Three companies on our client list dropped headlines in recent sessions. Let’s dive right in.

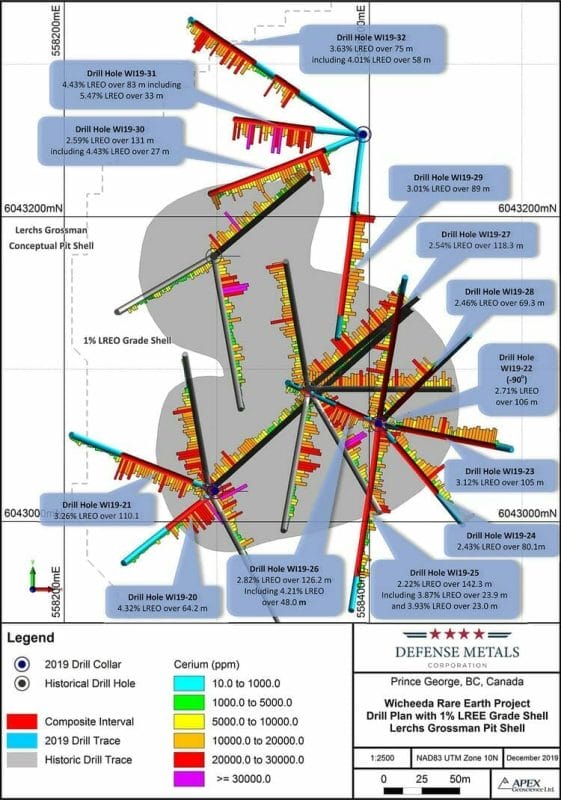

Defense Metals (DEFN.V)

Defense has generated its fair share of joy in recent weeks. An increasingly volatile political backdrop threatening the REE supply chain and recent corporate initiatives put a spotlight on the Company’s flagship resource.

Hats off to the Defense team.

It’s about time the market woke up to this highly strategic REE play.

The Company’s flagship Wicheeda Project has a current indicated resource of 4,890,000 tonnes averaging 3.02% LREO (Light Rare Earth Elements) and an inferred resource of 12,100,000 tonnes averaging 2.90%.

That’s some rich rock.

Flotation pilot-plant processing of a 26-tonne Wicheeda bulk sample yielded a mineral concentrate averaging 7.4% NdPr oxide (neodymium-praseodymium). Critical magnet metals, these.

Flotation pilot-plant processing of a 26-tonne Wicheeda bulk sample yielded a mineral concentrate averaging 7.4% NdPr oxide (neodymium-praseodymium). Critical magnet metals, these.

Last month, the Company announced its role as a founding member of the recently launched Canadian Critical Minerals and Materials Alliance:

“Defense Metals and nine other C2M2A founders reflect a broad knowledge base across the suite of critical material supply chains; including current & prospective producers and processors, commercial & national laboratories, academia and innovation hubs, and engineering & business experts.”

More recently, on February 11th, the Company dropped the following headline:

Here, Defense engaged Welsbach Holdings to assist in building awareness for its flagship asset, providing market research, sourcing potential supply chain partners and assisting in (commercial) negotiations.

The market liked this piece of news, for obvious reasons.

Craig Taylor, Defense’s CEO:

“The engagement of Welsbach will enable Defense Metals to leverage their extensive experience and relationships in the Asia-Pacific region (Australia, Singapore, China, Japan, and South Korea), Continental Europe, and the United States towards engaging in one-on-one discussions with REE refiners and separators. The goal is the successful negotiation of one or more binding commercial REE offtake and/or other supply chain agreements with respect to the Wicheeda REE Deposit. Welsbach will immediately commence its work aiding with respect to strategic partner identification, business introductions, and ultimately commercial negotiations.”

