Crude Oil prices have surprised many investors and traders throughout 2020. Similar to Copper, in a sense that both are an economic recovery play. Way back last year, we saw Oil hit 0, a day I still remember. A few weeks after, Oil formed a head and shoulders reversal pattern. The uptrend has been held since that pattern printed, overtaking $50 a barrel, and surpassing price levels before the pandemic.

But we have finally now hit a major resistance zone which could signify a shift in trend. Is a new downtrend ready to begin?

First of all the fundamentals. Oil above $50 is big because it signifies a recovery. Even with second lockdowns in many nations, Oil continues(d) to move higher. The catalyst was the Covid Vaccine. In a previous Market Moment post, I aptly said that Oil is the true Covid Vaccine play. With a vaccine developed, the question now becomes how quickly it can be distributed and how quickly will people get inoculated. Hedge fund managers like Kyle Bass, see this being bullish because the demand for air travel once things re-open will be greater than many expect. People will want to live life and do things they were holding back on due to lockdowns. Traveling more is on the top of most people’s list, but they will only do so once they feel safe. Jetfuel demand will be overwhelming, and it will take most of the market by surprise.

The second major fundamental is of course OPEC. The oil cartel is saying that demand for oil is cloudy due to pandemic uncertainty. What kind of uncertainties you say even with a vaccine? Well, maybe a stronger mutation means the vaccines become useless, and we go back to lockdowns. Nevertheless, OPEC members have decided to maintain their production cuts due to low demand.

OPEC discussions can be an issue going forward with surprise cuts or production increases. The Biden https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration and their green energy plan will be seen as negative on fossil fuels, but the truth is we cannot phase out of oil very quickly. Oil will still be here.

One of the biggest stories in Canada yesterday was a rumor that the Biden https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration plans to cancel the Keystone XL permit on his first day in office. Not looking too good for Alberta, and the secession movement will just get stronger.

When it comes to fundamentals, one large sticking point are the balance sheets of the major Oil companies. Yes, I know that many Oil company balance sheets are bad, but I have told my readers that in this irrational exuberance fueled market, investors will look for things that are ‘cheap’. Our options were limited to airlines, cruise ships, banks and energy stocks which took a major beating. Energy just looked the best because these companies will continue to pump, and with rising Oil prices, can churn out a profit.

Regardless of what you think about Oil , it has surprised many people who were bearish the commodity. I trade the markets I see, not the ones I hope or want to see. Emotions are set aside. I have profited on the way up, and I believe there is an opportunity to play a short.

