still plenty of room for shenanigans.

Now I want to be clear – I’m not saying Aurora is a steaming pile of doody.

Far from it. CEO Terry Booth has built something that I didn’t think was possible back when it was coming out of its former identity as Prescient Mining, and there were courtroom battles with former founders and emails going out bathed in Fireball at 3AM. But when Cam Battley showed up to bring calm to the place, Aurora started making a lot of right moves; including forcing Organigram (OGI.V) to fess up about their pesticide-laden B2B product, which may have been the most decent, legit weed move I’ve seen from an LP to date.

Aurora is legit. That’s not the question – the question is, how legit is it, and is it legit enough, and cashed up enough, and not overly leveraged enough that it can fight off shorters, buy up competitors, expand production capacity by 20 times its current production space, and maintain the existing market cap?

If Booth can pull that off, he’ll have Kaizer Soze’d the market. The short positions are fair, but he’s proven us wrong before. Either way, next week is going to bring a reckoning for someone.

— Chris Parry

FULL DISCLOSURE: We own HIVE. We know people at HEMP. We’re not shorting anyone, nor acting in concert with anyone shorting anyone, nor have any commercial interest in any of the weed companies mentioned in this story. Though OGI does still owe us ten grand from ages back, which occasionally bugs.

Yields 8x higher than other LPs? How do you figure that? Sky is projecting 100,000KGs in 600,000 Sq ft of cultivation space. That’s about 170 grams per sq ft which is about half of what you boys at ABcann are claiming to do (while still somehow being organic). It’s not Aurora’s claims I find concerning.

We’ll have more on this next week. We’ve spent literally weeks digging in on each LP and some of the numbers are… odd.

Chris, those shortdata.ca numbers are corrupted. They seem to show aggregate short trades over the 14 days, not the net value. Even the prior October 31st number seems off in comparison to TMX data… https://www.tmxmoney.com/en/research/short_positions.html

Chris that was a well written neutral bias commentary, love the sector and love your opinion.

Cheers Mac