A more recent headline…

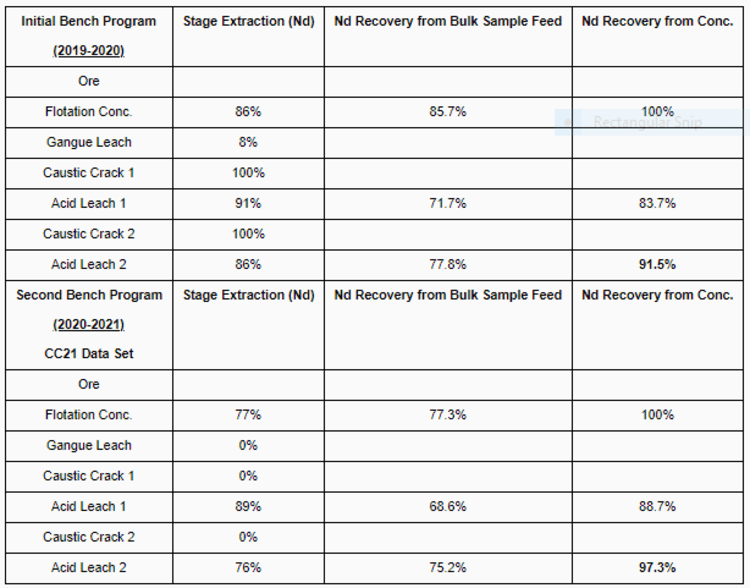

Here, the Company announced receipt of additional infill hydrometallurgical test results from SGS Canada’s Lakefield Site.

Highlights:

- Increased REE extraction from 91.5% to 97.3% from flotation concentrate (~75% from bulk sample feed) into a chloride-based leach solution compared to initial testing (CC-21, table below);

- Decreased REE losses via milder gangue leach compared to the base-case flowsheet;

- Simplification of flowsheet by removing re-grind step and reducing caustic dosage on re-crack (CC-20) yielded comparable REE extraction of 95.8% from flotation concentrate (~74% from bulk sample feed).

CEO Taylor again:

“Our decision to conduct additional infill hydrometallurgical test-work has yielded significant REE recovery gains approaching 100% REE extraction from the flotation concentrate. Perhaps more importantly, this additional testing has advanced the Wicheeda REE separation flowsheet such that we able to “tune” process variables (chiefly: grind size, acid, and caustic concentrations) to achieve a balance of minimizing REE leach losses and maximizing impurity removal. This level of process control will de-risk our planned hydrometallurgical pilot plant and contribute to greater flexibility in design of a future commercial-scale hydrometallurgical plant.”

The concerns here in the West regarding the REE supply chain are not exaggerated. China controls the lion’s share of global REE processing.

The concerns here in the West regarding the REE supply chain are not exaggerated. China controls the lion’s share of global REE processing.

Heightening this concern over China’s grip on the global REE refining market, this salvo, first reported by the Financial Times on Feb. 16th…

China Threatens To Hobble US Defense Industry By Limiting Export Of Rare-Earth Metals

The following is a recent interview with CEO Taylor where he talks about the engagement of Welsbach Holdings and offers a brief overview of the Wicheeda deposit…

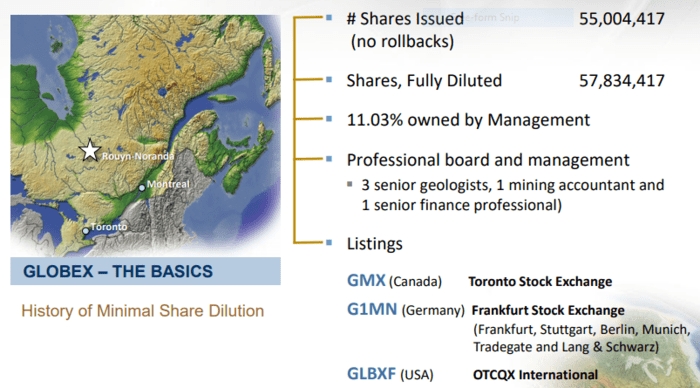

Globex Mining (GMX.T)

Globex is our preferred mineral property landbank and incubator.

