On December 21, 2017, First Cobalt (FCC.V) announced completed financing on a bought deal basis.

A “bought deal” indicates that an investment bank or brokerage firm buys the entire offering, intending to sell the shares later to other investors. The under-writing institution is taking a risk. If there are no buyers, a gaggle of in-house accountants and geologists miss out on their Christmas bonus.

The deal includes 4.7 million Flow-Through Units @ $1.51.

“Flow-through shares” have been around for about 30 years. It’s a Canadian tax innovation that has generated many billions of dollars for junior explorers.

It works roughly like this: since exploration companies are – by definition – “pre-revenue” – they don’t need tax write-offs. The flow-through shares allow the individual investors to claim the expenses and apply it against their personal incomes.

If it seems like an accounting sleight-of-hand – it is – but for once it’s a tax instrument that helps the little guy (as well as the mining companies).

FCC has also sold an additional 20.9 million units @ $1.10 for a grand total of $30 million.

All Common Shares and Flow-Through Shares issued today pursuant to the above offerings will be subject to a statutory four-month and one day hold period.

That means participants in the financing can not sell their shares for the next 4 months.

The point is probably mute.

It is unlikely that the smart money will be dumping shares of FCC any time soon.

On May 24, 2017, we first alerted our readers to First Cobalt, stating that Keeley-Frontier Mine in Ontario, has historically produced 3.3 million pounds of cobalt and 19 million ounces of silver from 300,000 tonnes of ore.

Keeley has the best cobalt-to-silver ratio of all major producers in both Cobalt and Silver Centre mining camps, producing 1 lb of cobalt for every 5.8 ounces of silver.

At time FCC was trading at .43 with a market cap of $21 million.

After a 3-way merger between, FCC, Cobalt One (CO1.ASX) and CobalTech Mining (CSK.V), FCC is now trading at $1.20 with a market cap of $232 million.

At the time, in a Resource Stock Digest interview, First Cobalt CEO, Trent Mell stated:

“Treasury’s looking great. I’m not taking a salary and our corporate G&A’s pretty light. Almost all of our money’s going in the ground. So, with this transaction, we’re eliminating two management teams, two head office overheads, lawyers and filing fees.”

The share price of FCC has risen about 300% since we started chatting them up 7 months ago.

We’d love to take credit, but there are bigger forces than us at play here.

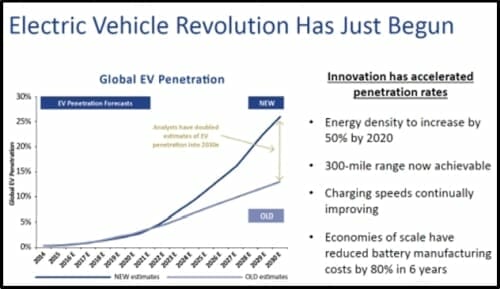

Cobalt is a critical ingredient in lithium-ion batteries. In the last 25 years – rechargeable battery cobalt consumption has increased 5,000%.

Major automobile manufacturers are currently securing cobalt from the Democratic Republic of Congo (DRC) – a country with a serious child-labour problem.

Recently, leading carmakers including Volkswagen (VOWG.DE), Toyota (TM.NYSE), Ford (F.NYSE), BMW (BMWG.DE), Honda (7267.T), Jaguar (TAMO.NS) and Volvo Trucks (VOLV-B.ST) formed a “Drive Sustainability” partnership – pledging to “uphold ethical and socially responsible standards in their purchases of minerals for an expected boom in electric vehicle production”.

On Dec. 07, 2017 FCC announced that it has purchased four mining claims located in the Ontario Cobalt Camp, near the past producing Caswell mine.

The properties are contiguous to FCC’s existing properties, further consolidating FCC’s large land position.

First Cobalt now controls over 10,000 hectares of prospective land and fifty historic mines as well as a mill and the only permitted cobalt refinery in North America capable of producing battery materials.

To answer the question in the headline: with this $30 million war chest, FCC is going to do everything in its power to become North America’s next high-grade cobalt mine.

We have bet, with our own money, that they are going to succeed.

Full Disclosure: First Cobalt is an Equity Guru marketing client, we also own stock.