A good number of the junior exploration companies we follow here at Guru Central have claimed higher ground in recent sessions: Skeena Resources (SKE.V), HighGold Mining (HIGH.V), Coral Gold (CLH.V), Pure Gold (PGM.V)… to name a few.

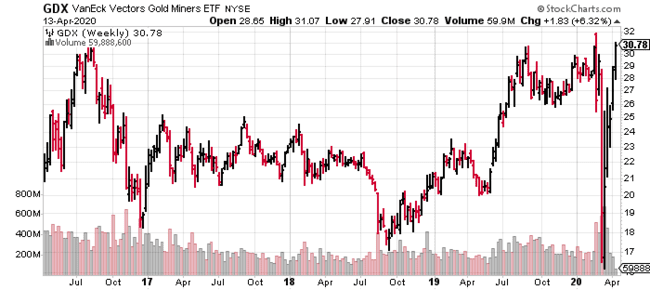

It would appear that gold stocks are beginning to de-couple from general equities. The following GDX chart shows a push towards multi-year highs.

It’s important to remember that during previous liquidity crises, gold stocks were the first to turn. During the 2008-2009 financial debacle, by the time the broader markets had bottomed in March of 2009, gold stocks had more than doubled.

The GDX wants to go higher. It may churn and consolidate at current levels, but if history is any guide, a breakout above $32.00 could trigger significant upside trajectory.

The real test will be if (when) the broader markets sell off again, testing their Mar. 16 crash lows. If gold stocks hold up during such an event, fugget about it (it’ll be game on).

Of the companies I follow in the junior exploration arena, only a handful are plumbing their lows. And of that handful, Strategic Metals stands out.

Strategic Metals (SMD.V) – (SMDZF.OTC)

- 96.65 million shares outstanding

- $33.34M market cap based on its recent $0.345 closing price

- $28M in working capital ($7M in cash)

Major shareholders:

- Strategic Management – 10.3%

- Condire Resource Partners – 13.1%

- Sprott Asset Management – 10.7%

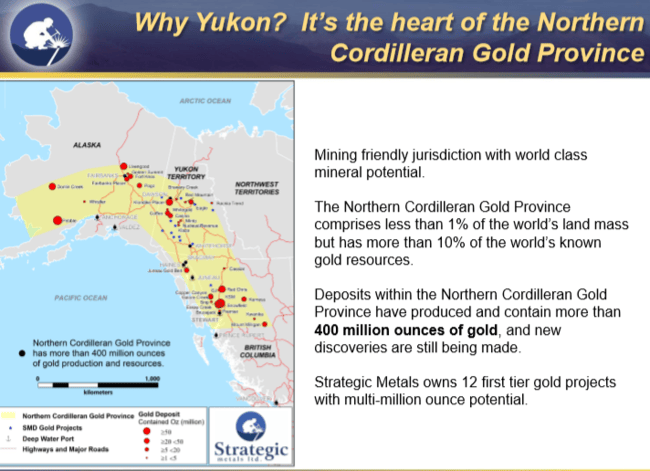

Strategic Metals has called the Yukon “home” for decades. The company, employing the prospect generator business model, characterizes itself as “the plankton that feeds the system”.

But there is one project in its portfolio that could see this conservative biz-model pushed aside in 2020. We’ll home in on this prospect a little further down the page.

The company is helmed by an award-winning exploration team credited with discovering the two highest grade 1-million-ounce-plus gold deposits in the Yukon, AND, the largest gold and copper deposit in the territory.

As THE dominant claim holder in the region, the company accumulated an impressive project portfolio of over 130 properties representing a diverse suite of metals, most of which are 100% owned with no underlying royalties.

