You asked and we answered.

It’s time for your Friday coin rundown.

Here are your top ten coins.

Bitcoin

market cap $166,929,623,109

Researchers discovered a vulnerability in a number of popular bitcoin wallets, potentially leading to millions of users crypto being exposed.

The wallets known to be affected include Ledger Live, Edge and BRD.

The vulnerability is called BigSpender, and allows the attacker to make the wallet holder think that a payment has been received when it’s actually been replaced by the sender.

Nice.

I bet those dot matrix printers and cold-storage paper wallets you passed up because they were too much of an inconvenience are looking pretty good right about now.

Ethereum

market cap $25,101,863,061

Elon Musk apparently is neither for or against Ethereum’s decentralized platform, based on rumours that he’s using it for some project.

He’s not the only one either.

The platform is being used by hundreds of household companies as part of the Ethereum Enterprise Alliance, including AMD, FedEx, JPMorgan, Microsoft, VMWare, and more.

While none of that is particularly surprising—what is surprising is how many people give a shit what Elon Musk thinks.

Tether

market cap $9,627,504,728

Tether announced a major transfer of its tokens to a number of different blockchains, including Tron and Ethereum. It’s not going to be enough to affect the number of USDT in circular. The Tron-based USDT will be burned and the same amount of tokens will be issued at the ETH blockchain.

Tether’s also made a home on plenty of other blockchains, including EOSIO, Omni and Liquid. Although the majority of the coins can be found on Ethereum’s blockchain—ranging around 61.6%.

XRP/Ripple

market cap $7,837,074,909

The argument about whether or not XRP is a security is ongoing, and the only people getting richer are the lawyers as they line up their class-action lawsuits like dominos. So far the Securities and Exchange Commission has stayed hands off on this, which isn’t doing anyone any favours.

A few weeks ago, we covered former chairman Chris Giancarlo of the Commodity Futures Trading Commission, when he published a paper about Ripple’s XRP not being a security. Giancarlo has done this before—specifically with Bitcoin and Ethereum, indicating that they’re not securities either.

But there is a slight bit a conflict of interest. Giancarlo isn’t working for the CFTC anymore, and is instead in private practice, and actually working for a law firm that’s firmly in Ripple’s pocket.

Still your move, SEC.

Bitcoin Cash

market cap $4,067,390,045

BIGG Digital Assets (BIGG.C) added Bitcoin Cash to their growing watchlist of coins earlier this week.

“QLUE stands for Qualitative Law Enforcement Unified Edge, and it’s a program used by law enforcement, banks, and other financial institutions to provide security for blockchain investigations and do due diligence with deeper forensic reach,” we wrote.

Seriously. Go read it. It’s the biggest thing that happened to BCH this week.

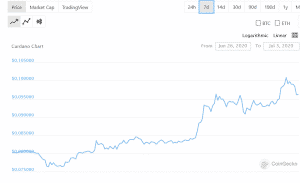

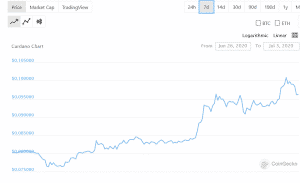

Cardano

market cap $2,987,327,420

Cardano’s getting a facelift today. They’re transitioning away from their “Byron” format – a static, federated blockchain, to their “Shelley,” format. Which is a dynamic, decentralized version.

“Shelley will finally show us whether Cardano’s technology has what it takes to become a truly decentralized and scalable global crypto asset,” Juan Villaverde, who leads the Weiss Ratings team of analysts, told Decrypt.

Supply chains and decentralized finance (DeFi) are two of the sectors Cardano is targeting when they fork at the end of July.

Bitcoin SV

market cap $2,853,251,361

Bitcoin Association, a Switzerland-based organization devoted to advancing business with Bitcoin SV, announced that they’re establishing a Technical Standards Committee. They’re hoping that the development of this committee helps to professionalize the development of their coin in order to support major business use, and pave the way for global adoption.

But we’ve heard this song and dance before.

According to Bitcoin foundation Jimmy Nguyen:

“Our Association is professionalizing the Bitcoin industry, and that includes leading development of standards. Technology history has repeatedly demonstrated the value of seeking consensus on technical standards to fuel industry growth through compatibility and interoperability between different businesses. The Technical Standards Committee was formed now to ensure that Bitcoin SV grows to support a world where all business and online activity can be on-chain, like how the Internet grew with standards set to support a world where everything can be online.”

Litecoin

market cap $2,667,590,565

Earlier today, David Burkett, Litecoin’s senior MimbleWimble developer, gave an update for the protocol’s progress for June 2020. The stage is apparently set for a mid-September testnet launch of MimbleWimble.

Besides informing us that Charlie Lee is an absolutely huge Harry Potter nerd, a MimbleWimble is a protocol shift in Litecoin’s core code that reduces the amount of data storage requirements, and makes it highly scalable for storing the blockchain.

Binance Coin

market cap $2,263,367,213

Binance Coin is now the third crypto to receive a branded hashtag on Twitter, which appears to be in preparation for its three year anniversary.

It had a fairly interesting mid-week bounce before plummeting back to earth. Probably because the six people who bought it thought they had clicked on Bitcoin, and came back a few days later to see how their investment was doing.

If you’re not familiar, Binance Coin is the digital spawn of the largest exchange in the world, Binance. The other two coins to have received their own branded emoji hashtag are Bitcoin (of course) and Crypto.com.

EOS

market cap $2,262,977,535

Apparently, the whales swim this far down the coins list as well.

Last month, a wallet belonging to PlusToken, which is an alleged crypto Ponzi scheme, withdrew over 26 million EOS tokens (or roughly $67 million) from its wallet. PlusToken was accused of stealing up to $3 billion from its users this time last year. At the time, if the Chinese media can be trusted, it would make PlusToken the biggest crypto ponzi scheme to date.

Whoever said crime doesn’t pay never met the guys at PlusToken.

Keep hodling.

—Joseph Morton