The Hydroponics Company (THC.ASX), which listed on 4th May, is the latest cannabis outfit to tap the market for funds, halting their stock through the week to undertake an 8m+ capital raising.

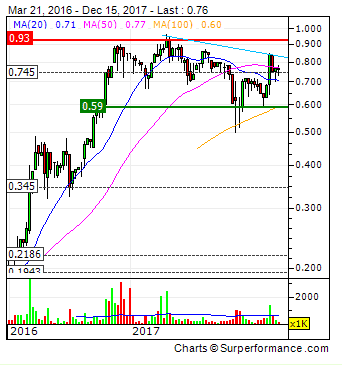

Shareholders won’t mind too much as they have enjoyed a November to remember, with the stock rising from $0.27 to $1.08, before pulling back over the past few weeks.

While money sometimes has trouble finding a good home, it seems investors have a ferocious appetite for risk in the current market climate.

$8m placement and SPP

Details as per the THC announcement:

| Option | $$$ Value | Shares |

|---|---|---|

| 1 | 500 | 794 |

| 2 | 1000 | 1588 |

| 3 | 2500 | 3969 |

| 4 | 5000 | 7937 |

| 5 | 7500 | 11905 |

| 6 | 10000 | 15874 |

| 7 | 15000 | 23810 |

- Offering is priced at $0.63 per share.

- $8 million placement completed. (sophisticated and institutional investors)

- Share Purchase Plan (SPP) open to Eligible Shareholders who were holders of Shares in THC at 7.00 pm (Sydney Time) on 13 December 2017 and whose registered address is in Australia or New Zealand.

- Company directors will all participate by taking their full allocation in the SPP.

Read the last line again and join us in giving the directors a round of applause. Now, that’s how you do it!

In an unusual move, eligible investors must apply to purchase a set dollar amount of shares ranging

from $500 to $15,000 (See table). The offer opens on December 20th and closes on January 19th, 2018.

As always, the goalposts might be moved and expect a scale-back if you’re planning to partake.

Not surprisingly, the share price has held up well since the resumption of trade, closing at $0.67 on Friday.

Tapping the market for millions

2017 has been a busy year for ASX cannabis companies, especially when it comes to rattling the tin. With nearly a dozen separate equity raisings in the weed space this calendar year, one imagines the Lamborghini dealerships will be busy over the new year period.

The following chart1 shows how much capital ASX weed companies have raised since entering the market via an IPO or transitioning into the cannabis space via an RTO2 as well as subsequent capital raisings which were acheived via placements, share purchase plans (SPP) or rights issues. (or a combination thereof)

CANN Group (CAN.ASX) and Creso Pharma (CPH.ASX) are counting the cash having bagged a total of 83.5 and 31.5 million respectively.

CANN Group (CAN.ASX) and Creso Pharma (CPH.ASX) are counting the cash having bagged a total of 83.5 and 31.5 million respectively.

CAN can thank their major investor Aurora Cannabis (ACB.TSX), who increased their stake from 19.9% to 22.9%.

With the weed mania taking place over there, those Canadians must have too much money!

CPH meanwhile, have frustrated shareholders with the timing of their recent CR, throwing a wet blanket over a scorching rally. We (shareholders including yours truly) trust there’s enough cash in the kitty to last them a while now.

As can be seen, the other cannabis companies have had mixed results in scooping up the much-needed moola.

Who’s next?

We can’t be sure – but here’s our best guess.

BOD Australia Limited (BDA.ASX) are enjoying their share price being near an all-time high and have only reached out for a measly $6 mil so far. In Sydney, that’s barely enough to pay the monthly rent and a weekends worth of cappuccinos and smashed avos. They’d best talk to their friendly investment banker.

Likewise Medlab Clinical Ltd (MDC.ASX), who are suffering the cash burn blues.

Back in July we said:

It’s been a comfortable ride for everyone onboard this baby. If you snapped up stock in the IPO you’re sitting on a four-bagger today and even stragglers have probably managed a double. The share price has been building a solid base over the past 6 months and is sitting right in the middle of that range now, at 80 cents, which infers a market cap of $134 million.

It’s still hanging around the 80 cent level like a fart in an elevator.

Luckily MDC shareholders haven’t been troubled by the volatility which has plagued other names in the sector, with the stock trading in a tight 30 cent range for the past few months. The chart is impressive, looks like it’s about to mount an assault on another leg-up.

Surely they would be quite happy NOT to have to endure the ennui which accompanies a CR, yet with only 1.2 million in the bank (as per last quarterly 4C) it’s hard to see how the company won’t have to ask the faithful for more funding.

Nothing puts the brakes on a rally like an unexpected capital raising. You can never have too much money in the bank, can you?

–// Craig Amos

FULL DISCLOSURE: None of the companies mentioned in this article are Equity Guru marketing clients. The author holds stock in Creso Pharma.

FULL DISCLOSURE: None of the companies mentioned in this article are Equity Guru marketing clients. The author holds stock in Creso Pharma.

[Editor – Did you offload all of that Teldar Paper?]

Footnotes:

1. Data compiled from publically available ASX announcements while drinking a Sierra Nevada Pale Ale.

2. RTO – Reverse Take Over: The acquisition of a public company by shareholders in a private company.