About a week ago, we noted a company we’ve been watching for a while, Nicorp Developments (NB.T) had gone on a run.

The run hadn’t coincided with any real news. The messageboards weren’t talking about anything weird. It was just, day after day, up 10%, for several days on end.

Now, we’re used to companies we look at going up hard, that happens when the winds blow in the right direction and people discover the story and the company builds on momentum – see Skyharbour Resources (SYH.V) over the last month. But this wasn’t down to us.

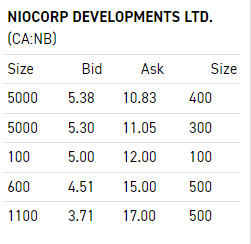

We mentioned the rise at around $5.60, that the gaps were huge, that few had stock for sale, that every buy was 100 shares, that the buys were coming late in the session, and that it could drive a lot higher depending on how long the algos were in.

I mean…

We also said we weren’t waiting for a top, that we were tapping out shortly. We filled at $6.88.

That turned out to be prescient, as the stock has collapsed almost immediately, falling to $6.16 today and, if I were a betting man, I’d say it’ll keep going down tomorrow.

I have no idea if this situation had anything to do with management or if they simply found themselves selected by an organized trading group – or both – but here’s what I’ve found in doing some snooping.

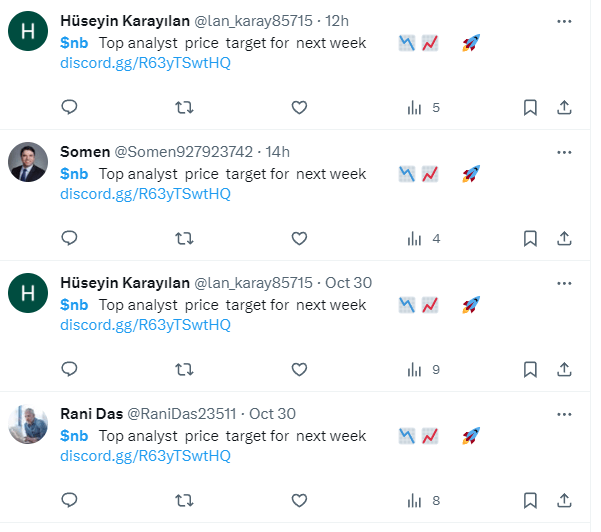

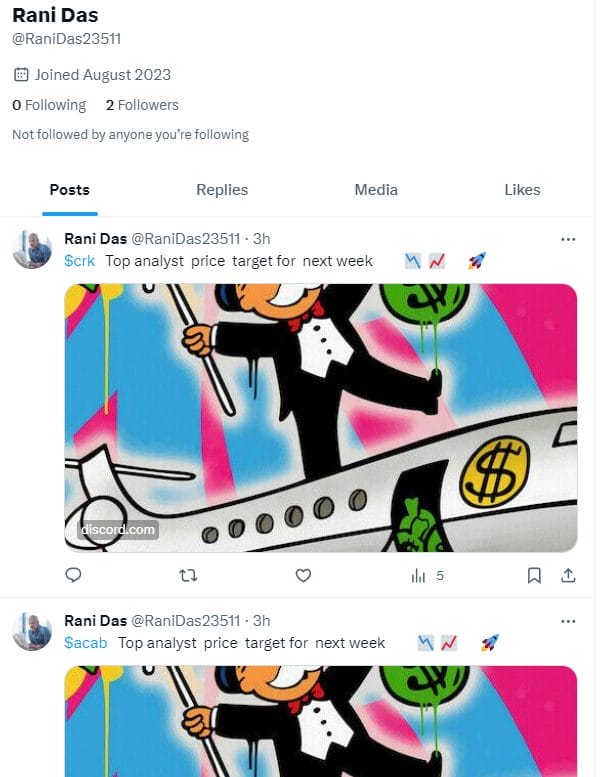

- Twitter accounts pumping NB over the last few weeks are plentiful, repetitive, low quality, and unengaged with. Same tweets across the board, all pointing to a Discord group.

- The links in each of those messages go to the same place, a Discord server that’s trying to sell access to insider trading info for $50 p/mth.

- The accounts pushing this are usually marked by random numbers in the name, stock images as avatars. they were created recently, and they repeat the same shit, over and over, with just the ticker symbol changed.

So these sockpouppet accounts are mindlessly pumping the stock, algos are buying it at 100 shares per trade, a Discord server with 675,000 accounts on it (though only 650 were online when I checked, and most of those are playing games – I’d be shocked if more than 50 were active) is talking up the ticker, and it moves from mid $4’s to almost $7 in two weeks.

Then it collapses.

I’ve often said I’ve made more money on bad stocks than good ones, precisely because when you see this sort of pattern playing out and can see the patterns forming, it’s an easy trade to get in and get out before the ponzi flattens.

