AMAZON.COM ANNOUNCES FINANCIAL RESULTS AND CEO TRANSITION

Founder and CEO Jeff Bezos will transition to the role of Executive Chair in Q3, with Andy Jassy to become Chief Executive Officer of Amazon at that time.

It’s not often the founder and CEO of a trillion-dollar enterprise leaves his life’s work up to other executives to run the ship. What’s even weirder is that the man, the myth, the legend is only 57 years old, which is 8 years away from the American average retirement age. As with most entrepreneurs, once you create something and accomplish your dreams, you tend to want to do more (and for some, do less). Many choose philanthropy like Bill Gates; others choose to venture into new territory like Elon Musk & now Jeff Bezos.

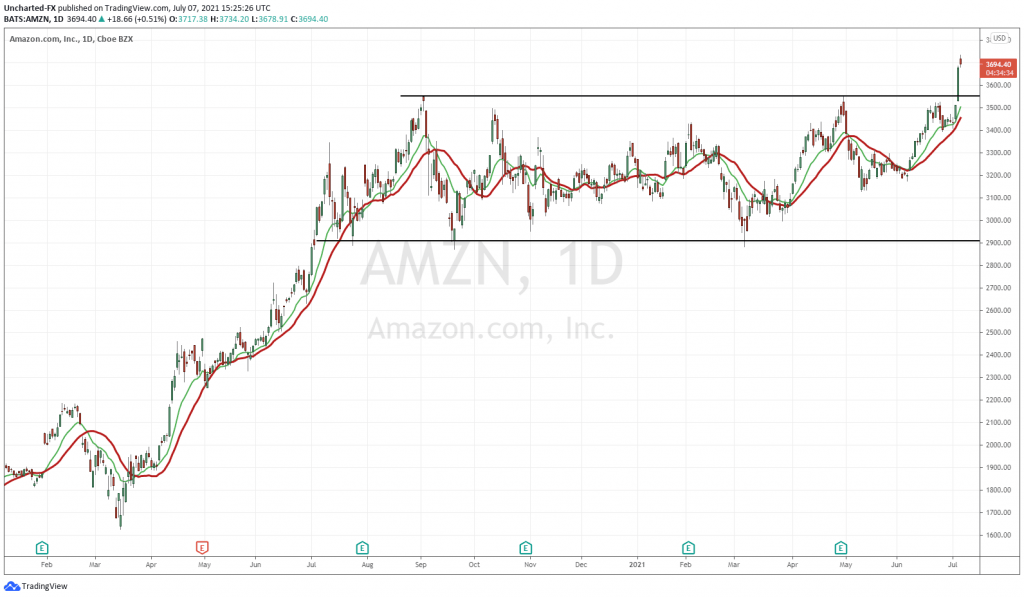

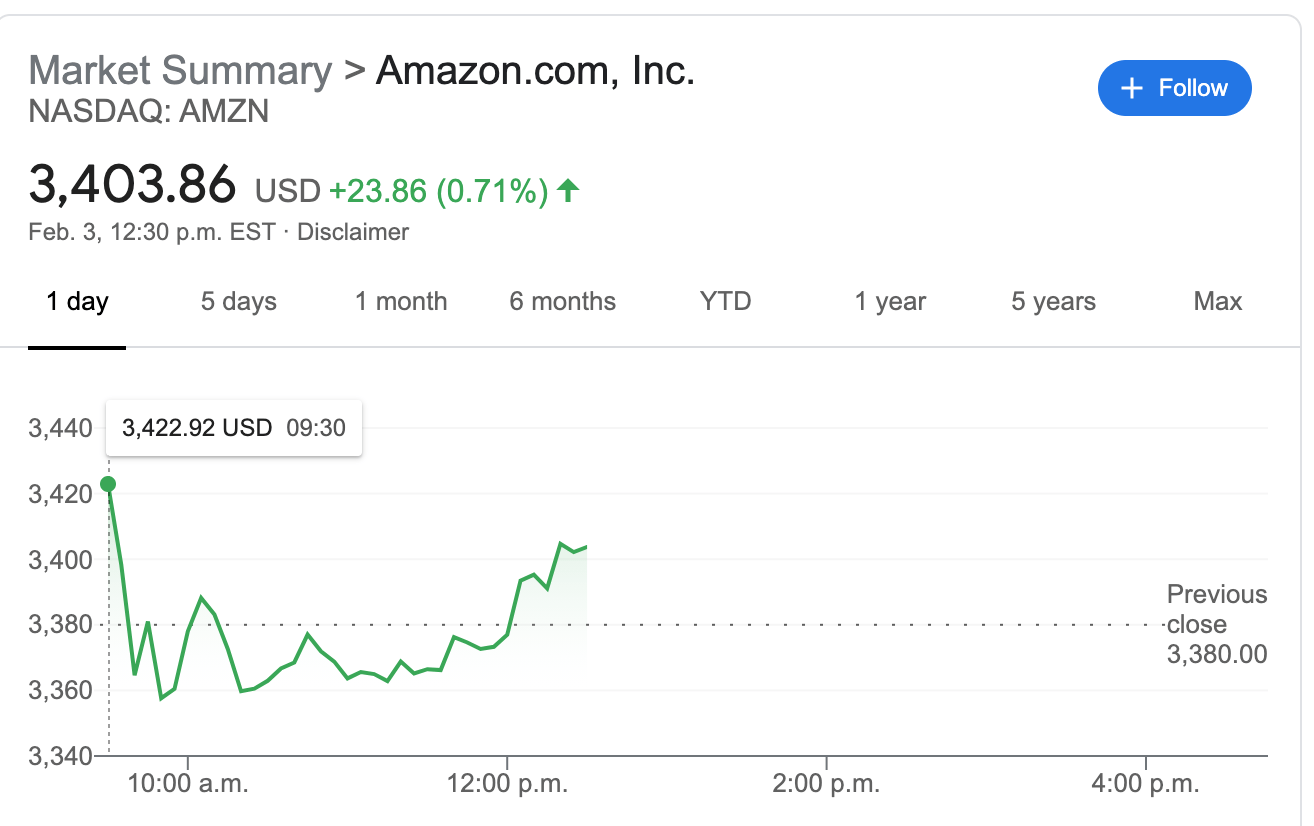

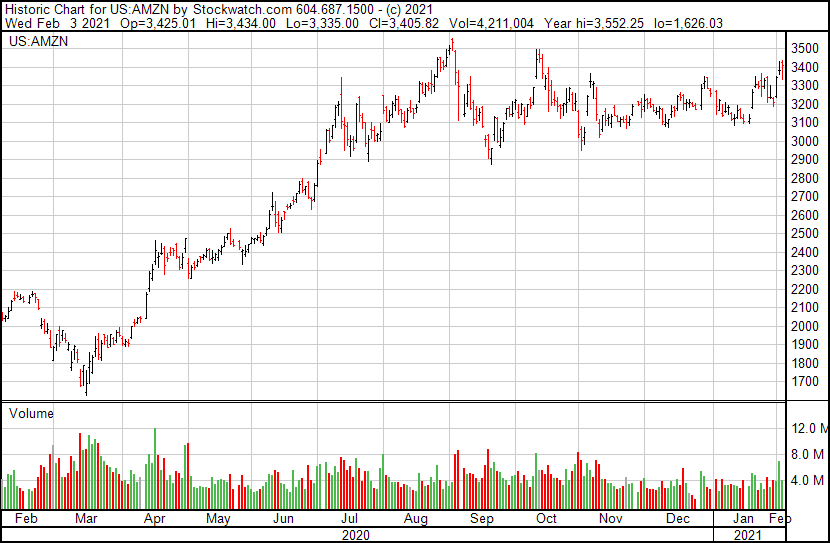

Amazon stock dipped ever so slightly on this announcement the next morning. It has now fully “recovered” and it’s going for all-time highs. The slight dip this morning was due to market makers or speculators settling some of their overnight transactions.

You would assume such an announcement would cause the stock price to drop dramatically, but when you factor in the fact that Bezos still owns just over 10% of the company and will continue as an executive chair to the board of Amazon, this surprise announcement opens a new age for Amazon.

In his press release, Jeff Bezos stated that :

“Amazon is what it is because of invention. We do crazy things together and then make them normal. We pioneered customer reviews, 1-Click, personalized recommendations, Prime’s insanely-fast shipping, Just Walk Out shopping, the Climate Pledge, Kindle, Alexa, marketplace, infrastructure cloud computing, Career Choice, and much more,” said Jeff Bezos, Amazon founder, and CEO. “If you do it right, a few years after a surprising invention, the new thing has become normal. People yawn. That yawn is the greatest compliment an inventor can receive. When you look at our financial results, what you’re actually seeing are the long-run cumulative results of invention. Right now, I see Amazon at its most inventive ever, making it an optimal time for this transition.”

This sort of announcement is usually somber, but he makes it seem so optimistic. Although various stakeholders are yawning today about Amazon, we always need to appreciate the sheer pace at which this company has grown.