Management’s specialty is sourcing and acquiring high-quality projects in mining-friendly jurisdictions, advancing them through the application of good science (modern exploration techniques), and monetizing them via JVs, royalty agreements, and outright sales.

Some companies take a stab at this business model, very few succeed.

Globex, helmed by Jack Stoch, has been around for decades.

I can’t emphasize enough the importance of digging into management’s background when shortlisting companies in this capital-intensive arena.

Without the right team in place, things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises.

The following snippet, extracted from the Directors and Senior Management link on the Globex website, pertains to CEO Stoch:

Jack is a major shareholder of Globex and is an experienced geologist with an entrepreneurial spirit, devoted to building Globex into a highly successful public mining and exploration company.

Following a stint with Noranda Exploration Ltd., Jack, in 1976, started acquiring and vending exploration projects, through his own consulting businesses, Jack Stoch Geoconsultant Services Ltd. and Geosol Inc. At one time, Jack was reported to be the largest private mineral rights holder in the Province of Quebec, Canada.

In 1983, Jack Stoch, gained control of Globex and has since amassed a mature exploration portfolio. He has attracted a knowledgeable and well-connected Board of Directors and has expanded the Company’s exploration, evaluation and mining team.

In 1972, Jack earned a B.Sc. in Geology from Sir George Williams University in Montreal, with additional graduate courses at McGill University. He was awarded the designation Acc. Dir., Accredited Director in 2007 by the Chartered Secretaries Canada and is a registered Professional Geologist in Quebec, Canada.

Globex has just over 55 million shares outstanding (57.8 million fully diluted) and there’s never been a roll back. That’s a remarkable feat for a Junior with this extended history.

The Company has a total of 192 properties in its project portfolio—96 are prospective for precious metals, 60 for base metals, and 36 for specialty metals (lithium, manganese, scandium… and antimony).

The Company has a total of 192 properties in its project portfolio—96 are prospective for precious metals, 60 for base metals, and 36 for specialty metals (lithium, manganese, scandium… and antimony).

Breaking the project pipeline down further, 71 of these properties have an underlying royalty held by Globex, four have been optioned out (JV’d) to other Exploreco’s, and importantly, 54 have a mineral resource (historical or 43-101 compliant).

The Company succeeded in monetizing seven projects last year (blue bar, top right)—management’s key to preserving its enviable cap structure.

The market appears to be waking up to the latent potential of this well-run company, with its vast portfolio of high-quality projects.

The following is a 5-year chart. Note the steady accumulation since the March 2020 crash-day lows.

The current share price represents multi-year highs.

I’d characterize this positive price trajectory as ‘Smart Money’ accumulation.

A new acquisition…

Globex Acquires Bald Hill Antimony Deposit, New Brunswick

The Company just acquired a 100% interest in the Bald Hill Antimony Property located in Queens County, south-central New Brunswick (40 km northwest of the town of Sussex and approximately 60 km southeast of the City of Fredericton).

Bald Hill consists of 26 claims covering the Bald Hill antimony deposit and surrounding area. An additional eight claims adjoining Globex’s Devils Pike gold deposit property were also acquired. (See Press Release dated January 7, 2016).

What is antimony? Good question. Antimony—symbol Sb and atomic number 51—is ranked No. 10 on the most critical mineral list by the United States Geological Survey.

Its applications are many. It’s used in lead-acid batteries, as a fire retardant with halogen in plastics. It’s a key ingredient in communication equipment, night vision goggles, optics, laser sighting, etc etc.

Sixty percent or more of North America’s antimony is imported from China, hence the critical mineral designation.

This silvery, lustrous gray metalloid currently fetches roughly $2.75 per pound.

Of interest, antimony is one of the best pathfinders for gold (the Company’s Devil’s Pike gold deposit is just over the rise from Bald Hill).

Surface trenching by a previous operator, Rockport Mining, returned up to 43% Sb over 2.0 meters and 2.90% Sb over 8.18 meters at Bald Hill.

Widely spaced holes delineated a strike length of approximately 450 meters, to a depth of 300 meters.

