Tilray (TLRY.Q) is up 37% today after inking an importation and distribution agreement with Grow Pharma to get their medical cannabis products into the United Kingdom markets, according to a press release.

The agreement lets Tilray provide medical cannabis patients in the UK a locally maintained supply of medical cannabis. They expect to have their GMP-certified, medical cannabis products on shelves in the UK by March 2021, accessible through either prescriptions through private practice or the National Health Service (NHS).

“As demand continues to ramp up in the UK, Tilray is well-positioned to be a leading supplier of medical cannabis products. Regulations are progressing as more and more countries across Europe are recognizing the benefits of medical cannabis and its potential to improve patients’ quality of life. We’re pleased to reaffirm our commitment to delivering medical cannabis to patients in the UK and look forward to offering a variety of GMP-certified, pharmaceutical-grade products in the coming months,” said Sascha Mielcarek, managing director of Tilray Europe.

A comparison of the two companies merits some explanation here. Tilray’s $4.7 billion market cap puts them as one of the biggest cannabis companies in the world. They’re involved in every facet of the business from seed to sale, and serve tens of thousands of patients in 17 countries and five continents.

Grow Pharma is comparison is a medical cannabis distributor in the UK, and part of the Grow Group. The purpose of which is to unlock the medical potential of cannabis for those who need it through three businesses—Grow Pharma, Grow Trading and Grow Biotech. Grow Pharma works with producers and helps them introduce their products into new markets, like the UK and Ireland.

Hence, why the relationship makes sense.

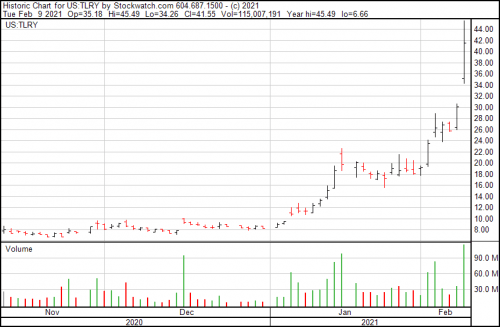

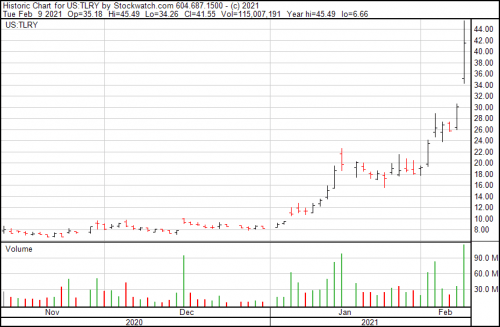

Tilray’s 2020 was horrible on the company’s fortunes, facing a bevy of class action lawsuits and the general market malaise that caused everyone’s cannabis bets to dip, but 2021 may have spelled the first turnaround, at least for Tilray’s fortunes. They’re up from their mid-November low of $6.68, having rallied to today’s price of $42.24.

—Joseph Morton