THE TIMELINE:

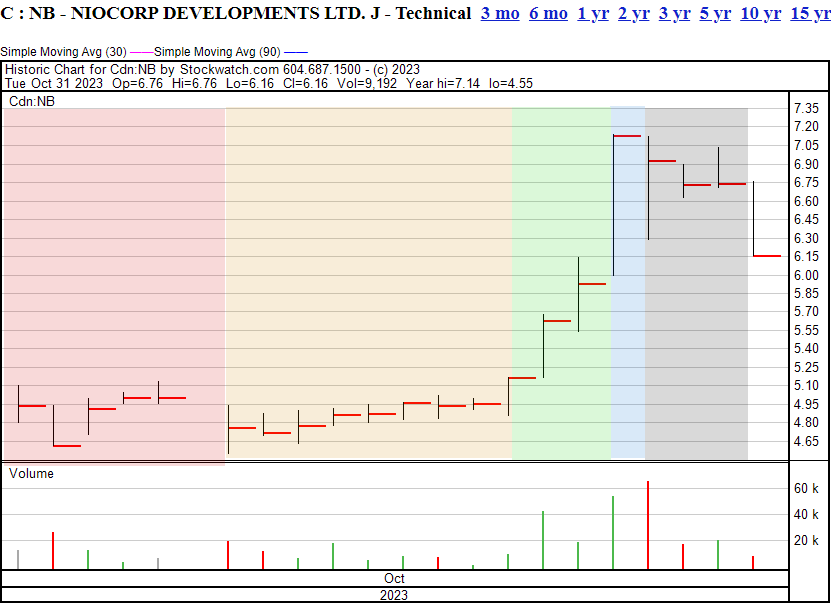

Here’s the NB chart for October. It’s thinly traded, which makes it primo for a hyena run.

That’s my terminology for it, because hyenas will move to a fresh piece of savannah and ravage it, only moving on when they’re full or the savannah is depleted.

- The red section in the above is your uusual trading activity. Not much volume, not much volatility, but the level II (the bids and asks waiting to be filled, seen up-story) is slim. This means a small amount of concerted buying (or selling) can have a dramatic effect on price.

- The yellow section is where the hyenas run experiments. A little more buying per day than usual, just to see if there are big stock icebergs (hiddens bids and asks) that get triggered on a trade. When the stock keeps rising on those small trades, the hyenas know they’ve got a live one. That’s where we noticed the trend and alerted readers.

- The green section is where they make their move. Larger amounts of buying activity, eating into the asks, again with lots of small trades so they know the moment they hit any big blocks of resistance. The end of that section comes when holders get wise and start dropping big blocks to sell. I did this at $7 and didn’t get filled. After a few days coming close, I dropped my ask to $6.88 and got cleaned up. I wasn’t selling at the top, but I was close enough, and earning enough profit that if it continued to run to $8 or $10, I wouldn’t have complained about missing out.

- Once the hyenas filled my block, my guess is they were out of gas and began taking profits, and quickly, because the selling in that blue section was the same amount of trading in one day as the buying in the two days previous, combined.

- The grey section was your chance to run. People who’d come in behind the buying and had convinced themselves it would continue to rise, handed their money over to those getting out, only to find they were left holding the bag. You’ll often find a two or three day wobble at the top where entusiasts claim it’s a ‘new base’, before the base gives way.

- On the last trading day (the grey section), you’ll note the selling volume was very light, but the share price cratered because there’s nobody left coming in. Folks will check their accounts tonight and be shocked to find the big drop and that they missed their chance to profit. Now they wait for another bottom to come in berore they’ll allow themselves to buy again.

For me, as someone who already owned a chunk of Niocorp and wasn’t averse to getting out for a nice return, this was great. Free money.

For traders, as long as you got in at the beginning of the rise and got out again quickly, it was great. Free money.

But for Niocorp, none of this is any good. The share chart now has a big heart attack monitor look to it, any good news will come out in the wake of a big fall-off, potential buyers looking for signs of executive legitimacy will assume they’ve been part of an irresponsible promote (whether or not they have), and folks like me won’t rebuy until we’ve seen a new base form for a few weeks, even if we like the company proper (and I do).

WAS IT AN INSIDE JOB?

One sign that this might have happened TO the company and not BY the company is, I don’t see NB execs announcing new financings based on the higher stock price. If they’d come in with a $5.80 financing as the stock was falling from $7 to $6.15, I’d be crying Shenanigans.

But what we’re seeing now from the company right now is nothing. No ‘we don’t know why the stock is up/down’ news releases, no financing, no frivolous news releases designed to look like the reason for the rise. Management are silent and, if I were a betting man, likely hoping all of this stops soon so they can get on with actual business.

Niocorp is a good opportunity, IMO, but they went after a SPAC merger at the wrong time, which took them off the fast track and delayed a lot of good things for months, and for no real benefit at the end.

In my opinion, they do have good management and they do have a great property, and they do have an offtake deal with Stellantis which would be massive down the road, but they do also have a perception problem and this past month will add to that.

If it gets back down to $4 (or holds at this level for a few weeks), I’ll look at getting back in with the money I made.

Not a client, just a company we still have an interest in.

UPDATE: Next day, mid $5.50’s.

— Chris Parry