Several years back, Hugh Rogers was in my office talking about his cannabis company. Way back then, the plan was to grow in Germany and be first on the continent, using an old wartime bunker as a ‘safe growing facility’. Those plans morphed quickly as the reality of the cannabis space became clear.

The cannabis market did what it did, and weed wasn’t all it was cracked up to be… this is no secret. But while some ran their weed deals into walls and off cliffs like Wile E. Coyote, insisting any day now the good time would start to roll… Rogers tacked left.

EVOLUTION BEATS REVOLUTION

Rogers didn’t pivot in the strictest sense – to me, pivoting means you’ve screwed up and have to handbrake turn things another way. Rogers didn’t do that. He veered, and adapted, and rolled into the world of psychedelics.

Okay, we all know plenty of folks did that, and once again the tendency was to run their deals into those same anvils and walls painted to look like tunnels, but as that business got lumpy, Rogers tacked again, rolling in an oral dissolvable film tech that could be used to deliver pain medication and psychedelics, among a container-load of other things.

He also opened a subsidiary, Vektor Pharma, a drug development and manufacturing company, licensed for “the design, testing and manufacture of innovative, non-invasive drug delivery systems, particularly transdermal patches and sublingual strips for the delivery of active pharmaceutical ingredients for the treatment of pain and neurological conditions.”

When Covid hit, he utilized that IP and infrastructure to pull in a diagnostic testing kit that could be used for Covid-like issues, early detection of infection in dental implants, as well as oral dissolvable testing for Influenza A (such as swine flu and avian flu), when the world was crying out for just that.

The common factor tying all of these plans together was not just being around whatever’s in the zeitgeist, but the delivery systems and technology and licensing that could be used along the way. Sure, the company was of interest to weed, shroom, and Covid investors directly, but the underlying tech that tied it all together wasn’t WHAT was being delivered, but HOW, and that meant Bionxt IP had uses in far more than just those base industries.

I’m not going to try to tell you Rogers planned that all along – I’m quite sure he didn’t. But one thing he’s been very good at is keeping his company leaning into the wind, and knowing the right time to tack as the winds begin to change.

Bionxt Solutions (BNXT.C) is still running with a full sail, having just engaged in a decent sized financing, picked up more IP on the medication delivery tech side, and more IP on the medicine side, and has figured out a way to roll all of that tech into one potentially huge product that may be better, more effective, and potentially far more profitable than what came before it.

WHATS THE PRODUCT?

I’m glad you asked.

Cladribine was an oncology medication for some time, approved for use in 73 countries around the world, and recently discovered to be effective in treating highly active forms of relapsing-remitting multiple sclerosis.

That’s great! And MS patients would agree, as they’ve been using the medication for some time now.

But that medication has a bottleneck.. it comes in pill format.

That may be fine for you and me, but it’s a poor deal for MS sufferers because over 40% of them struggle with a gag reflex when taking pills, and those that can get the pill down absorb the medication through their stomach which, from a bioavailability standpoint, is not the ideal way to take in a drug that needs to be in your bloodstream. Dosage has to be higher when not all of it going to get through, and accurate dosing may be difficult or inconsistent using that format.

Thankfully, Bionxt has an oral dissolvable film tech that it’s applying to Cladribine, which looks to make the drug much more bioavailable, would allow for lower, more consistent dosage, and would be easier to use for more patients.

That ODF platform is useful for an array of other things – such as psychedelics – but one thing at a time now, lads.

The potential market for MS treatments is $43 billion a year currently, with over 2 million MS patients worldwide. With other applications possible for leukemia and cancer, Bionxt is focused on ensuring this vertical moves quickly through testing, approval, and commercial application.

WHAT ELSE ARE THEY ROLLING WITH?

The company is also running a comparative drug absorption study for the company’s transdermal (TDS) rotigotine patch for the treatment of Parkinson’s disease and restless leg syndrome, and acquired a novel solid oral drug dosage form coating and delivery technology earlier in 2023 that compliments the transdermal and oral dissolvable drug delivery platforms already in the Bionxt portfolio.

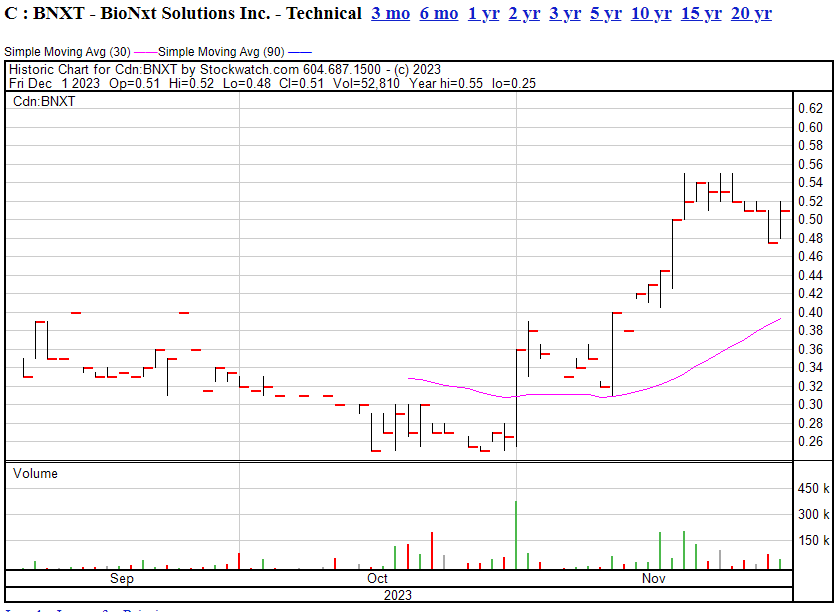

On the financial side, Bionxt ran a roughly $1m loss last quarter, before raising $2m, and while cutting the previous quarter’s loss by around 30%. If they can continue that cost cutting while at the same time expanding their IP and product streams in the way they have, (and as the stock has run up almost 75% in a month), Bionxt will be in good shape going forward.

— Chris Parry

FULL DISCLOSURE: Not a client company, at least not for four years now, but I’, long on the stock and believe it’s getting to where it needs to be.