In 2010 Conestoga-Rovers and Associates of Fredericton, New Brunswick produced a report titled “National Instrument 43-101 Technical Report on the Bald Hill Antimony Project, southern New-Brunswick, Canada, NTS Map Sheet 21G/09 and 21H/12 for Rockport Mining Corp. authored by Heather MacDonald, MSc., P.Geo.”

“Based upon 16 widely spaced drill holes totaling 3,554 meters and 609 assays, an antimony zone 450 meters in length was outlined including drill intersections of up to 11.7% Sb over 4.51 meters (core length).”

The report states the following:

“The potential tonnage and grade of a potential mineral deposit at the Bald Hill Property which is the target of further exploration, is expressed as ranges in the table below. The potential quantity and grade is conceptual in nature as there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource.”

A subsequent NI 43-101 report titled: National Instrument 43-101 Technical Report: Bald Hill Antimony Project (claim group 5061) Southern New-Brunswick, Canada, NTS Map Sheet 21G/09 and 21H/12, Prepared for Tri-Star Antimony Canada Inc. by Peter Banks, B.Sc., P.Geo. and John Langton, M.Sc., P.Geo. of MRB & Associates, October 28th, 2014 detailed additional exploration work on the property. Conclusions derived from this work, as reported in a brief under “Interpretations and Conclusions”, are reproduced below.

A subsequent NI 43-101 report titled: National Instrument 43-101 Technical Report: Bald Hill Antimony Project (claim group 5061) Southern New-Brunswick, Canada, NTS Map Sheet 21G/09 and 21H/12, Prepared for Tri-Star Antimony Canada Inc. by Peter Banks, B.Sc., P.Geo. and John Langton, M.Sc., P.Geo. of MRB & Associates, October 28th, 2014 detailed additional exploration work on the property. Conclusions derived from this work, as reported in a brief under “Interpretations and Conclusions”, are reproduced below.

“Rockport’s drilling on the Bald Hill main grid has confirmed the Sb mineralization over a significant area of approximately 700 m on surface (Note by Jack Stoch: additional 250 m strike length) and to 300 m depth. Surface mineralization and soil geochemical anomalies indicate that the mineralization extends for at least 1.5 km, along strike from the delineated mineralized zones. The 2014 trenching program, centered approximately 1.0 km along strike to the southeast from the main Bald Hill occurrences, exposed new antimony mineralization grading 9.04% Sb over 2.60 metres.”

“In addition to the on-site exploration programs, preliminary processing and metallurgical test-work of Bald Hill lithological drill-core and bulk samples was carried out. This work comprised bulk mineralogy, basic chemical profiling, textural features of the ore minerals and preliminary analysis of liberation characteristics and amenability of the ore to gravity concentration and/or flotation, preliminary ore-characterization, mineralogical and chemical profiling, and optical ore examinations.”

“The work completed by Rockport on the Bald Hill Project substantiates the occurrence of a potential resource of economically interesting antimony mineralization. The Project is a valid exploration target that remains largely untested with respect to its full dimensions and its regional structural relationships.”

Importantly, Globex also acquired a digital data bank of some 16,500 files on the property and surrounding area.

“Globex believes that the property has excellent exploration potential and considering the strategic importance of antimony, a significant addition to Globex’s large bank of mineral properties currently made up of 192 property interests, including 96 gold assets, 60 base metal assets, 36 specialty metal and industrial mineral assets including 71 royalties. The Bald Hill antimony property was acquired for a single cash payment.”

I’m sure CEO Stoch has plans for Bald Hill. It wouldn’t surprise me if he’s currently entertaining potential JV partners.

