Home Depot (HD) reported fiscal first quarter 2023 earnings which mostly missed estimates and has raised concerns that the consumer is being tapped out. Put it another way in our consumer based economy, are signs of an economic slowdown or recession increasing?

This has been on the mind of investors ever since the Fed has raised interest rates to their terminal rate. The mainstream financial media narrative is not about the Fed raising rates or pausing, but rather now when the Fed will CUT interest rates due to a slowing economy.

Many would say a recession started a long time ago as the US did print two consecutive quarterly declines in GDP, the criteria used to define a recession. However, many would argue that inflation was still high and interest rates not nearly at levels which would be constrictive enough that the usual recession criteria was ignored.

The Fed has said the economy is still strong and robust. Even though we have seen manufacturing and other data come out weak, the labour market has been resilient. Powell and the Fed have been pointing to employment numbers and then saying, “see! what economic slowdown/recession are you talking about?”. Even with major tech companies laying off tens of thousands of employees, US non-farm payrolls (NFP) data has been strong and generally beats estimates by quite the amount. Going forward, any miss in NFP would change market expectations of what the Fed would do as it would be the first sign of a slowdown the Fed would recognize.

When it comes to the US consumer, recent earnings and forward guidance from corporations have been mixed. We are seeing some signs of weakness and some signs of strength. But most middle class/men and women on main street would say there are signs of a weaker consumer.

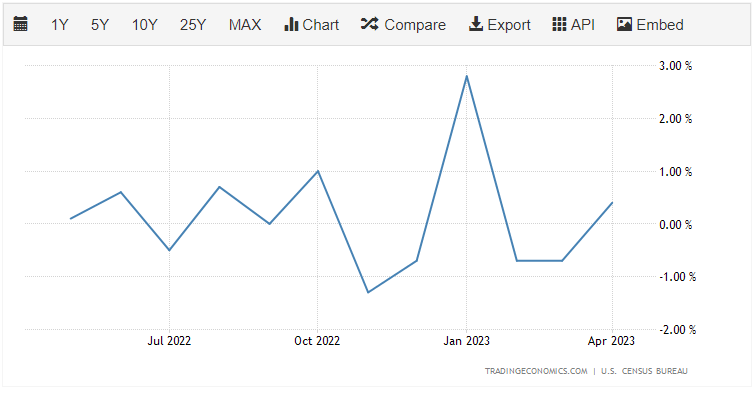

US retail sales for April 2023 rose 0.4% from the previous month which came in lower than projected. Economists predicted that retail sales would rise 0.8% over the prior month after a surprise retail drop in March 2023 which saw retail sales drop by 1%. Surprise? Or signs of an upcoming economic slowdown and recession?

Strong consumer spending kicked off 2023… but will it last through the year?

Excluding gas station and automotive sales, retail sales rose 0.6% in April. Six of the 13 categories highlighted in the release saw declines from a month ago. Sporting goods and hobbies saw the largest decline of any category, falling 3.3% from the last month and 5.4% from last year. Furniture and home furniture stores declined 0.7% from last month and 6.4% from April last year. Growth at miscellaneous store retailers and nonstore retailers, which includes online sales, helped keep total sales higher than the month prior.

Oren Klachkin Oxford Economics Lead US Economist shared his thoughts:

“Consumers remain inclined to spend though they are becoming more selective in their purchases,”

“A stronger-than-expected handoff to Q2 indicates the main engine of GDP growth continues to hum. However, with storm clouds gathering on the horizon, we think consumer spending will soon run out of steam.

“We expect a weaker labor market, depleted excess savings buffers, tighter credit standards, and high prices will make consumers less inclined to spend in H2.”

This report comes during the week when we get quarterly results from US retailers such as Target (TGT) and Walmart (WMT). And we have already had our first major retailer stock drop signaling a weakening in consumer spending momentum.

Here’s how Home Depot initially reacted to earnings on the intraday chart:

The stock tumbled as much as 5% before recovering most of its losses.

Home Depot reported its biggest revenue miss in more than 20 years, and forward guidance was slashed as the Company expects consumers to delay large (and expensive!) projects and buy fewer big-ticket items. Executives said that “big ticket comparable transactions or those over $1,000 were down 6.5% compared to the first quarter of last year.” That includes softness in discretionary items like patio, grills and appliances.

The largest US home improvement chain said comparable sales are expected to decline between 2% and 5% this fiscal year compared with last year, both missing the consensus estimate of -0.73%.

For Q1, comparable sales fell 4.5%, far worse than the expected drop of 1.4%. Here are the earnings highlights:

Q1 Results:

- Net sales $37.26 billion, -4.2% y/y, estimate $38.34 billion

- EPS $3.82 vs. $4.09 y/y, estimate $3.80 * Customer transactions -4.8%, estimate -5.36%

- Comparable sales -4.5% vs. +2.2% y/y, estimate -1.42%

- US comparable sales -4.6% vs. +1.7% y/y, estimate -2.14%

- Average ticket sales $91.92, +0.2% y/y

- Average ticket +0.2%, estimate +2.63%

- Sales per square foot -4.7%

- Merchandise inventories $25.37 billion, estimate $26.16 billion

- Total location count 2,324, +0.3% y/y, estimate 2,323

- SG&A expense $6.36 billion, -3.9% y/y, estimate $6.84 billion

What was to blame for the rough start of the year? Lower lumber prices and bad weather.

“After a three-year period of unprecedented growth for our sector, during which we grew sales by over $47 billion, we expected that fiscal 2023 would be a year of moderation for the home improvement market. Our sales for the quarter were below our expectations primarily driven by lumber deflation and unfavorable weather, particularly in our Western division as extreme weather in California disproportionately impacted our results,” said Ted Decker, chair, president and CEO.

