When people saw Ashley Gold (ASHL.C) was a $0.065 stock a few days ago, they may have ignored it as just another little gold explorer at a time when gold explorers are largely unloved. We wrote about it because we liked the guys behind it, and their plans to work it when everyone else in their business is hiding under their golf club bags.

But a funny thing happened with this microcap when it went out to raise money, in a crap market, where nobody is raising money.

People looked at their project technicals and thought, “Huh, okay.”

And they looked at their market cap, just $2 million, and thought, “Huh, okay.”

And they read about the CEO, Darcy Christian, and how he’s heading out to the projects next week to ‘help’ get work done on the ground.. literally lifting rocks to save money on staffing costs, and they thought.. “Huh, okay.”

And then they took a nibble at ASHL stock because it was so cheap and, being as there’s only 20 million shares out there, it ran a little.

And ran.

And by the end of today, we ALL said, “Huh, okay.”

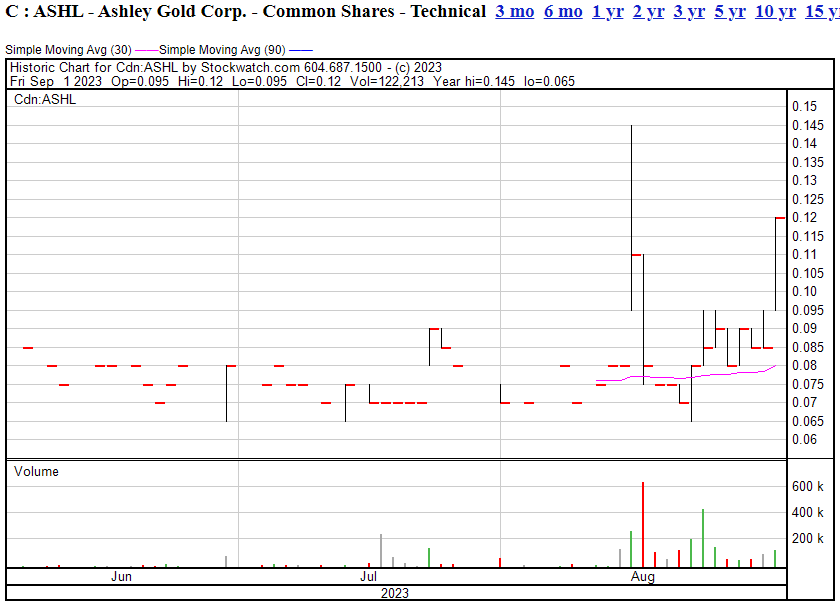

Ashley Gold is up 42% in the last 24 hours, having raised cash at $0.07 a ferw weeks back, with a $0.12 warrant. The stock actually touched the warrant price today, which means, should it get much higher, there’s every chance warrant dollars will begin coming in to the company coffers to add to their financing totals.

For a $2 million microcap to buck the national trend and draw new investors and new dollars into an early stage gold exploration company, to the point where the stock is popping off, is notable. You wanna know what else is notable?

The CEO isn’t flying Business Class on his way out to the field.

Hell, he isn’t even flying Economy.

“I’m flying Flair,” he told me on the phone. “Every dollar that can go into the ground, goes into the ground.”

I hope his damn flight doesn’t go into the ground!

Ashley Gold (no relation to the Pawn Stars reality TV star by the same name) has three properties, all a literal Uber ride from Dryden, Ontario, all surrounded by other companies with projects of the same ilk, with more advanced work done, and with more advanced market caps as a result. Ashley doesn’t need to do a lot to advance their projects – some geophysics, some trenching, literally walking the property and looking at outcrops, of which Christian, a geoologist by craft, says there are many.

There have been others that worked these fields historically, quite some time back, when technology wasn’t as good and gold prices weren’t as high, so a lot of the work is simply going to involve hitting old holes and confirming old data. That’s not overly expensive work, though the weather in that locale allows for drilling year round, so Christian has ambitions to run a pair of drill programs every year.

That’ll take more money, which they’re not in a hurry to get while the market cap is so cheap. In the meantime, they’re being stingy (Christian begrudgingly pays himself a small enough wage to cover the essentials of staying alive), showing progress to the market, and quietly talking to their neighbours who, should they find anything worth expanding over, will need to expand – into – Ashley’s holdings.

“My long term investors would like to see us produce gold,” says Christian, “which tells you they’re not here for a quick 41% jump in share price, they want to see us keep progressing for years to come.”

That’s a good sign, as all too many microcaps, when they do hit a rich vein in their share price, no pun intended, see the early stage guys take their exit.

Ashley isn’t rich, by any stretch, but their present stock price, if you emit one-day extremes, is an annual high.

That’s not something a lot of gold explorers can say. Most are way down the other way and looking for ways to put AI in their name as a last ditch effort at raising the money Ashley just raised.

“I’ve talked to a lot of people over the last few months,” says Christian, “And we’ve been real clear what we are… we’re the scrappy little guys who IPOed instead of RTOed, so we don’t have hinky shell issues that might see the stock blown out, we don’t have long term investors that are way underwater from rollbacks and pivots, and the price we came out at, it allows everyone to make money along the way. We set out to be the clean play, doing the work, not a lifestyle play, and not a four month churn. We want to yank gold out of the ground and when I walk the property, I feel like that’s doable.”

As someone who got in on that raise, more of the same please, Darcy. I’m right there with you.

Except for the lifting rocks thing.. you’re on your own there.

— Chris Parry

FULL DISCLOSURE: Ashley Gold is an Equity.Guru marketing client, and we own stock in the company.