The following is a very recent interview where CEO Stoch talks about the Bald Hill acquisition, Devil’s Pike (next door to Bald Hill), Battery Hill (currently operated by Manganese X), and Parbec (operated by Renforth Resources)…

For a deeper delve into Jack Stoch’s company, the following link offers additional insights, including a cursory look at several key projects:

Globex Mining (GMX.T) – an undervalued Project Bank, Incubator, Explorer, and Royalty Company

(Globex also trades on the OTC market in the US under the symbol GLBXF and on the Frankfurt Exchange under the symbol GIMN)

Huntsman Exploration (HMAN.V)

The price of nickel—Ni on the periodic table—has been surging, taking out multi-year highs in recent weeks.

Huntsman, formerly Bluebird Battery Metals Inc, has several prospective properties in its project pipeline, but the Company’s current focus is nickel—a metal with a host of compelling drivers (pun intended).

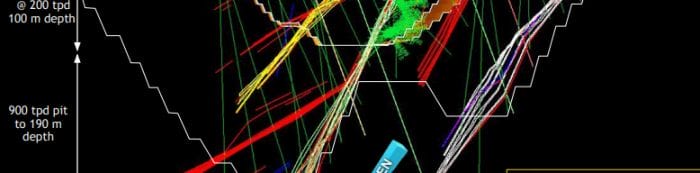

Canegrass is Huntsman’s flagship project where the target is high-grade nickel—Nickel Sulphide specifically—a key ingredient in a new generation of EV batteries.

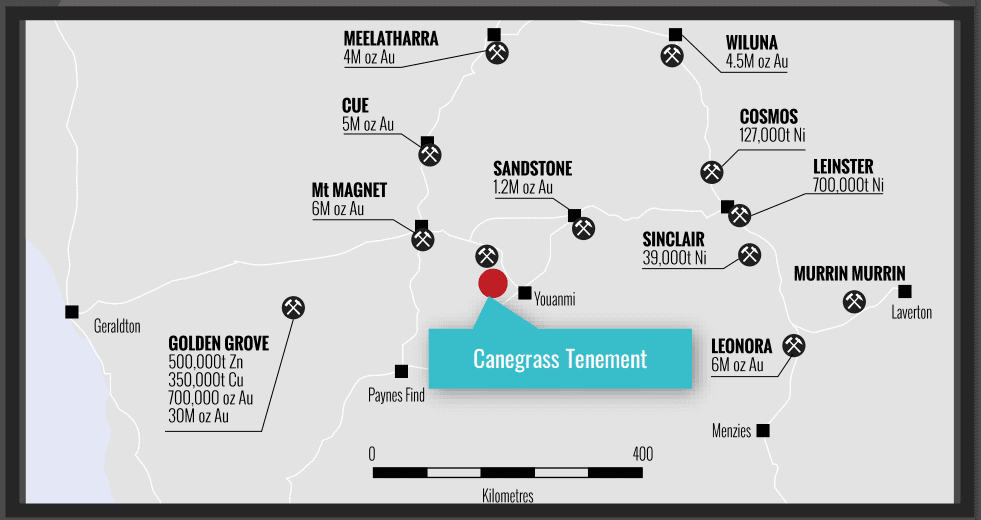

Canegrass is located in Western Australia. As a mining destination, a more friendly jurisdiction does not exist. This, according to the Fraser Institute’s most recent investment attractiveness survey.

The Canegrass project covers 4,200 hectares of geologically prospective terrain. It’s positioned in a prolific geological setting—the Windimurra Intrusive Complex—and is surrounded by world-class deposits.