Amazon’s IPO commenced in 1997 and was trading at $1.73 per share. Since then, the stock has gone up by a compounded annual rate of return of just over +30%. Today as of this writing, one share in Amazon is worth $3,323.16. If an investor had put $10,000 (and made no further contributions or deductions) into Amazon in 1997, they would have a total of $20,170,875.90, for a total return of +191,990% over this 23-year period. (not adjusted for inflation)

If those numbers don’t shock you, let’s look at how fast the company has actually grown relative to the stock’s appreciation. At the end of December 1995, Amazon had generated a total of $ 511,000.00 in sales, -$303,000.00 in profits whilst utilizing $ 1,084,000 in Assets and $ 977,000 in equity capital. At this time, it was only an online bookstore (how captivating is that?).

Fast forward 25 years and Amazon is now generating a total of $ 386,064,000,000 ($ 734,520.55 per minute) in sales, $ 13,180,000,000 ( $ 25,076.10 per minute) in profits. All of this whilst using $321,195,000,000 in Assets and $93,404,000,000 in equity capital. Now it basically sells everything (yawn!)

For those of you who are nerds like me, and love numbers and the power of compounding, let’s even go a little deeper. Jeff Bezos and his team grew sales by a compounded annual rate of return (CAGR) of about +58% and grew assets by a CAGR of +62%. This kind of growth is just amazing when you think about some of the stuff that’s happened in the last 25 years.

No wonder he feels this is the right moment for him to step down and allow other minds (specifically the current president of AWS Andy Jassy) to spearhead the tailwind for Amazon for the next decade or so.

The stock is up by 61% for the year, and this is just the perfect time for such an announcement. It leaves so much open to interpretation, especially by Wall Street analysts who tend to get a lot wrong (but what do I know, I’m just a guy who writes about companies )

It’s important to note that Jeff Bezos is not leaving Amazon completely but will probably have an advisory role for the foreseeable future. He will probably spend most of his time working on space exploration, philanthropy, and other billionaire activities that they keep secret from us regular plebeians.

If you’re a current Amazon shareholder, just hold the bag, there’s no better way to say it, this transition might not change a lot in the business. Only time will tell what actually happens. It’s always sad to see a founder leave their life’s work because we know what kind of passion goes behind these kinds of endeavors. Amazon will probably continue to be a market leader ( approximately 11% market share in online retail), and with time we can expect this rapid growth to plateau as the business matures and the market becomes increasingly oversaturated.

For those of you who are thinking about becoming potential Amazon shareholders or just love valuing businesses (like myself ), let’s have some fun and update our models, to see how much Amazon stock should approximate over the next 10 years.

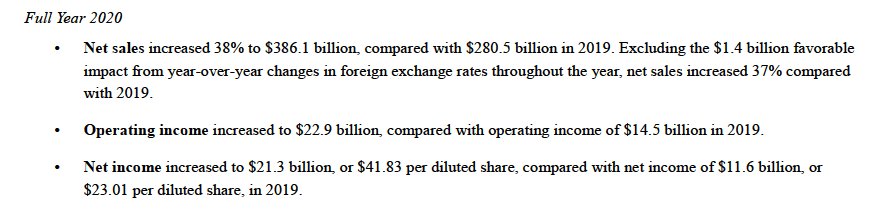

The excerpt above is from their current Q4 2020 press release. At year-end, they had $386.1 billion in net sales which was a 38% increase compared to 2019. This massive increase in sales also reflected itself in the bottom line with a net income of 21.3 billion or 41.83 dollars per share for 2020.

At this point, Amazon has a steady customer base and is constantly growing by acquiring smaller businesses in retail, wholesale, and the Internet of things. This diversity in their portfolio of businesses while rarely being responsible for production, allows the company to be profitable even with lines of businesses that have thin margins. It has recently concentrated on its Internet of Things segment because this segment produces the highest profit margins.

Knowing this we can assume the business will grow between 10% to 20% for the next five years and after that, growth will plateau to the US economy’s gross national product of about 1-2%. Assuming the company will be able to produce a net income of 21.3 billion and adjusted for inflation, foreign exchange rates, the risk appetite of the investor, and other unknowns, we get a conservative price range between $1,658.2 to $2,504 (margin of error is $846).

This gives us an average intrinsic valuation of justice over $2,000 per share. Sadly, this might not be the best time to pick up Amazon stock but there are analysts on Wall Street who believe the stock should be worth $5,200 and others who think it should be worth $3,048.00 (margin of error of $2,152), meaning their average price target is just below $4,000 per share. (Yikes! I don’t know about you but that’s a really wide margin of error).

Although we might not be able to get into Amazon at $1.73 per share today, the market always gives you opportunities to buy great businesses at bargain prices. There are many ways to make money in the market, which doesn’t mean any of them are empirically right, but it’s always best to buy something for less than it’s actually worth. There has been no better way in the history of the capital market to make money as an investor than that. (Gamestop and Tesla short-sellers, I’m looking at you!)

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.