The company’s 36.3% stake in Rockhaven Resources (RK.V), a fellow Yukon ExplorerCo, gives it exposure to a significant resource—the Klaza Project—located in the Mount Nansen camp, southwestern Yukon:

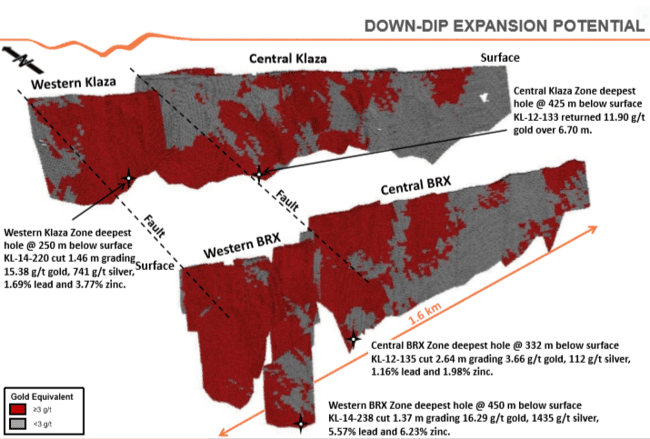

- An Indicated Resource of 4,457,000 tonnes grading 4.8 g/t Gold, 98 g/t Silver, 0.7% Lead and 0.9% Zinc, containing 686,000 oz Gold, 14,071,000 oz Silver, 73,268,000 lbs Lead and 92,107,000 lbs Zinc… or, a gold equivalent metal content of 907,000 ounces at a gold equivalent grade of 6.3 g/t.

- An Inferred Resource of 5,714,000 tonnes grading 2.8 g/t Gold, 76 g/t Silver, 0.6% Lead and 0.7% Zinc, containing 507,000 oz Gold, 13,901,000 oz Silver, 77,544,000 lbs Lead and 89,176,000 lbs Zinc… or, a gold equivalent metal content of 725,000 ounces at a gold equivalent grade of 3.9 g/t.

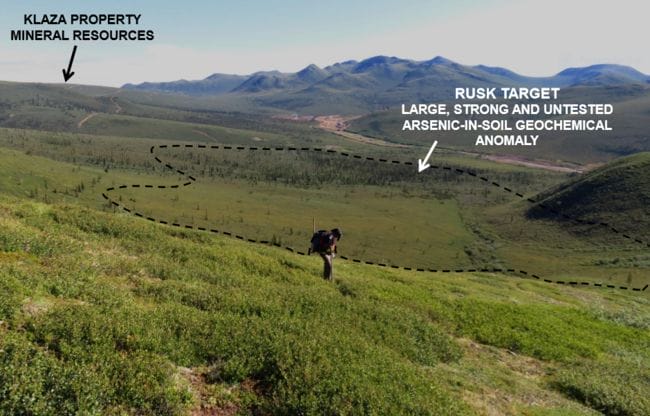

Eleven mineralized vein structures have been discovered on the property to date.

All of the boxes appear to be checked off here: top-shelf management running the show, agreements in place with the local First Nation, no underlying royalties, easy road access, high-grade rock, good metallurgy (94% gold, 88% silver, 83% lead and 84% zinc recovery rates), and wide-open exploration upside…

Note the gold and silver grades at depth (map below). The down-dip resource expansion potential has to be considered excellent…

Geologically, Klaza is similar Buriticá (purchased by Zijin in 2019 for $1.4 billion)—a deposit with a huge vertical extent of over 1.6 kilometers, and Porgera—characterized by “Treasure Box” zones located in areas of structural complexity (Barrick and Zijin are looking at 240,000-260,000 ounces of annual production from Porgera).

The surface has barely been scratched here. Klaza has district scale potential.

There’s more to the Rockhaven story. We’ll be keeping a close eye on the company as the 2020 field season approaches.

Strategic’s flagship project

Strategic generates newsflow from a number of projects, but Mount Hinton dominated the headlines in 2019.

