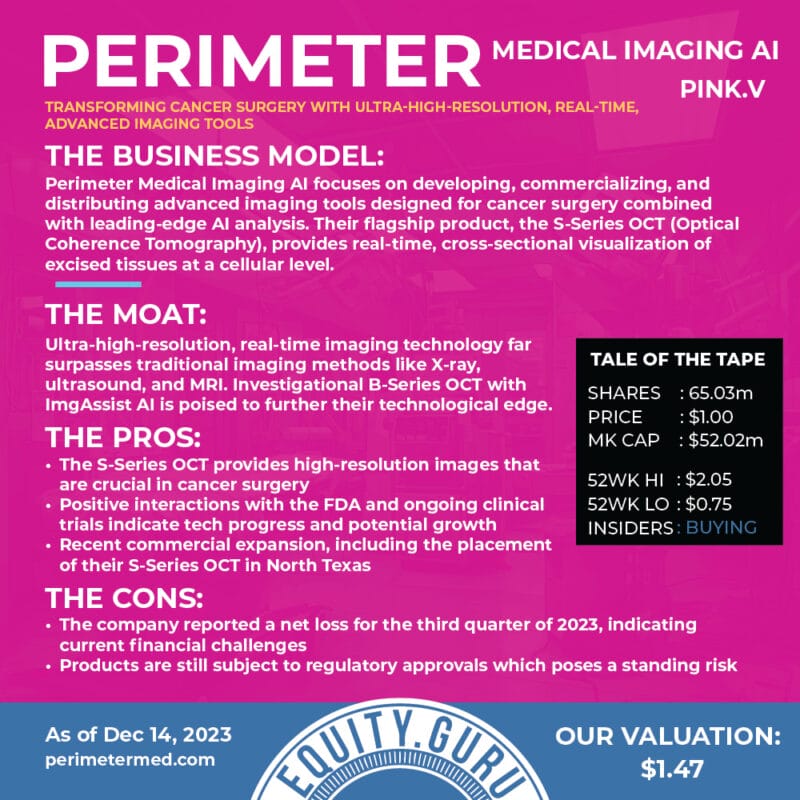

If you’ve been around here for a while, like going back three years or so ago, you may recall a former client company in Perimeter Medical Imaging (PINK.V).

I really loved repping PINK, because sometimes it’s nice to be able to say that you really ARE trying to cure cancer, and make some profit while doing so – and we did both. Keeping mam’s yams safer from cancer surgeries is a noblke cause, and if you can help that along with your investment dollars and be repaid not just with karma but also dollars, that’s the be all/end all.

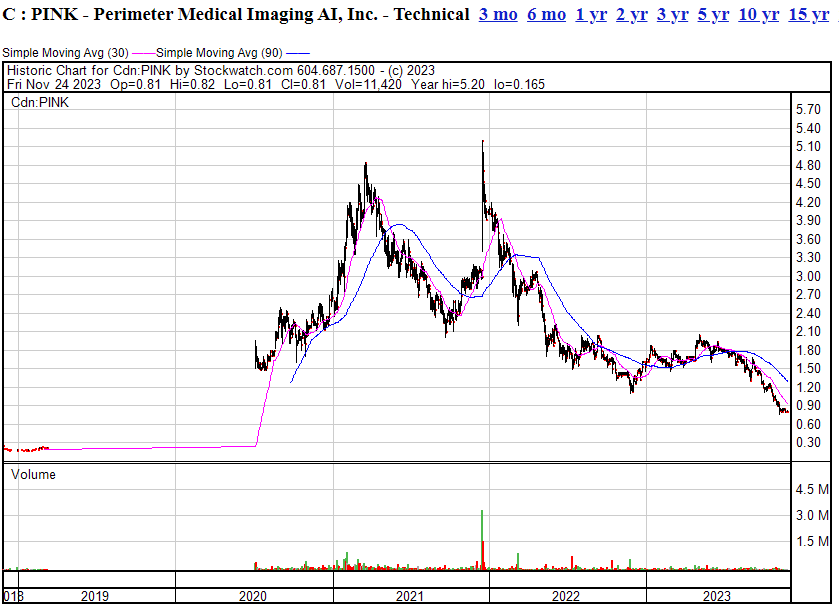

But while we watched the company climb from $1.50 to over $4.80 in 2020/2021, there comes a time where a fair valuation has been reached, and you’ve got to lock in your gains.

We did so in the mid $3 range, so we missed the high, but we also missed the slide back to $2.10 over the next ten months.

A quick burst of energy saw the atock run again to over $5 for a hot minute but, since then, it’s been a steady slip down to, now, $0.81.

I’m reticent to suggest that’s as low as it’ll get, because even though it’s forming a bit of a base, it did that back at $3 and $2 back in the day, anbd the trading volume right now is spartan so any jump in buying or selling will likely cause a lot of friction.

