The world of mineral exploration and resource development is often filled with hidden treasures, waiting for those who are patient and diligent enough to uncover them. Rockridge Resources (TSXV: ROCK) is one such company that may have been flying under the radar, despite possessing two incredibly promising assets in the heart of Canada. In this article, we’ll dive into the insights shared by Jonathan Wiesblatt, the CEO of Rockridge Resources, during a recent video interview with Equity Guru. We’ll explore the company’s assets, dissect the challenges they face, and discuss the potential for a significant turnaround in their stock valuation.

Exploring Rockridge’s Precious Assets

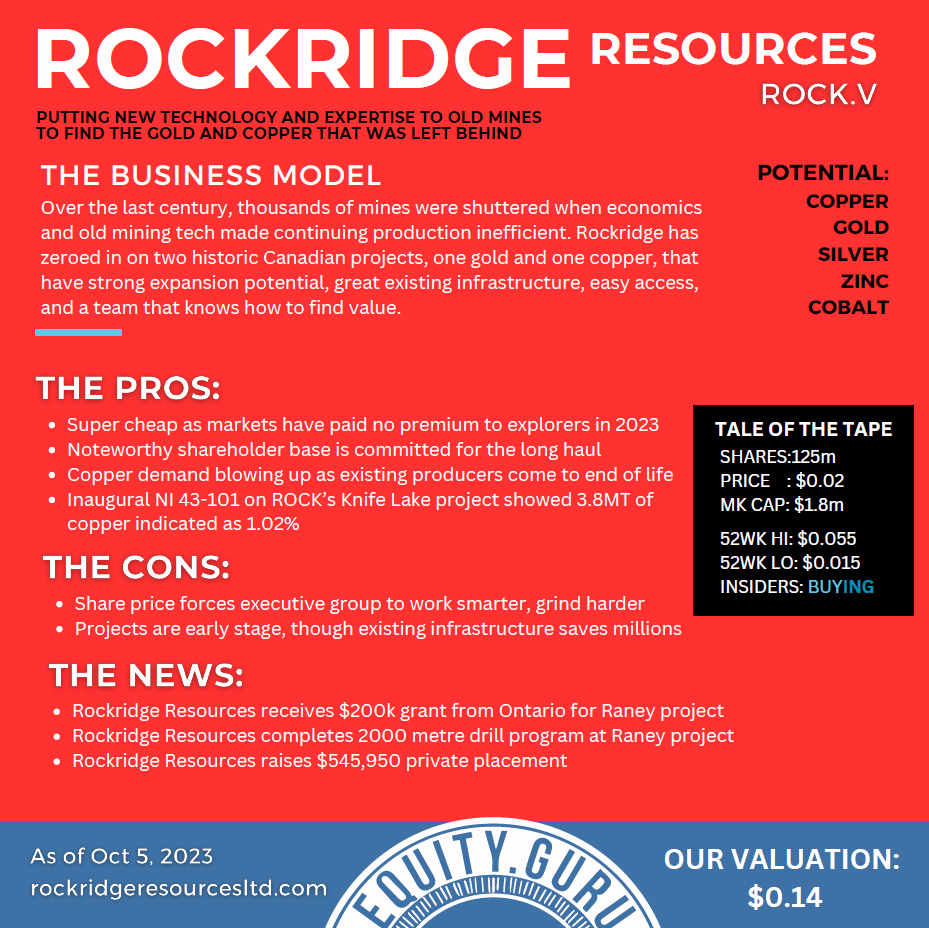

Rockridge Resources is a junior exploration company listed on the TSX Venture Exchange under the ticker symbol ROCK. Jonathan Wiesblatt introduced Rockridge as a company with two flagship properties—one nestled in Saskatchewan and the other in Ontario.

The Saskatchewan property stands as a VMS copper play with an impressive resource of over 200 million pounds of copper readily available at the surface. What makes this asset even more appealing is the quality of the copper and the fact that it’s situated in an area with solid infrastructure. Rockridge Resources owns 100% of this promising property. Meanwhile, in Ontario, the company is exploring the Raney Gold Project, which sits approximately 150 kilometers southwest of Timmins. This gold exploration property has recently seen drilling activities aimed at evaluating its potential for high-grade gold mineralization.