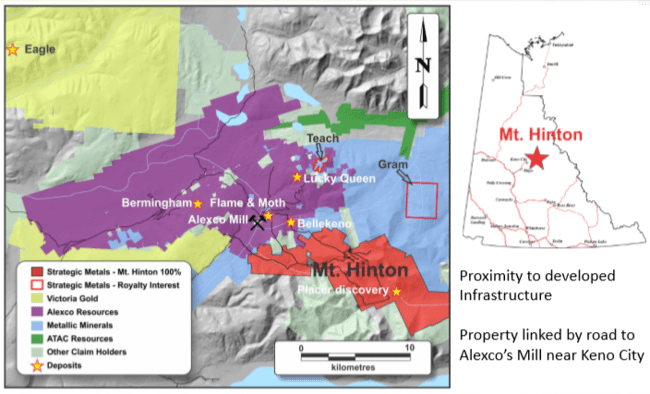

Note Mt. Hinton’s proximity to Alexco Resources (AXU.TO) in the legendary Keno Hill Mining District, one of the highest grade silver districts in the world having produced in excess of 200 million ounces at a grade of 44 ounces (1,247 g/t) Ag per tonne.

If you’re unfamiliar with Alexco, the company is on the verge of making a production decision where…

- Current reserves stand at 1.2 million tonnes grading 800 g/t silver + a further 7% combined lead (Pb) and zinc (Zn).

- Current resources, both Indicated and Inferred, total more than 107 million ounces plus significant zinc and lead credits.

- A 2019 PFS demonstrates an after-tax NPV (5%) of $101.2M and an IRR of 74%.

Mount Hinton newsflow

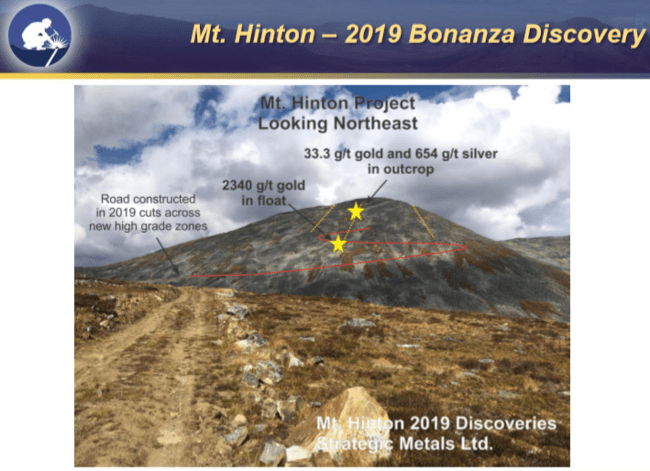

An Aug. 21, 2019 press release got the juices flowing re Mt. Hinton:

Strategic Metals Ltd. Announces 2340 G/T Gold in a Rock Sample From its Mount Hinton Property, Yukon

This was a multi-phase program designed to follow-up on promising gold values tagged during a 2018 soil and rock sampling campaign.

The highlight of this press release (quoting the NR):

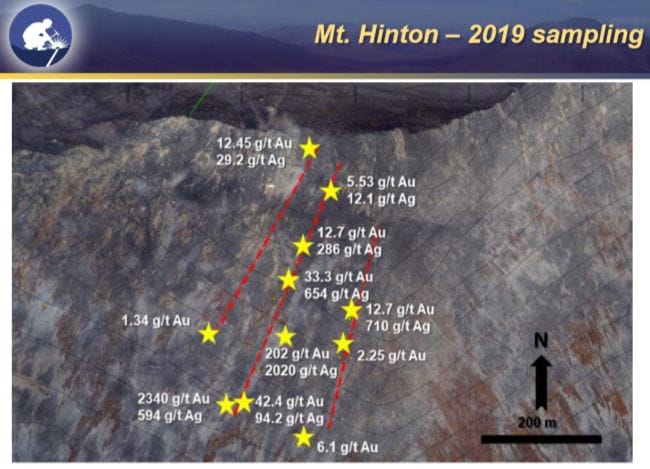

- The discovery of a linear train of vein quartz and brecciated vein extending 230 meters northeasterly from a talus sample that assayed 2340 g/t gold and 597 g/t silver to an outcrop of altered and oxidized breccia grading 33.3 g/t gold and 654 g/t silver.

Yes, these are only surface samples, but they’re pretty damn compelling, especially considering the Keno Hill address.