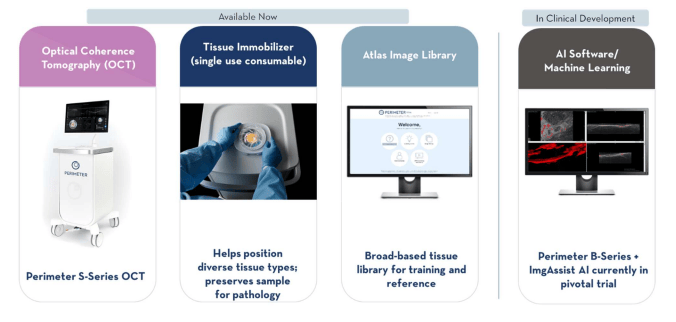

Perimeter, as a company, has moved on and advanced a lot from what it was back when we were telling you about it in 2020. The basic tech remains the same – they have a tool that allows cancer surgeons to quickly scan for removable mass, allowing the surgeon to see how they’re doing while actively working, rather than guessing, closing up, and waiting a few weeks for new scans to see whether they have to go back in.

This is great for a lot of reasons;

- Fewer re-surgeries because there’s a higher likelihood of initial success

- Less unnecessary cutting in the surgery proper because the surgeon doesn’t have to guesstimate

- Less expensive to be able to avoid going back for more work, meds, and hospital time

- Less onerous on the patient – one surgery is ideally plenty

- 10 x higher resolution than traditional x-ray, and 100 times more than ultrasound

If you were here back in the day, this will sound familiar, because it was the pitch when the tech was new.

So what’s different now?

- FDA Approval and Commercial Availability: The Perimeter S-Series OCT system is cleared by the U.S. FDA and commercially available across the U.S., offering potential for widespread clinical adoption

- Innovative AI Development: Perimeter is developing “ImgAssist AI,” a machine learning and AI technology, with support from a $7.4 million federal grant, which could further enhance the efficiency and effectiveness of their imaging system

- Clinical Trial Progress: The FDA granted Breakthrough Device Designation for the Perimeter B-Series OCT combined with ImgAssist AI, and a pivotal study is underway to measure its effectiveness in breast lumpectomy procedures

That new AI tech addition explains why it’s now called Perimeter Medical Imaging AI, Inc now, and while it makes all the sense in the world to train AI to look over the scans, that news eminated back in 2021, so it’s been sitting on the vine for a bit, meaning it’s not giving PINK any of that ‘we too are an AI company’ madness that some pubcos have received.

In April 2021, the FDA granted a Breakthrough Device Designation for Perimeter B-Series OCT combined with + ImgAssist AI, allowing for accelerated interactions with the FDA during product development and prioritized review of future regulatory submissions. In November 2021, the FDA granted an Investigational Device Exemption (“IDE”), enabling the ATLAS AI Project to move into the next validation stage of clinical development by evaluating Perimeter B-Series OCT with + ImgAssist AI in a pivotal study.

Don’t get me wrong, that news was what popped the stock back over $5 back in the day, but none of that has held to this point.

Right now, PINK is rudderless, as far as the markets are concerned. The story has been forgotten, management has churned, the stock price has been unsupported and the news everyone would be waiting for – FDA trials ending and approval being given – could take a while.

So why would you buy now?

For mine, the current price may be an opportunity, for a few reasons.

First, revenues are minimal right now, which is the first thing potential investors look at and likely scares a lot away. I’m not bothered about that because the company isn’t at the monetization point yet, so what revenues do come in are incidental – testing machines and pilot projects and consumables for those who already have one.

The more important numbers, for mine, are the profit/loss:

For the three months ended Sept. 30, 2023, the net loss was US $344,792 compared with US $660,781 during the same period in 2022.

The loss in Q2 was US $4.9 million, so $344k is manageable.

Muh brothers, where the runway at?

As of Sept. 30, 2023, cash and cash equivalents were $18,105,837.

That’s a LOT of runway.

Considering PINK is engaging in expanded FDA trials, while selling the occasional machine to hospitals to get a sense of it, and with permission to sign up more patients so they can properly sample size their effectiveness. That’s FURTHER along than it was back when we started on this journey, but you can buy some at half the price you could have bought it at, on the opening day of its public existence.

I could say more but, it’s worth repeating, they’re not a client anymore. I’m only here updating y’all because, when I look at what it was back when PINK was blazing a stock market trail, and I see what they have now that is BETTER and MORE ADVANCED, this is clearly a better company today.

They won’t make a profit next quarter, but if they can keep progressing, pulling in federal grants, and get that AI product functional, there could be a real launch point here, and soon.

And, hey, maybe they could start marketing themselves to investors again some time.

Get it on your watchlist. Save the yams.

— Chris Parry

FULL DISCLOSURE: Not a client, don’t own it, no commercial relationship, just think it’s getting close to go time.