You’ve built a decent little company. You’ve grown some brands. You’re feeling okay about things when a bigger company comes along, offers you a bunch of their stock, making you a significant shareholder, and tells you there are other strong hands in the investor base, including the wealthy chairman who has been lending the company money whenever it’s needed.

It’s all going to be great.

Except, a month later that stock is worth 20% of what it was, because the guys buying your company have filed for creditor protection. Their stock is basically worthless, and their chairman, who loaned money to the company just before you came in, is looking to buy up the assets for pennies and take the whole thing private.

Your assets included.

How steamed would be?

WELCOME TO BZAM LTD:

Middle-East funded cannabis pubco BZAM Ltd (BZAM.C), which had snared troubled assets such as The Green Organic Dutchman and Ascent Industries during its relatively short lifetime on the public markets, applied for creditor protection today, claiming it needed time and space to restructure their business and financial affairs.

That was seemingly news to Final Bell Industries, which merged with BZAM less than 60 days prior, and agreed to terms on the basis of what it says were statements, representations, and warranties by the company that supposedly presented a solid financial future.

Earlier today, BZAM announced the reshuffle.

Due to, among other things, margin pressures caused by significant competition and the fragmentation of the cannabis industry, and financial underperformance and pressures resulting from obligations owing to creditors, the BZAM group has been unable to generate positive cash flows and has incurred cumulative losses. After careful consideration of all available alternatives, the board of directors of each member of the BZAM group determined that it was in the best interest of the BZAM group and its stakeholders to seek creditor protection under the CCAA.

Translated: Nobody could have seen this coming, the industry is just hard, we’re just a bunch of kids trying to do the best we can in this crazy mixed up world..

Half an hour later, Final Bell went public with their side:

BZAM’s acquisition of FB Canada closed on January 5, 2024, and resulted in the Company becoming BZAM’s second largest shareholder, its largest unsecured lender and a key supplier of hardware and packaging on an ongoing basis,” a news release from Final Bell said today. “The acquisition involved extensive due diligence by the Company based on material provided by BZAM and its management, together with BZAM’s public filings, and the Company relied on representations and warranties made by BZAM and its management to support the value of the consideration received by the Company and BZAM’s ability to service its debt obligations to the Company. The information resulting from such due diligence, together with the representations, warranties and other agreements at closing of the transaction, also formed the basis for the Company’s senior secured lender’s agreement to release its comprehensive security package over FB Canada in favour of a charge over the consideration received.

Translated: These MFs told us their shit was going to hold together, took our asset, blew some stock out to us, then called in the receivers.

- At the time of the transaction, FBC got 90 million shares of BZAM at $0.15 per, or $13.5 million.

- After the creditor protection announcement, those shares are worth $$0.03 per, or $2.7 million.

BZAM also got a promissory note from FBC for $8 million at 0% interest.

Who’s to blame?

It was only last month when both parties were peddling this bullshit to investors:

The combination of BZAM and FBC creates a Canadian cannabis powerhouse, significantly advancing core tenants of BZAM’s mission: (i) to deliver the brands and products consumers want; and (ii) to be a favoured partner of the retailer community nationwide.

The following month, that ‘powerhouse’ is in creditor protection.

Let’s be honest:

BZAM’s cursed existence was hardly a secret. For much of its lifespan, BZAM has made a practice of buying things that nobody else wanted in the hope they could turn things around. They’d come in looking for pennies on the dollar when the only other option was a liquidation sale, and now they are the same tainted meat they once fed on.

Since early 2023, BZAM has been selling physical assets, shutting down SKUs, taking $60 million write downs on assets.. it’s been a dog’s breakfast for a long time, and shown absolutely no sign that it could right the ship before it could turn a corner.

Highlights:

- Q2: $65 million loss with $60 million of that in write downs

- Q3: $12 million loss despite selling grow facilities worth millions

- Millions in loans from the chairman

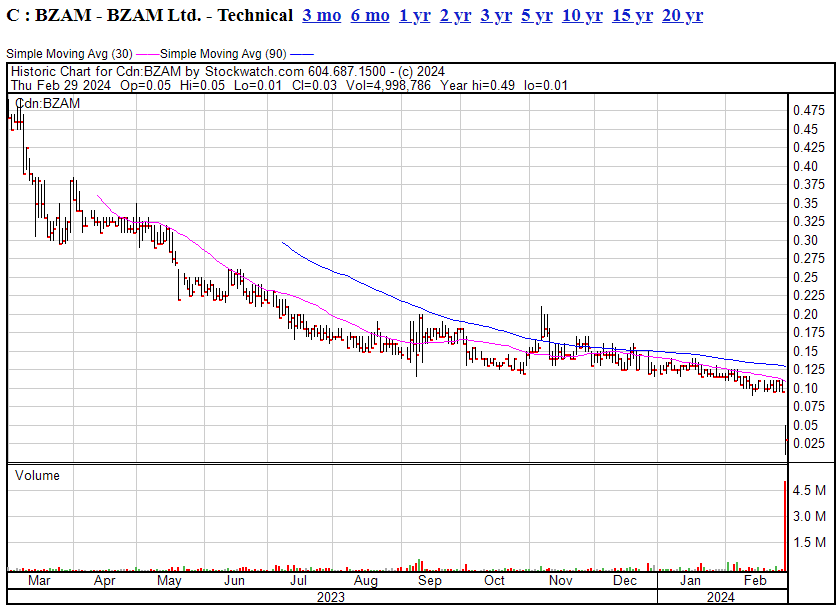

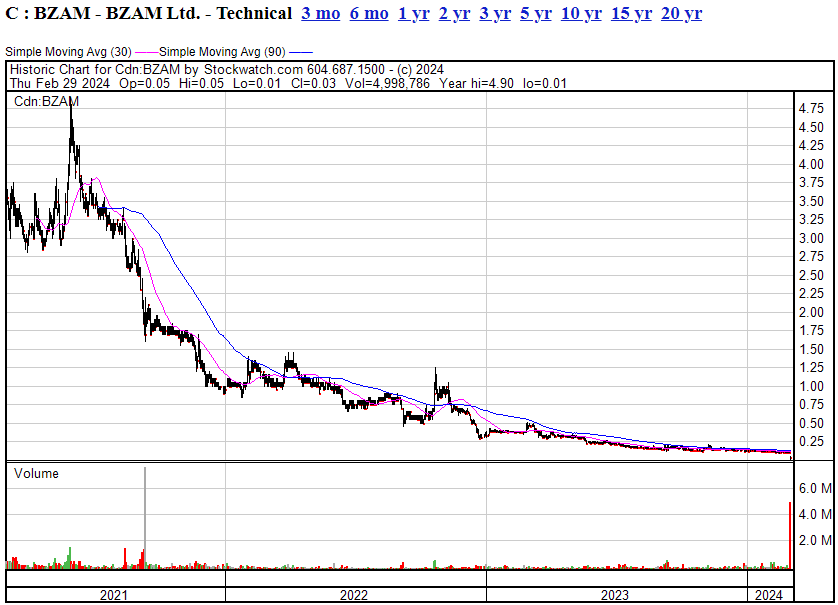

The markets knew. The stock had been sliding for a long time and no good news was moving the needle.

And if you think that chart looks bad, roll it back to the 5 yr chart and you may lose your breakfast.

Maybe FBC were naive. Maybe they thought they had inside info on BZAM that pointed to a big win being in the works.

Either way, they’re about to be sold to ‘the creditor’ for pennies, a month after they signed their deal.

The stay of proceedings and DIP Financing will provide the BZAM Group with the time and stability required to consider potential restructuring transactions and maximize the value of its assets for the benefit of its creditors and other stakeholders. This may include the sale of all or substantially all of the business or assets of the BZAM Group through a court-supervised sales process.

In that regard, the BZAM Group intends to seek Court approval to launch a sale and investment solicitation process for its business and assets (the “SISP“) on or around March 8, 2024. [..] In connection with the SISP, BZAM expects to enter into a transaction with an entity related to an existing creditor and significant stakeholder of the company to acquire substantially all of the business and assets of the BZAM Group (the “Stalking Horse Transaction“).

The Creditor, you say?

So yeah, that ‘existing creditor’ would be the chairman of BZAM, Bassam Alghanim – the one loaning it money in financial quarters prior.

Final Bell will no doubt ask the courts to undo the transaction, or block the creditor protection process and, morally speaking, the courts should do exactly that since, clearly, BZAM hosed Final Bell in this deal.

But ‘morality’ may not be the final measure when legality is being assessed.

Our view: Yes, BZAM hosed Final Bell here but, honestly, what was Final Bell doing closing this deal when any cursory look at BZAM’s share price and newsflow over the last year would tell you they were on death watch?

Anyone left in the Canadian cannabis game right now is either a cultural enthusiast or a frustrated asset seller at this point, and if the only option you have to stay alive is to take on someone elses disintegrating paper, you can’t really complain too hard when that paper becomes worthless before the end of the quarter.

No winners here, just douchebags riding out the clock on an industry forever darkened by those using it to lever cash out of other peoples pockets.

— Chris Parry

FULL DISCLOSURE: No dog in the fight. TGOD and Ascent were clients back in the day, and both of them screwed over investors in ways most shameful.

These crooks including Aurora and auxly screwed my life savings big time…. I hope I will meet them in hell…