Then, on September 9, the company dropped the following headline:

Strategic Metals Discovers More Gold-Rich Veins at Its Mount Hinton Property, Yukon

Highlights from this rock sampling campaign included (quoting the NR):

- A two-meter wide vein, intermittently exposed along a 75 meter strike length, where four widely-spaced rock samples returned: 28.5 g/t gold; 23.5 g/t gold with 1720 g/t silver; 11.6 g/t gold; and 4.44 g/t gold;

- Another outcropping vein, found within a fault zone, graded 12.6 g/t gold and 2100 g/t silver;

- A second exposure within the same vein fault located 50 meters along strike, where chip sampling returned 30.5 g/t gold and 53.1 g/t silver over 1.2 meters and a grab sample assayed 48.5 g/t gold and 74 g/t silver;

- A third, 0.5-meter wide vein in outcrop, which is covered by talus along strike in both directions, assayed 46.9 g/t gold and 446 g/t silver.

Interestingly, follow-up prospecting within the float train that produced the 2340 g/t gold sample a few weeks earlier turned up a discovery of native gold, plus a rock sample grading 202 g/t gold and 2020 g/t silver (roughly 120 meters along strike to the northeast).

Again, compelling values.

In a November 18 press release – Strategic Metals Continues To Discover High-Grade Gold At Its Mount Hinton Property, Yukon – the company prefaced the highlighted values with the following:

More visible gold was identified during phase three; however, keeping with previous phases of work, no samples containing visible gold were sent for analysis.

Most companies would have taken these visible gold (VG) samples, assayed them, and trumpeted them far and wide. Not this crew. They’d rather keep it real.

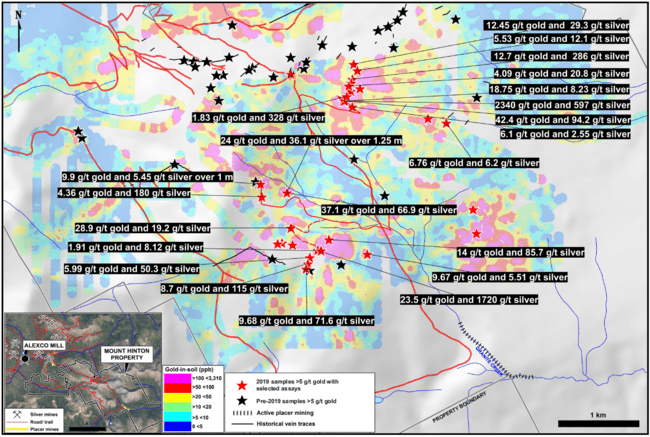

Highlights from the Nov. 18 rock sampling and trenching campaign (quoting the NR):

- Discovery of two new veins in outcrop on the western side of Granite Creek. One where a chip sample returned 24 g/t gold over 1.25 meters, and another that is up to 1.5 meters wide where a grab sample yielded 9.67 g/t gold;

- A sample from a large boulder of quartz vein, which assayed 42.4 g/t gold, expanded the main high-grade float train identified in phases one and two, on the east side of Granite Creek;

- A sample from a northeast striking zone of quartz vein float surrounded by oxidized breccia that is located 60 meters west of, and parallel to, the main high-grade zone on the east side of Granite Creek yielded 12.45 g/t gold;

- A 1-meter wide chip sample across a quartz vein and altered quartzite wallrock exposed in a trench on the west side of Granite Creek returned 9.9 g/t gold;

- Float samples from other new areas of mineralization yielded 28.9 g/t gold, 14 g/t gold, 9.68 g/t gold, 8.7 g/t gold with 115 g/t silver, 4.36 g/t gold with 180 g/t silver and 1.83 g/t gold with 328 g/t silver.

Importantly, these surface samples correlate nicely with a number of recently defined geochemical anomalies. The red and purple circular to sub-rounded clusters represent the higher-grade soil values (map below):

One last image—a recent placer discovery in the southern portion of the Mt. Hinton claim block yielded the following collection of gold nuggets…

These are early innings for Mount Hinton. We should see an aggressive follow-up drilling campaign over the coming months. And as I speculated further up the page, the company will likely go this one alone, without a JV partner.

There are a number of moving parts to the Strategic story, all potential company makers, but Mt. Hinton has my undivided attention.

END

—Greg Nolan