Market Sentiment: The Elephant in the Room

One of the most pressing topics discussed in the interview was the current market sentiment, particularly in the junior commodity sector. Wiesblatt acknowledged that despite global turmoil, gold equities and related securities have not received the love they usually do as a safe-haven asset. He delved into the intricacies of the market dynamics that contribute to this disconnect.

Understanding the Market Sentiment

To truly grasp the situation, it’s essential to zoom out and look at the broader market dynamics. In recent years, the S&P 500 has been skyrocketing, primarily fueled by mega-cap technology stocks. These giants have dominated the market, leaving many smaller stocks, especially in the resource sector, struggling for attention. The allure of technology-driven growth has, in a way, overshadowed investments in hard assets like gold and base metals.

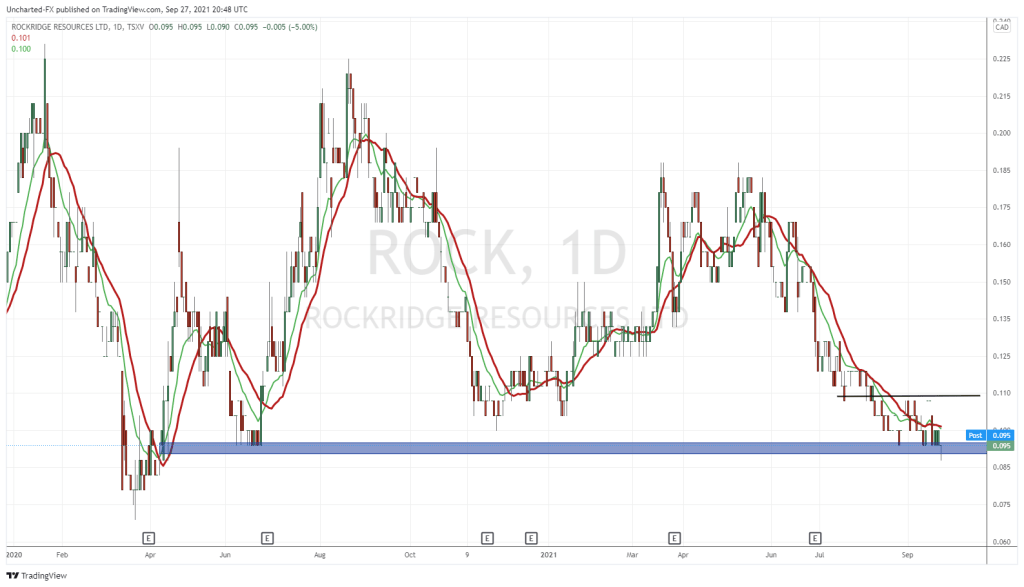

Wiesblatt highlighted the fact that volumes in various resource sectors, such as the TSX Venture Exchange, have reached multi-year lows. Apathy seems to be reigning supreme, and desirability for these resource stocks is at a nadir.

Rockridge Resources: A Coiled Spring Waiting to Spring

In the midst of these challenges, Rockridge Resources possesses several factors that could potentially turn the tide in their favor. The CEO emphasized that there’s an astounding disconnect between the value of the assets held by Rockridge and its market valuation. This chasm suggests that the market might not fully grasp the potential and intrinsic value of these assets.

Moreover, insiders at Rockridge Resources have been actively acquiring shares, indicating their unwavering confidence in the company’s future. The CEO himself recently purchased a significant block of stock, and other key figures within the company have followed suit.

Looking Ahead: The Potential Catalysts

As Rockridge Resources eagerly awaits assay results from its recent drilling activities at the Raney Gold Project, there’s a palpable sense that the company stands at the brink of a pivotal moment. The prospect of positive news flow, coupled with insiders’ interests closely aligned with those of shareholders, makes this a compelling time to consider Rockridge Resources as a potential investment opportunity.

While market sentiment may have temporarily eclipsed companies like Rockridge Resources, it’s essential for investors to recognize the value inherent in these undervalued assets and remain patient as market dynamics evolve. In the resource sector, as in many others, opportunities often emerge when least expected. Rockridge Resources may very well be one of those opportunities, waiting for a broader audience of investors to discover its true potential.

With assets of significant promise and a dedicated team committed to unlocking their full value, Rockridge Resources might just be the hidden gem you’ve been searching for in the world of mineral exploration and resource development.