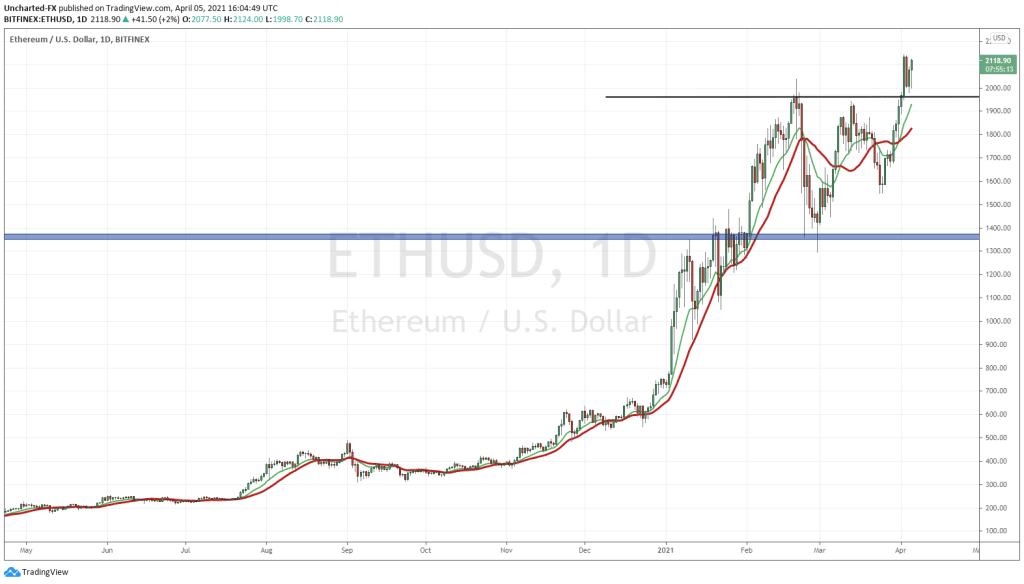

Ethereum printed new record all time highs on Good Friday as Stock and Bond markets were closed for the holiday. Not only are we into all time high territory, but we climbed above an important psychological zone of $2000.