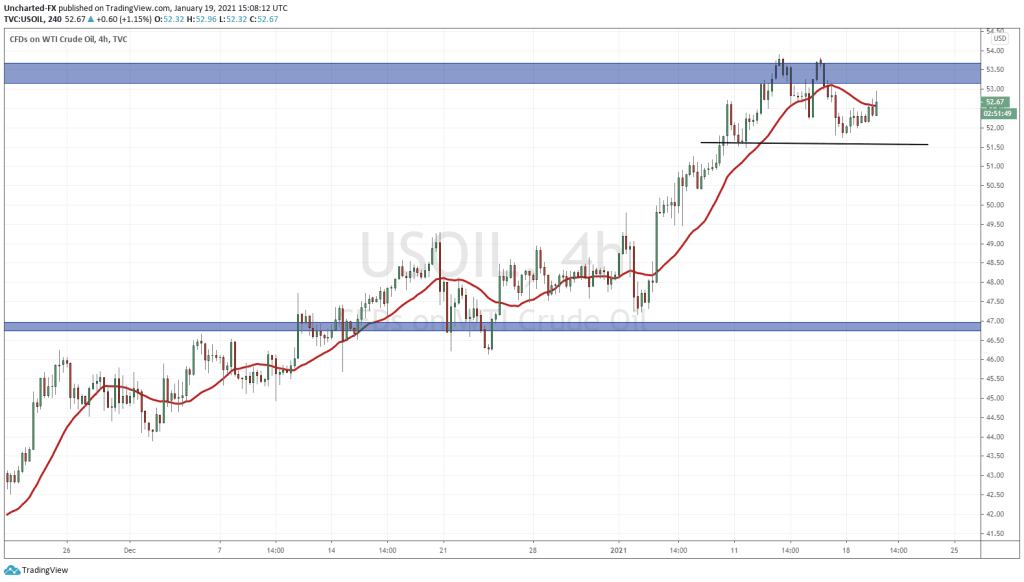

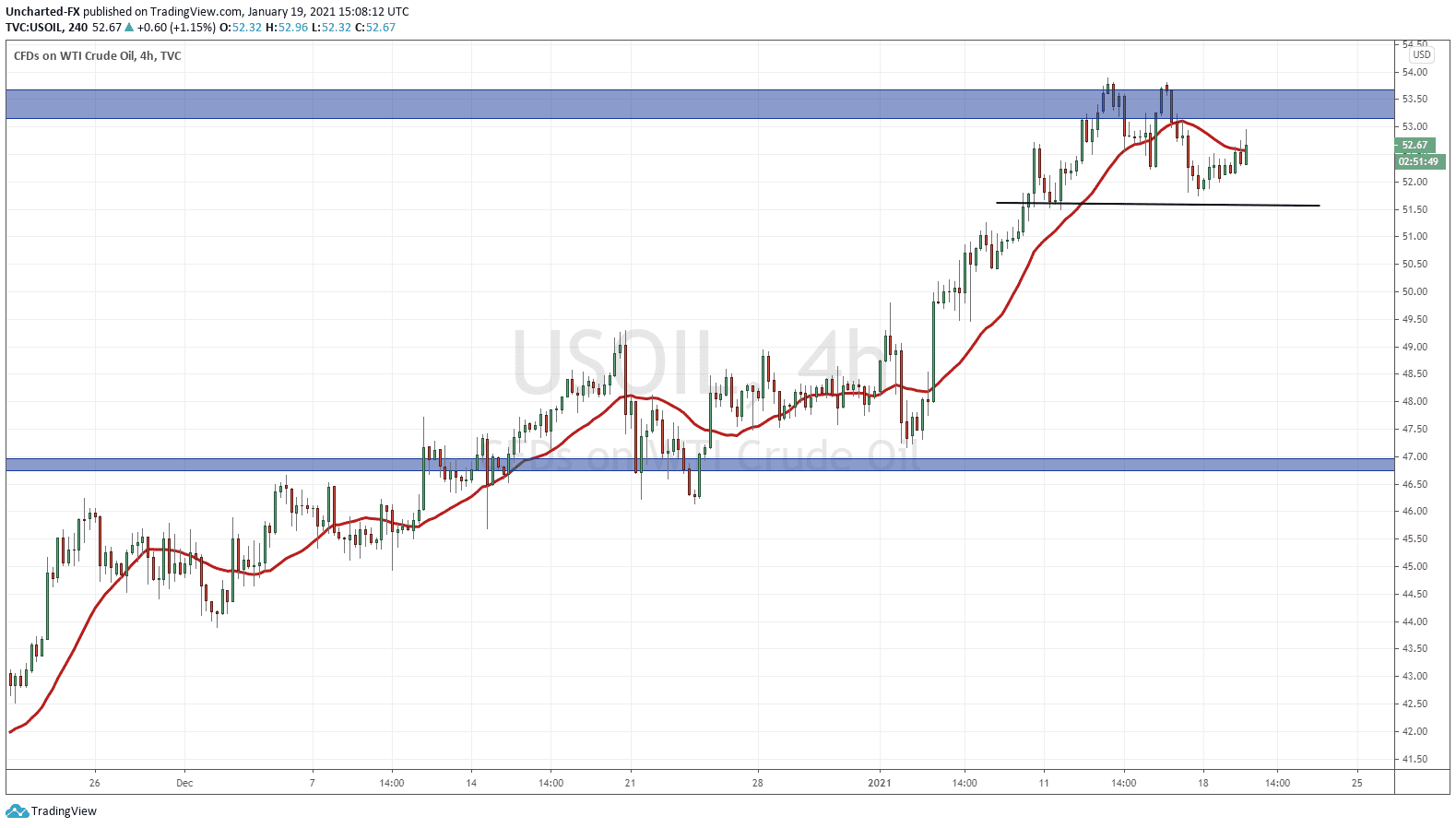

Starting with US Oil (West Texas), the 4 hour chart is showing some price reaction at the major $53.50 resistance zone. I recommend going out to a longer daily time frame to see why this area is major resistance (or just look at the charts of my previous Oil posts). A good zone for profit taking and a trend reversal. If you don’t want to, that’s okay, this zone is super important because this is where Oil sold off during the pan sell off on Covid in February 2020.

Most of my readers already see the pattern that is forming. The reversal pattern known as the double top, and looks like the letter ‘M’. In fact the short was triggered yesterday, but there was one major issue: US markets were closed due to MLK Jr Day. When the US markets are closed, a lot of liquidity is lost, and breakouts tend not to carry that momentum.

Nevertheless, we are seeing some sellers step in now as price approaches $53.00. A break below $51.00 will trigger our shorts to the downside. One can enter now if they want for a better risk vs reward set up, by placing a stop loss above $53.50. The target to the downside would be the $49.00 zone, although pay attention to how price reacts at the psychologically important $50.00 zone.