“We also observed more broad-based pressure across the business compared to when we reported fourth quarter results a few months ago. Despite a more challenging environment, our associates maintained their relentless focus on our customers, and I would like to thank them and our many partners for their hard work and dedication. While the near-term environment is uncertain, we remain very positive on the medium-to-long term outlook for home improvement and our ability to grow share in a large and fragmented market,” said Decker.

In terms of forward guidance:

2024 Forecast:

- Sees comparable sales -2% to -5%, estimate -0.73%, saw approx. flat (Bloomberg Consensus)

- Sees sales -2% to -5%, saw approx. flat

- Sees EPS down 7% to 13%, saw down mid-single-digits

- Sees operating margin 14% to 14.3%, estimate 15.5%

CFO Richard McPhail said, “Given the negative impact to first quarter sales from lumber deflation and weather, further softening of demand relative to our expectations, and continued uncertainty regarding consumer demand, we are updating our guidance to reflect a range of potential outcomes.”

From a technical analysis standpoint, the stock is seeing a bid at the support zone of $280 and has made up most of its earlier losses. There is a gap which needs to be filled with a close above $288. The test could still see sellers enter after digesting the data and other major retailer earnings this week from Target and Walmart.

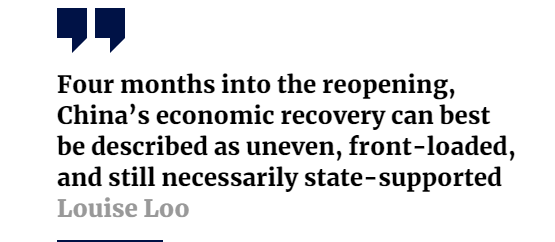

It should be noted that this slowdown is not just in the US. Hopes for global growth are fading with China data disappointing. The China recovery/re-opening trade is losing steam quickly. Chinese data has missed estimates. Industrial production for April rose by 5.6% year-on-year, compared to the 10.9% expected by economists. Retail sales rose by 18.4% – lower than economists’ forecast a surge of 21%. Some might be puzzled by the ‘weakness’ in these figures but China recovery/growth expectations have been high and so far, data is missing expectations.

“China is in the stage of recovering, compared to last year, the numbers are positive as we just saw, but is the recovery good enough for the market, is the recovery good enough to meet investors’ expectations – that’s the big question here,” BofA Securities China equity strategist Winnie Wu.

“It’s not good enough to meet with investors’ expectations – that’s a problem,” Wu said, adding that the momentum from China’s pent-up demand seems to be fading away.

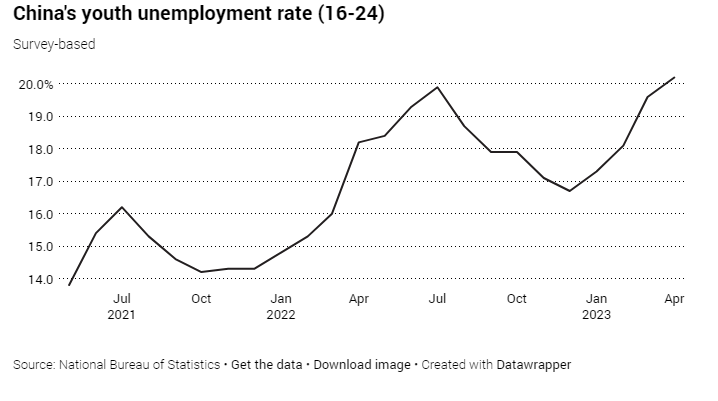

I think one of the crazier data points is youth unemployment. Unemployment among China’s youth (the unemployment rate between ages 16 and 24) rose above 20 per cent for the first time in April. This reading marks a record high.

“Many people, investors see this as a leading indicator. If the younger people are unable to get jobs, don’t have the income security, where is the confidence, where is the consumption recovery coming from?” said Wu.

Other signs of economic slowdown?

Copper, known as Dr Copper, as it is used to gauge the health of the global economy, is falling. Copper is used for infrastructure. When economic activity is high, copper demand will be high. If economic activity is slow or slowing… well you can guess where copper demand goes. Watch for a further decline in copper prices and more analysts to state that the price action is a strong sign of recession.

Another big one is oil. Historically, we are approaching a high demand seasonality. As the weather gets better, people are expected to drive more and take road trips etc. Oil prices tend to be higher as we approach Summer due to demand. But maybe this time, people will forgive their vacation and travel plans to save some money.

A big bearish sign for oil was when OPEC+ cut production. They tend not to do this in a strong oil market. Some may argue geopolitics, but OPEC+ cutting production was a tell tale sign of a fall in demand and hence, signs of an economic slowdown. Oil even gave up the gains it made from the production cut gap up indicating the weakness and fall in demand for oil.

From a technical perspective, it looks like oil is set for another major drop as sellers enter on a retest at the $72 zone.

Investors and traders are still trying to digest all the headlines from inflation to interest rates to earnings. The S&P 500 and the Dow Jones generally remain in a range, while the Nasdaq has seen some upside movement. What narrative wins out? Will markets react to a Fed pause and eventual rate cuts? But remember, the Fed has said it intends to keep rates higher for longer until inflation falls closer to its 2% level. Or, will impending signs of recession cause the stock markets to break this range and sell off? If stocks react to the real economy, we should expect a drop. However, if you are one to believe that money is hunting for yield and return, then you can argue a Fed cut would be bullish for stocks.

Keep in mind, it appears as if a global recession is on the cards.