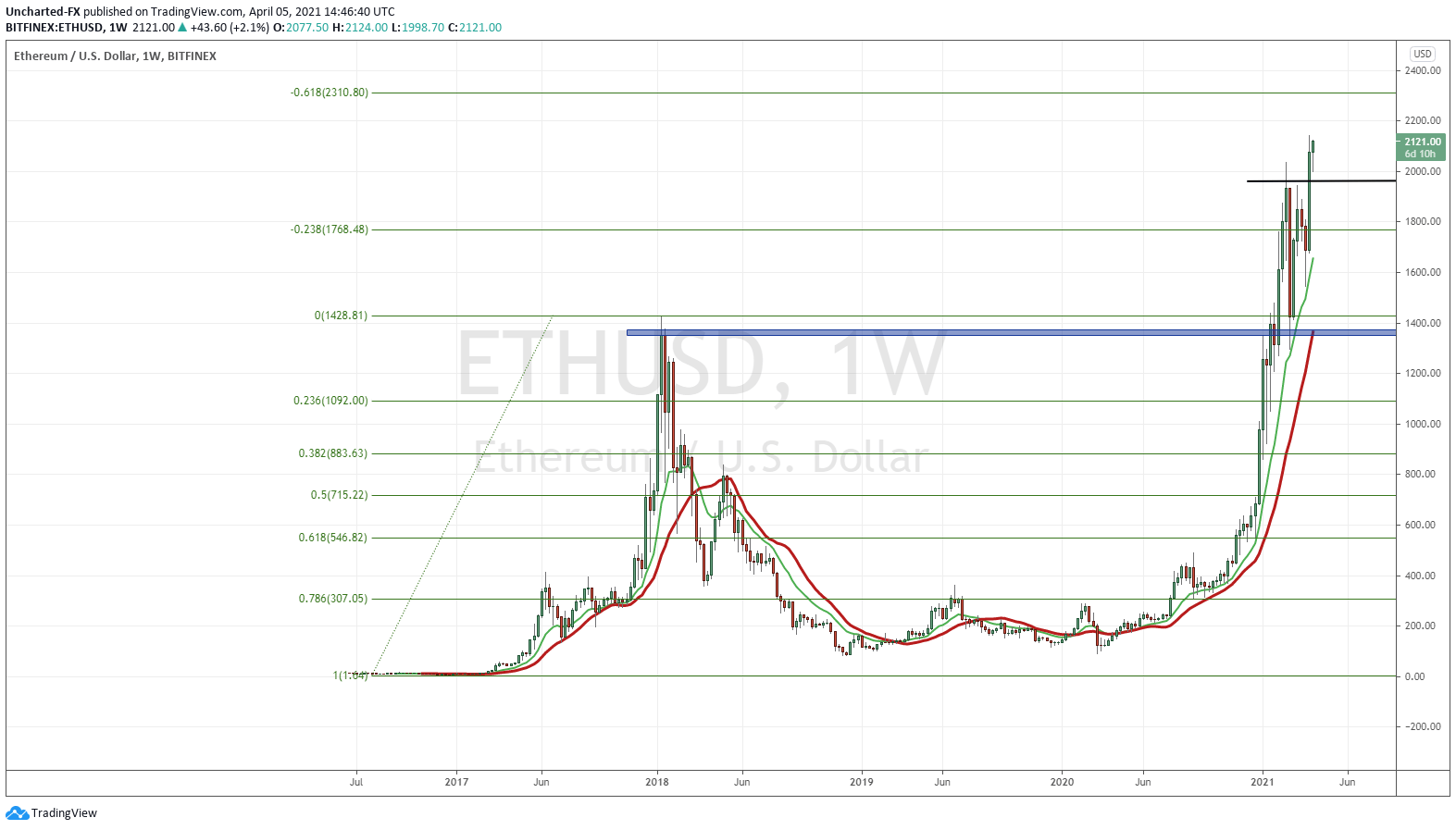

Just a reminder from my Ethereum fibonacci targets posted back in February. Just a reminder, we went bullish Ethereum when it broke and retested $360 way back in 2020. We have ridden this over on Equity Guru’s Discord Trading Room, so please do join us if you have not.

My premise for being long crypto’s remain the same: it is a way out of fiat currency. We all know that money printing, and crazy central bank monetary policy will continue. All central banks are weakening their currency to boost exports and/or keep assets propped. This is the currency war I have been warning about. AND in my opinion, why Tesla bought 1.5 billion in Bitcoin (and is open to buying Gold or anything to diversify Dollar holdings).

However there are two other reasons which could be attracting people to buy Ethereum:

Non- Fungible Tokens, or NFTs have been hot. And I mean HOT! We have seen a digital artwork auctioned off for $69 million, and the key point is that these tokenized things are secured by the Ethereum blockchain.

For more information on what the heck an NFT is, check out Madelyn Grace’s awesome Investment Education articles on NFTs!

The second major reason is Decentralized Finance Tokens, of DeFi, as they are based on the Ethereum Blockchain.

In a recent edition of Market Moment, I discussed Ray Dalio’s take on a Bitcoin ban, and why regulations are pretty much a certain. With Wall Street getting their hands on crypto’s, it will be bullish as more institutional money flows, BUT the crypto purists will hate it since the original purpose of it is defeated.

The idea of cryptocurrency was to be away from the banks and government. To be decentralized. Hence why many in the community hate XRP/Ripple.

I believe that many are frontrunning these regulations and moving into DeFi tokens.

For the top DeFi tokens by market cap, take a look here.

My Experience Using Ethereum to Buy DELTA

So I really do believe that DeFi is going to see some incredible gains. Not only due to regulations on crypto, but because of governments raising taxes and tracking money flows. The truth is that we are likely going to be using THEIR digital currency so all money can be tracked and taxed.

