Electric Royalties Ltd. (ELEC.V) opens a new avenue for investors seeking both profitability and sustainability in the exciting green energy sector. The rise of the green energy sector has been fueled by the prediction we will reach peak oil as early as 2030. The McKinsey Global Energy Perspective 2023 also points out that renewable energy sources, led by solar and followed closely by wind are expected to provide between 65 and 85 percent of global power generation by 2050 despite headwinds like supply chain disruptions and rising costs.

A Diverse Portfolio with a Sustainable Focus

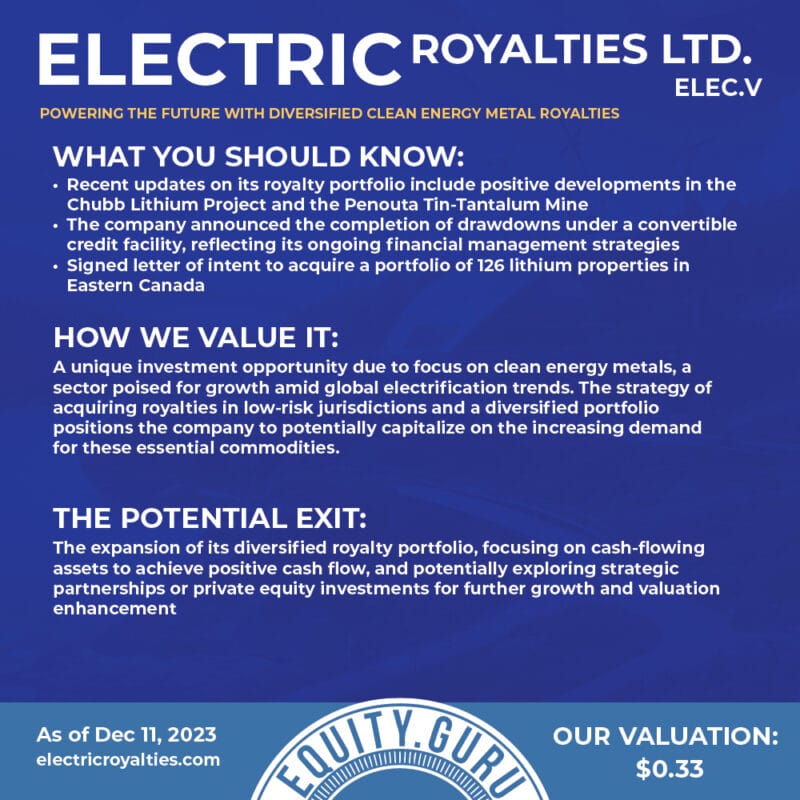

Electric Royalties Ltd. sports a diversified portfolio with 22 royalties. These royalties span across various minerals essential for clean energy production, such as lithium, vanadium, manganese, tin, graphite, cobalt, nickel, zinc, and copper. This diversification not only mitigates risk but also ensures exposure to multiple high-demand commodities in the green energy transition. And that transition is already in motion. In fact during the first half of 2023, there was a 16% increase in solar generation with the U.S. solar industry expecting a growth trajectory of 55% by year’s end.

Strategic Investments in Low-Risk Jurisdictions

Many of the countries in the world that are rich in resources are also plagued by instability and corruption. Miners that operate in these troubled areas which include Brazil, Ghana and the Democratic Republic of the Congo are beset by exploration and operational challenges beyond the business of mineral resource development, substantially increasing investment risk. Electric Royalties Ltd. avoids this by strategically investing in jurisdictions with lower geopolitical strife and a pro-mining sentiment.

Aligning with the Global Electrification Trend

The global push towards electrification, primarily driven by the electric vehicle (EV) market and the shift to renewable energy sources, presents a significant growth opportunity for Electric Royalties Ltd. The global electric car market saw a remarkable increase in sales, exceeding 10 million in 2022. This represented 14% of all new car sales, a significant jump from around 9% in 2021 and less than 5% in 2020. China continues to lead global sales, accounting for around 60% of these sales, followed by Europe and the United States.

Sales in the U.S. alone increased by 55% in 2022, and electric car sales in Europe rose by over 15% in the same year. Overall, electric car sales are expected to reach 14 million by the end of 2023, representing a 35% year-on-year increase. And as countries and corporations worldwide commit to carbon neutrality, the demand for the minerals in Electric Royalties’ portfolio is set to increase further, potentially leading to an appreciation in the value of its royalties.

What We Think

A Vision for the Future

Electric Royalties Ltd. isn’t just about capitalizing on current trends; it’s about being part of a long-term solution for a sustainable future. The company’s focus on clean energy minerals aligns with global efforts to combat climate change and transition to a greener economy.

For instance, in the United States, President Biden’s Federal Sustainability Plan, issued in December 2021, outlines a comprehensive strategy to transform government operations. Key objectives of this plan include achieving 100% zero-emission vehicle acquisitions by 2035, 100% carbon pollution-free electricity by 2030, and net-zero emissions in federal buildings by 2045. This plan is part of a broader effort to reduce U.S. greenhouse gas emissions by 50-52% from 2005 levels by 2030 and to limit global warming to 1.5 degrees Celsius.

Internationally, the Net-Zero Government Initiative, launched at COP27 and expanded at COP28, has brought together 30 countries across six continents. These countries, including Andorra, Bulgaria, Chile, Costa Rica, Croatia, Estonia, Italy, Luxembourg, Monaco, Nigeria, and Spain, have committed to achieving net-zero government emissions by 2050. This initiative highlights the role of national governments as major energy consumers and purchasers in driving global climate action

Electric Royalties’ mandate positions the company as a forward-thinking player on the front of this necessary long term global trend.

Financial Performance and Future Prospects

Electric Royalties is in its emergent state and of its 22 royalty holdings only two are producing at this point with a graphite project in Quebec expected to commence first-phase production in 2026. There is also some patented IP in the works with Manganese X Energy, one of Electric’s royalty holdings. The remaining exploration royalty assets are continuing to further exploration and build resource numbers. The company has reported revenues for the last three quarters. At $84,000 CDN for the three months ending September 30, 2023, there’s not a lot to write home about, but Electric is managing to keep its quarterly net losses within a range and just may be able to chip away at that to be in the black in the next two years once the graphite project goes into production.

Conclusion

Electric Royalties Ltd. offers a unique blend of sustainability and diversification in alignment with global electrification trends. For investors looking to tap into the green energy sector, this company presents an interesting opportunity for potential growth, but its early stage business also presents commensurate risk. As always, do your due diligence and speak with an investment professional before making any portfolio decision. Good luck to all.