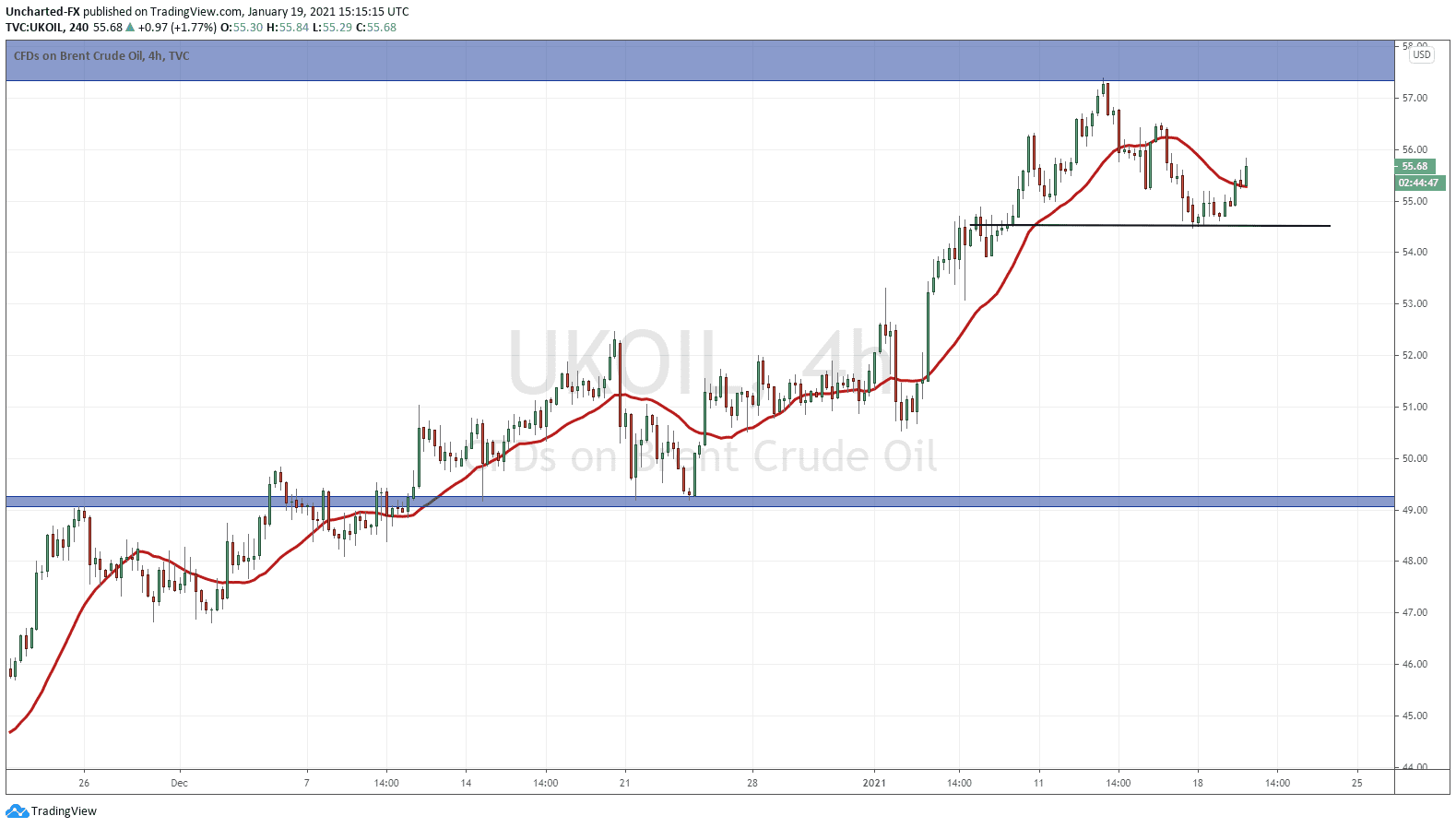

UK Oil, or Brent crude, looks just as nice. Instead of our double top pattern, we have a head and shoulders reversal pattern.

The same technicals and analysis apply: at a major resistance zone, and a breakdown would trigger the reversal. To the downside, I would target a broad zone between 51.00-52.00 as it is a major flip zone (an area that has been both support and resistance in the past). For an entry, you can enter right now frontrunning the breakdown lower, or wait for price to break below $54.50. A reminder the trade off is entering now for a better risk vs reward but a reduced probability of success, as price could just continue the uptrend, versus awaiting for the breakdown to trigger the downtrend and have a higher probability of success for the trade.

Oil is the lifeblood of the economy, and higher prices are pointing to a recovery. Not just in China, but worldwide. Other ways to play Oil would be with currencies highly correlated with Oil. I am talking about the Canadian Dollar, the Russian Ruble and the Norwegian Krone.