I got in very early in DELTA. I staked it. This is a bit different than buying from an exchange. Which you can now. DeFi tokens can be bought and traded on Binance, Coinbase, and Bittrex and other major crypto exchanges.

This is not investment advice. In fact, I would say this is more of a speculation. However, it is a risk I am willing to take and it is what I believe, will be a way to hedge what will occur to the crypto markets. Do your own due diligence!

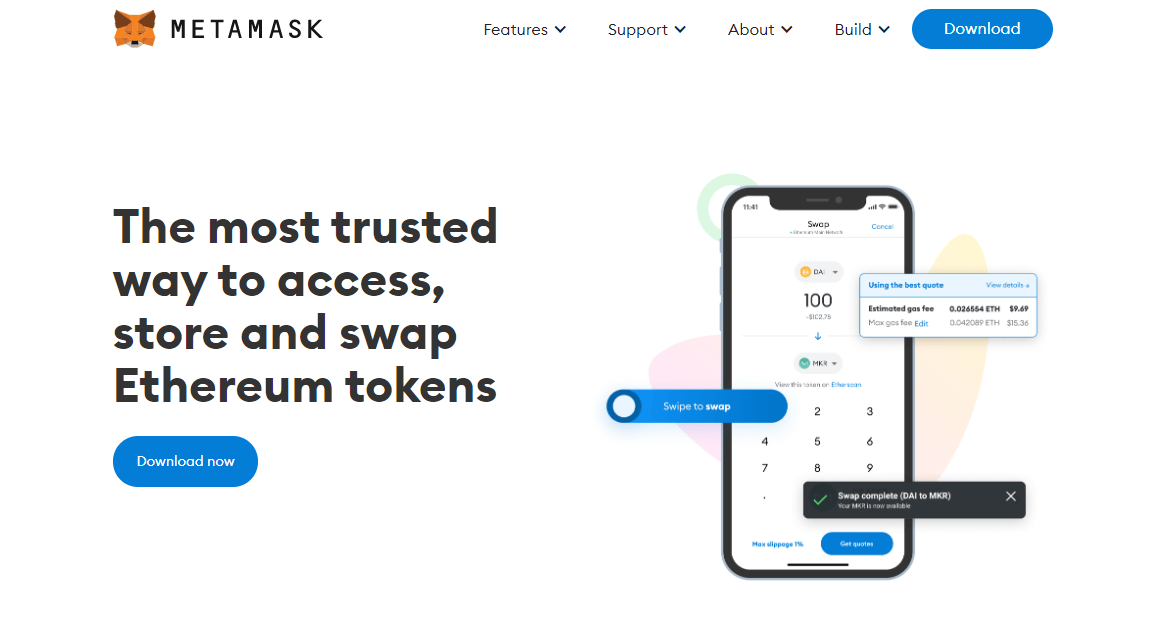

So the easy step was to buy Ethereum tokens. Once I had that, I had to use an app called MetaMask for storing and swapping Ethereum tokens.

On the image above, I laugh a bit at the gas fee costs. This is where things do not look so good for Ethereum. Fees.

While Bitcoin is dubbed the safe haven and store of value, Ethereum has been dubbed the money of the internet by crypto enthusiasts. But a lot of work has to be done for it to truly be the money of the internet.

It was my first time actually using Ethereum for a transaction. I have used Bitcoin for transactions in the past, albeit during heavy volume trading days, which meant the transactions were slow and pricey. But that did not prepare me for my experience with Ethereum.

I got ready to purchase DELTA on the presale, had my Ethereum ready to go. Placed the order…and then my jaw dropped when I saw the gas fees (and the transaction took a long time to fulfill).

What is a gas fee I hear you ask?

Gas refers to the fee required to successfully conduct a transaction on Ethereum. In essence, gas fees are paid in Ethereum’s native currency, ether (ETH). Gas prices are denoted in Gwei, which itself is a denomination of ETH – each Gwei is equal to 0.000000001 ETH (10–9 ETH).

The demand for more ETH and the ability of the blockchain platform to execute smart contracts is the reason why the gas price fees remains high.