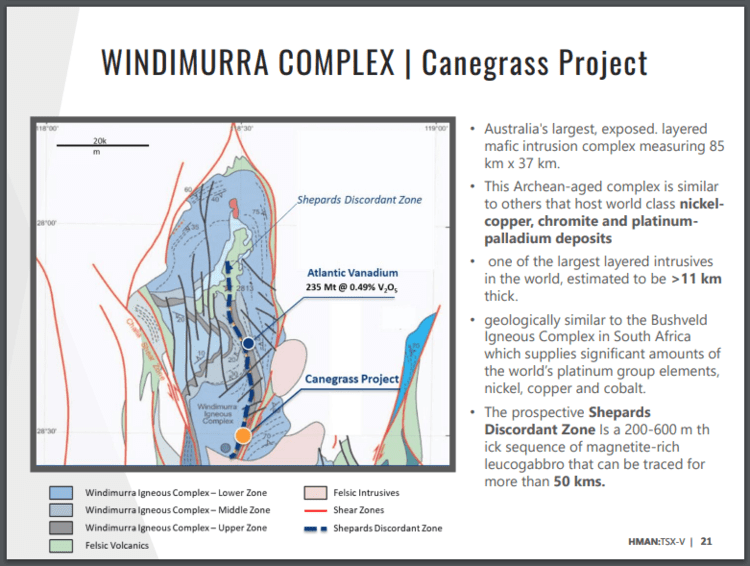

Windimurra is Australia’s largest, exposed, layered mafic intrusion complex measuring some 85 kilometers x 37 kilometers by some 11 kilometers thick.

This Archean-aged complex is geologically similar to the Bushveld Igneous Complex in South Africa, the source of much our planet’s nickel, copper, cobalt, and platinum group elements.

Within the Windimurra Complex, the prospective Shepards Discordant Zone—a 600 meter thick sequence of magnetite-rich leucogabbro—can be traced for more than 50 kilometers. And it trends directly onto Huntsman’s ground.

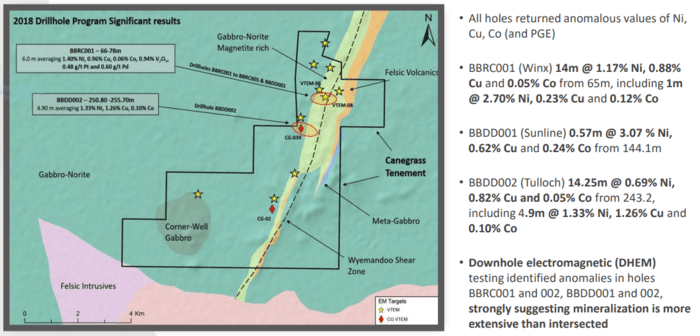

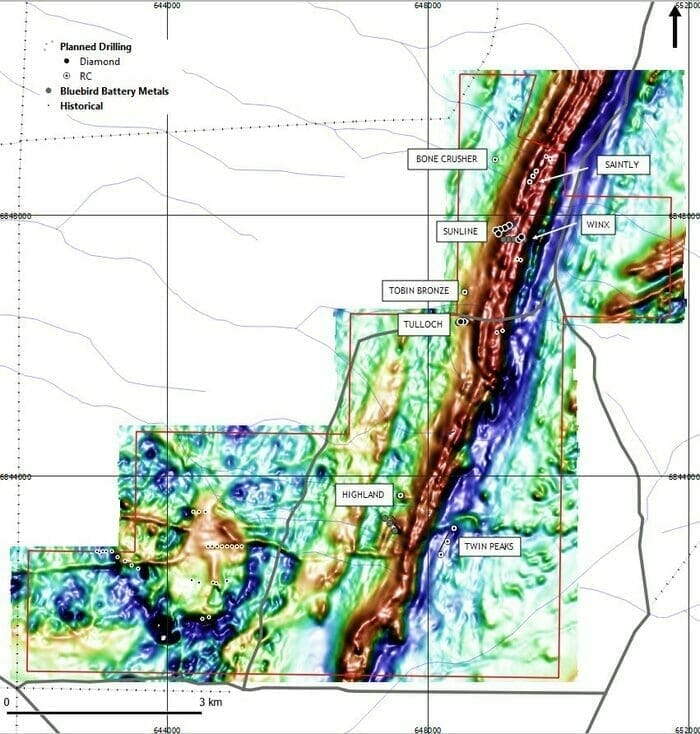

The next map shows an 8.5-kilometer magnetite rich-gabbro-norite structure trending parallel to a shear zone, a potential trap for mineralization.

Geologically, this is a fertile setting for a high-grade discovery.

