Yesterday, on March 23rd, Defense Metals (DEFN.V) dropped an important headline—one I’ve been eagerly anticipating as I monitor developments from the sidelines.

Leading up to this news event, in a recent interview with Defense Metals’ CEO, Craig Taylor, I asked…

“Back in February, you engaged Welsbach Holdings to assist you in a number of areas. What are your expectations—what do you hope to achieve from this partnership?

CEO Taylor’s reply:

“Welsbach has ties in Singapore, Japan, Korea, Europe, Australia, and China. They’re connected to every smelter, every end-user in the space. They’ll serve as a key broker, moving us forward in securing MOUs for offtake agreements. They see the upside in what’s happening globally.”

Naturally, I followed that query with another, looking for specifics:

“You probably can’t answer this, but are there any names, any end-users in the space that have expressed interest in your REE concentrate?”

CEO Taylor’s reply:

“No. I can’t give you any names, not just yet. We’re in the short strokes now—we’re working on putting together a list and sending out samples of our concentrate. I’m hoping to have that list within the next six to eight weeks.”

Well, we now have an answer to those questions, though the names remain shadowed at this point.

The March 23rd headline

This might strike some as a neutral piece of news, but in reality, it’s anything but.

It would appear that engaging Welsbach Holdings is beginning to pay off.

According to this press release, two Rare Earth Element (REE) processors, both from Asia, are requesting samples of the Company’s high-grade REE mineral concentrate for evaluation purposes. This could ultimately lead to an offtake agreement.

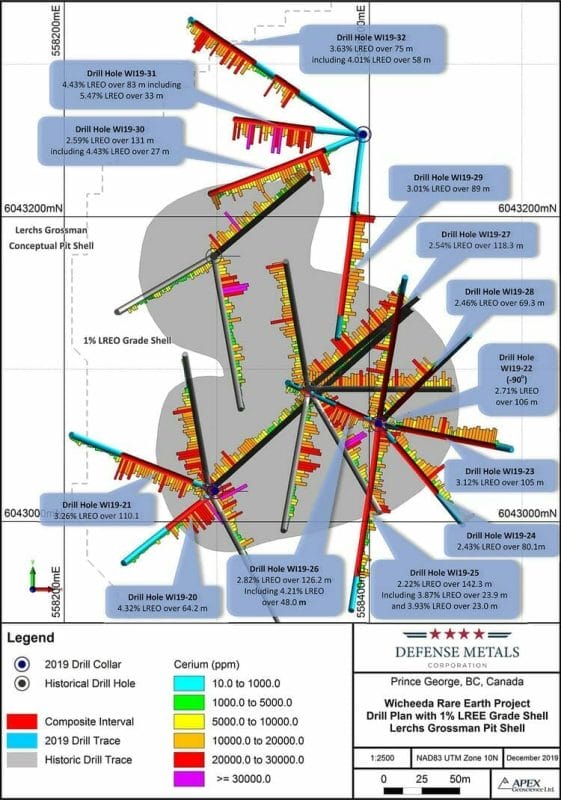

To refresh memories, the Company’s Wicheeda REE Project boasts 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Oxide) in the Indicated category, and 12,100,000 tonnes averaging 2.90% LREO counted as Inferred.

“Two specific rare earth minerals Monazite and Synchysite/Parasite-Bastnaesite are contained in approximately equal proportions.”

The values highlighted on the map below demonstrate the high-grade nature of this strategically located LREE deposit. Note the high-grade intervals tagged outside the main resource block (the grey rubber duckie image).

Wicheeda appears destined to grow, perhaps significantly so.

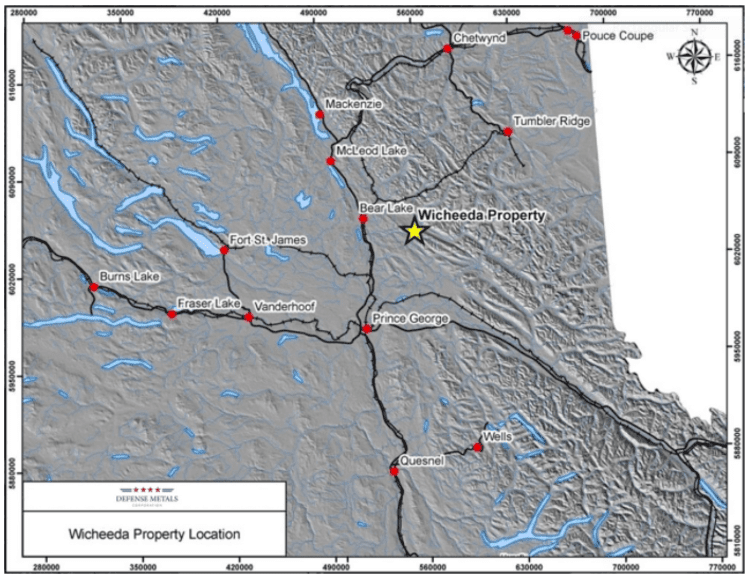

This 1,708-hectare project, located along a well-maintained forestry road in the mining-friendly region of Prince George, B.C., is the Company’s flagship.