Note the 2018 drill hole highlights on the above map. Note the yellow stars and red diamonds distributed along this 8.5-kilometer trend. These symbols represent no less than twelve geophysical anomalies, several of which correlate well with the intervals tagged during the 2018 campaign.

Also, note the yellow star and the grey circular anomaly in the southwest corner (still on the above map)—the Corner-Well Gabbro (note the map’s scale). The company is excited about the potential of this large zone. Multiple probes with the drill bit may be in the current drill plan.

Western Australian nickel deposits often have two components: a disseminated zone (low-grade bulk tonnage material), and a higher grade component (a zonally confined structure).

Nickel deposits in this corner of the world also have tremendous (mother-lode) potential at depth—the intervals tagged during the 2018 campaign may represent only fingers of a much larger (richer) hand buried below.

On January 26th, the Company kicked off an 18-hole (3,160 meter) campaign at Canegrass.

Huntsman Begins Drilling Operations at Canegrass High-Grade Nickel Project, Western Australia

More recently, the Company reported progress with the truth machine (drill rig)…

Huntsman Hits Nickel Sulphides in Multiple Holes at Canegrass Project, Western Australia

Here, the Company announced that recent drilling tagged nickel sulphides in multiple holes along a 7-kilometer mineralized trend.

“Phase 1 of the 2021 drill program is following up on the Company’s successful first-pass program, which encountered high-grade nickel, copper, cobalt and palladium at shallow depth in several holes. Assays on current operations are pending and drilling is ongoing.”

2021 Drill Program Highlights:

2021 Drill Program Highlights:

- Majority of drilling to date has encountered encouraging nickel sulphides within very favourable geological units;

- Two rigs (one Diamond drilling and one Reverse Circulation) are on site testing Nickel zones along 7 kms of the mineralized trend in the layered igneous complex;

- Phase I drilling has completed 14 holes at multiple targets. Total program includes 16 holes totalling approximately 3,500 meters;

- All assays are pending, however, specific drill intervals have been submitted for “rush assay” treatment to help further understanding of high priority zones.

Rush assays? Paying extra to shove one’s core to the front of the line at the lab is always a popular plot twist.

Ongoing Property Wide Exploration:

MLEM Survey. The extensive Moving Loop Electromagnetic (MLEM) survey has commenced. The survey will cover portions of the property where previous ground-based EM data was limited. The drilling and MLEM work is designed to detect massive sulphide accumulations proximal to the Shepherds Discordant Zone (SDZ) and at depth. There are no sedimentary horizons within the area and, given that all conductors detected and drilled to date at Canegrass have been mineralized, any new bedrock conductor that is detected will be considered highly prospective. The MLEM program will concentrate on areas west of the shear zone, with additional work on eastern areas to follow.

Peter Dickie, Huntsman’s CEO:

“We are excited at the encouraging, early indications of drilling success at the Canegrass nickel project. The team is looking forward to receiving the assays, as well as the data from the MLEM survey and additional downhole EM work. The previous EM survey was highly instrumental in prior drilling success and will enable rapid definition of new targets. We will continue to share further updates as results come in.”

This press release went on to summarize some of the highlights from the 2018 campaign.

- BBRC001 (Winx) 14m @ 1.17% Ni, 0.88% Cu, 0.05% Co, 463ppb Pd and 375ppb Pt from 65m, including 1m @ 2.70% Ni, 0.23% Cu, 0.12% Co, 751ppb Pd and 723 ppb Pt;

- BBDD001 (Sunline) 0.57m @ 3.07 % Ni, 0.62% Cu and 0.24% Co from 144.1m;

- BBDD002 (Tulloch) 14.25m @ 0.69% Ni, 0.82% Cu and 0.05% Co from 243.2, including 4.9m @ 1.33% Ni, 1.26% Cu and 0.10% Co;

- All 2018 drill holes returned anomalous values of Ni, Cu, Co and were open along strike and at depth.

Interesting developments—all three client companies.

END

—Greg Nolan

Full disclosure: All of the companies featured in this article are Equity Guru clients.