Wicheeda is surrounded by all the infrastructure necessary to breathe life into a modern-age mining operation.

And this wholly-owned project is being pushed aggressively along the development curve.

Last September, via the completion of its flotation pilot plant test-work, a 1,200-kilogram bulk concentrate sample was produced. This is what these REE processors are after.

The two companies interested in sampling Defense’s wares represent major and mid-tier REE processors.

The sample sizes requested are between two and six kilograms in size.

Defense is now preparing all the Canadian government export permit documentation required to export these samples abroad.

CEO Craig Taylor:

“We are extremely pleased that Welsbach has successfully identified two REE processors interested in receiving representative samples of our high-grade Wicheeda REE Deposit mineral concentrate. These requests represent a major step forward in our efforts to assess the market potential of long-term REE mineral concentrate offtake sale agreements.”

Mr. Brendan Jephcott of Weslbach Holdings:

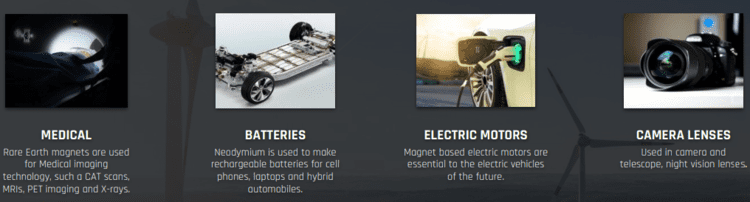

“Potential partners in Asia are seeking a secure, long-term supply of rare earth concentrate to cover projected shortages in NdFeB magnet supply as demand for electric motors used in new energy vehicles continues to grow.”

There are a number of catalysts lining up in the short to medium term that could exert upward pressure on the trajectory of Defense common.

One potential catalyst might be an upcoming drill program, something in the order of 15 to 20 holes for 2,000 meters—a combination of infill and stepout drilling. Clearly, there will be an emphasis on resource category conversions—upgrading the Inferred material to the higher confidence Indicated category in preparation for a pre-feasibility study (PFS).

But Wicheeda is open in multiple directions and at depth (refer to the above map). A few well-placed stepout holes could yield some nice surprises.

This Summer-of-2021 drill program is still in the planning stage—we should learn more shortly.

Another potential catalyst: the construction of a pilot plant capable of producing oxide material.

When I asked CEO Taylor to summarize the work being carried out with SGS Canada, this was his reply:

“In a nutshell, what we’re trying to do through the SGS bench-scale test work is optimization towards our hydromet pilot plant. The more bench-scale testing we do, the more kinks we can iron out ahead of building the pilot plant. All of these technical studies are aimed at achieving greater efficiencies—optimal output at the lowest cost. The team at SGS are very good, they’re very thorough scientists and they’re coming up with some new ideas that could yield bigger, better results. It’s been money well spent, and the SGS team isn’t finished yet.”

On deck is a preliminary economic assessment (PEA) which will give us a first-pass look at Wicheeda’s underlying economics. In my mind, this could also represent a weighty piece of news, and we shouldn’t have long to wait before this headline drops.

Lastly, there may be other major and mid-tier REE processors lining up for a sample of what Wicheeda’s got in its subsurface stratum.

Final thoughts

I don’t need to tell you how important it is for the West to secure ample supplies of REEs to satiate demand from the technology arena. This demand covers everything from night vision goggles to the control rods in nuclear reactors.

China controls the vast majority of the world’s mined output and has a stranglehold on processing. The West needs Wicheeda.

It now appears that new REE companies—mostly exploration stage entities—are popping up like weeds. But precious few of these ExplorerCos can boast a legit REE resource. Fewer still can boast a three-year track record of development success, on multiple fronts, like our Defense Metals.

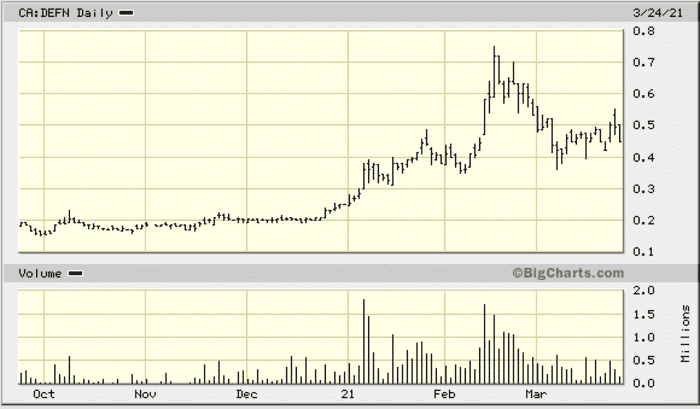

The stock, after registering some handsome gains earlier this year, is consolidating at a level that may represent an attractive entry point.

We stand to watch.

END

—Greg Nolan

Full disclosure: Defense Metals is an Equity Guru marketing client. We own shares.